Excise tax was introduced across the UAE on 1 October 2017. Excise tax is a form of indirect tax levied on specific goods which are typically harmful to human health or the environment.

The aim of excise tax is to reduce consumption of these commodities, whilst also raising revenues for the government that can be spent on public services.

These goods are referred to as “excise goods”.

Stated below are list of excise goods:

- Carbonated drinks include any aerated beverage except for unflavoured aerated water. Also considered to be carbonated drinks are any concentrations, powders, gels, or extracts intended to be made into an aerated beverage.

- Energy drinks include any beverages which are marketed or sold as an energy drink and contain stimulant substances that provide mental and physical stimulation. This includes, among others: caffeine, taurine, ginseng.

- Tobacco and tobacco products and devices.

- Electronic smoking devices and tools, liquids used in such devices and sweetened drinks

Rates of Excise Tax in the UAE

- 50 % on carbonated drinks

- 100 % on tobacco products

- 100 % on energy drinks

- 100 % on electronic smoking devices

- 100 % on liquids used in such devices and tools

- 50 % on any product with added sugar or other sweeteners

How to Set up and Map Excise Tax using Deskera Books?

Any VAT registered business owner in UAE, can calculate Excise on manufactured goods. So for this you need Excise tax calculation as well.

Using Deskera Books any business owner can map an excise tax payable account with following simple steps,

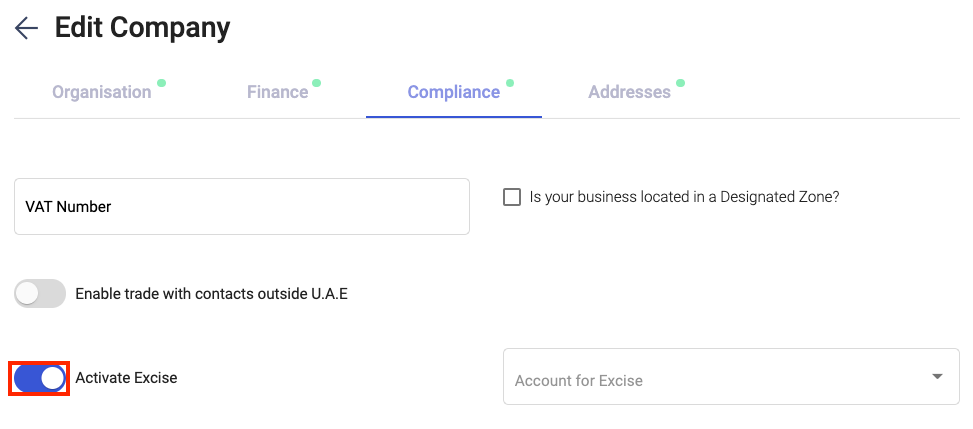

In the ‘Settings’ on the main dashboard menu, click on the Company tab.

After clicking on the “Excise Details” below option will pop up.

- Tick on the Activate Excise button for activating this Excise option in the system

- Select the account to Excise Tax Payable from the dropdown menu

This Excise tax account will be used for Sales, Purchases, Sales Return and Purchase Return transactions

Mapping of Excise Tax on Deskera Books:

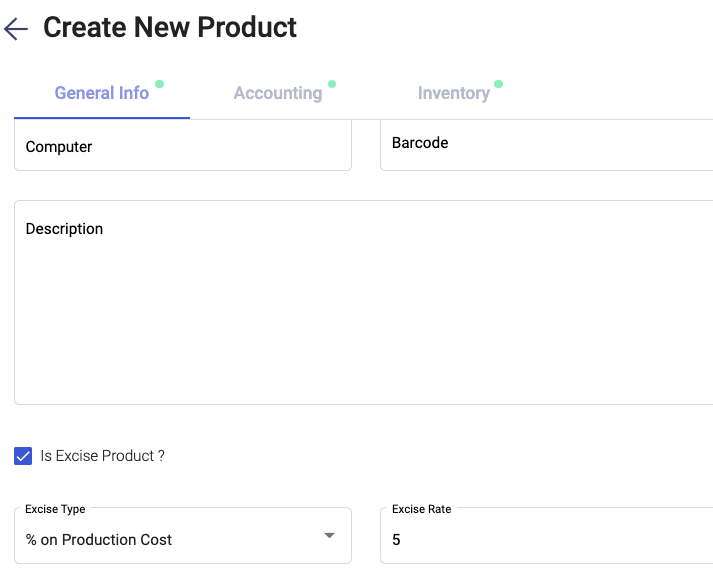

Click on +Add Products to impose excise tax upon creation of new products. The excise tax will be applicable on only Tracked products.

Under product details tab, you will see the below option to impose the excise tax on products.

Tick the option “Is Excise Product ?” to categorize this product as an excise product

- Select the % on Production cost and enter the required percentage amount.

Sales Invoice / Quotation:

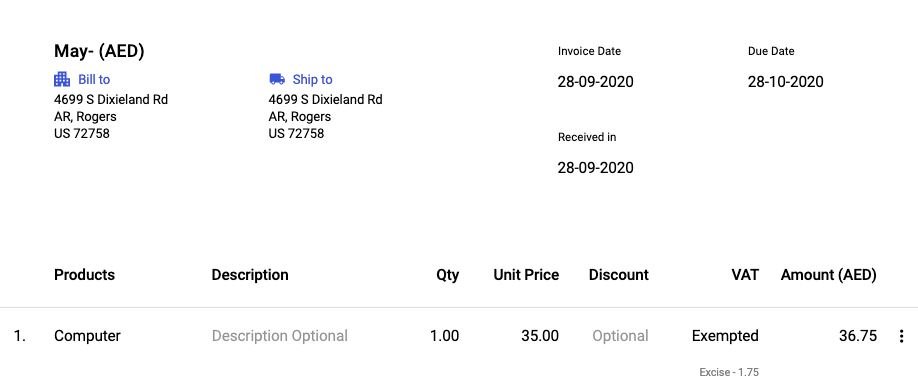

While creating a sales invoice/ quote the excise rate will be captured from the Product you have created. Excise tax will be calculated before VAT is calculated on the product and this excise amount will be credited to the sales invoice.

Similarly, if orders of excisable goods are created then also calculate Excise tax in Order will be calculated.

Excise will also be charged on Purchase transactions as well if you are importing any excisable goods along with RCM will be charged.

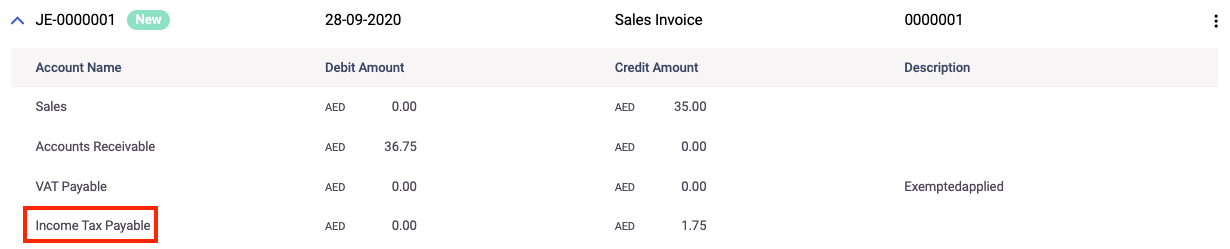

Journal Entry

A separate JE will be passed with the excise tax calculation.