As a business owner in PH, using Deskera Books you can file the BIR2550Q- Quarterly VAT return to the government.

To file the BIR2550Q Quarterly Return using Deskera Books, select the Report button on the sidebar menu. Under VAT Reports Section, click on BIR2550Q Quarterly Return.

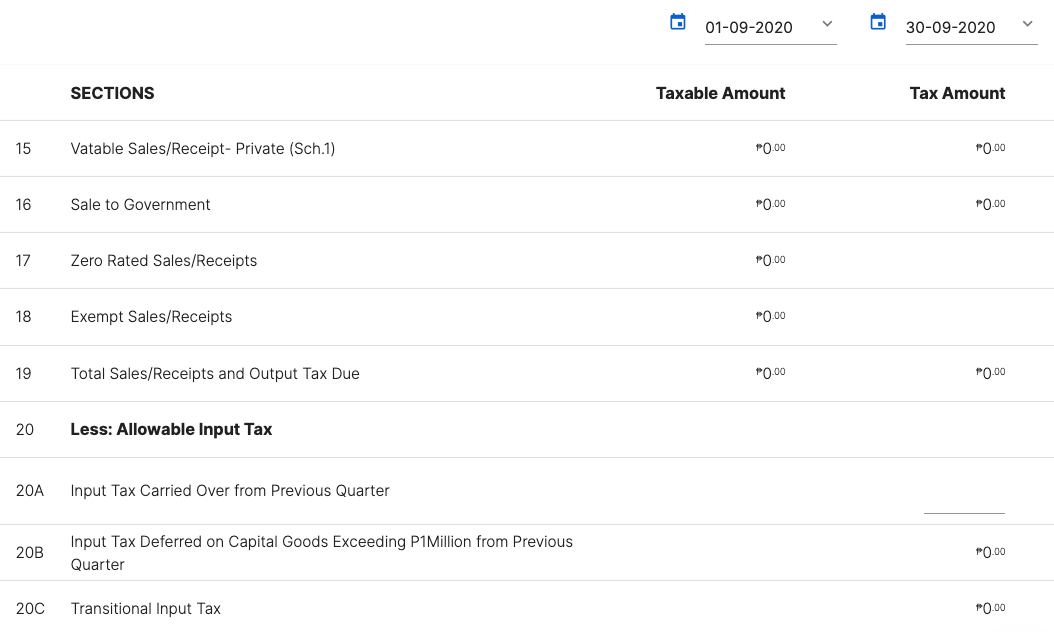

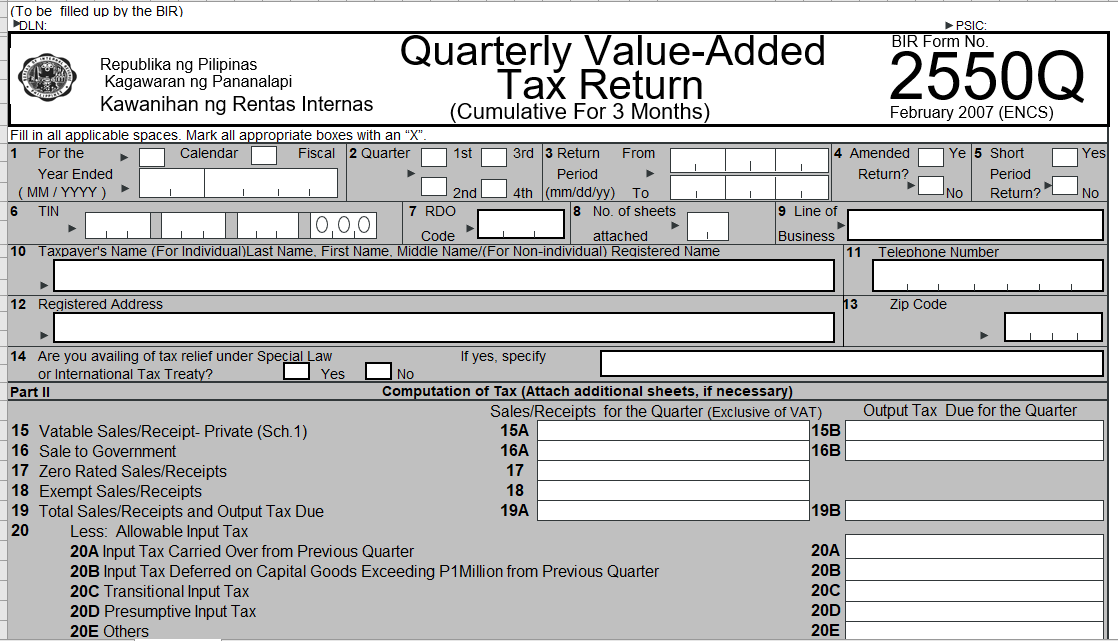

Lister below are the descriptions of sections,

- Section 15 to 19 are for sales transactions only

- Section 15- Supplies on which VAT is applied

- Section 16- Supplies to Government contacts

- Section 17- Zero rated supplies

- Section 18- Exempt sales

- Section 19- is for total sales + tax value

- Section 20A-Purchase tax carry fwd from last quarter

- 20C,D,E- Keep blank

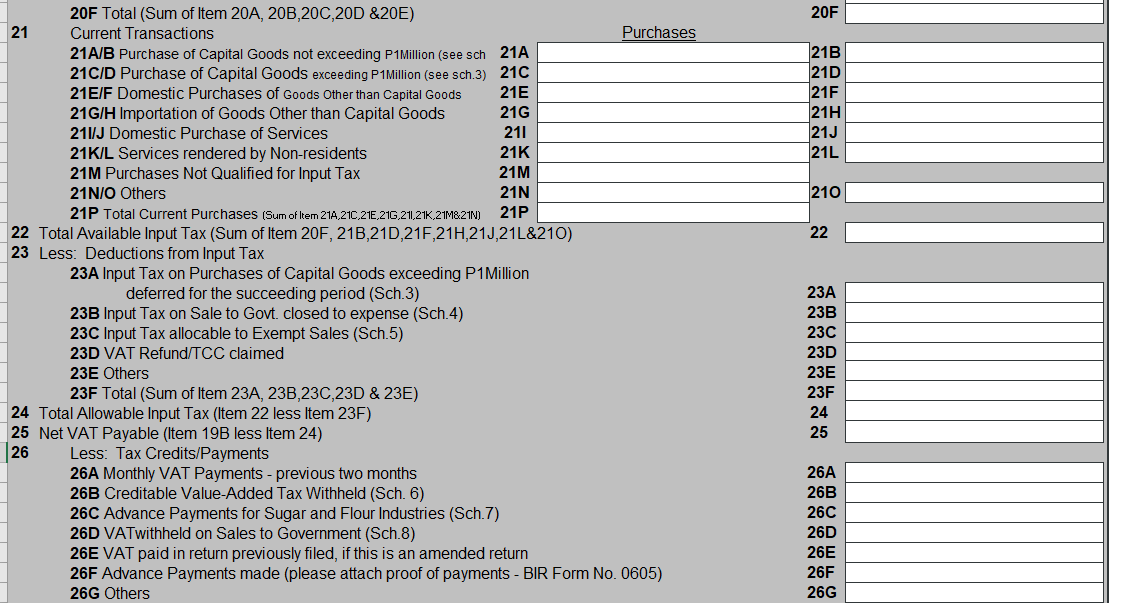

- 21 C/D- Details from Asset acquired. When we say exceed P 1Million meaning for each asset if the amount is exceeding, so sum up all such assets transactions \\ together.

- 21M- Zero rated and exempted purchases.

- 21N- Blank

Report will have the below view as expected by Govt.

Once you have all the information you need regarding the VAT Report you can file for your tax.

For failure to file, keep or supply a statement, list or information required on the date prescribed shall pay and administrative penalty of One Thousand Pesos (P1,000.00) for each such failure, unless it is shown that such failure is due to reasonable cause and not to willful neglect; and an aggregate amount to be imposed for all such failures during a taxable year shall not exceed Twenty-Five Thousand Pesos (P25,000.00).