As you have read in the previous article on how to create a new tax rate, you can now apply the new tax-rate that you have created and apply it to the different Modules in the system.

Imagine in a scenario where your country announced an increment of 2% of collectible sales tax, you are required to comply with the new regulations.

Instead of using the default tax-rate that is shown on Deskera Books, users have the flexibility to create a new tax-rate under any circumstances.

- Login to Deskera Books account.

- Click on the Switch To button at the bottom left of the screen. Select Deskera Books.

- On Deskera Books' Main Dashboard, click on Products via the sidebar menu.

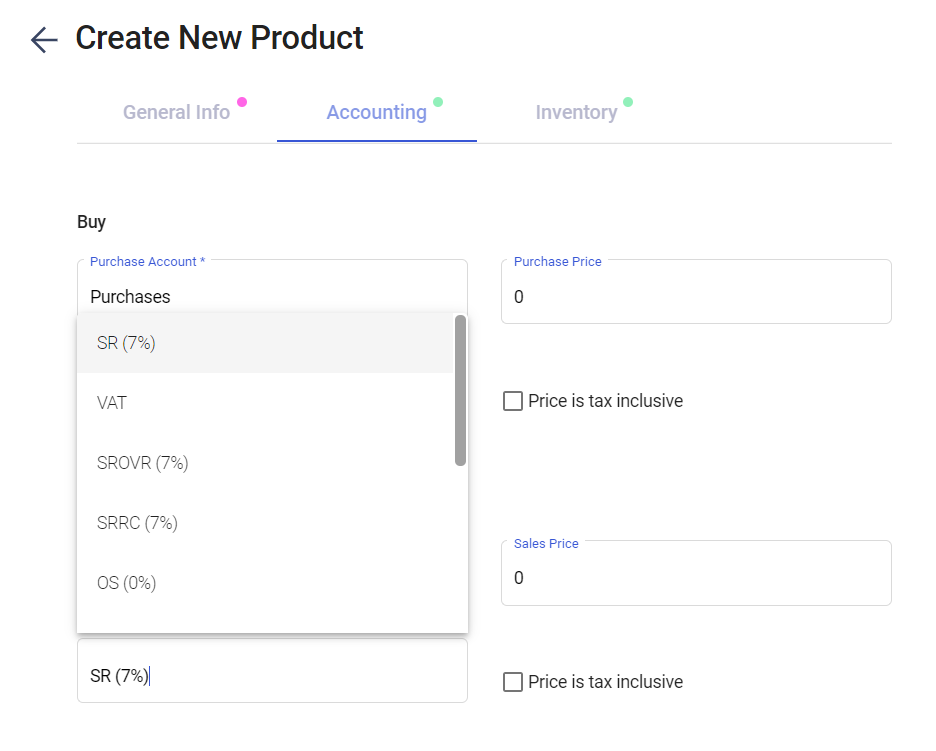

- In the Product Module, you can select the new tax rate that you have created by clicking on the drop-down arrow in the Purchase Tax and Sales Tax section.

- Click Save.

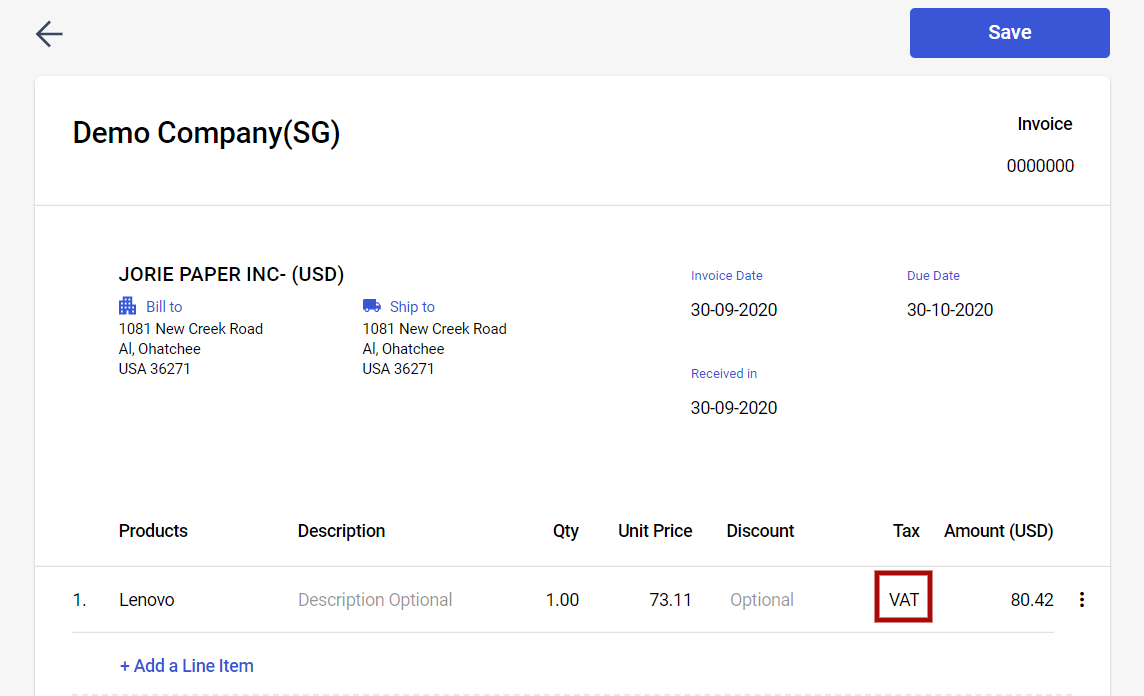

- The tax-rate of the product will be auto-populated when you are creating the bill/order/quote/invoice documents.

7. You are given the option to change the tax-rate by clicking on the tax box as shown above. Once the changes are made, click on the save button in the respective document.