Deskera Books Plus is compliant with Malaysia tax regulations, which means you can apply the country's sales tax against your invoice document easily.

There are different types of sales tax rate in Malaysia and they are exempted sales, sales tax at 5%, sales tax at 10%, zero-rated tax, and service tax at 6%.

Read more below to find out more about the tax rates in Malaysia:

Exempted sales

- Some manufacturers are exempted from registration, however if they choose to register voluntarily, they are still eligible for the exemption of sales tax for input.

- Tailor, optician, engraving, vanishing table top are some of the manufacturing activities exempted from registration regardless of the turnover.

- Products that are exempted from sales tax are live animals, unprocessed food, vegetables, medicines, machinery and chemicals.

Sales Tax @ 5%

- Products that are charged with tax rate 5% are basic foodstuffs, processed fruit juice, fruit juice, cod liver oil, etc, IT; telecommunications and printing hardware and materials, petroleum oil, construction materials and timepieces. The tax rate for oil and petroleum are subject to quantity based rates.

Sales Tax @ 10%

- The sales tax, a single stage sales tax is charged by the registered manufacturers of taxable goods and on any imported taxable goods to Malaysia. The sales tax charged at 10% is the default sales tax rate in Malaysia.

Service Tax @ 6%

- The services include hotel and accommodation, car hire, rental and repair, insurance, domestic flight, legal accounting, restaurants, electricity, digital supplies, Telecoms, business consulting services. Do note that services that are imported and exported are exempted.

- However since the start of 1 Jan 2020, digital services provided but foreigners to consumers in Malaysia exceeding RM 500,000 per year will have to register for Service Tax.

- The designated areas in Malaysia such as Langkawi Island, Tioman Island, and Labuan are exempted from service-tax.

Sales Tax @ 10%

- The sales tax, a single stage sales tax is charged by the registered manufacturers of taxable goods and on any imported taxable goods to Malaysia. The sales tax charged at 10% is the default sales tax rate in Malaysia.

Zero-rated (0%)

- The difference between zero-rated and exempted goods is zero-rated are taxable supplies that are taxed at the rate of SST 0% whereas exempted goods are non-taxable and it’s not subject to SST.

- For any products listed as zero-supplies, the company is eligible to claim input tax credit for the materials used to build the supplies.

- Examples of zero rated supplies are basic food,sugar, water and utilities

How can I create a new tax rate in Deskera Books Plus?

Follow the steps below to create a new tax rate in the system:

- Login to your Books Plus.

- Click on Settings via the sidebar menu.

- Select Tax.

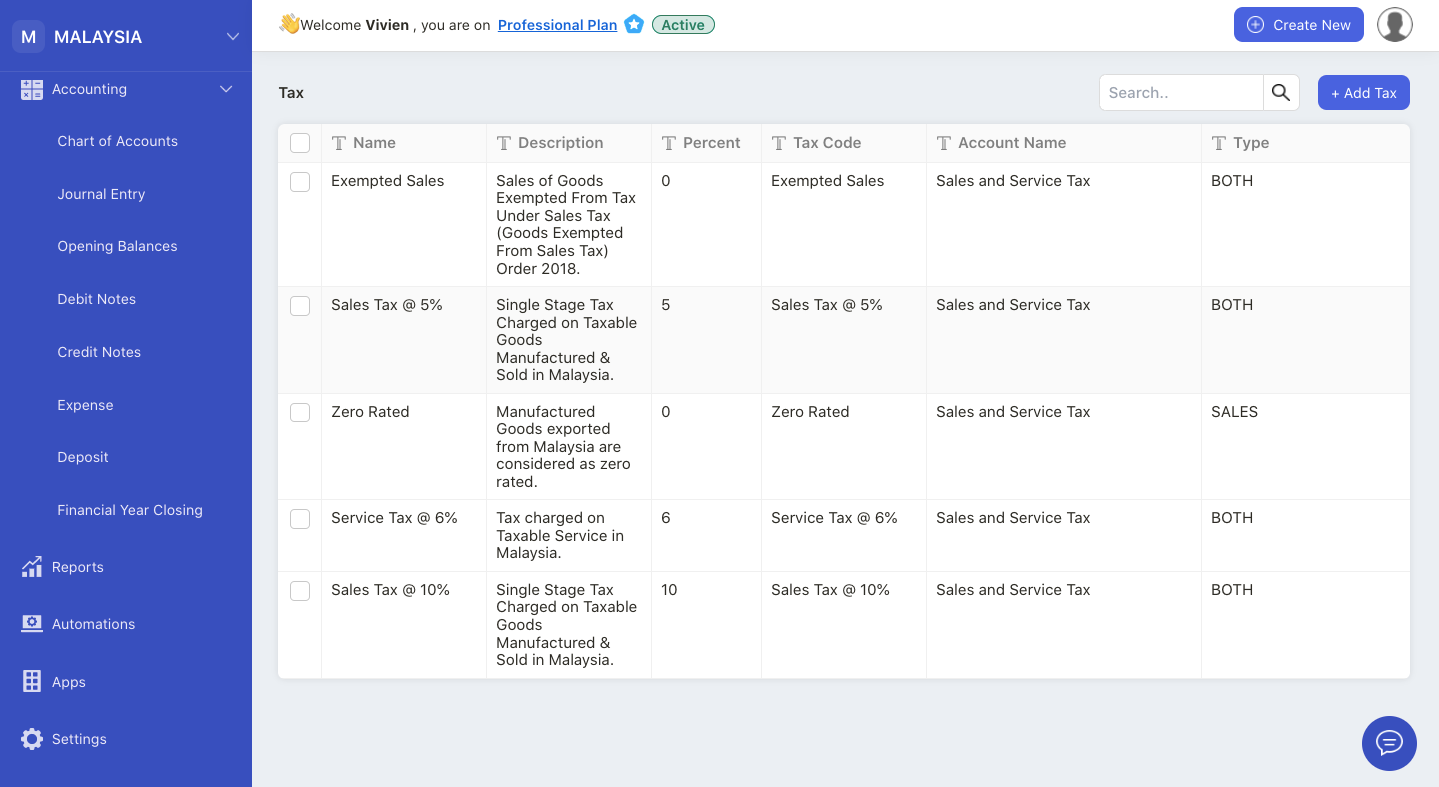

4. On this page, you can all the default tax rates in Malaysia visible here. You can apply these tax rates in your invoice and purchase documents created in the system.

5. If you can't find the correct tax rate, you can create a new tax-rate in the system. Read more here.

6. You can apply these tax rates against your product and documents in the system.