TDS stands for Tax Deducted at Source. It is a process to reduce the invoice amount, whereby TDS is deducted from the invoice, reducing the amount to be paid by the buyer.

The seller can then declare the gross income and take credit for the TDS adjustment to offset the final tax liability.

Under the GST Rule, TDS must be deducted at 2% on payments made to the supplier of taxable goods and services, 1% CGST and 1% SGST for intrastate supply, and 2% IGST for interstate supply.

To create TDS in the system, follow the steps suggested below:

- Login to your Books+ account.

- Go to Setting via the sidebar menu.

- Then, select TDS setup.

- Click on the "+ TDS rate" button.

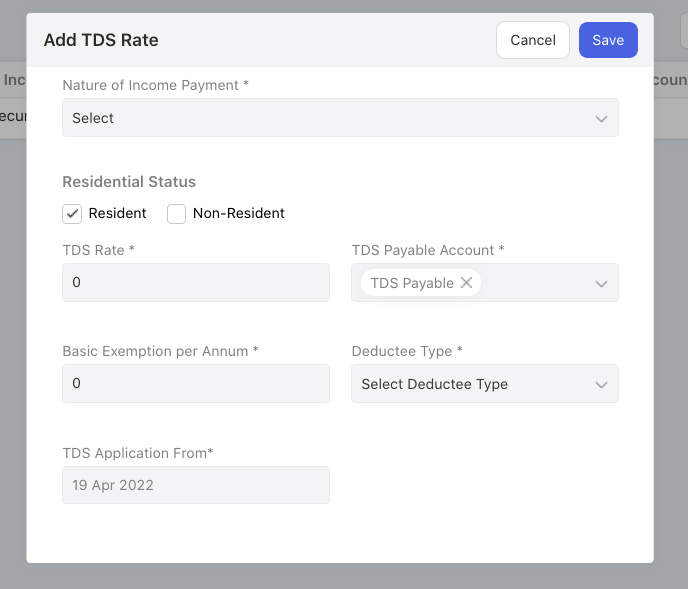

- A pop-up will appear and you can fill in the fields below:

- Nature of income statement- Choose the nature of income statement. The drop-down options here are reflected from the nature of income statement tab.

- Residential status - Select either resident or non-resident option

- TDS rate- Indicate the TDS rate here

- TDS payable account- Choose the TDS payable account affected

- Basic exemption per annum- The amount of basic exemption per annum

- Deduction type- Choose the deduction type; the drop-down menu options are as per the deductee type screen

- TDS applicable from- Choose the date the TDS is applicable from

6. Click on the Save button after filling the fields required.

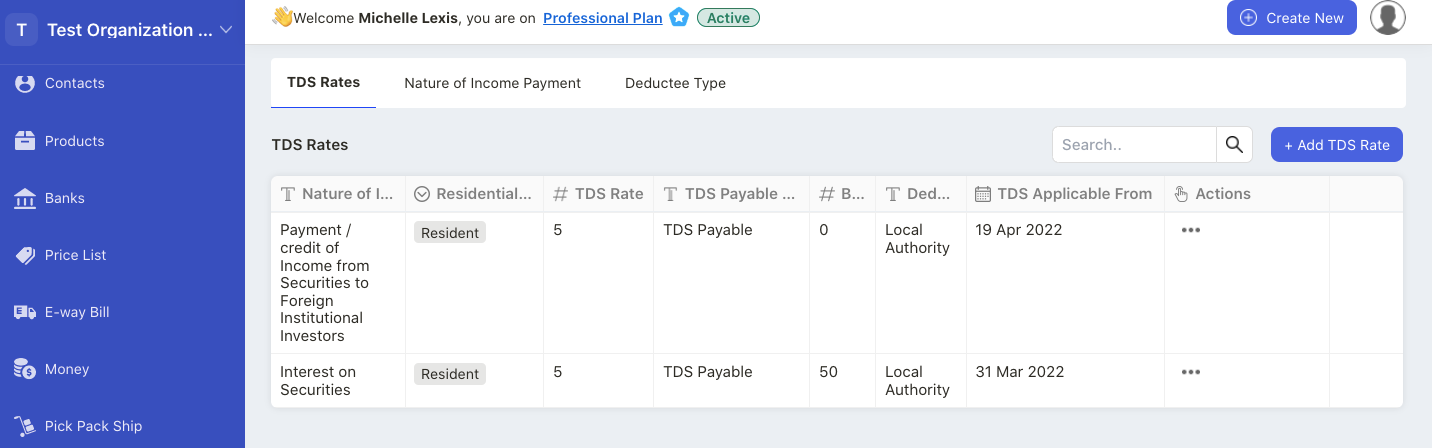

7. Finally, you can view the TDS rate added to your organization.

8. To edit the TDS fields, click on the three dots under the action column. Select edit button. If you wish to delete the TDS rate, select delete button.

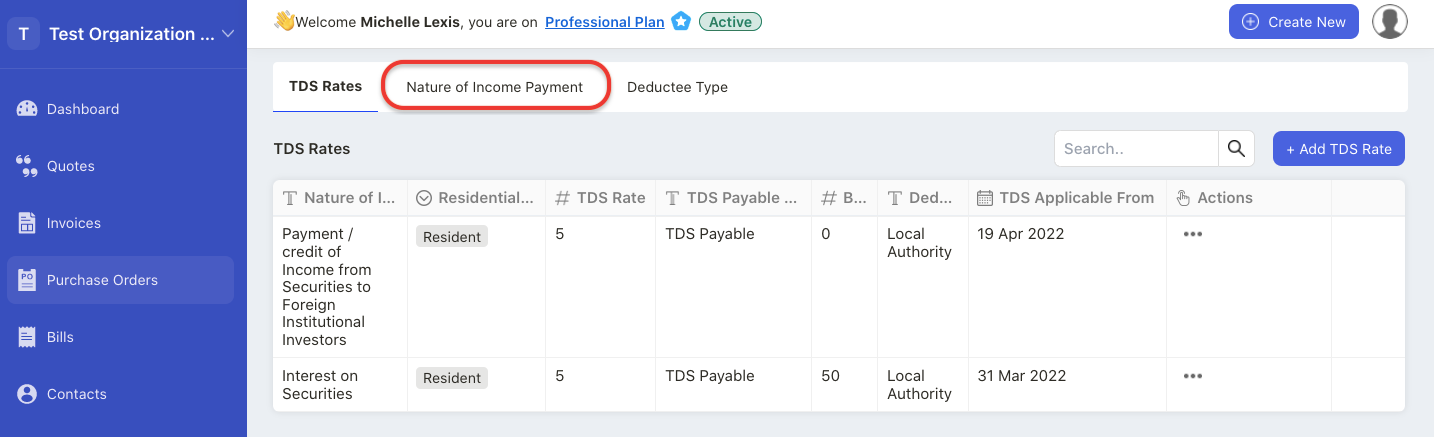

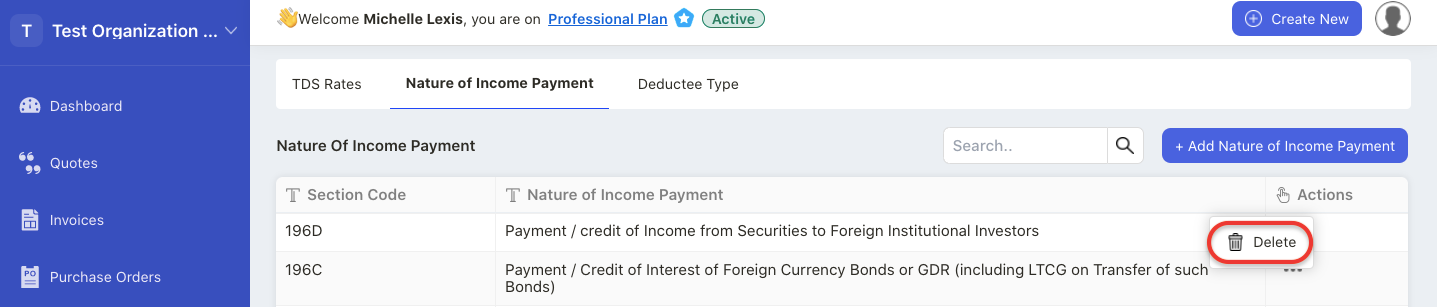

How to add a new nature of income payment?

- On the TDS screen, click on the Nature of Income Payment tab.

- Then, click on the Add button.

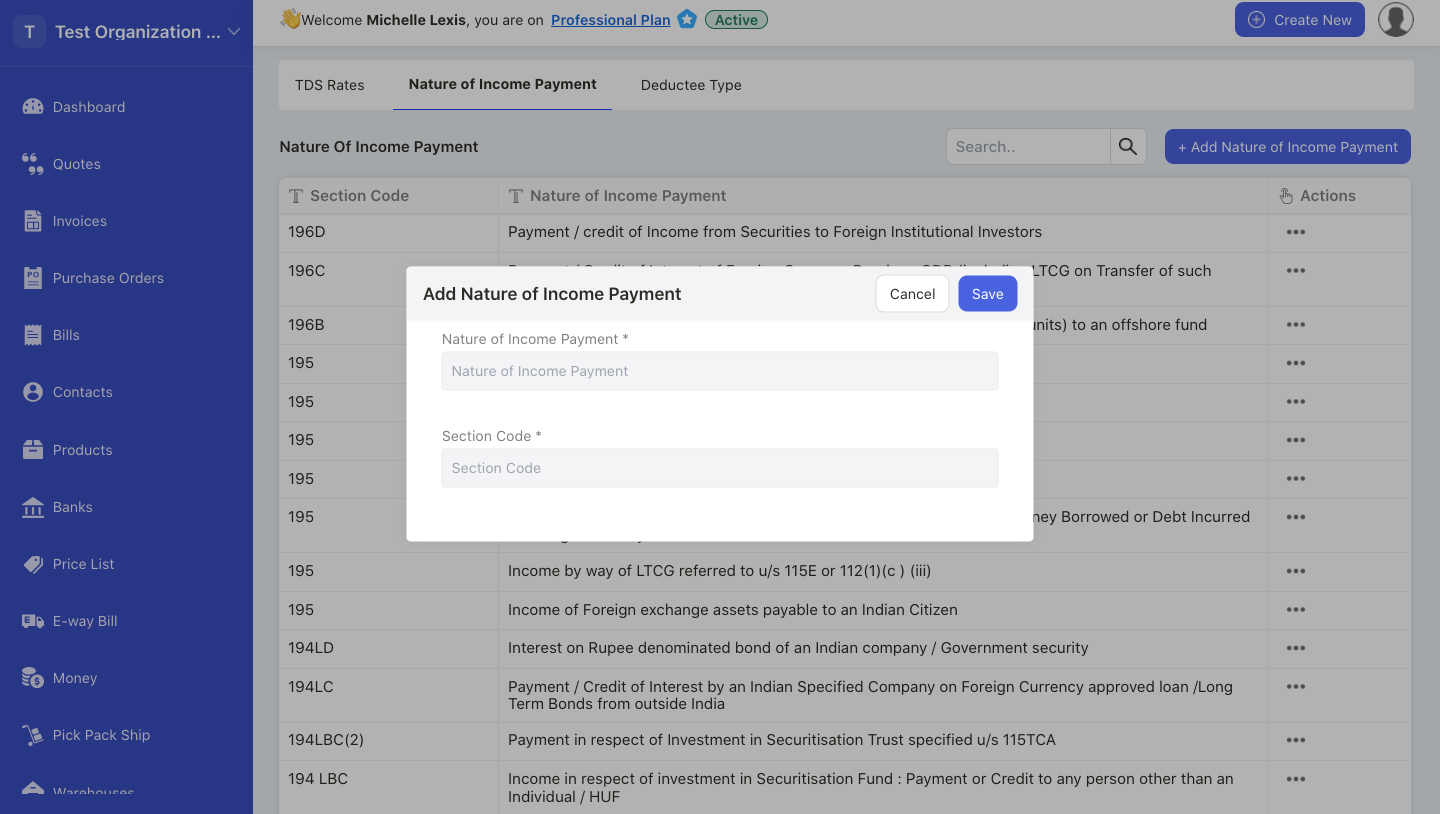

3. A pop-up will appear and you will need to fill in the nature of the income payment and the section code.

4. Click Save.

5. You can always delete the nature of income payment by clicking on the bin icon.

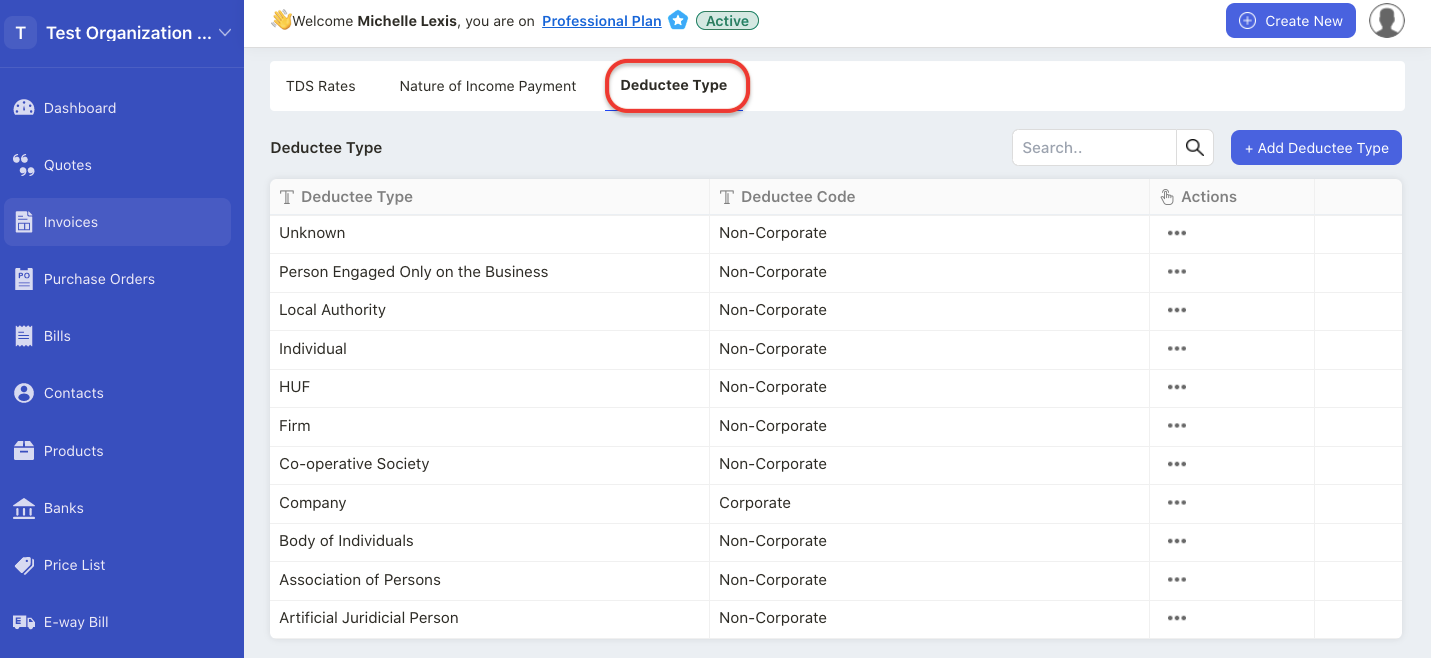

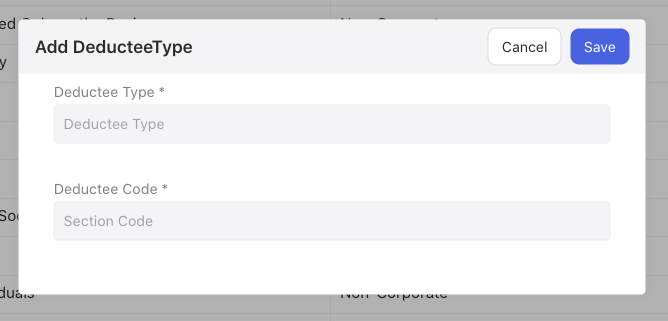

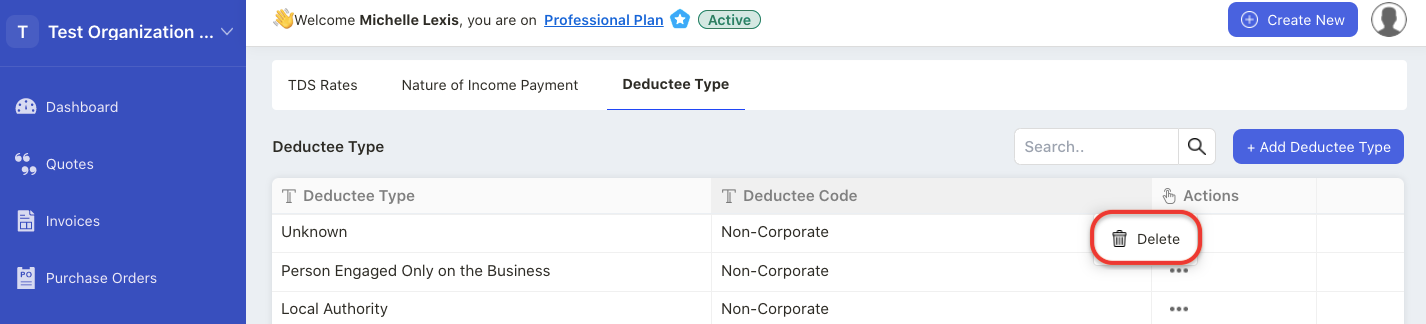

How to add a new deductee type?

- On the TDS screen, click on Deductee Type tab.

- Then, click on the Add button.

3. A pop-up will appear and you will need to enter the deductee type and the deductee code.

4. Click on the Save button.

5. Click on the bin icon to delete the deductee type under the actions column.

How to add TDS rate in Deskera Books Plus?

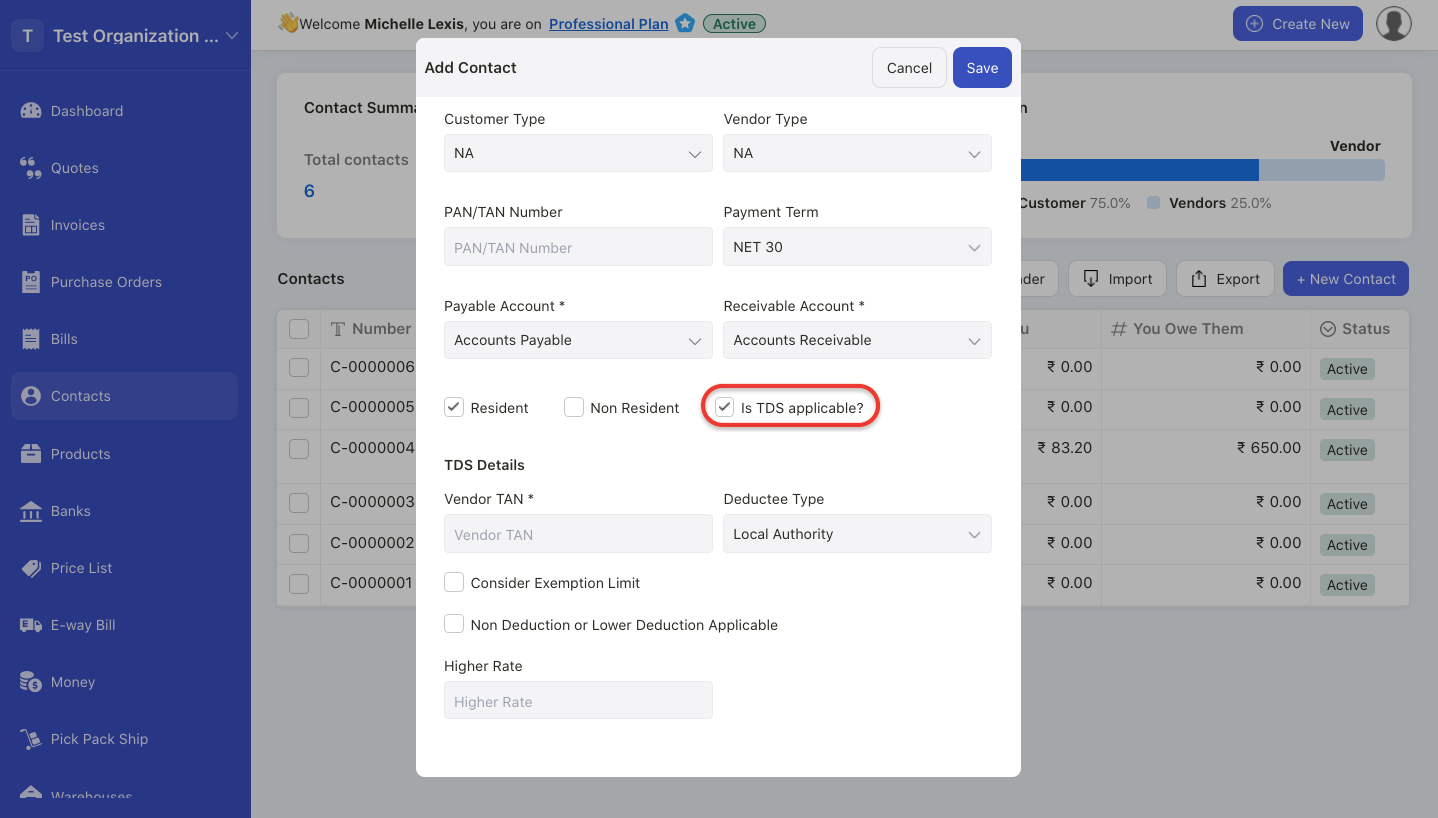

- Go to the Contact Module.

- Create a new contact.

3. Enable the checkbox if TDS is applicable to you under accounting tab.

4. After enabling the TDS checkbox, you are required to fill in the:

- Vendor's PAN number

- Deductee Type

- Enable exemption limit, and input the TDS higher rate here

- Non-deduction or lower deduction applicable; enter the certificate number and TDS rate after enabling this option, From and to date and state the reason

5. Save the contact details.

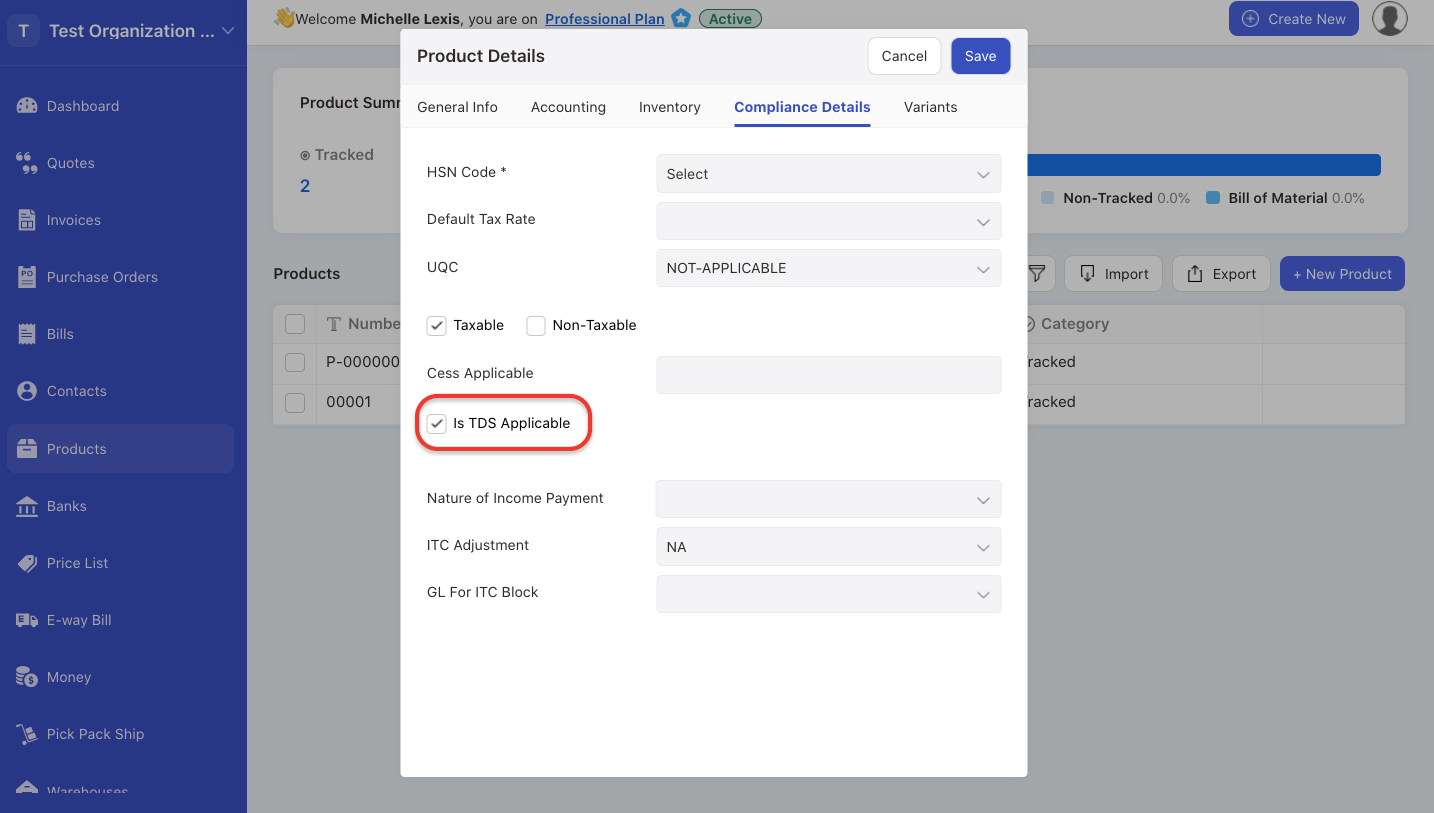

How to apply TDS against a product?

- Go to Product Module.

2. When creating the product, you will come across "Is TDS applicable" checkbox. Tick the checkbox if TDS is applicable for this product.

3. Once you have enabled the TDS option, choose the nature of income payment, ITC adjustment account and GL for ITC blocked.

4. Next, fill in the remaining fields and save this product.

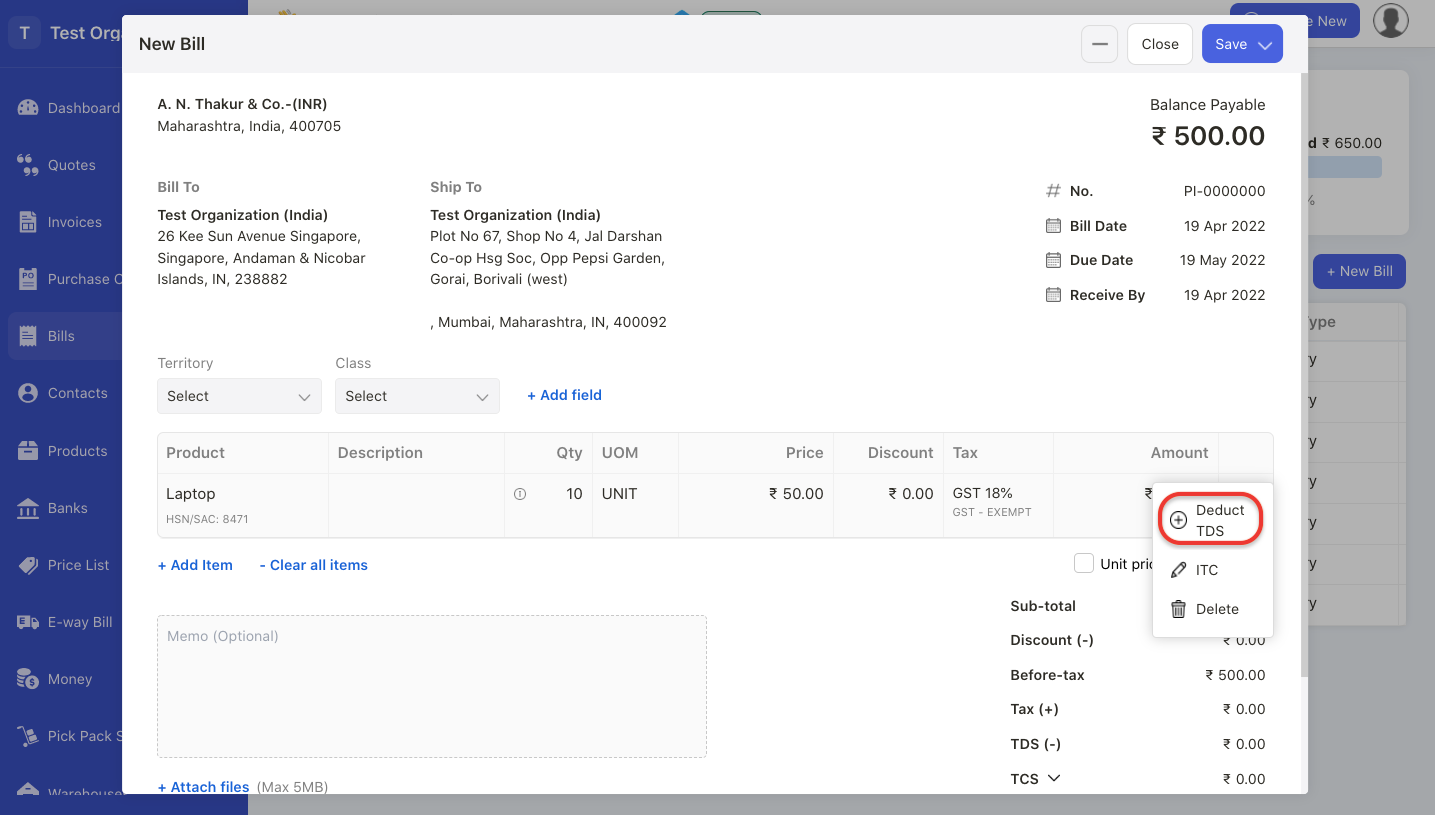

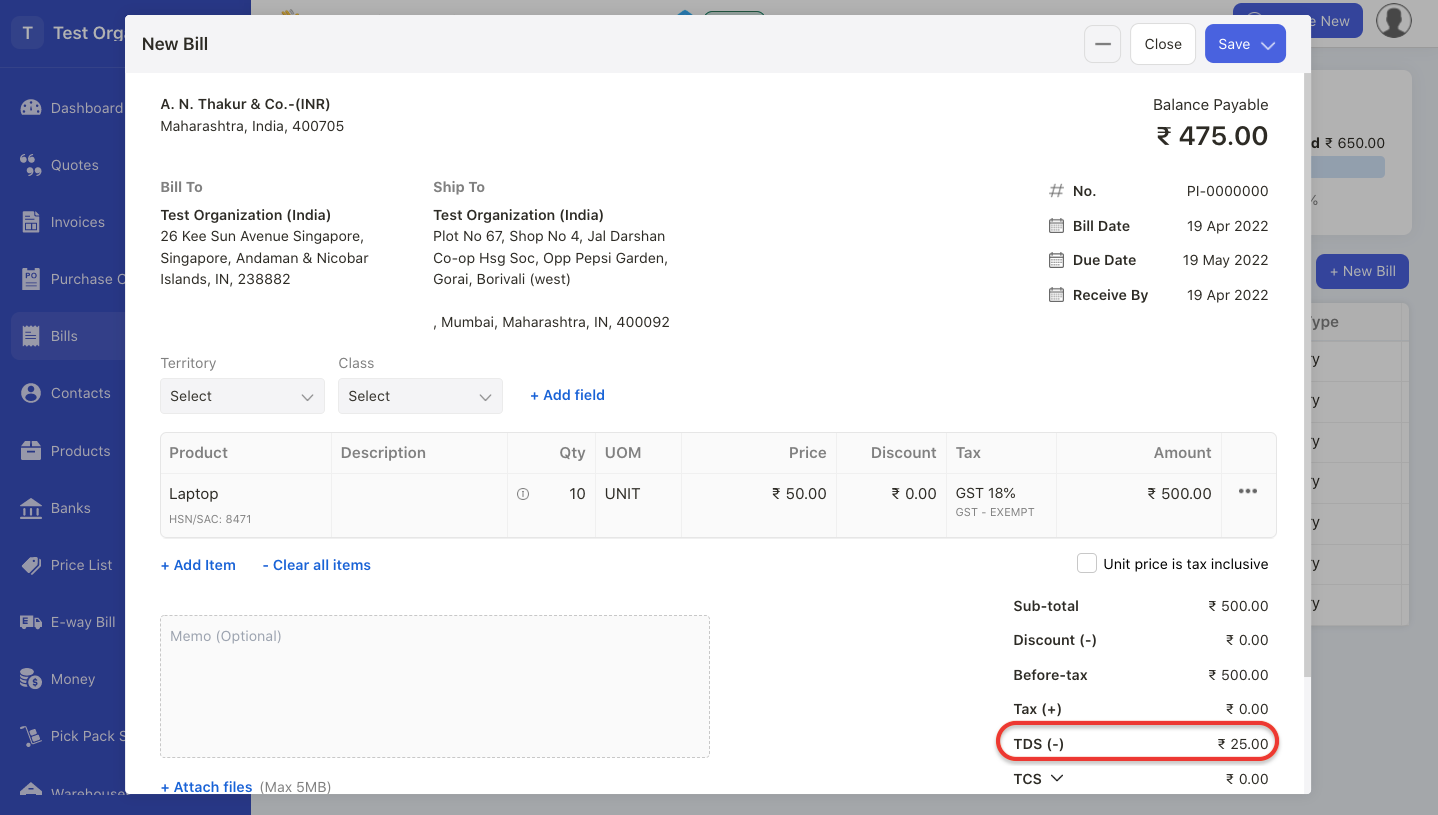

How to apply TDS in a bill document?

- Go to the Buy tab.

- Next, create a bill document.

- Select the contact and product with applied TDS as per the steps above.

4. After you have added the line item, click on the three dots and select deduct TDS button.

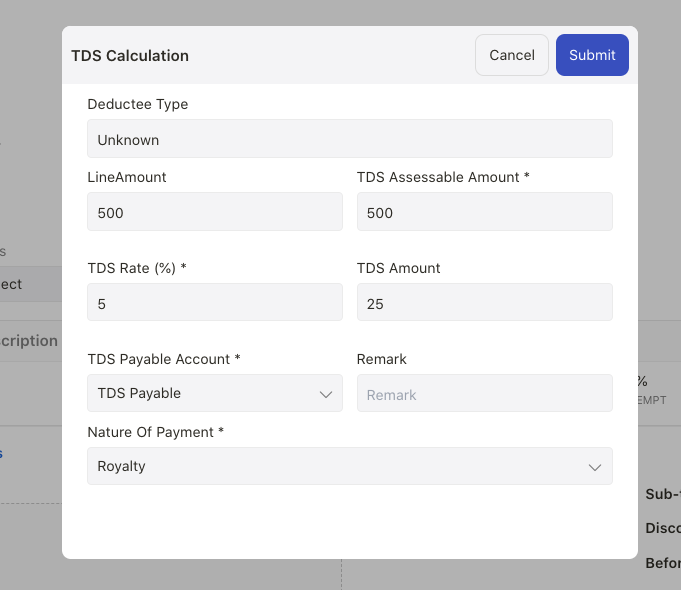

5. A pop-up will appear. Fill in the fields in the pop-up box;

- TDS assessable amount - Enter TDS amount, in which this amount can't be greater than the line amount

- TDS rate- Enter the TDS rate

- TDS amount- This field is auto-populated

- TDS account - Enter the TDS account

- Remark- Enter any notes or short description for this field

- Nature of payment- Choose the nature of payment for this TDS

6. Click on the Submit button.

7. Once you have applied the TDS in the bill document, you can view the TDS deduction in the bill document itself.

8. Then, click on the save button.

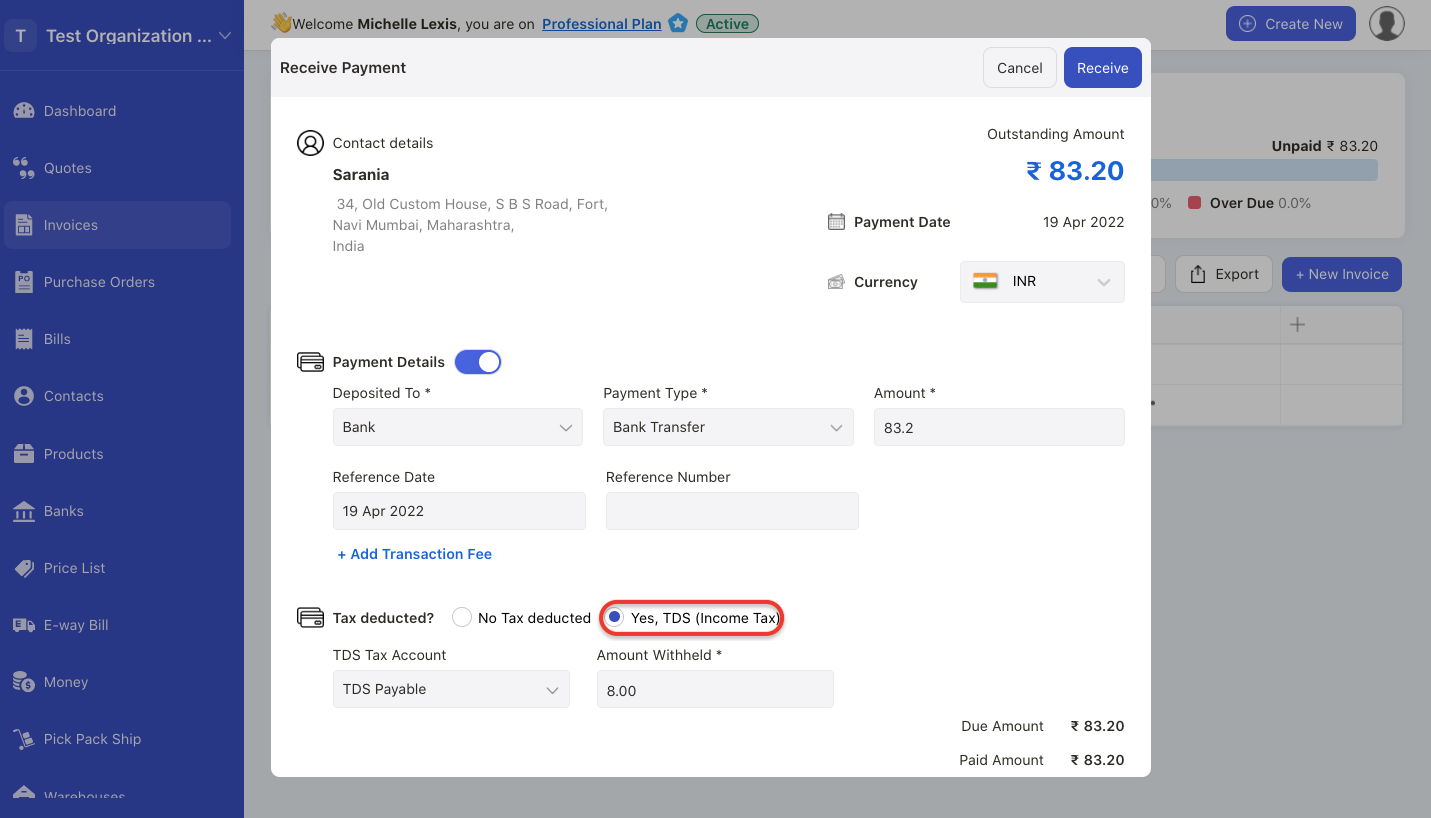

How to apply TDS in an invoice document?

- When receiving a payment for an invoice, you can view the TDS field.

- To apply the TDS for an invoice, tick the checkbox Yes TDS (income tax) option.

- Next, indicate the TDS tax account and the amount withheld.

- Click receive button.

- This will reduce the invoice outstanding amount.

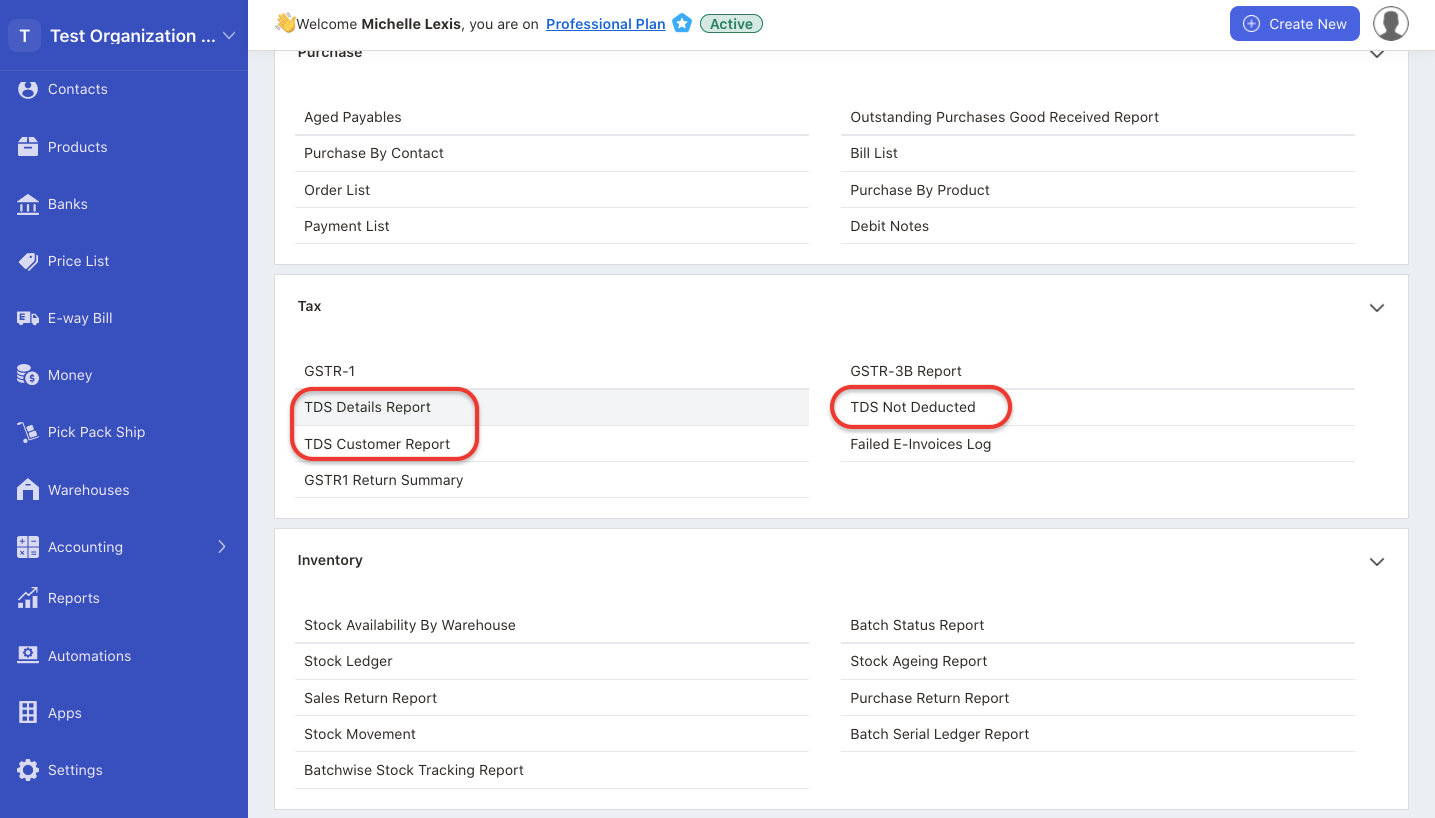

How to generate TDS report?

- Go to Reports Module via the sidebar menu.

- Under Tax section, you can view three TDS reports;

- TDS details report- The summary of all the contacts with TDS applied

- TDS not deducted- The summary of contacts, with TDS not deducted

- TDS customer report- The summary of customer's report with TDS

3. Click on the Export button to download a copy of these reports.