I'm sure you have a clear understanding of how the ITC works in India based on the explanation of Input Tax Credit (ITC) in the previous article.

In this article, we will delve further into the reversal of Input Tax Credit in GST.

ITC reversal in GST

Input Tax Credit reversal in GST means the credit claims of inputs tax added to the output tax liability are effectively voided.

Businesses need to make payment of interest depending on when the reversal is done.

Scenarios of ITC reversal

- Reversing ITC of any inputs held as stock in trade

- The ITC reversal amount calculation should be proportionate based on corresponding invoices in which the credit had been availed for inputs in stocks.

- Reversing ITC for non-availability of invoices

- The credit reversal amount should be based on the current market price of the goods on the date of the relevant events where the tax described above invoices are not available.

- Reversing ITC related to capital goods

- By taking the residual life of the capital goods as five years, the input tax credit for the remaining residual life in months should be calculated based on a pro-rata basis.

Examples of calculation related to capital goods

Capital goods that have been used for three years, five months, and 15 days

The residual remaining life in months = (60-42) = 18 months

The input tax credit is taken on capital goods = 12,000

Input tax credit for the remaining residual life = 12,000 x 18/60 = 3,600

Eligibility to claim input tax to pay the output tax liability

You are eligible to claim the input tax if you satisfy the following conditions:

- Manage to make payment to your supplier within 180 days from the date of invoice issuance.

- Capital goods and Inputs are not used for personal purposes

- Capital goods and Inputs are not used for providing exempt supplies

- Submission of GST Returns promptly.

If you failed to satisfy the conditions above, you're not eligible to claim credit for taxes paid on inputs.

Hence, you will need to fill in Form GSTR-2, point 11, which deals with a reversal of input tax credit.

Take note to segregate the amount of ITC reversal into IGST, CGST, SGST, and Cess and fill in the amount in the column above.

How does this apply to Deskera users?

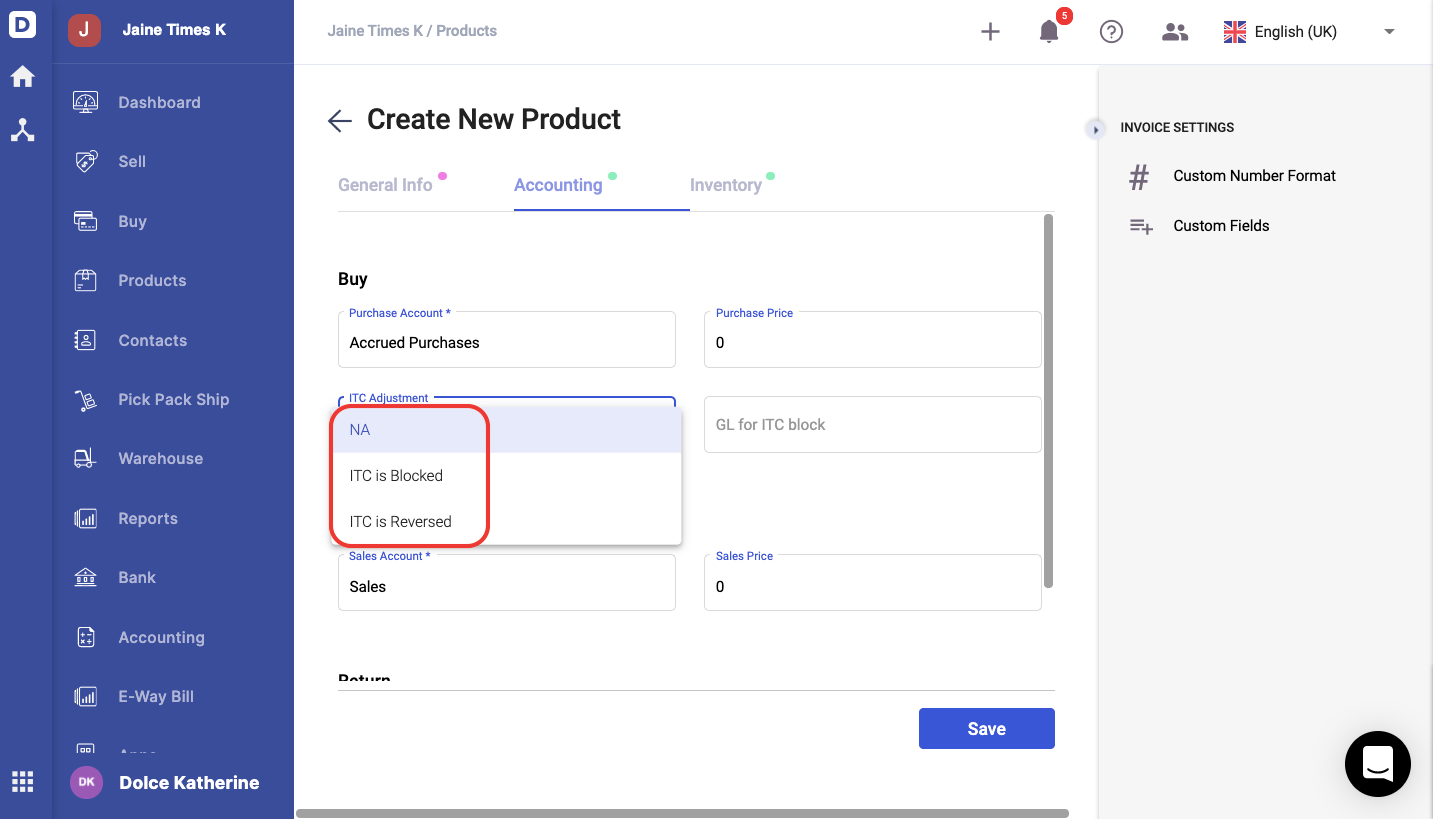

When creating a product, Deskera users can indicate if the Input Tax Credit (ITC) is blocked or reversed under the ITC Adjustment in the Buy section.

ITC is only applicable in the Purchase Account.

- Click on the drop-down arrow from the ITC adjustment field.

- Select either ITC is blocked, or ITC is reversed.

- ITC is blocked for general insurance, repair, and maintenance services related to motor vehicles, servicing, work contract services related to construction, etc.

How to indicate that I'm ineligible for ITC?

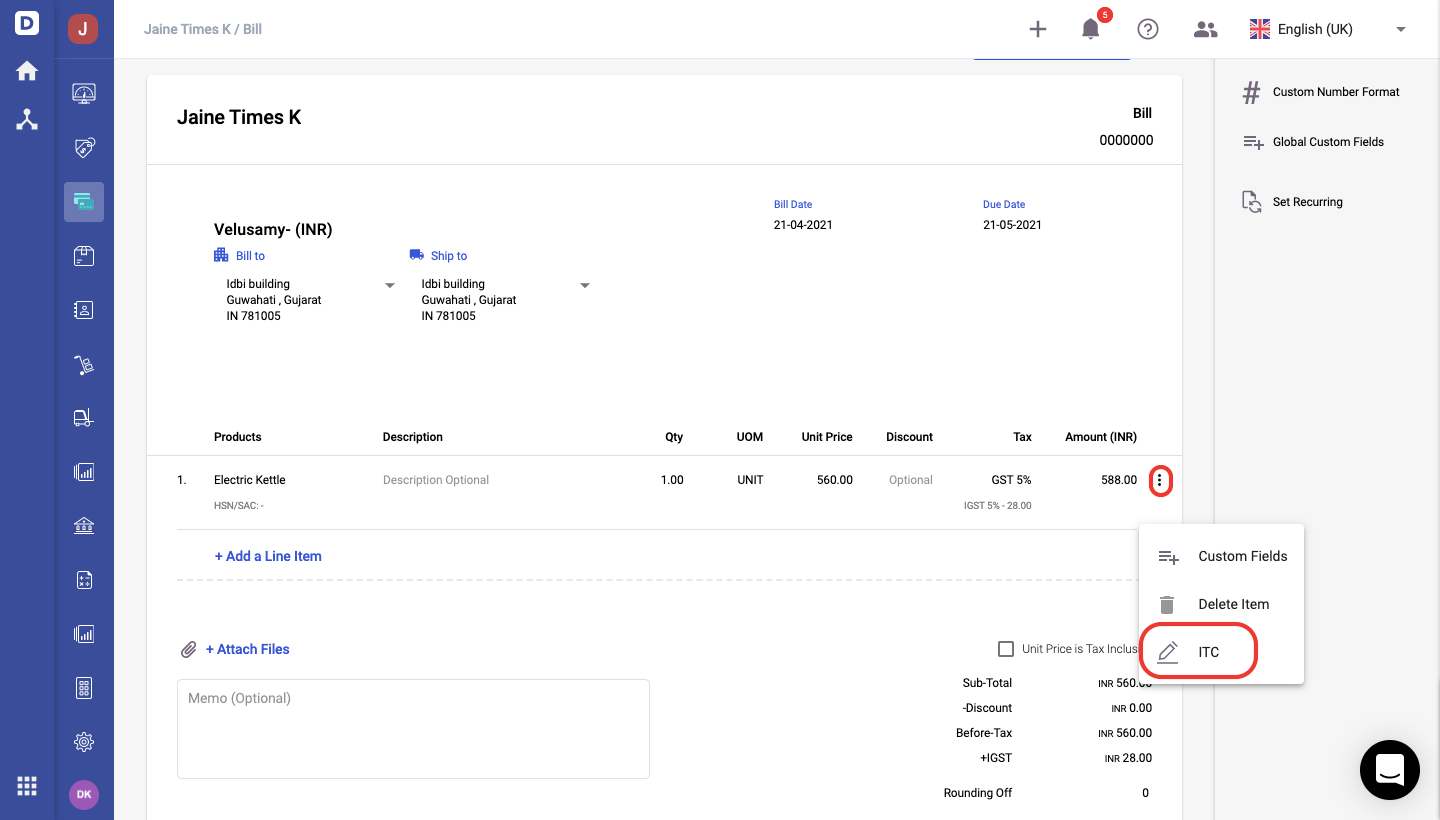

To indicate that you are ineligible for ITC, follow the steps below:

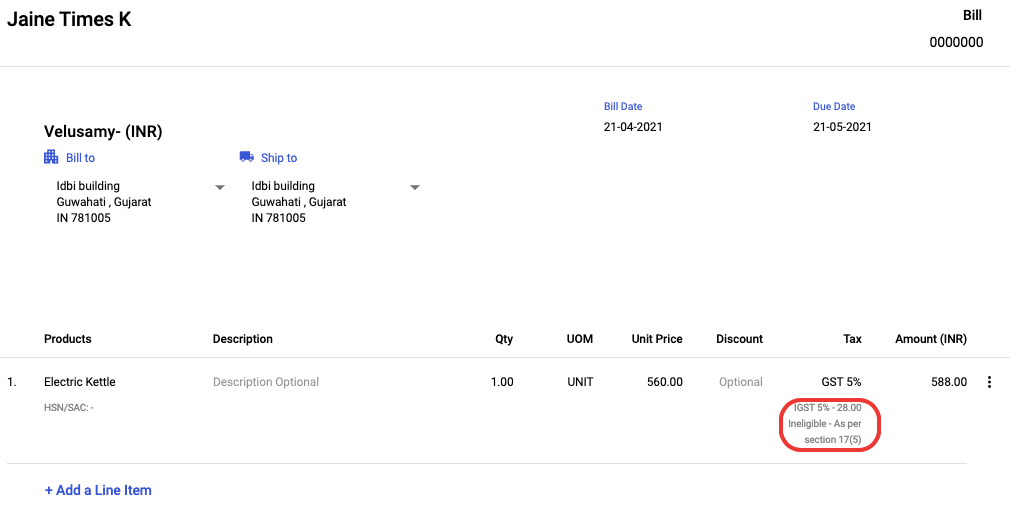

- Go to the Buy tab via the sidebar menu.

- Create a new bill document.

- Input the vendor's name and the line item.

4. Click on the three dots on the line item. Then, select the ITC option.

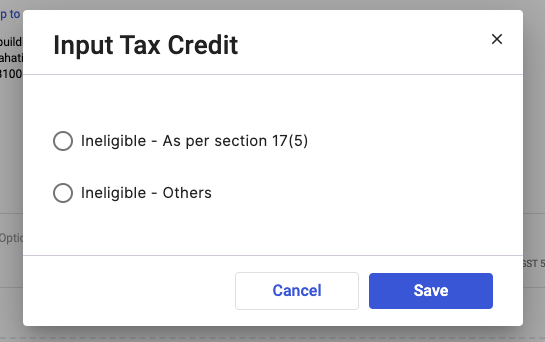

5. A pop-up will appear. Choose either you're ineligible as per section 17(5) or others. Select the Save button.

6. Once done, you can view the ineligible ITC statement under the tax column.

7. Save the billing document.

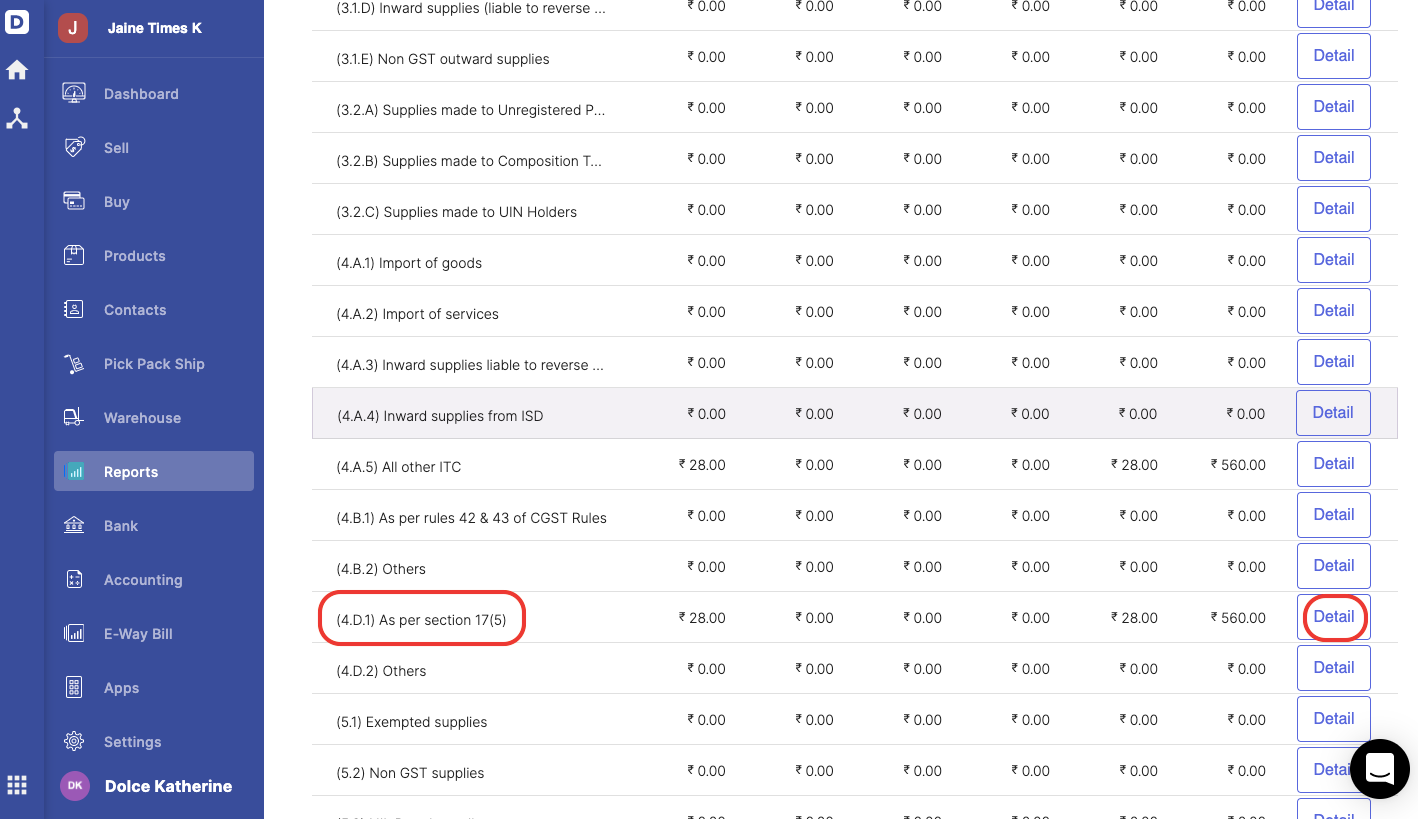

8. To view these transactions in GSTR-3B, go to the report section.

9. Click on the detail button under (4.D.1) as per section 17(5) in the GSTR-3B Report.

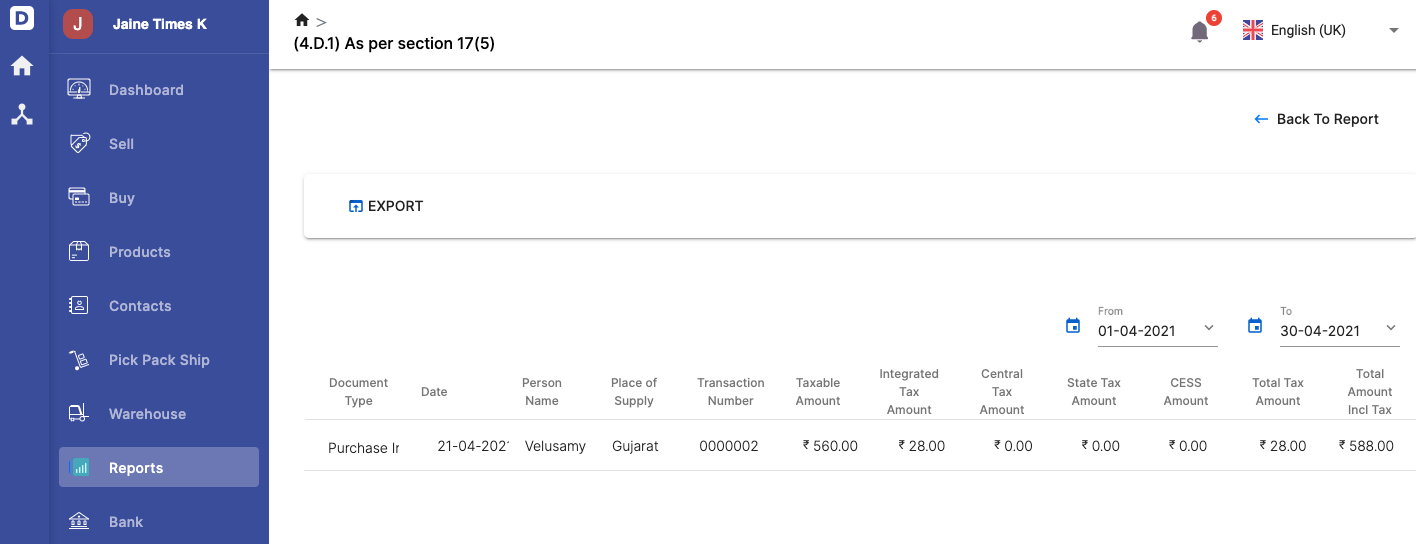

10. You should be able to view all the ineligible ITC under section 17(5) transactions saved in this window.

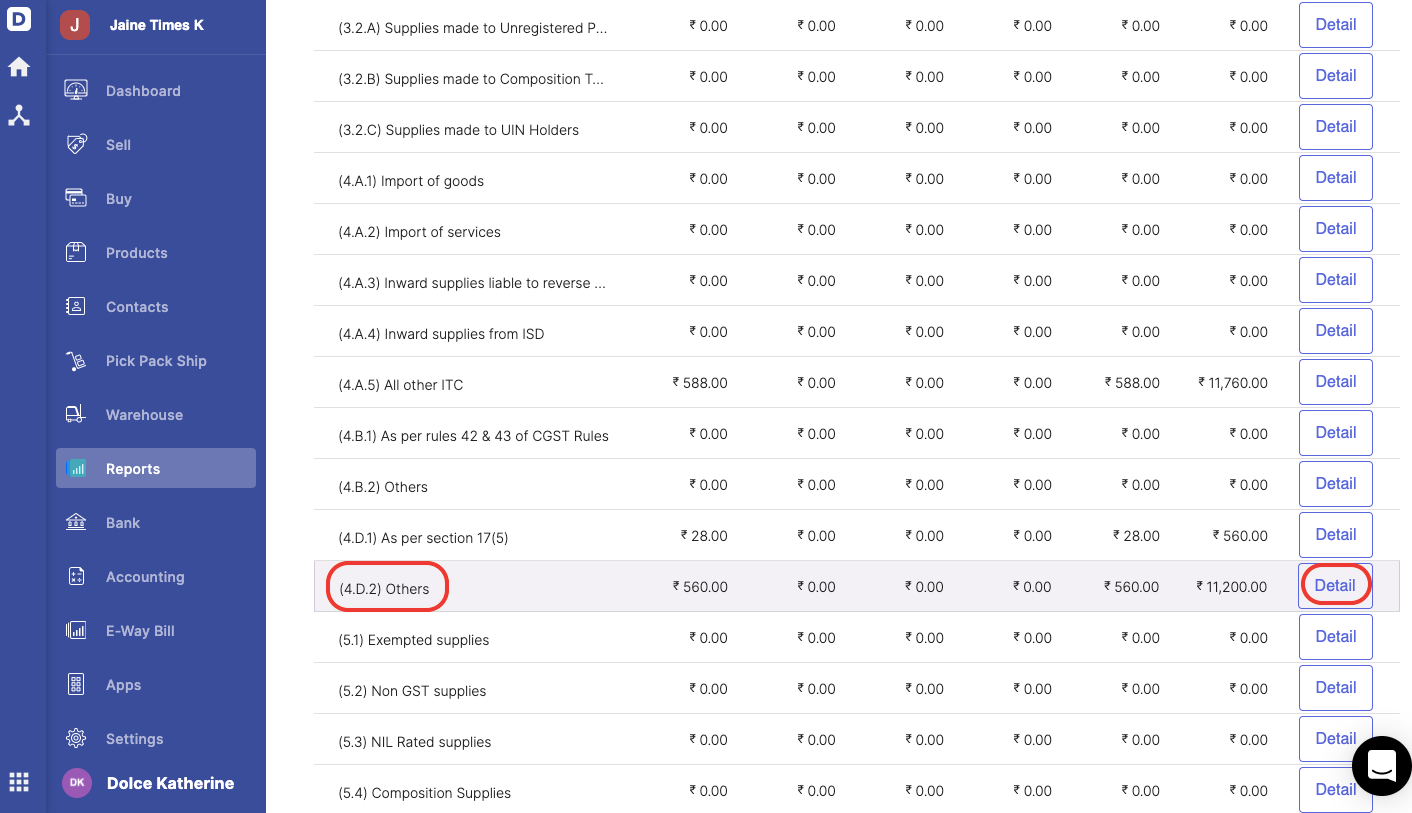

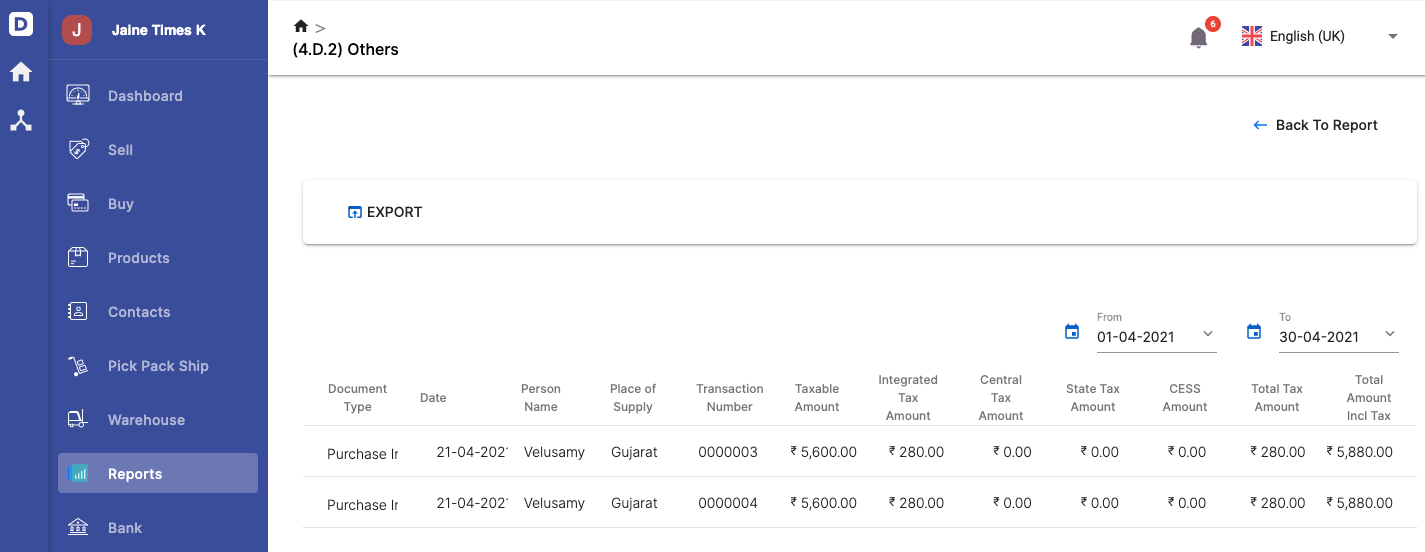

11. If you have selected the other option in point (5), click on the detail button under (4.D.2) Others.

12. You should be able to view all the ineligible ITC saved as others in this window.

13. Click on the Export button to download this report in xlsx format.