What is IR8A?

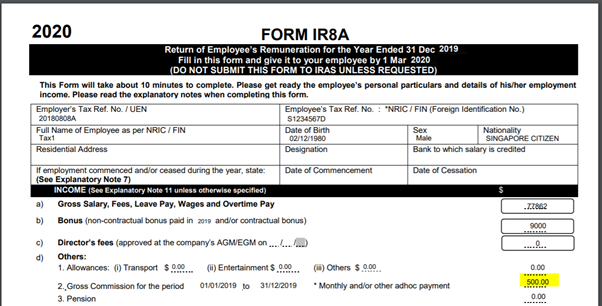

Form IR8A in Singapore is a mandatory document that contains information on employees’ earnings. Depending on various working conditions of your employees you might need to prepare Appendix 8A, Appendix 8B, and Form IR8S as well. They are issued by the employer and relate to employees’ income for the preceding year.

For whom does the employer prepare IR8A?

All employers must complete a Form IR8A for:

- full-time and part-time resident employees;

- non-resident employees;

- resident company directors;

- non-resident company directors;

- board members receiving Board/Committee Member Fees;

- employees who are working for the company while receiving a pension;

- employees who have left the company but should get income for the preceding year.

What is the Auto-Inclusion Scheme (AIS)?

Under this scheme, employers submit electronically the employment income information of their employees to IRAS. The submitted information will then be automatically included in the employees’ income tax assessment so that they do not need to declare these incomes themselves. You do not need to issue the same forms to your employees separately.

How to Submit Form IR8A?

For employers who are specified under the Government Gazette, you will be required to submit the income information of your employees electronically to IRAS by 1 March annually. This is applicable if you fall under the AIS for employment income. All information that is submitted by the employers will be displayed on the employees’ electronic tax returns and automatically included in their income tax assessments. AIS employers will also require a hard copy of form IR8A.

Contrary, employers who are not under the AIS for employment income, will be required to provide a hardcopy of Form IR8A and applicable appendices to their employees by 1 March annually for the filing of their income tax returns.

Employers will not be required to submit these forms to IRAS. Be sure that the submission deadline is met along with the other tax documents that need to be submitted to ACRA; otherwise, there will be legal repercussions for your company.

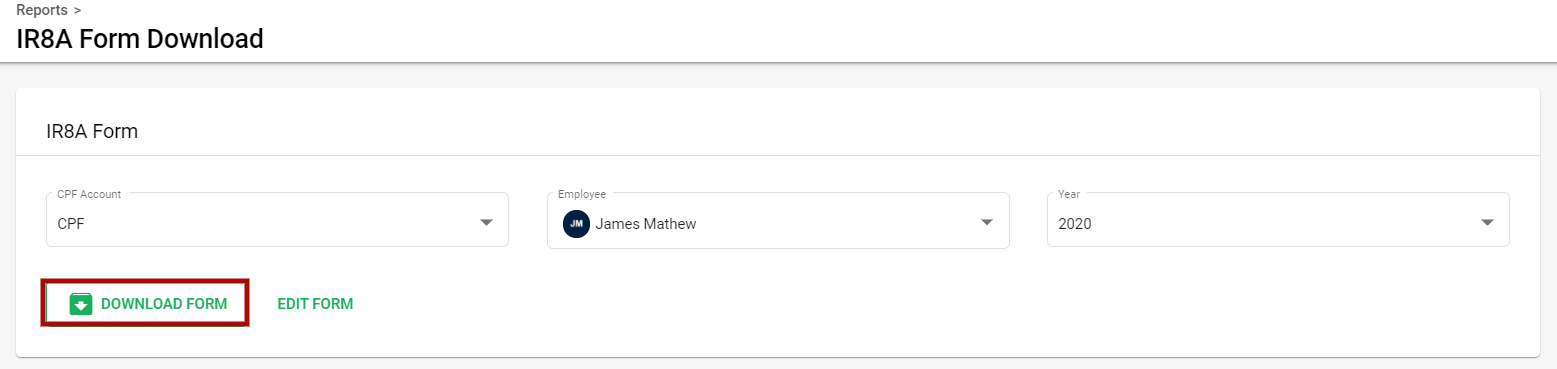

Downloading IA8A Form using Deskera People

Using Deskera People as an admin you can download the IR8A forms for your employees which is required to file tax returns.

Following are the below simple steps:

1. Go to the Report Tab under the sidebar menu>> A window will appear>>Under IRAS>>click on IR8A Form Download>>below screen will appear

2. By default, the CPF account will be set along with the current accounting year for which the IR8A form needs to be submitted for the tax return of employees.

As you need to submit the IR8A form for each employee, from the employee box you can select the employees from the dropdown menu and download the form and edit the details if required.

3. To download the IR8A form, click on the Download Form button and the form will be downloaded in PDF for the selected employees.

Once the form is downloaded, filled in correctly it will be further submitted to IRAS.

Edit IR8A Form

In case any information captured in the form is incorrect, you have an option to edit the form

By clicking on the Edit Form, an editable window of IR8A form will be displayed where you can make the required changes and save it for further reflection in the system

Congratulations! You have successfully learned How to download IR8A Form using Deskera People