As a business owner, one of the main responsibilities you should be practicing without fail is to collect and remit sales tax correctly.

As we are aware that sales taxes are governed by individual states, each state can set its own sales tax due date.

Most of the states would prefer the sellers to file the sales tax return on the 20th of the month after the taxable period, which can be on a monthly, quarterly, or yearly basis.

However, some states would prefer the due date to be on the last day of the month, or on the 25th of every month.

Follow the steps below to generate the report:

- To view the sales tax report on Deskera Books, select the Report button on the sidebar menu.

- Next, click on the Sales Tax report under the Report section.

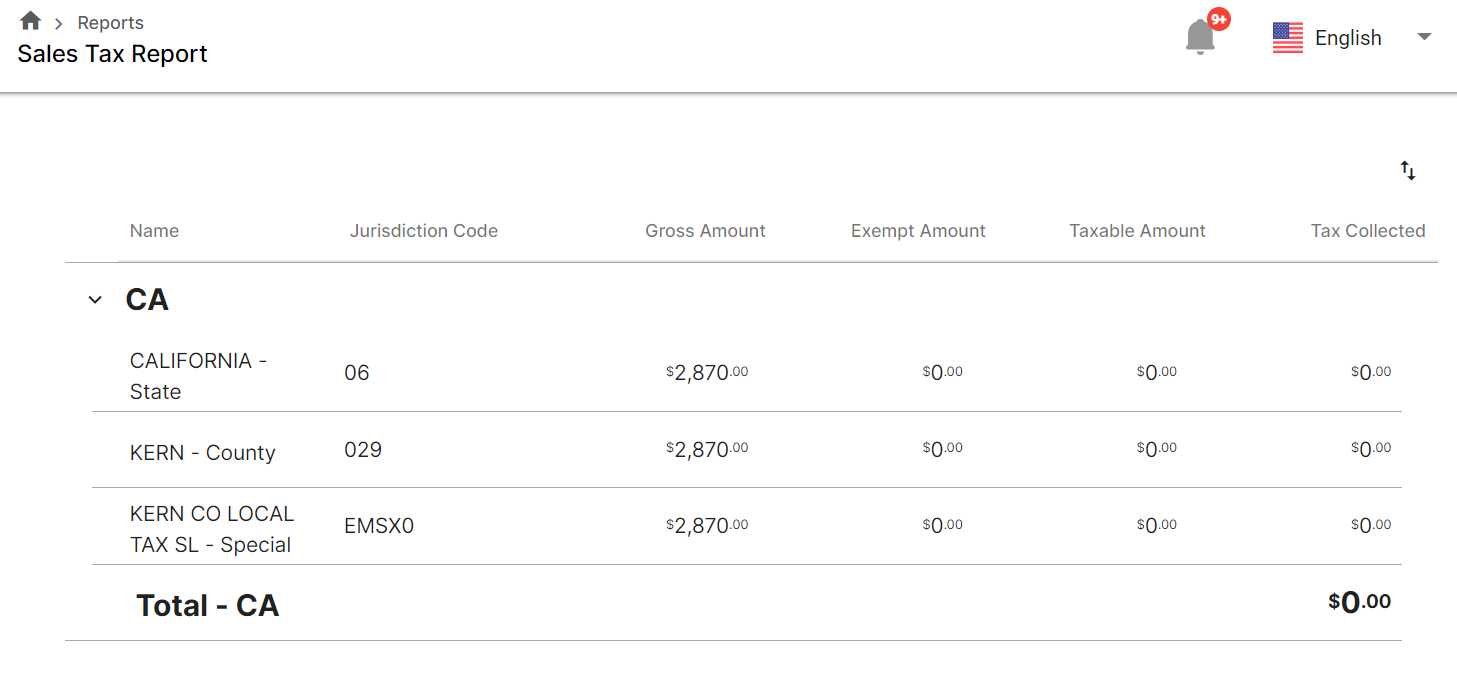

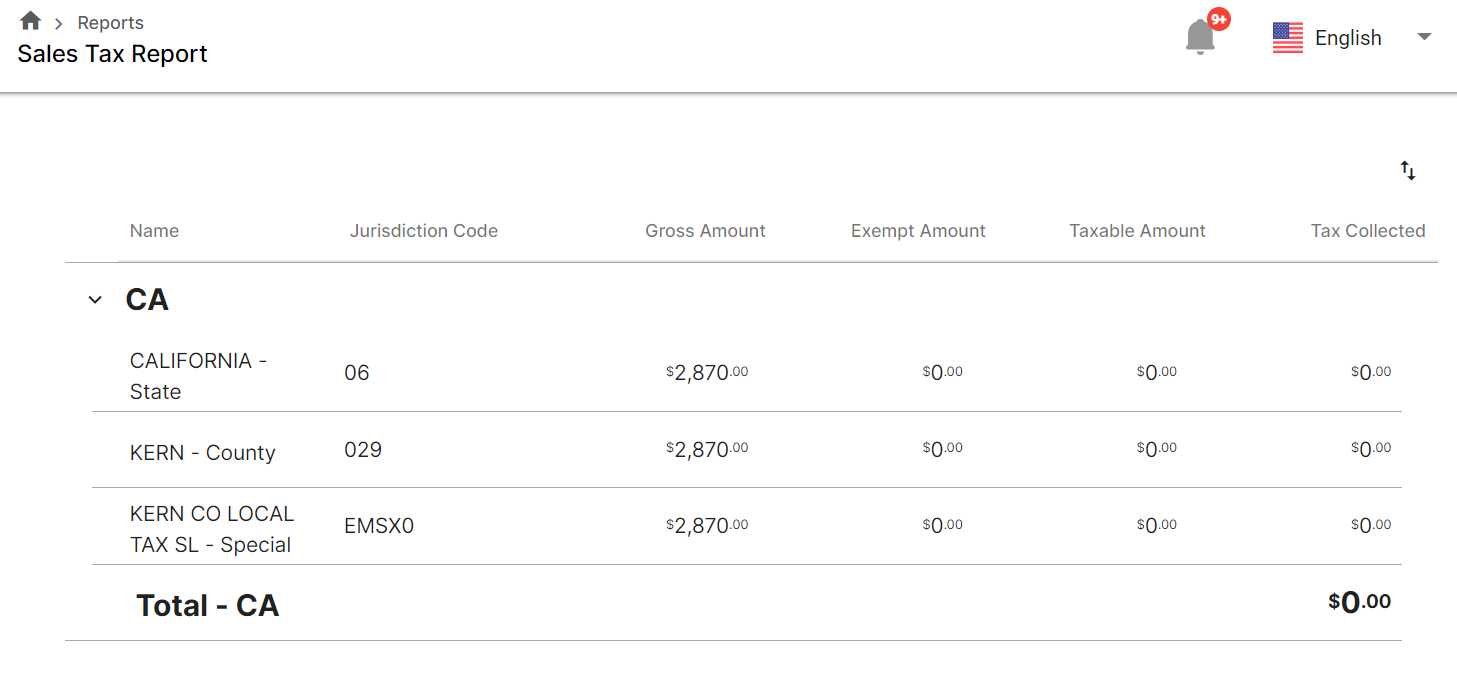

- You can view the Gross Amount, Exempt Amount, Taxable Amount and Tax Collected for each state once you're in this report.

- The amount reflected is based on sales invoices you have created in the Sell Tab.

- Click on the drop-down arrow of each state to view in detail the tax segregation of each state.

- In each state, there is a different jurisdiction code and the total sales tax is split into state tax, county tax, the local tax, and even special tax. Depending on the ruling of each state, some states do not collect sales tax - the states that currently do not collect sales tax are Alaska, Delaware, Montana, New Hampshire, and Oregon.

6. Deskera Books users are able to compute the sales tax conveniently using our backend data.

7. The computation of sales tax is determined by the product classification, the ship-to address, ship-from address, out-of-state transactions, and products exempted from sales tax. Instead of sourcing for a tax consultant to determine the sales tax payable, the sales tax is auto-generated on Deskera Books.

8. Once you have all the information you need regarding sales tax in each state, you can file for your sales tax return for that state.

9. You are required to file your sales tax return even though you did not collect any sales tax in some scenarios.

If you fail to file your sales tax return, your organization might have to bear the consequences enforced by the Internal Revenue Services (IRS).