What is the Philippines withholding tax?

When a business withholds a portion of a payment for services or goods to a supplier and remits that portion to the government on behalf of its supplier is known as withholding tax. This is a tax compliance method utilized by governments to ensure that taxes are remitted properly by a business and on a timely basis.

This is nothing but, the government is shifting the burden of tax collection from the BIR to the businesses.

As a proof the business is required to provide BIR Form 2307 (or Form 2306 in certain cases) to the supplier of the withholding. This form is then used by the supplier as an evidence of payment. This tax amount of withheld should then be deducted from the taxpayer’s income tax at the end of the year.

If you are a tax withholding agent, you are required to deduct 1% of the value of payments for purchases of goods and 2% for purchase of services from all local suppliers. A tax withholding agent is also required to withhold tax from non-resident aliens engaged in trade or business in the Philippines.

Is withholding tax deducted from every supplier?

No. The supplier must be a regular supplier, meaning the withholding agent has transacted a business at least 6 times (last year or in the current year) with that supplier. However if there has been a single purchase transaction of at least P10,000, withholding tax has to be applied.

Who is a Withholding Agent?

A Withholding Agent is any person or entity who is in control of the payment subject to withholding tax and therefore is required to deduct and remit taxes withheld to the government.

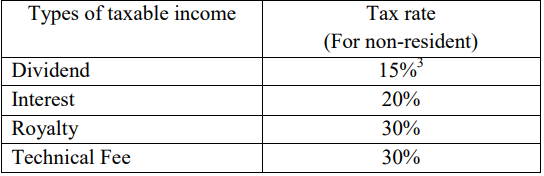

WHT Tax rates and categories:

Tax exemption under WHT Tax

An individual earning less than P250,000 a year is exempted from withholding tax, where the income is coming only from a single payer.

Forms required for submitting withholding tax

All TWAs are required to remit taxes monthly using BIR Form 0619E. The form must be submitted on the 10th calendar date after the month the tax has been withheld. EFPS users, those who pay their taxes online can file up to the 15th of the month. The form should be submitted every February, March, May, June, August, September, November and December. For eg, if you are an EFPS user, withheld taxes for April must be paid on May 15th.

For quarterly tax payments, Form 1601EQ must be filed every January, April, July and October. The deadline is the last day of the month after the quarter ends. So for the 1st quarter ending in March, the deadline is April 30.

Together with your 1601EQ, a business must submit a Quarterly Alphalist of Payees (1604E or 1604F). This is a list of all payees from whom a business withheld taxes and includes their Tax Identification Numbers, the amount withheld and business addresses, in addition to other relevant information. The Alphalist Data Entry and Validation Module must first be downloaded from the BIR website to complete this.