When dealing with customers based in the US, you might find yourself having to pay sales tax as dictated by the state your customer is located in. Sales tax in the US is not uniformly implemented throughout the entire country but is instead given to each individual state to govern. Therefore, each state has its own tax, making the US tax system complicated to navigate.

Fortunately, Deskera Books software is able to determine the sales taxes required for products and services sold to a customer.

The US Taxation article series is to help you understand how US sales taxes are being calculated. However, you do not need to worry about manually calculating the sales taxes.

There are some factors to consider when calculating US sales tax:

- Nexus

- Product Classification

- Exemption from sales tax

- Out of state transactions - Origin VS Destination State Tax

In this article, we will touch on the US states that are exempt from sales tax, the types of exemptions, exemption certificates, and sales tax holidays.

US states do not have sales tax

As of January 2020, there are five states in the US that do not have the sales tax:

- Alaska

- Delaware

- Montana

- New Hampshire

- Oregon

However, even if there is no statewide sales tax, some products transacted in the states mentioned above might be subject to local and county taxes, if any.

Types of exemptions

Due to various factors such as organization type, product classification, or the purpose of the buyer, the transactions involved may be exempted from sales tax.

There are three types of exemptions:

Product-based exemptions

- Some products are not taxable in certain states. You may read more about it in our US Taxation article on Product Classification.

Use-based exemptions

- Products sold with the intention of resale are usually exempted from sales tax.

- This is because sales tax will come into effect when the distributor sells the product to the end-user.

Buyer-based exemptions

- Non-profit organizations such as a charity or religious organization are usually exempt from paying sales tax.

- Government organizations, including some state agencies, are also exempted from paying sales tax.

- Buyers based in the five states mentioned in the previous section may also be exempted from sales tax in most transactions.

- If the state that your business has nexus does not have origin state tax and your buyer is overseas, they are exempt from US sales tax.

Exemption certificates

An exemption certificate is needed when it is a specific exemption given to an organization, based on either the organization's nature (non-profit, government, etc.) or the use of the products purchased (resale).

Entity-based certificates are given to organizations that are exempt from sales tax, such as non-profit organizations and government agencies. This allows these organizations to purchase goods without incurring sales tax, regardless of the purpose of the goods bought.

Usage-based certificates are typically given to resellers of products such as distributors. Only products meant for resale will be exempt from sales tax - products bought by these companies for their own use will incur the usual sales tax applicable.

An exemption certificate is not needed if it is an existing exemption equally applied throughout the state (e.g. exemption of sales tax in the state of California for cold food products).

As a seller, you will need to keep track of your buyers' exemption certificates as this will also be reviewed should your company undergo an audit.

Sales Tax Holidays

Sales tax holidays are defined as a limited-time period where sales taxes are not applied completely or reduced to transactions occurring during that period. They can be either annually recurring or only on certain years. Most sales tax holidays are only applicable to certain product categories and usually are limited by a product value threshold. You can find out more on sales tax holidays in each state by checking the state's official tax website.

What does this mean for me as a Deskera user?

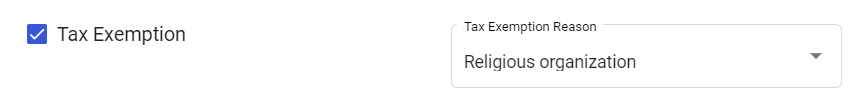

When creating a new Contact, you will need to indicate if your Contact is exempt from sales tax. If the contact is exempted from tax, the tax won’t be applied to the business transactions (sales) for this particular contact. On the Add Contact page, there will be a Tax Exemption checkbox. Ticking it will prompt for a reason for tax exemption, where you can select from a list of different tax exemption reasons. This ensures that sales tax is not incorrectly charged. Take note that the tax-exemption reason is a mandatory field fill in.