The Malaysian payroll and tax process can be complex for foreign businesses who are unfamiliar with the country’s laws and submission requirements and deadlines. When operating and employing in Malaysia, there are a number of things to be aware of to make sure your business is compliant with regulations.

Below are a few things to keep in mind when processing payroll in Malaysia.

Understanding Payroll & Tax in Malaysia

In Malaysia, a monthly tax deduction (MTD) system applies where the employers need to deduct monthly income tax from their employees income.

Employers are required to submit a monthly withholding tax return, and make MTD payments to the Malaysian Inland Revenue Board (MIRB) by the 15th day of the following calendar month.

Failure to do so will result in a penalty fine of RM200 – RM20,000, imprisonment or both.

Malaysia Individual Income Tax Slabs

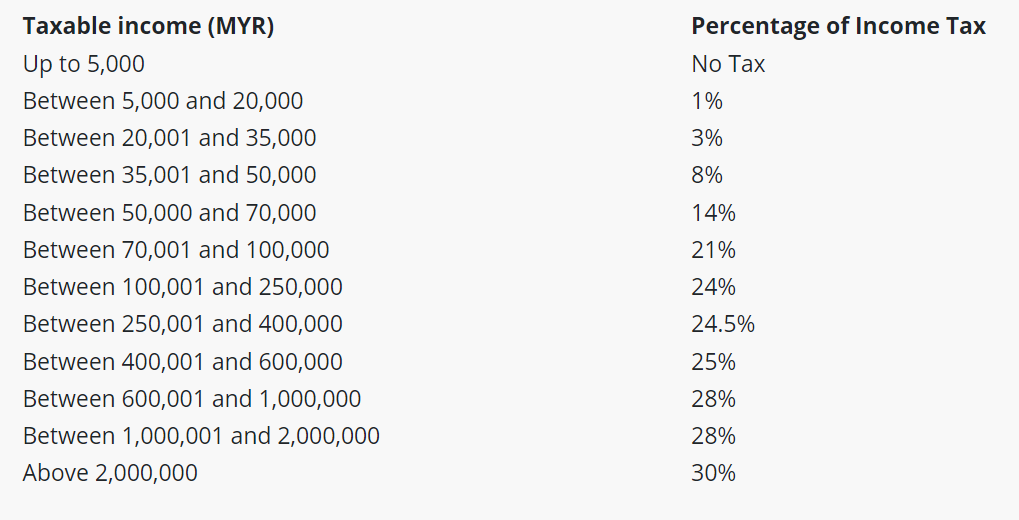

Income tax rates in Malaysia are progressive and range from 0% to 30%. The following rates apply:

Payroll Contributions in Malaysia

There are three statutory payroll contributions that Malaysian employers must be aware of.

Social Security (SOCSO)

The Malaysia Social Security system (SOCSO), also known as PERKESO (Pertubuhan Keselamatan Sosial), is a scheme to protect an employee against occupational injury including diseases, invalidity and other matters relating to employment.

Social security protection in case of injury/invalidity; for the main scheme (Malaysians under 60) the employee contributes 0.5% and the employer 1.75%; payable to PERKESO by 15th of the following month.

Employee Provident Fund (EPF)

EPF is a national retirement saving scheme. Malaysian employees and permanent residents are required to be contributors to the scheme. Foreign employees are not required to contribute to EPF, but may choose to do so.

This retirement scheme contributions; employee contribution rate is 11% for Malaysians under 60; employers also contribute 12/13% depending on salary; payable to KWSP by 15th of the following month.

Employment Insurance System (EIS)

The Employment Insurance System (EIS) protects employees aged between 18 and 60 years old who have lost their job. Employees enrolled into SOCSO are automatically entitled to EIS and employers can make payments to EIS through the same channels as SOCSO contributions. Foreign employees do not contribute to EIS.

Yearly Forms to be submitted

Every year the following forms must be provided:

- EA forms to be given to each employee detailing their income and contributions during the year; by end of February of the following year.

- E form detailing income and contributions of all employees to be filed online with LHDN by 31 March of the following year.