In Singapore, it is compulsory for businesses with turnover exceeding $1 million per year to register for Goods and Services Tax (GST).

Being a GST registered company, you will enjoy claiming 7% of input tax from IRAS for business expenses or purchase incurred by you. However, the downside is that you will need to collect output tax from your clients for revenue generate by sales of your goods and/or services.

Once you have registered for GST, you must charge GST on your supplies at the prevailing rate with the exception of relevant supplies that are subject to customer accounting. This GST that is charged and collected is known as output tax. Output tax must be paid to IRAS.

The GST that you incur on business purchases and expenses (including import of goods) is known as input tax. If your business satisfies the conditions for claiming input tax, you can claim the input tax on your business purchases and expenses.This input tax credit mechanism ensures that only the value added is taxed at each stage of a supply chain.

Paying Output Tax and Claiming Input Tax Credits

As a GST-registered business:

- You must submit your GST return to IRAS one month after the end of each prescribed accounting period. This is usually done on a quarterly basis.

- You should report both your output tax and input tax in your GST return.

- The difference between output tax and input tax is the net GST payable to IRAS or refunded by IRAS.

GST Report Under Deskera Books

Deskera Books allows you to generate your GST report for all the Purchases and Expenses with GST and Sales and Deposit with GST.

This accurate report will be helpful for further filing the GST returns to IRAS with no errors.

Below are the steps mentioned:

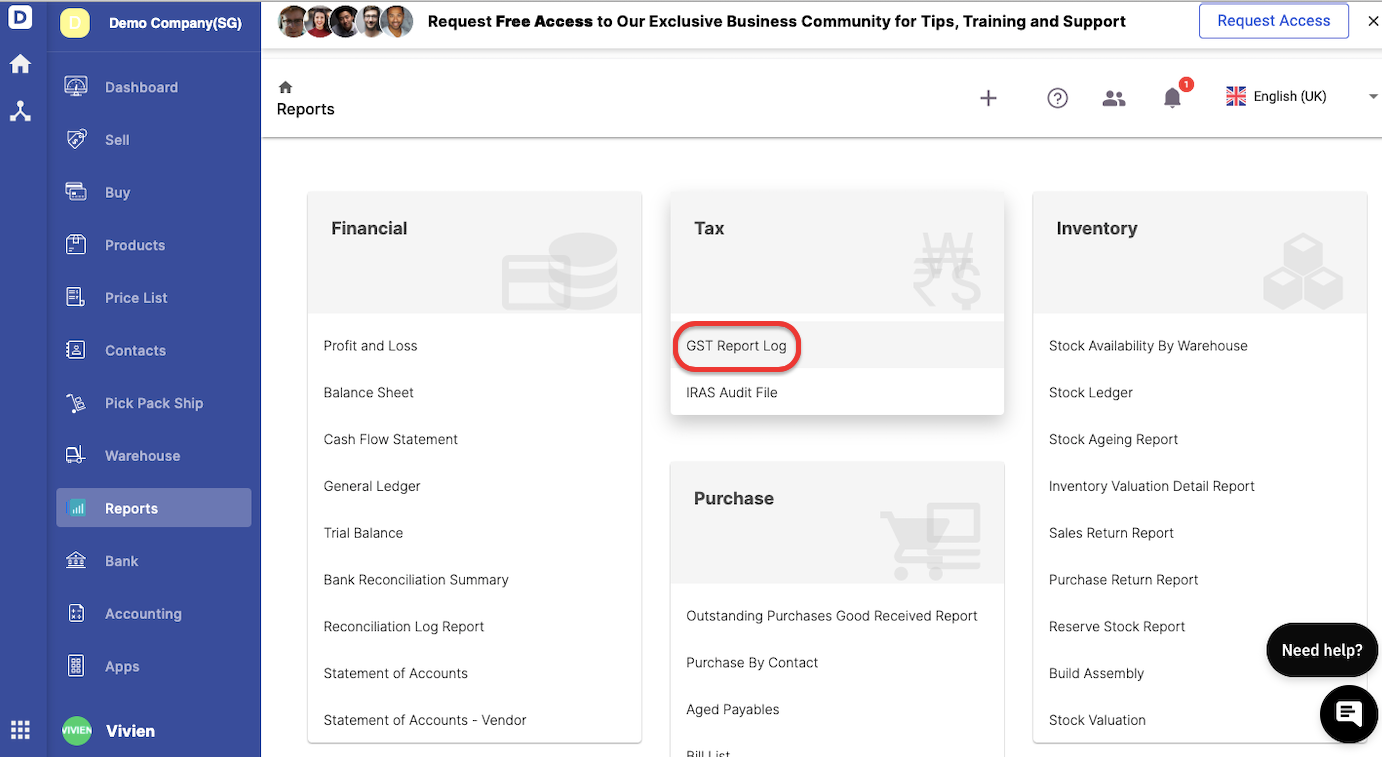

- Go to the ‘Reports’ on the sidebar menu. Click on the GST Log under the Tax section.

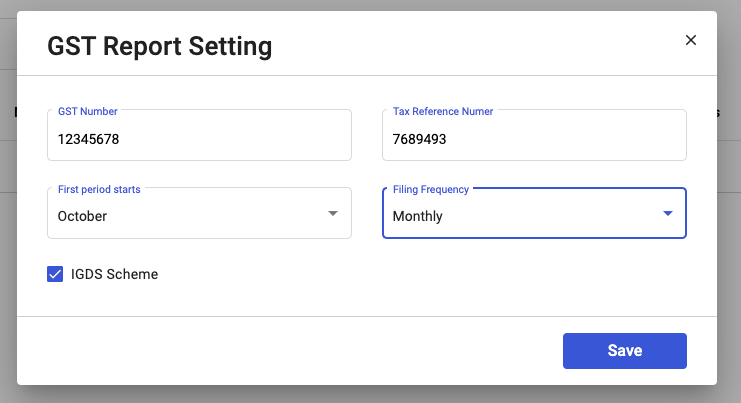

2. A pop-up will appear. Enter your GST number, tax reference number, the month for the start of first period, and filing frequency. Enable the IGDS scheme checkbox, if applicable.

3. Enter the save button.

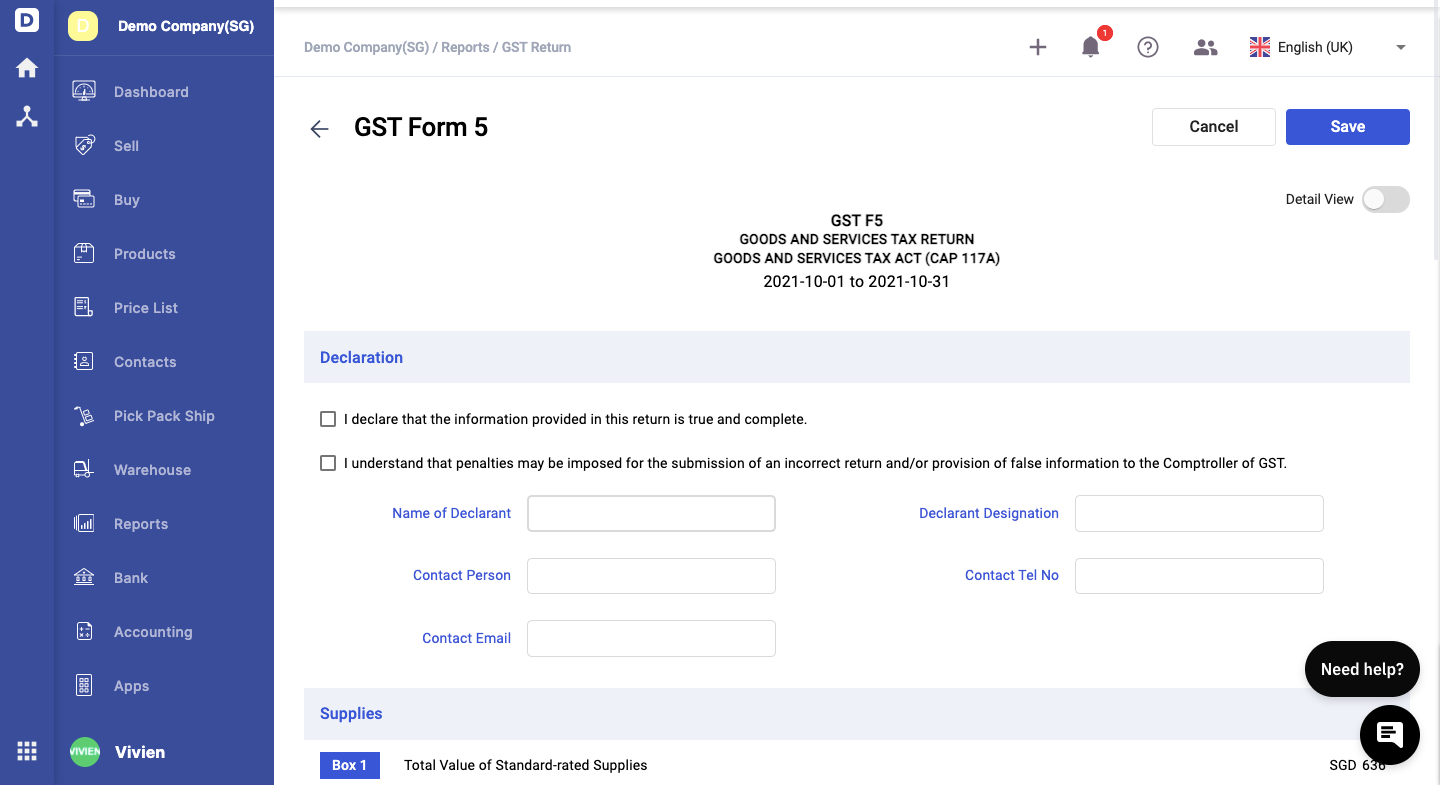

4. On the following screen, you should be able to view the GST Form 5 Report. Verify the amount from Box 1 to Box 19.

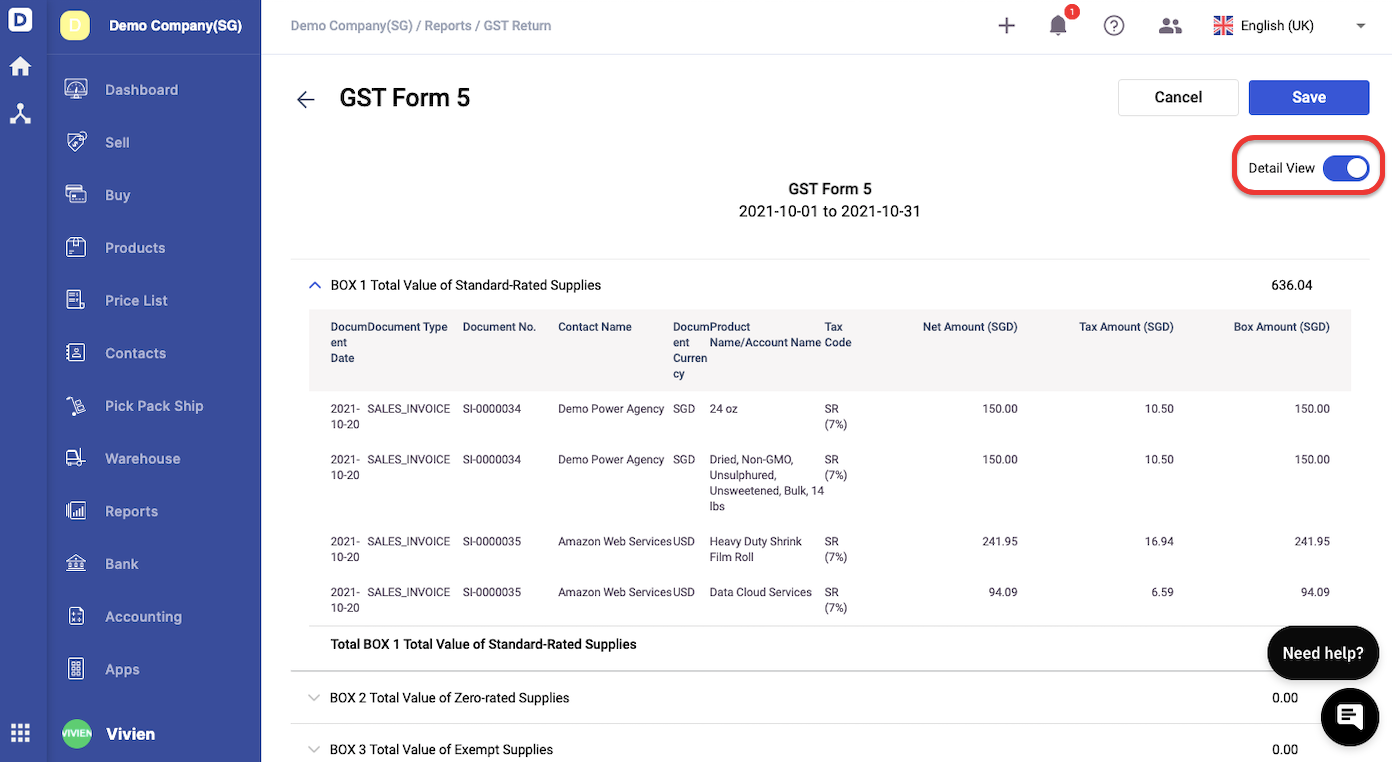

5. Enable the detail view to cross-check the transactions for each box.

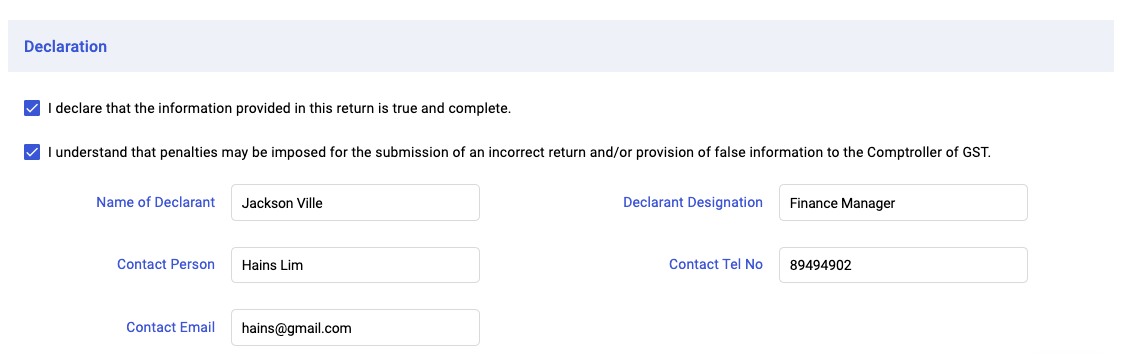

6. Once you have verified the information in the GST Form 5, enable the checkboxes under the declaration section.

7. Enter the name of declarant, contact person, contact email, declarant designation and contact number.

8. Click on the Save button.

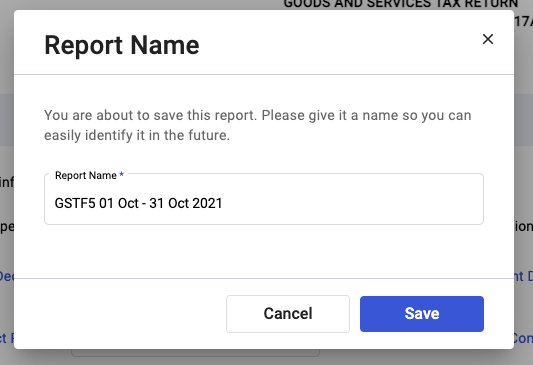

9. A pop-up will appear >> Enter the Report name and save it.

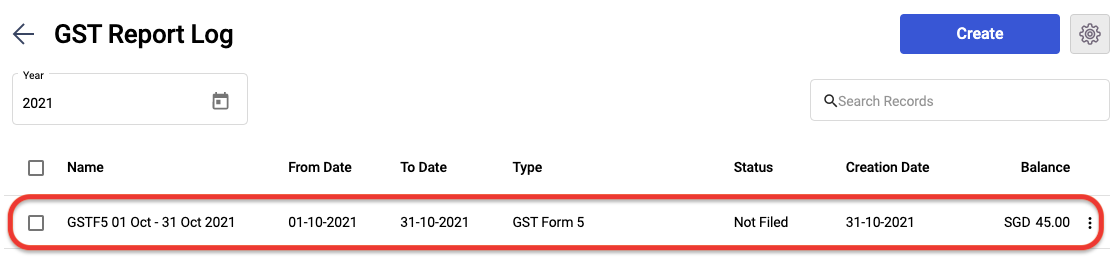

10. You can view the GST Form 5 on the GST Log screen.

Congratulations! You have successfully create a GST Form 5 Report using Deskera Books.