Indicating the right vendor type on Deskera Books during the creation of contact enables us to map the information accurately to the SST-02 Report.

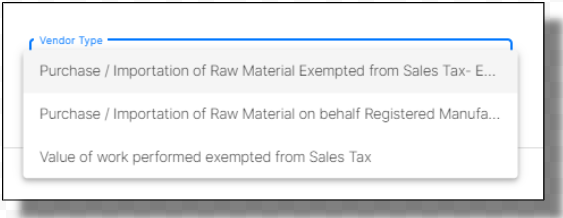

When you’re adding a contact, you should come across this section; vendor type. There are three options you can choose from when indicating your the type of the vendor your contact’s is;

- Purchase / Importation of Raw Material Exempted from Sales Tax- Exemption in Schedule

- Also known as C1 and C2

- Register manufacturer buy from another register manufacturer , you can exempt from the sales tax

2. Purchase / Importation of Raw Material on behalf Registered Manufacturer Exempted from Sales Tax

- C4 and C5

- Register manufacturer find representative to buy items for you, can be exempted

3. Value of work performed exempted from Sales Tax;

- Known as CJ

- Apply for any subcontractor work

Once you have indicated the right vendor type, whenever you are buying from your vendors, all the transactions will be recorded accordingly.

To view the report, you can click on the Report on the sidebar menu and select SST-02 Report.

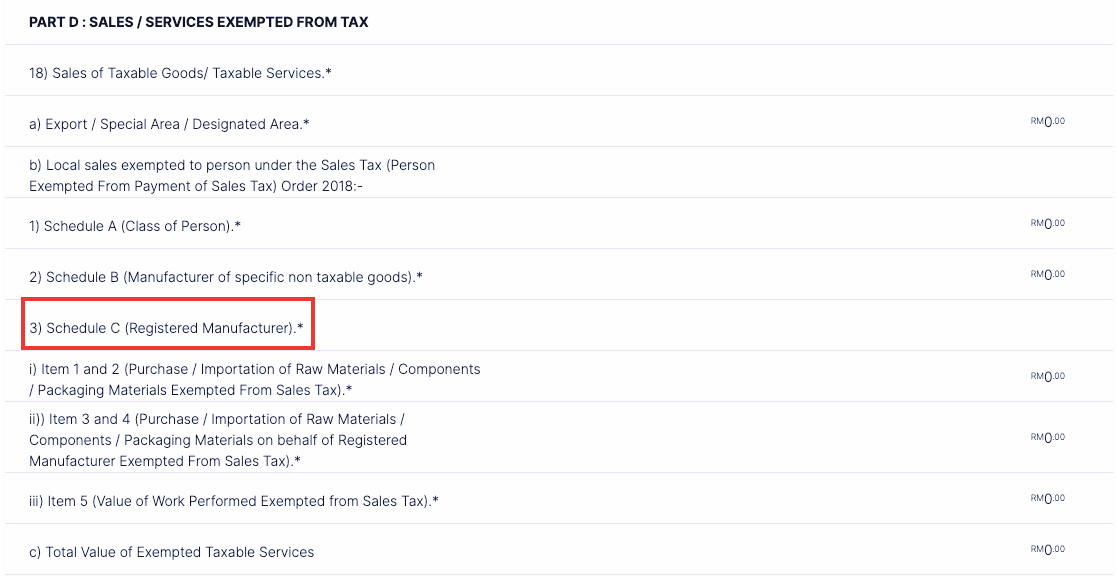

Under Section D, line 18, Schedule C, there are three types of vendor breakdowns.

These line items are mapped based on your vendor type you indicate during contract creation and the amounts are as per the Bills you’ve created for each vendor tagged to the type of business. The amount will be auto-populated