To view the Sales and Purchase Relief reports on Deskera Books, under the Report on the sidebar menu. You will see two reports, 1. Sales Relief Report, 2. Purchase Relief Report.

Let us see these reports in detail.

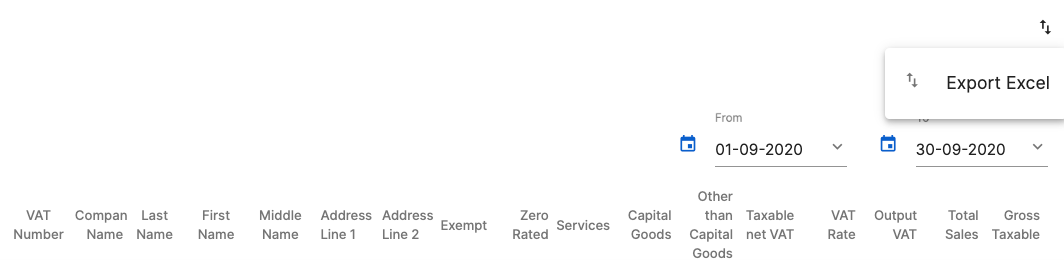

1. Click on the Sales relief report under the Tax section. Below window will appear and you can view the detailed report.

You can view the Exempt Amount,Zero Rated Amount,Service Charge amount, Capital Goods and other than capital goods amounts, Taxable Net VAT, VAT Rate, Output VAT, Total Sales amount, and gross taxable amount. The amount reflected is based on sales invoices you have created in the Sell Tab.

- From and To date: You can select from and to date to view the report date wise.

- Export Report: Click on the upward and downward arrow, where you can export the Sales Relief Report in Excel format.

2. Same like a Sales view report by Clicking on the Purchase relief report under the Tax section you can view and export this report.

You can view the Exempt Amount,Zero Rated Amount,Service Charge amount, Capital Goods and other than capital goods amounts, Taxable Net VAT, VAT Rate, Output VAT, Total Sales amount, and gross taxable amount. The amount reflected is based on Purchase invoices you have created in the Buy Tab.

From and To date: You can select from and to date to view the report date wise.

Export Report: Click on the upward and downward arrow, where you can export the Purchase Relief Report in Excel format.

Congratulations! You have successfully learned how to view the Sales and Purchase Relief Report using Deskera Books.