As a business owner, one of the primary responsibilities you should be practicing without fail is to collect and remit sales tax correctly.

As we know that individual states govern sales taxes, each state can set its own sales tax due date. Most of the states would prefer the sellers to file the sales tax return on the 20th of the month after the taxable period, monthly, quarterly, or yearly.

However, some other states would fix the due date on the last day of the month or 25th each month.

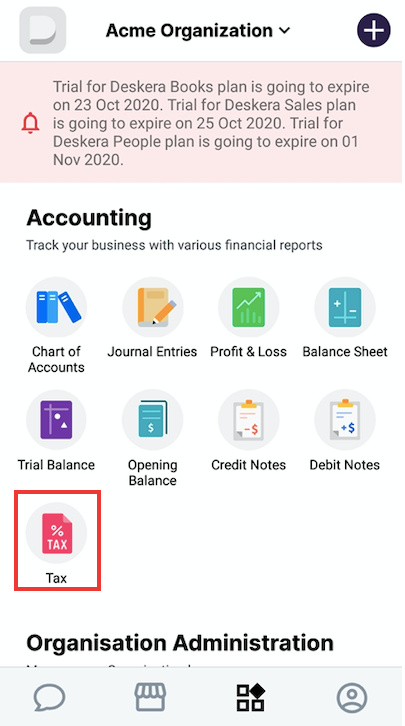

On the main screen of Deskera Mobile App, tap on the Tax Report under Accounting Module.

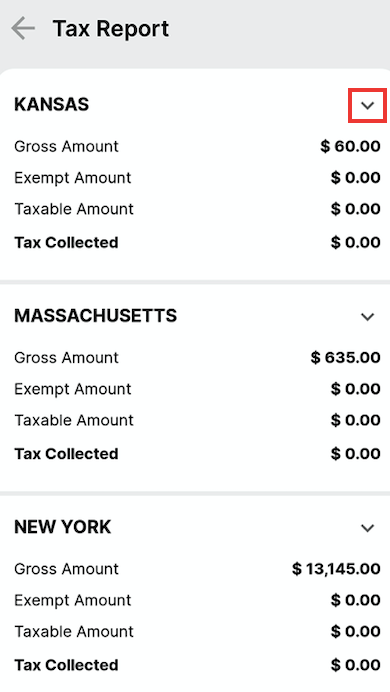

In the Tax Report page, view the gross amount, exempt amount, taxable amount, and tax collected for each state. This figure is mapped from the payment you have received from your customers.

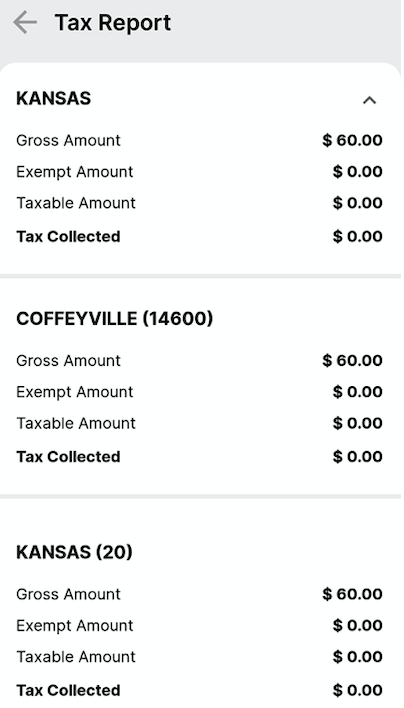

Click on the drop-down arrow to view the amount of tax collected for each jurisdiction. The digits as shown above represents the jurisdiction code. You can see that the tax collected for each jurisdiction is different.

Thus, this explains the complication of the computation of sales tax. However, you can have peace of mind as our software can compute the sales tax automatically based on the ship-to and ship-from address you have entered.

Once you have all the information about the sales tax in each state, you can file for your sales tax in the state.

You must file your sales tax return even though you did not collect any sales tax for some instances. If you failed to file your sales tax return, you'd have to bear the consequences taken by the Internal Revenue Services (IRS).