What is the W-9 form for contractors?

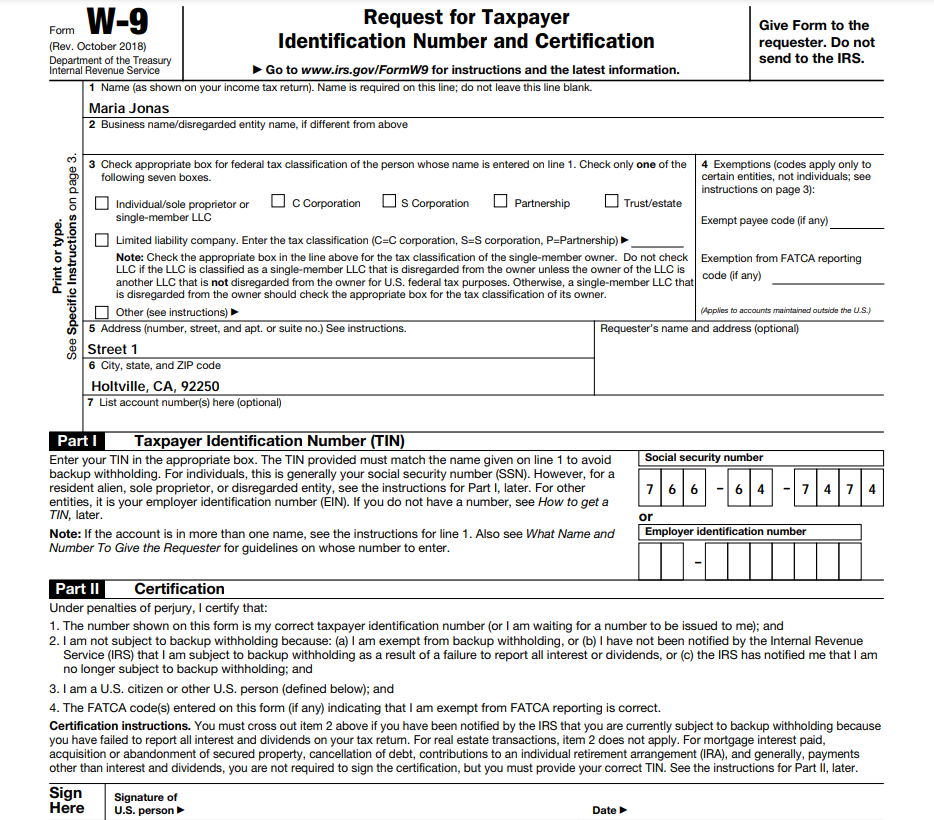

Businesses use IRS Form W-9, Request for Taxpayer Identification Number and Certification, to get information from vendors they hire as independent contractors (also called freelancers).

The form is filled out by independent contractors who provide services to companies that have not hired them as full-time employees. If you are paid $600 or less in a single year by a company, you will not need to fill out the form for that company.

When You Shouldn't Fill Out a W-9

An independent contractor who receives an unexpected W-9 should hesitate before filling it out and research whether the requester has a legitimate reason to ask for this form. Financial institutions sometimes use Form W-9 to request information from a customer when they need to report dividends or interest.

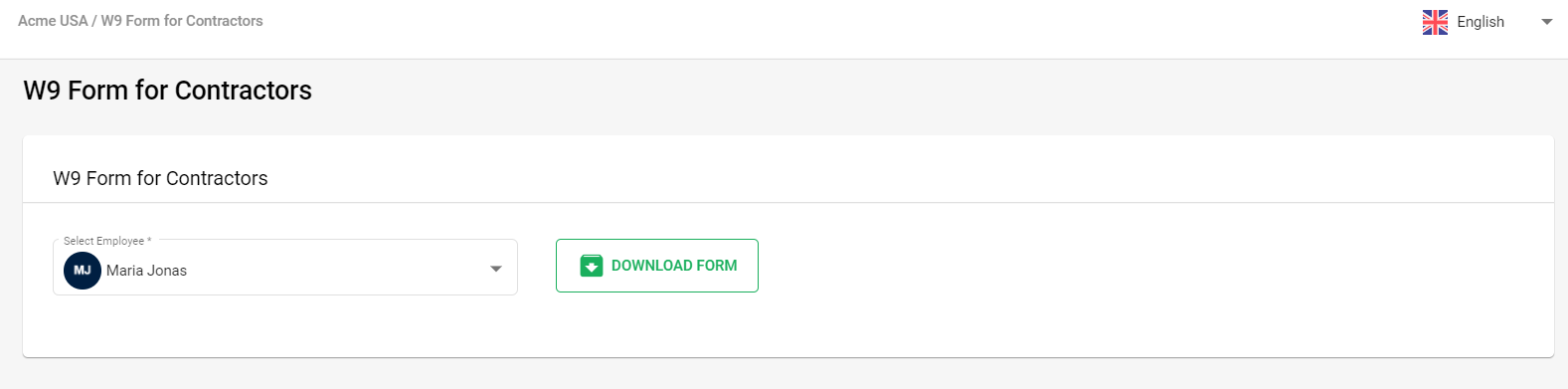

Downloading contractors withholding W-9 form in Deskera People

Using Deskera People you can Download the W-9 forms for contractors, with the following the steps,

1. Go to the Report Tab>> under Employee withholding section>> click on W-9 form for contractors >> Select the name from the dropdown list>> Click on the download form button for downloading this form.

2. Once you have downloaded the W-9 form below details will be auto-populated in the form as entered in the system,