Excise policy in Indonesia is mandatory imposed on certain goods that have certain aspects, such as cigarettes, e-cigarettes, alcohol, and other tobacco and alcohol related products.For collection of these excise in Indonesia,Directorate General of Customs and Excise , Ministry of Finance is responsible.

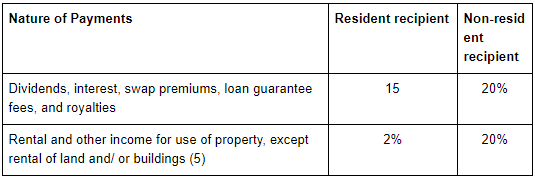

Mentioned below are the Excise rates imposed on good applicable,

How to Set up and Map Excise Tax using Deskera Books?

Any VAT registered business owner in Indonesia, can calculate Excise on manufactured goods. So for this you need Excise tax calculation as well.

Using Deskera Books any business owner can set up an excise tax rate with following simple steps,

In the ‘Company’ on the main dashboard menu, under company click on the “Compliance Setting” tab.

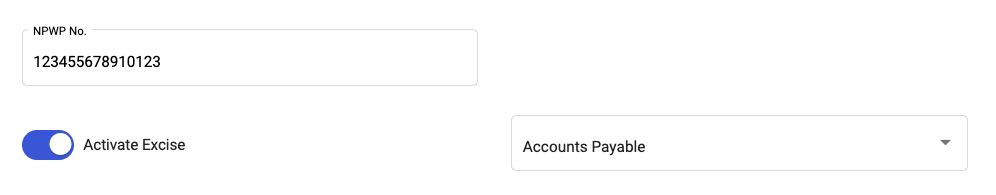

After clicking on the “Excise Details” below option will pop up.

- Tick on the Activate Excise button for activating this Excise option in the system

- Select the Account from Excise from the dropbox menu.

Mapping of Excise Tax on Deskera Books:

1. Under Products

Click on “+Add Products” to impose excise tax upon creation of new products. The excise tax will be applicable on both Tracked and Non - Tracked products.

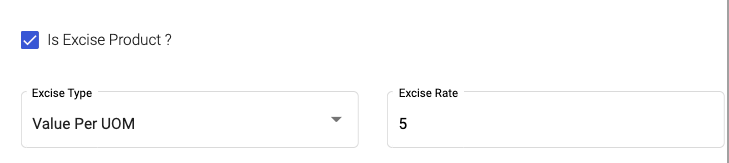

Under product details tab, you will see the below option to impose the excise tax on products.

- Tick the option “Is Excise Product ?” to categorize this product as an excise product

- Select the “Value per UOM(Unit Of Measurement) or % on Production cost from the drop box and enter the required quantity.

2. Sales Invoice / Quotation:

While creating a sales invoice/ quote the excise rate will be captured from the Product you have created. Excise tax will be calculated before VAT is calculated on the product and this excise amount will be credited to the sales invoice.

Similarly, if orders of excisable goods are created then also calculate Excise tax in Order will be calculated.

3.Purchase Invoice

While creating a Purchase Invoice for any type of goods for manufacturing from overseas Vendors the system will capture the rate of Excise from Selected product master. Excise tax will be calculated before VAT calculation. This Excise amount will get debited in the purchase invoice.