All Indonesian residents, including expats who have been residing in the country for more than6 months , have the right to obtain BPJS Kesehatan (Healthcare BPJS). This BPJS type is independently processed by individuals in Indonesia.

However, if you are a part of a company—for both local or foreign company—you will also get the BPJS Ketenagakerjaan(Social Security Card). BPJS is provided by the company to protect all of its employees. Apart from BPJS, there are also other types of independent insurance that you can have.

BPJS in Indonesia: Healthcare and Social Security

Indonesia’s social security programs are run by two organizations – the Social Security Administrator for Health (BPJS Kesehatan) for healthcare and the Workers Social Security (BPJS Ketenagakerjaan) for pensions. Below explaining are the general descriptions of both BPJS.

Healthcare (BPJS Kesehatan)

The BPJS Healthcare program has been officially established in the country since 2014. Every citizen of Indonesia should have this national insurance, especially when considering how expensive medical treatment can cost. This is in addition to all the other social and economic issues that come with being ill. The obligation to become a member of BPJS Healthcare was introduced in the Presidential Regulation Number 12 of 2013 regarding Healthcare Benefits.

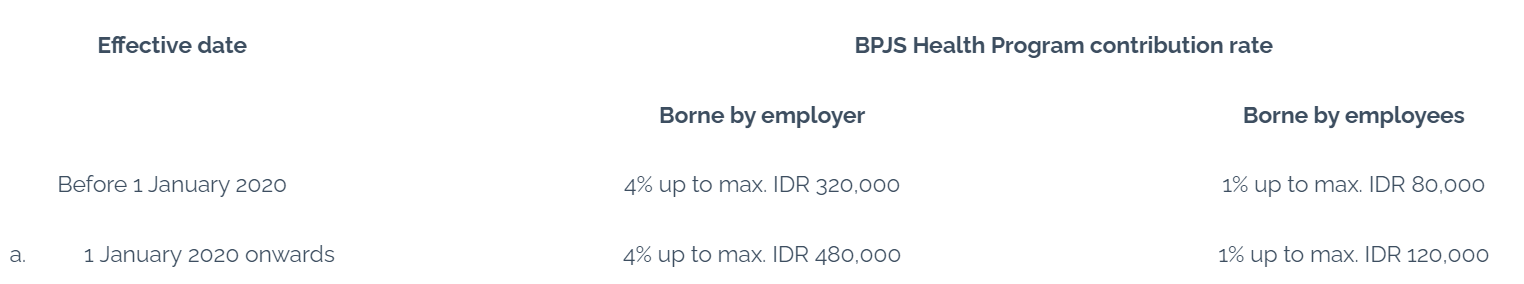

Please find below the updated details of BPJS Health :

- The maximum wage as the basis for calculating the BPJS Health contributions amounted Rp. 12,000,000.00

- This update on BPJS Health contribution shall take effect as of 1 January 2020.

- The above rates are applied to wages (basic salary and fixed allowances) up to a maximum of IDR 12,000,000 per month.

- The basic contribution provides coverage for a maximum of five family members (Employee, spouse & 3 children), including step-children. Any additional family members such as parents and parent in-law may be registered with a contribution rate of 1% per person per month.

- Contribution payments are due by the 10th of each month or the following work day if the 10th is a public holiday.

Social Security (BPJS Ketenagakerjaan)

The social security (BPJS Ketenagakerjaan) is to protect their security while working in the company and when they reach the pension time. Life insurance is part of this social security (BPJS Ketenagakerjaan). If you have a Social Security Card, you will have basic protections for:

- JHT (Jaminan Hari Tua/Old Age Protection). This protection is given you once you have left the company. You will get the max benefit if you have worked for more than 10 years in the same company.

- JKK (Jaminan Kecelakaan Kerja/Working Accident Protection). During your working hours or related to the task you perform wile working in the company, if you experience any kinds of accident, you will get compensation for any wounds or medical treatments performed.

- JK (Jaminan Kematian/Death Protection). As the name suggests, you will get benefit if you, during your service in the company, die.

- JP (Jaminan Pensiun/Pension Protection). If you reach the pension age, you will receive some amount of compensation from this kind of protection

The monthly payment for Social Security program should be paid by both the company and you (the card holder). Both parties should pay for the BPJS according to the type of protections and amount of monthly salary you get. If you are an independent member, you should pay the monthly fee all by yourself.

The monthly wages that are used as the basis for calculating contributions consist of the basic wage and fixed allowances.

Max Cap - the upper limit of wages as the basis for calculating the Pension Security Contribution (JP) which previously (2019) was IDR 8,512,400 to IDR 8,939,700 per month in 2020.

Social Security (BPJS Ketenagakerjaan) Contribution Rates

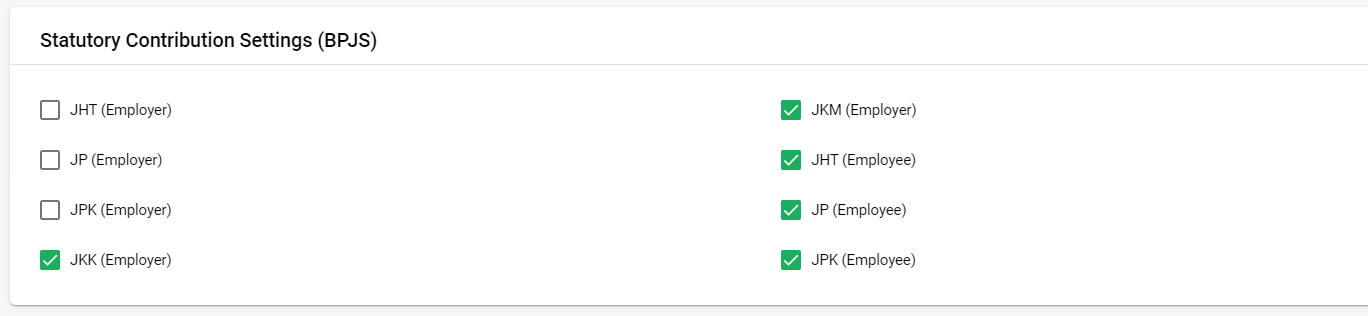

How do I set statutory contribution setting for BPJS using Deskera People?

With Deskera People you have an option to set the BPJS Statutory Contribution Setting that will help to decide Which BPJS Component is taxable or not taxable and which component will be calculated on Taxable Gross Pay. Follow the below steps to manage the BPJS setting,

Go to settings>> Tax Details>> Statutory Contribution Settings (BPJS)

By default below mentioned BPJS component will be marked as tick,

- JKK(Employer)

- JKM(Employer)

- JHT(Employee)

- JP(Employee)

- JPK(Employee)

Incase, you need to change the setting you can do so by selecting the options as per your company's needs.