With Deskera Books software, users are not required to prepare the sales and service tax return report manually.

For all the selling activities you have performed in the Sell tab, the data will automatically be mapped to the Sales and Service Tax Return Report.

To view these reports, go to the Reports tab on the sidebar menu on Deskera Books. Under the Tax section, you can choose to view the Sales Tax Return Report and Service Tax Return Report individually.

Once you have click on the Sales Tax Return, in this report, you can view the products that are sold to your customers based on the tariff code.

The tariff code is generated during the new product creation in the Product Module.

On top of that, users can view the total amount of the products sold to your customers, the tax rate of the product, and also the total tax payable that the business should remit back to the government.

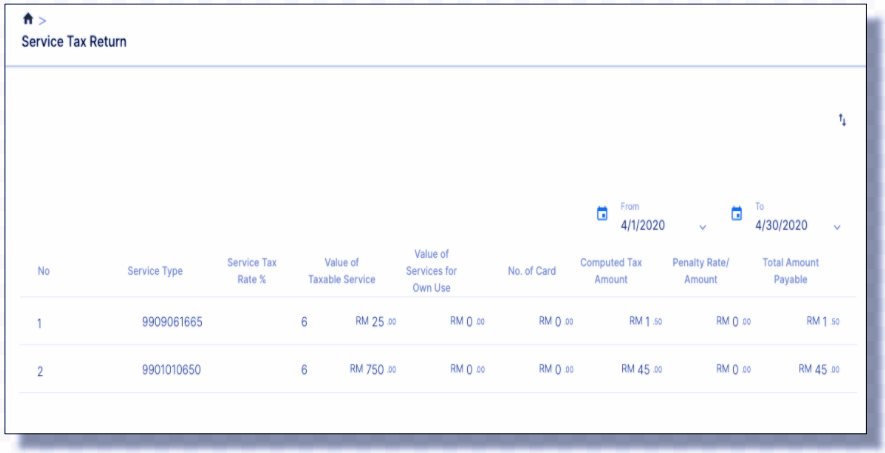

Besides viewing the Sales Tax Return, users can also view the Service Tax Return Report if they're in the service industry.

Based on this report, the service type column shows the tariff code of the service they're providing.

For example, 9901.01.0650 represents the accommodation services you've provided to your customers. The total amount of tax payable is also auto-populated.

You can file and make your tax payment based on the amount generated in this report.

If you wish to filter the report based on the date range, you can do so by changing the 'date from' and the 'date to' date.

Hence, both the report will be generated based on the date range you have chosen. Click on the arrow at the top right of the screen to export the report in an Excel sheet.