A journal entry is essential to all businesses as a means to record business transactions according to the Accounting Standards.

The first step that all accountants practice whenever business transactions take place is to record them to at least two accounts (known as double-entry accounting) in the general ledger.

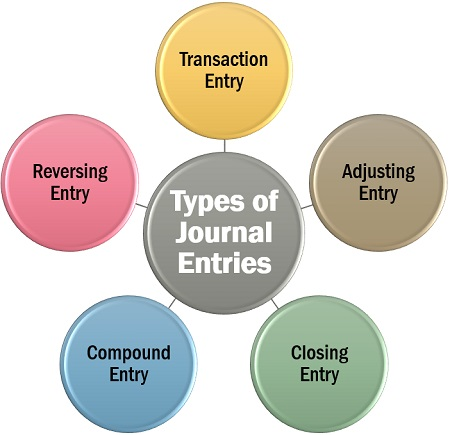

Types of Journal Entries

There are various types of journal entries you can make. Below listed are the same,

Transaction Entry

To record a cash or accrual transaction made in the business is known as a transaction entry.

Adjusting Entry

A journal entry which is done toward the end of the accounting period and adjust balances to maintain the financial position of an organization and to justify the principles of accounting.

Closing Entry

Closing entry is done with a closing entry. Where the temporary accounts are shifted over to the retained earnings for the next accounting period.

Compound Entry

To form a combined journal entry, a compound entry compiles of two or more transactions. This is possible only when these transactions are executed on the same date and are related to one another.

Reversing Entry

The journal entry which is normally done at the beginning of a new financial year or accounting period for the revenues or expenses that remained accrued. A particular entry is reversed and made the next financial year needs to be written off.

For this purpose, initially, the expense account is debited to the accrued expenses account and in the later new financial year, it is debited back to the expense account. Lastly, the expense account is debited to the accounts payable(AP) while making the actual payment.

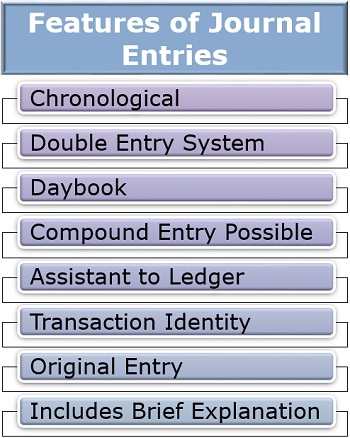

Features of Journal Entries

One must have an idea of what exactly journalizing is and why do we need it, to pass a journal entries

Following are its characteristics:

- Chronological: In which the transactions happen, the journal entries are to be recorded in a date-wise sequence or order.

- Double Entry System: Every transaction is equally entered on both debit and credit sides as it is a dual entry system. For the same value, one account is debited, and the other is credited.

- Daybook: It records day-to-day transactions.

- Compound Entry Possible: More than two accounts can be compiled together to form a single entry in a journal on the same day or more than one related transactions occurring in the journal entries.

- Assistant to Ledger: Since it is prepared from the information disclosed in the journals.

- Transaction Identity: To identify every business activity through its date and other essentials it sav.es the proof of each transaction and makes it easy

- Original Entry: Where a transaction is recorded The journal is the first books of account, and therefore, its authenticity and originality and must be maintained.

- Includes Brief Explanation: To clarify in a better way, each transaction has a short description which is called as the narration and written in brackets (Being_)

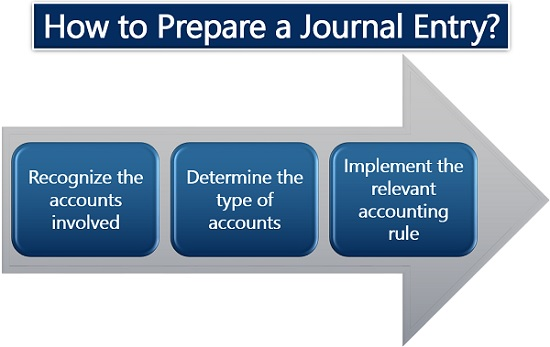

How is Journal Entry prepared?

In one or the other way, every transaction is somewhat different, though the clarification can be done into a similar account type.

Following are the three simple steps for recording these transactions in the format of journal entries:

- Recognize the accounts involved: The first step focuses on reading every transaction very carefully, that includes even its date, and identifying the various accounts created.

- Determine the type of accounts: In the next step allows to frame a suitable accounting equation, and decide if the accounts involved are personal or impersonal or belongs to the category of liability, expense, asset, revenue or capital

- Implement the relevant accounting rule: After the accounting type is identified, appropriate accounting rule is to be applied, and the entry is to be made in the format mentioned above.

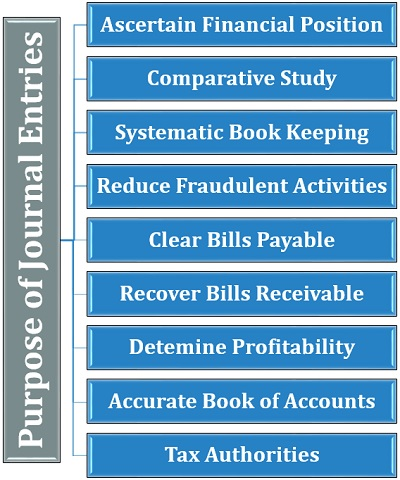

Purpose of Journal Entries

Mentioned below are the various reasons for which journal entries are to,

- Ascertain Financial Position: It determines the financial health of an organization, and JE helps to prepare the balance sheet.

- Comparative Study: With the help of journal entries, all financial accounts are ready to carry out a comparative analysis.

- Systematic Book Keeping: To ensure the orderly arrangement of transactions and facilitate quick reference, all JE's are made in a datewise order.

- Reduce Fraudulent Activities: The journal entries help to eliminate fraud and misleading if it is maintained properly.

- Clear Bills Payable: The organization ensures timely payment of the bills to keep a check on the bills due.

- Recover Bills Receivable: The management can provide the accelerated recovery of these bills, and keep track of the credit allowed to the customers.

- Determine Profitability: By the analysis of the books of account created through journal entries, the management can analyze the profitablility of the businesses.

- Accurate Book of Accounts: The books of account can be cross-checked with the help of a trial balance.

- Tax Authorities: The government and the tax authorities demand properly maintained accounts, and it all begins with the preparation of journal entries.

What’s Required for Each Journal Entry?

Each journal entry needs to include:

- The date (either the exact date or the last day of the month that the transaction occurred)

- Type of transaction that occurred

- Name of the accounts being affected

- Amount of the transaction

- A description of the transaction

Rules of Making Journal Entries

The most important rules for making journal entries are:

- Make journal entries as they occur

- All entries should be made in chronological order

- You must record a debit and a credit to the correct accounts for every transaction

- The accounts must balance for every journal entry

Shortcomings of Journal Entries

Journal entries have certain shortcomings though they are an essential part of accounting.

- Expensive: It quite expensive for business entities as it requires experienced accounting personnel.

- Bulky Records: It becomes a big task to record each of these transactions in a journal when the business is well settled with lots of transactions taking place every day.

- Complex: It seems to be a complicated process for small businesses.

- Lacks Prompt Information: Due to its bulkiness, it becomes tough for the accountant to locate a particular transaction.

- Repetitive Transactions: It makes a tedious task, as many transactions implicate the debiting or crediting of the same accounts repetitively though belonging to different dates.

- Cash Book is a Better Alternative for Cash Transactions: Under a single account, cashbook records all the cash related transactions. To make it a more comfortable option than recording each cash transaction in separate journal entries it has a debit and credit side.

How Do Debits & Credits Work?

One of the most important aspects of making correct journal entries is understanding how debits and credits work. Here are some critical rules to remember when recording debits and credits for each transaction:

- The debit and credit entry should always be equal to one another.

- For assets and expenses: An increase is recorded as a debit while a decrease is recorded as a credit.

- For liabilities, equities, and revenues: An increase is recorded as a credit while a decrease is recorded as a debit.

- The debit entry should be made first, followed by the credit entry.

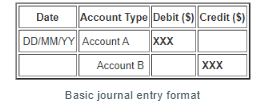

The structure of a journal entry consists of :

- The date of the transaction

- The type of accounts and descriptions

- Debit amount

- Credit amount

The example of a basic journal entry format is tabulated as below:

According to the accounting rule, the total amount recorded under the debit column should be equal to the total amount stated under the credit column.

Thus, the account is considered to be in "balance."