What is Benefit-In-Kind (BIK)?

BIK are benefits not convertible into money, even though they have monetary value. The phrase not convertible into money means that when the benefit is provided to the employee, that benefit cannot be sold, assigned or exchanged for cash either because of the employment contract or due to the nature of the benefit itself.

Tax Exemption On BIKs

There are certain benefits-in-kind which are either exempted from tax or are regarded as not taxable.

- Dental benefit

- Child-care benefit

- Food & drink provided free of charge

- Free transportation between pick-up points or home and place of work (to and from)

- Insurance premiums which are obligatory for foreign workers as a replacement to SOCSO contributions

- Group insurance premium to cover workers in the event of an accident

- Discounted price for consumable business products of the employer and discounted price for services provided by the employer

What is Value of Living Accommodation(VOLA) ?

Living accommodation provided for the employee by his employer is a benefit-in-kind which is not convertible into money. This benefit which arises in respect of having or exercising an employment is to be included as gross income of the employee from the employment.

The amount to be taken into account is the amount in respect of the use or enjoyment by the employee of living accommodation in Malaysia (including living accommodation in premises occupied by his employer) provided for the employee rent free.

How to determine value of BIK/VOLA?

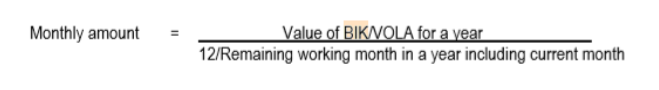

The Formula Method

Example :

Value of car in a year : RM25,000

Month/year of deduction agreed by the employer : April 2012

Remaining working month in a year including current month : 9 months

Monthly amount : RM25,000 / 9

: RM2,777.77 ≈ RM2,777.00

- The value of BIK/VOLA for a year is the actual benefit received by the employee.

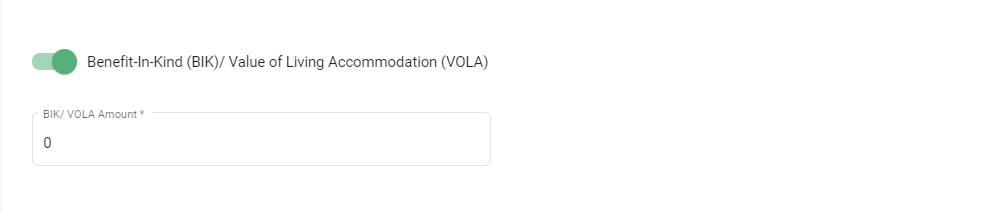

How to determine BIK/VOLA using Deskera People?

Go to Employees>>Employees List>>Select Employee>>Compliance Details,

- Enable the toggle button to add BIK and VOLA amountBIK/VOLA are used while calculating MTD

- Employee who has benefits-in-kind (BIK) and value of living accommodation (VOLA) as part of his monthly remuneration shall deduct PCB as per normal remuneration

- Amount of BIK/VOLA are used only for the purpose of MTD calculation.

- These amounts shall not appear in the pay slip and EA Form as gross salary/remuneration.