The employee details are filled partially during the initial onboarding process. Later the employee and admin can add the details in the system.

Using Deskera People+, you can add employee’s information for creating their profile required during the payrun.

How to add employees in Deskera People+?

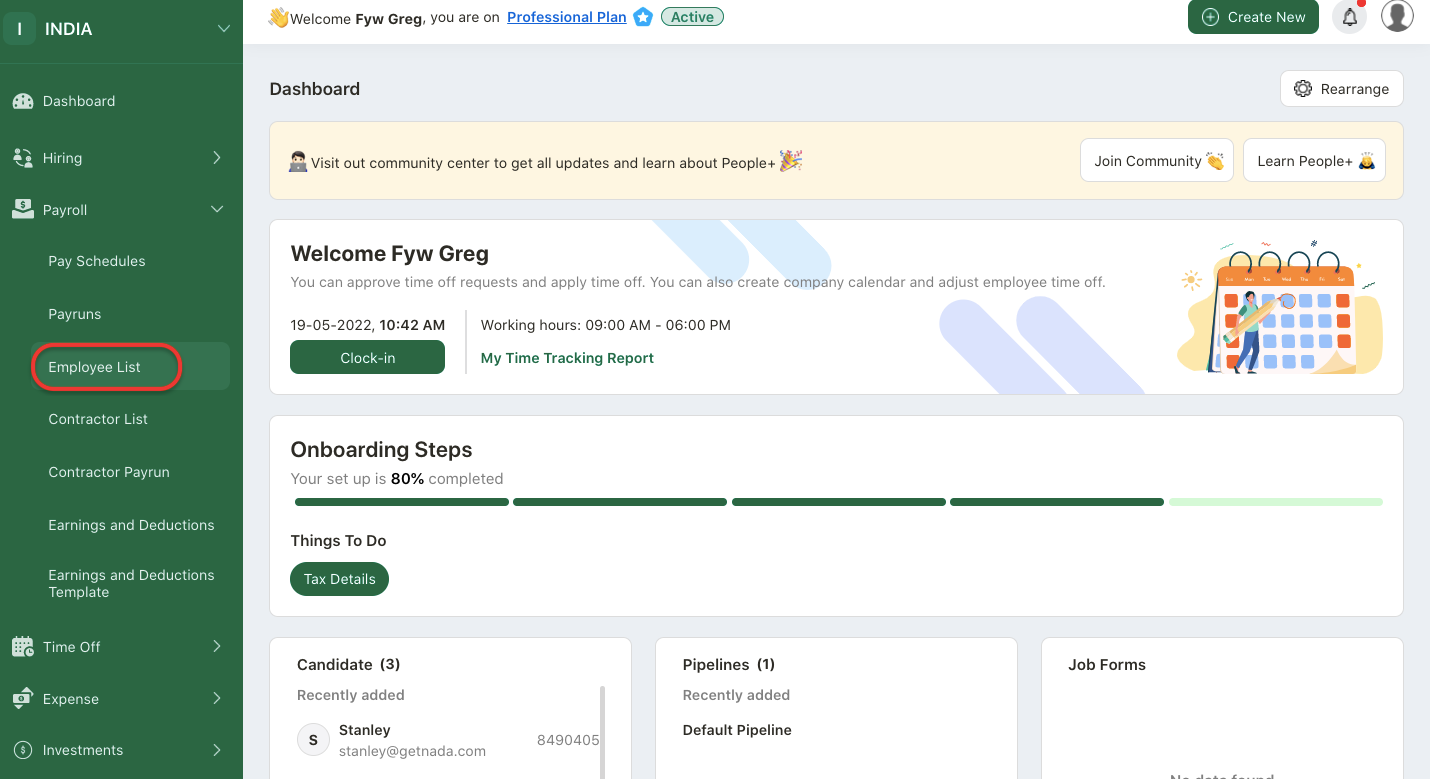

- Login to your Deskera People + Account.

- After you have logged into your account, you can view Deskera People+ Dashboard. Click on Payroll module on the sidebar menu. Under this, select the Employee List Module.

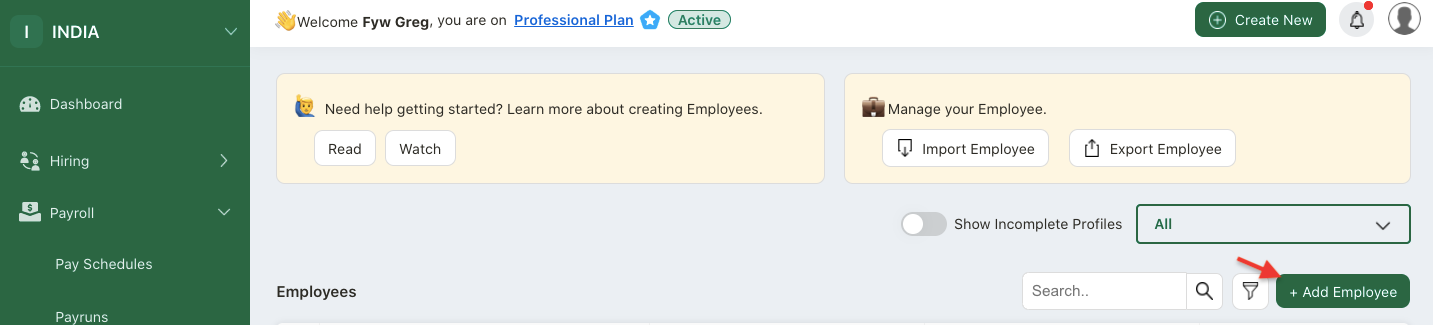

3. Next, click on the + Add Employee button to add a new employee in the system.

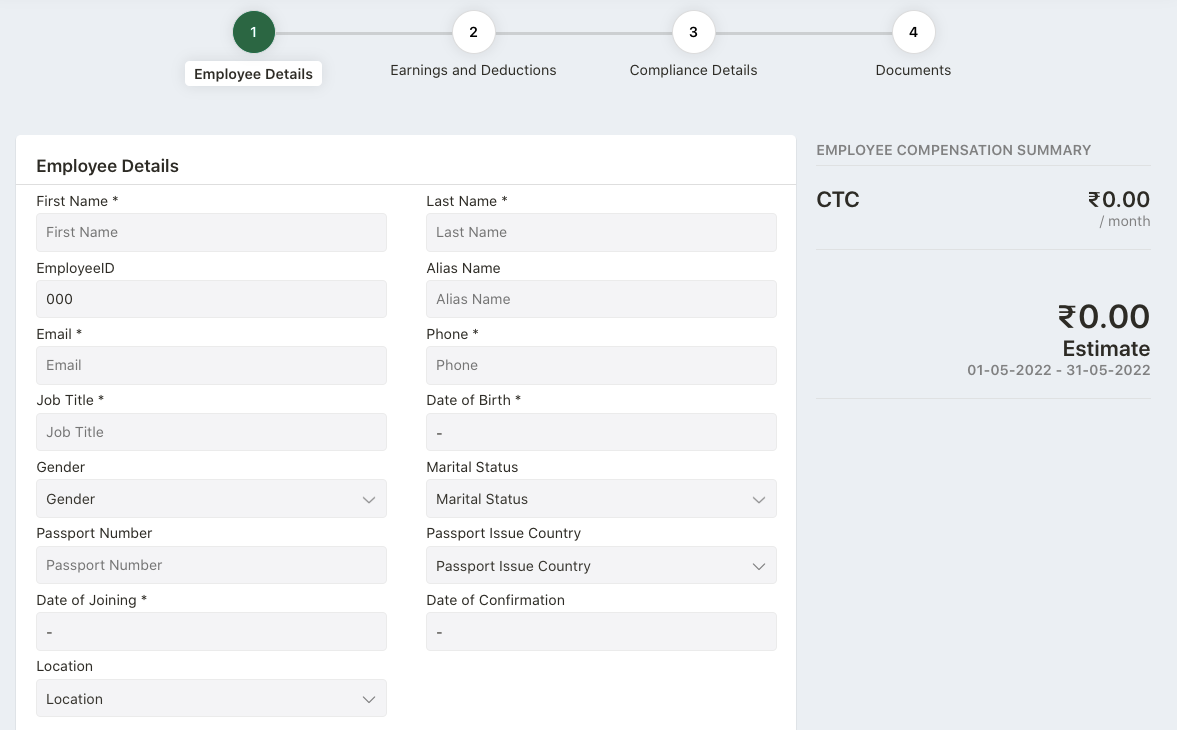

4. After clicking on the +Add Employee button below window will pop up where you need to fill in the required information for creating the employee profile.

Employee Details

Enter the details in below mandatory fields:

- First Name, Last Name - Enter First Name and Last Name

- Employee ID- Auto-populated

- Designation - Employee Designation

- Email id - Employee Email ID

- Phone Number - Employee contact number

- Date of birth - Employee DOB

- Date of Joining - Select employee DOJ form the calendar

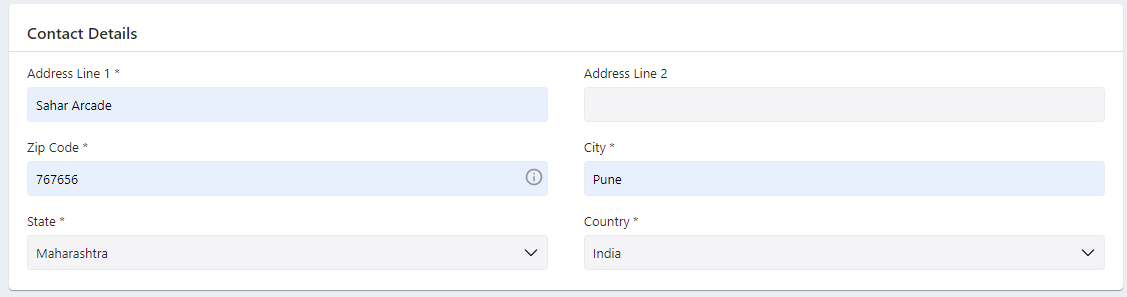

Contact Details

Enter the following details,

- Address Line 1

- Zipcode

- City

- State

- Country

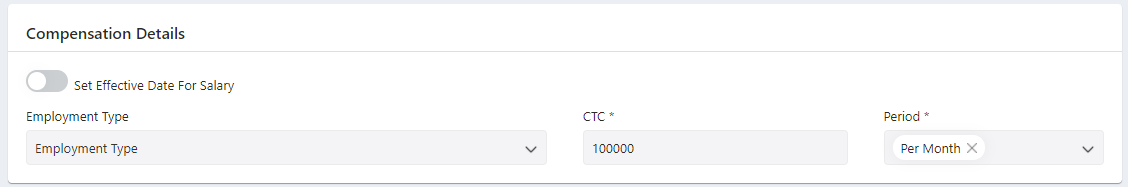

Compensation Details

- Employment type - Select the option from the drop-down menu

- CTC - Enter the employee CTC (Cost to Company)

- Period- Select period (Per year/Per month) from the drop-down menu

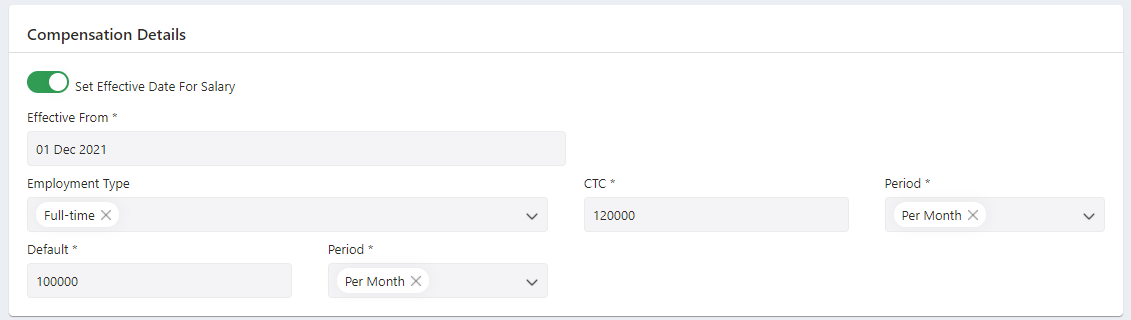

- Set Effective Date for Salary

If you enable the Set Effective Date for Salary toggle button, then as an admin you can set the effective date for salary, when the salary will be changed for a specific employee based on the time period so as to define the salary change for the employee.

- After the toggle button is enable you need to fill in the below details ,

1. Effective From - Select the date from the calendar, as when the changed salary will be with effect from.

2. CTC - Enter the changed salary under CTC.

3. Default - This default value will only be utilized outside of the effective from date.

- If you choose the effective from date, then the system will calculate the payroll based on that salary form that particular month onwards.

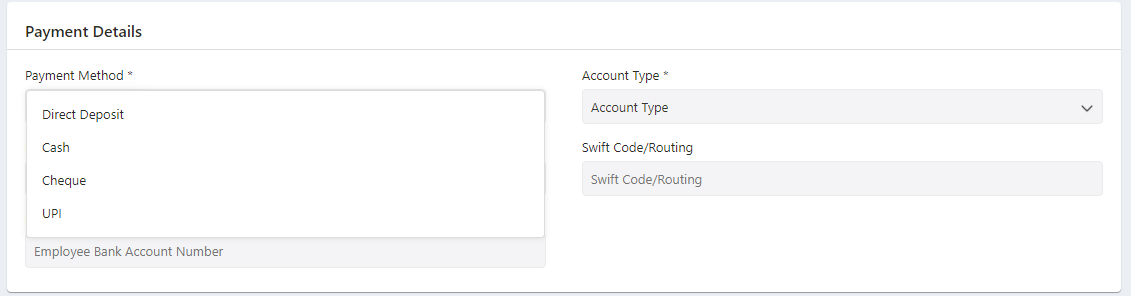

Payment Details

- Payment Method- Select the payment option from the drop-down menu (Direct Deposit, Cash, Cheque or UPI)

- If selected Direct Deposit enter - Enter Account type, IFSC Code, Swift Code/Routing and Employee Bank Account Number

- If Selected Cheque - Mention Employee Bank Account Number

- If Selected UPI - Enter UPI Code

Once all these employee details are correctly filled, click on the Next button which will take you to the next screen of Components.

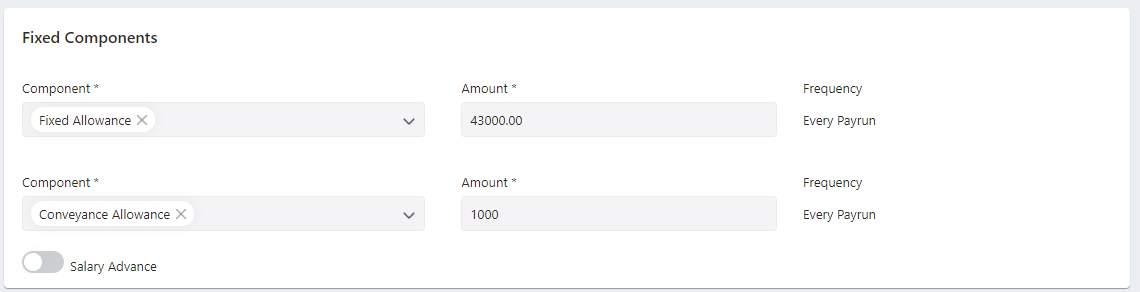

- Component Section

Under Fixed Component Section

-Under the fixed components section, you can view the default fixed earning payroll components set in the component module.

- If you want, you can edit the amount of these components. you can do it under the amount field.

- These components cannot be deleted.

- You can view the frequency Level set for each component.

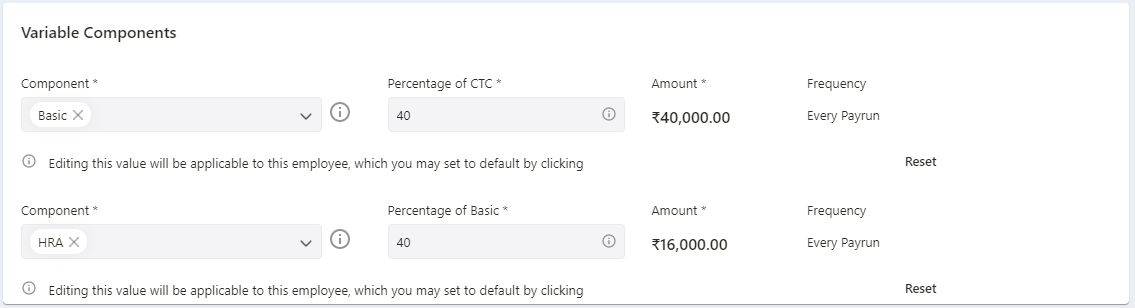

Under Variable Components Section

-Under the variable components section, you can view the default Variable earning payroll components set in the component module.

- For Basic Component, you can edit the Percentage of CTC to 40% or 50% which will calculate the percentage selected of CTC and also the HRA component value will affect if there is a change in the basic percentage and will be calculate on the basic value derived.

- If you only change the HRA Percentage to 40% or 50 %, it will calculate the value on the percentage selected of Basic.

- After this, percentage of Basic/HRA Component value is edited, you need to click on the reset button, where the value will be auto-calculate the amount in the system as per the percentage.

- You can view the frequency level set for each component.

After entering the Employee Details and Components, click on the Next button which will take you to the next screen of Compliance Details.

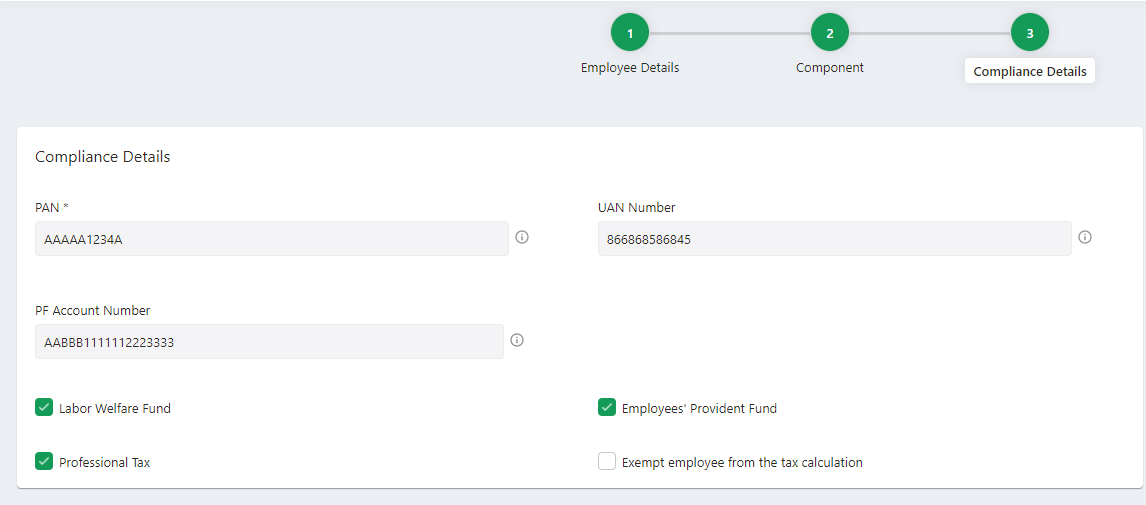

Compliance Details

-PAN - Enter Employee PAN number

PAN, or permanent account number, is a unique 10-digit alphanumeric identity allotted to each taxpayer by the Income Tax Department under the supervision of the Central Board of Direct Taxes. It also serves as an identity proof.

- UAN number - Enter employee UAN number

UAN stands for Universal Account Number to be allotted by EPFO. ... The idea is to link multiple Member Identification Numbers (Member Id) allotted to a single member under single Universal Account Number. This will help the member to view details of all the Member Identification Numbers (Member Id) linked to it.

- PF Account Number - Enter employee PF account number

Employee PF Account Number. The Employees' Provident Fund Account Number is an account number that can be used by employees to check the status of their EPF, the balance in the EPF account, etc. The number is mandatory for withdrawals from EPF.

- Labor Welfare fund - Tick on the check box if you are applicable for Labor Welfare Fund

- Employees Provident Fund - Tick on the check box if you are applicable for EPF

Employees’ Provident Fund or EPF is a popular savings scheme that has been introduced by the EPFO under the supervision of the Government of India. The EPF contribution rate for employees is fixed at 12%.

- Professional Tax - Tick on the check box if you are applicable for PT

The maximum amount of professional tax that can be levied by a state is Rs 2,500. It is usually deducted by the employer and deposited with the state government. In your income tax return, professional tax is allowed as a deduction from your salary income.

- Exempt employees from tax calculation - Tick on the check box if for any employee tax calculation need not to be made.

After all these details are filled in, click on Save Button. and the employee will be added in the system.

How to View, Edit, Delete, Terminate Employees?

Now let us see how can you view, edit, delete the employees in the system.

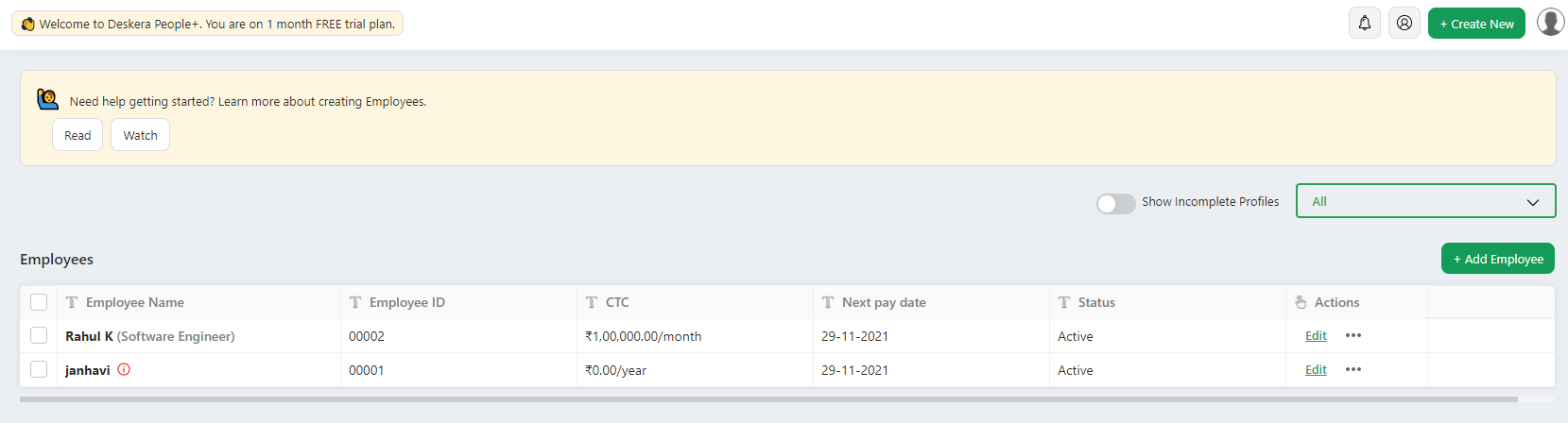

View Employee list

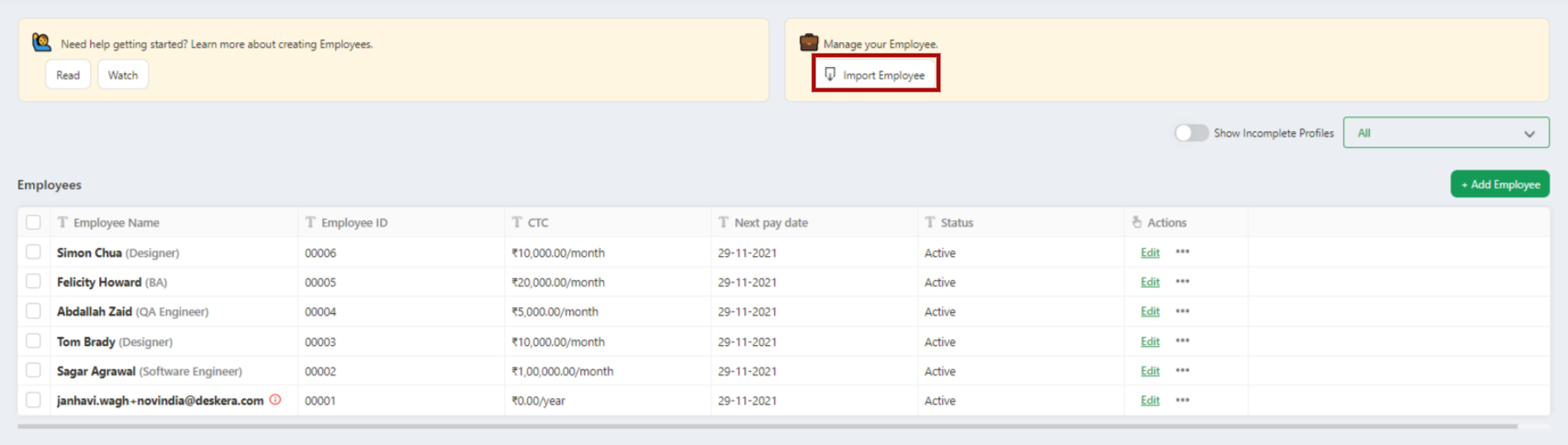

Once the employee details are Saved it will be added to the system. The added new employee details will be reflected in the Employee Details list.

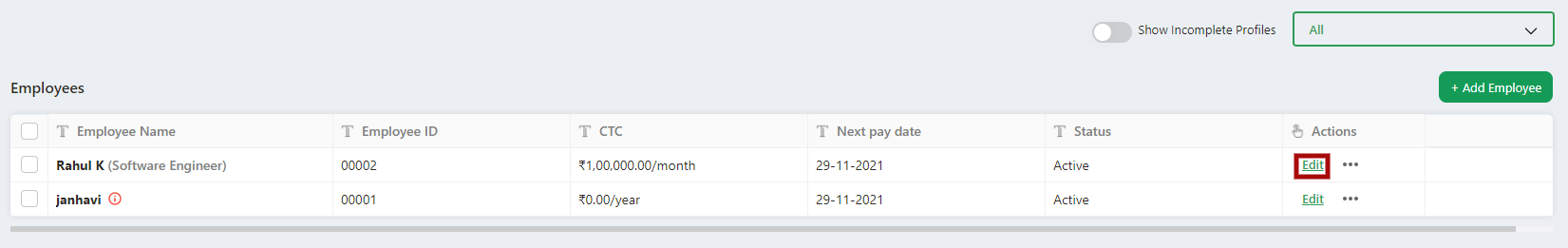

Edit employee details

Let us see below how to Edit the Employees.

- Select the Employee from the list, you wish to make the changes. Then by clicking on the Edit button under Actions Column, the employee details editable screen will appear and you can make the required changes and save it to get the changes reflected.

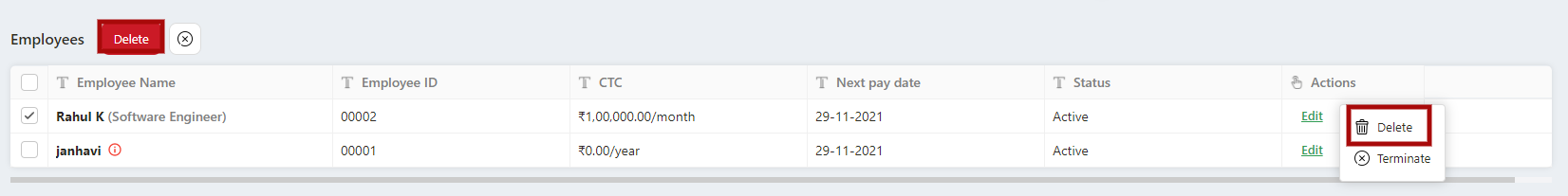

Delete Employees

If you wish to remove the Employee form the system, select the employee, click on the Delete icon located on the left side of the screen or by clicking on the three horizontal dots, you can delete the selected employee from the system.

Terminate Employees

Employees can be terminated for various reasons like the end of employment, or can be with or without notice, or caused by employee misconduct, etc.

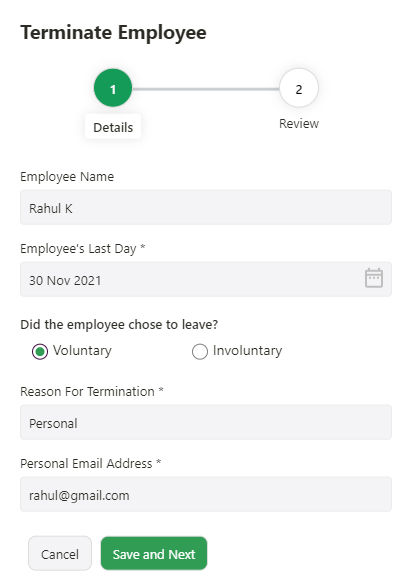

In this case, there is an option to terminate the employee from the system by clicking on the on the three horizontal dots, click on the Terminate option. Below pop up will appear where you need to fill in the employees below termination details,

i). Employee Name - Name of the employee whom you are terminating

ii). Employee Last day - Select the last working day from the calendar

iii). Select the employee leave option - Voluntary or Involuntary

iv). Reason for Termination - mention the employee reason of termination

v). Mentioned employee personal email id.

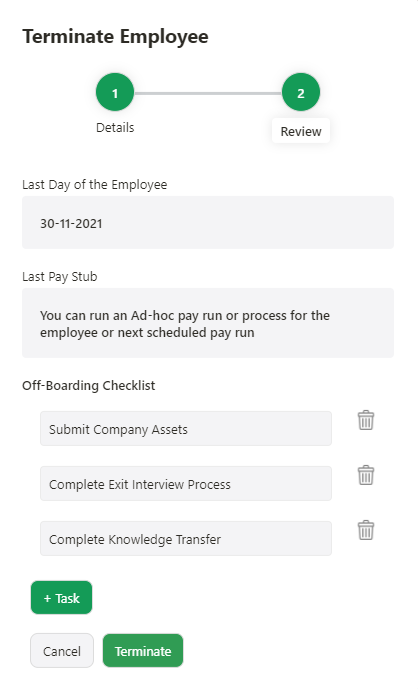

Then click on Save and next button, which will take you to the Review section where you will view the Last day of the employee and Off-boarding checklist where the employee need to do his assets clearance and other exit formalities.

If you wish to add a new Task, click on the +Task button. To delete any of the task click on the Bin icon located next to the task box.

After all these details are filled and reviewed , click on the Terminate button and the employee will be terminated from the system.

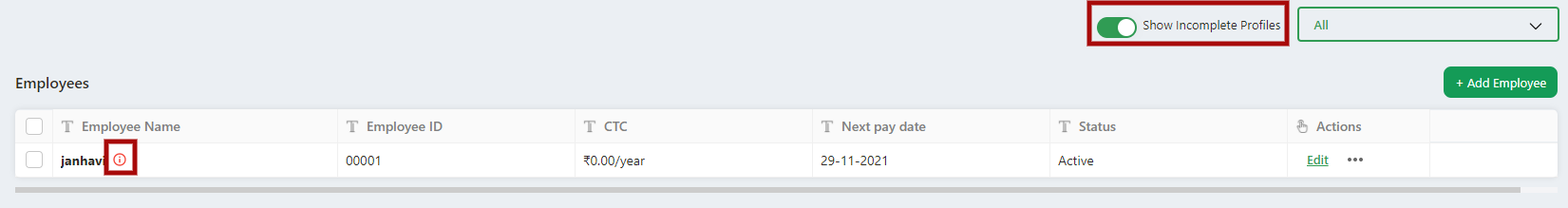

Employee Missing Information/Profile Completeness

If incase any employees profile information is missing, you can view the list of these employees by enabling the Show Incomplete Profiles toggle button.

By hovering the cursor on the 'i' icon, you can see the missing employee information missing in the profile, and can update the details accordingly.

Import Employees with compliance Details

Now you have an option to Bulk Import Employees along with their compliance details.

To import employees, you can simply do it by downloading the sample excel spreadsheet, fill in the details and upload this file. With this import function it will help you save your time.