The undeposited funds in Deskera Books allow you to hold onto your customer's payments from multiple invoices before your company deposits the funds to the bank.

Here's one main advantage of recording the payment as undeposited funds:

The undeposited funds feature can assist you in performing bank reconciliation faster and easier.

Instead of focusing on a long list of itemized records, you can concentrate on one lump-sum deposit in your bank account and Deskera transaction.

Read more below to find out how to use the undeposited funds in Deskera Books.

How do I start using undeposited funds?

Follow the steps below:

- Login to Deskera account.

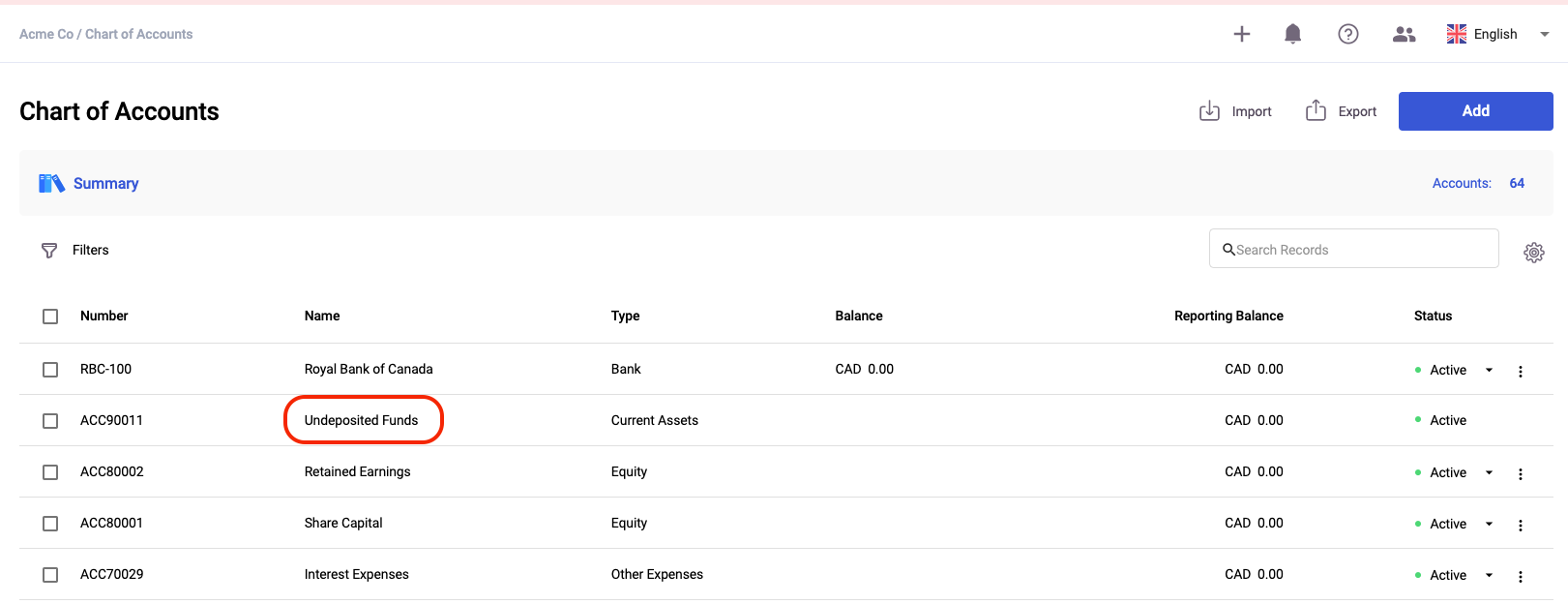

- Click on Accounting on the sidebar menu >> Select Chart of Accounts

- On this page, you can view the Undeposited Funds saved as a current asset in Deskera Books.

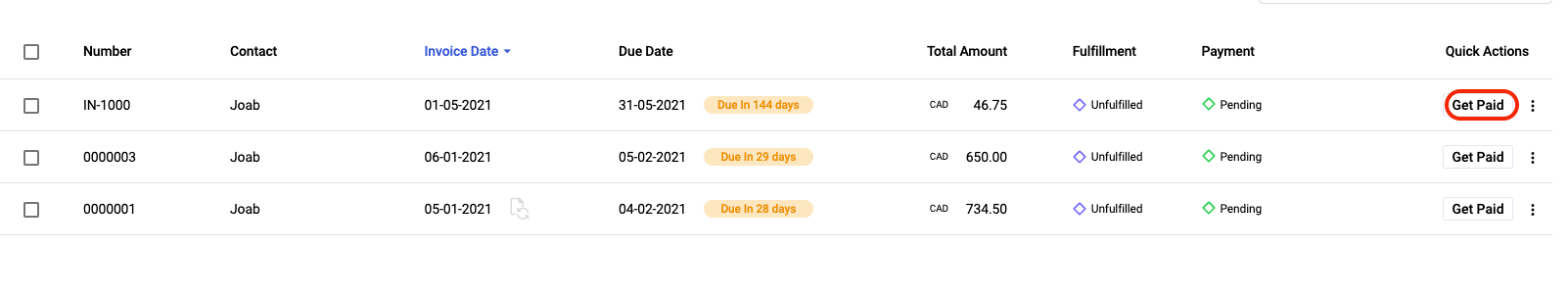

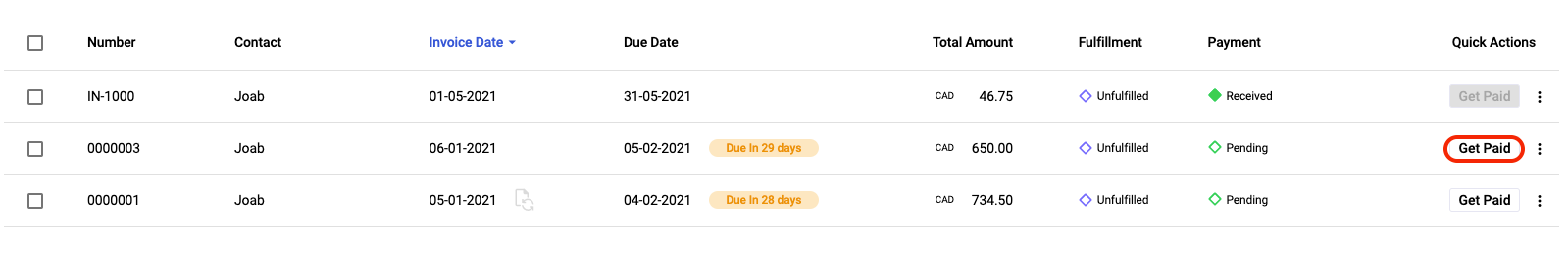

4. Next, go to the Sell tab via the sidebar menu and click on the Get Paid button.

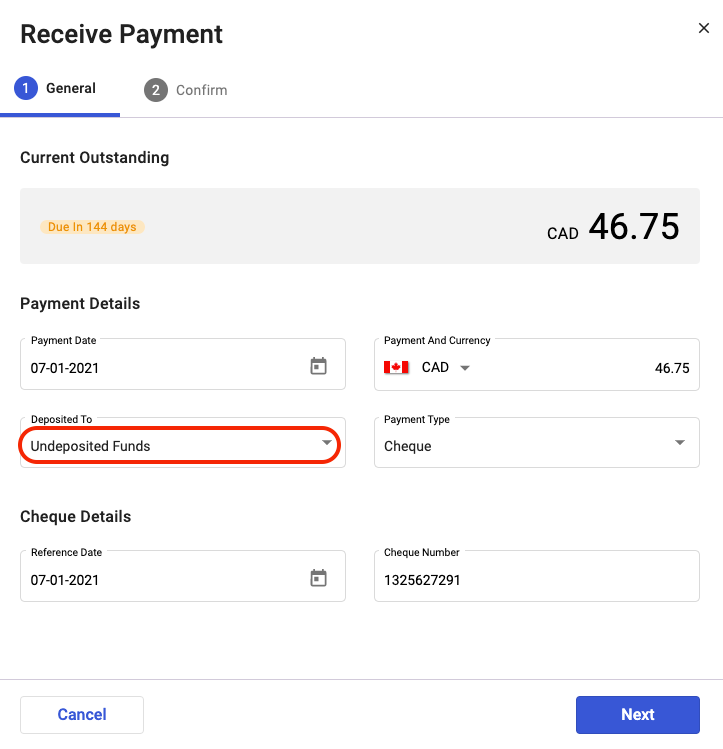

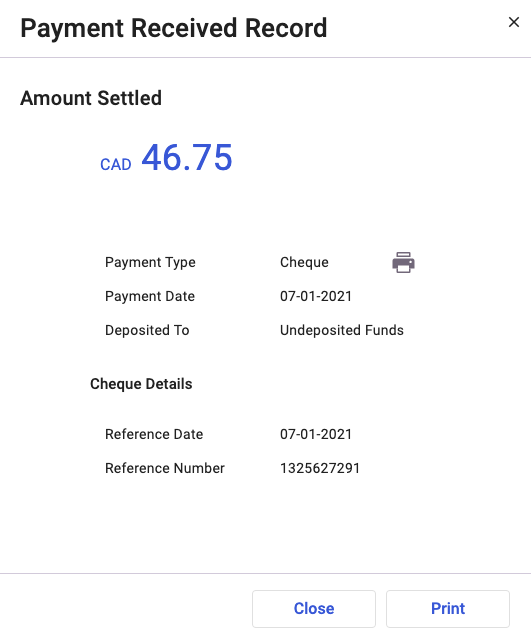

5. This action will open the dialog box. Please fill in the fields in the receive payments box:

- Payment date - The date you receive the payment

- Payment and Currency - The currency involved in this transaction

- Deposited To - Choose the Undeposited Funds from the drop-down

- Payment Type - Choose the mode of payment; Cash, Card, Cheque, or Bank Transfer

- Payment Details - The fields will change based on the mode of payment you choose above. Fill in the fields here, such as the reference date, reference number, or cheque number

6. Click on the Next button.

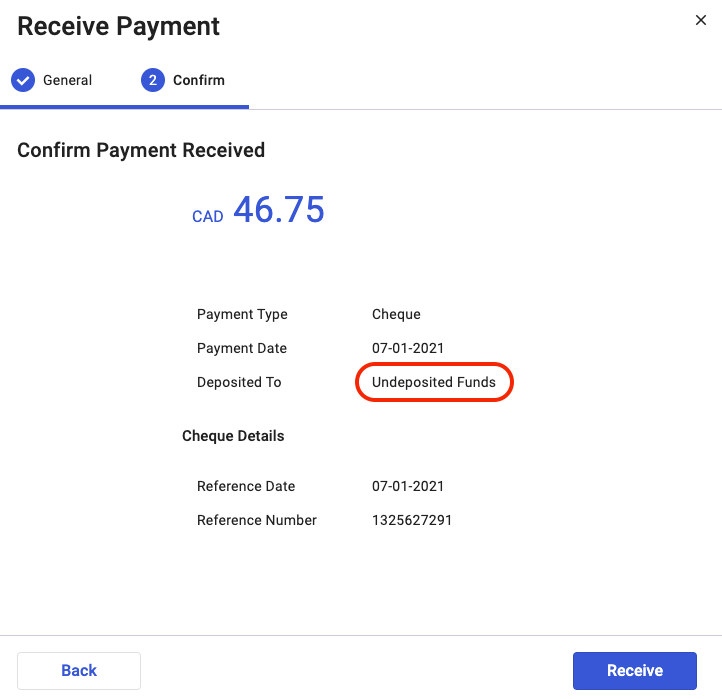

7. On the next screen, confirm the payment review.

8. Click the Receive button once you confirm and close the payment received record on the following screen.

9. Repeat steps 4-8 for the subsequent invoices you wish to group the payment.

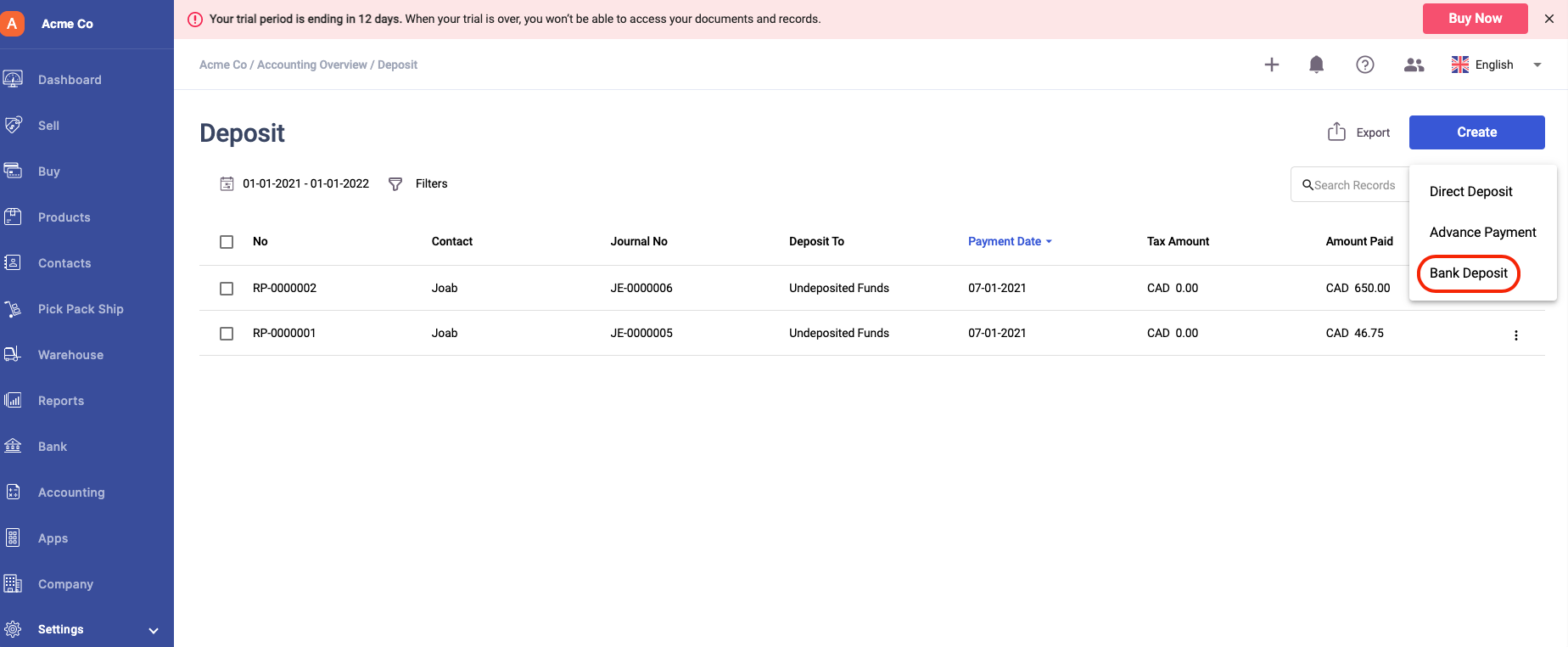

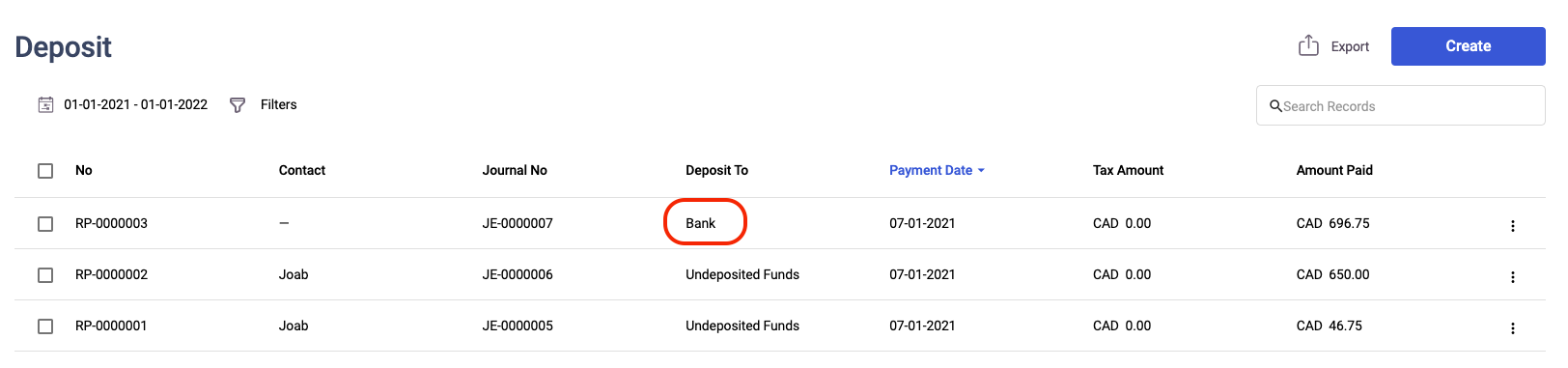

10. Once you have marked the payment of the invoices as Undeposited Funds, go to the Accounting tab via the sidebar menu >> Select Deposit.

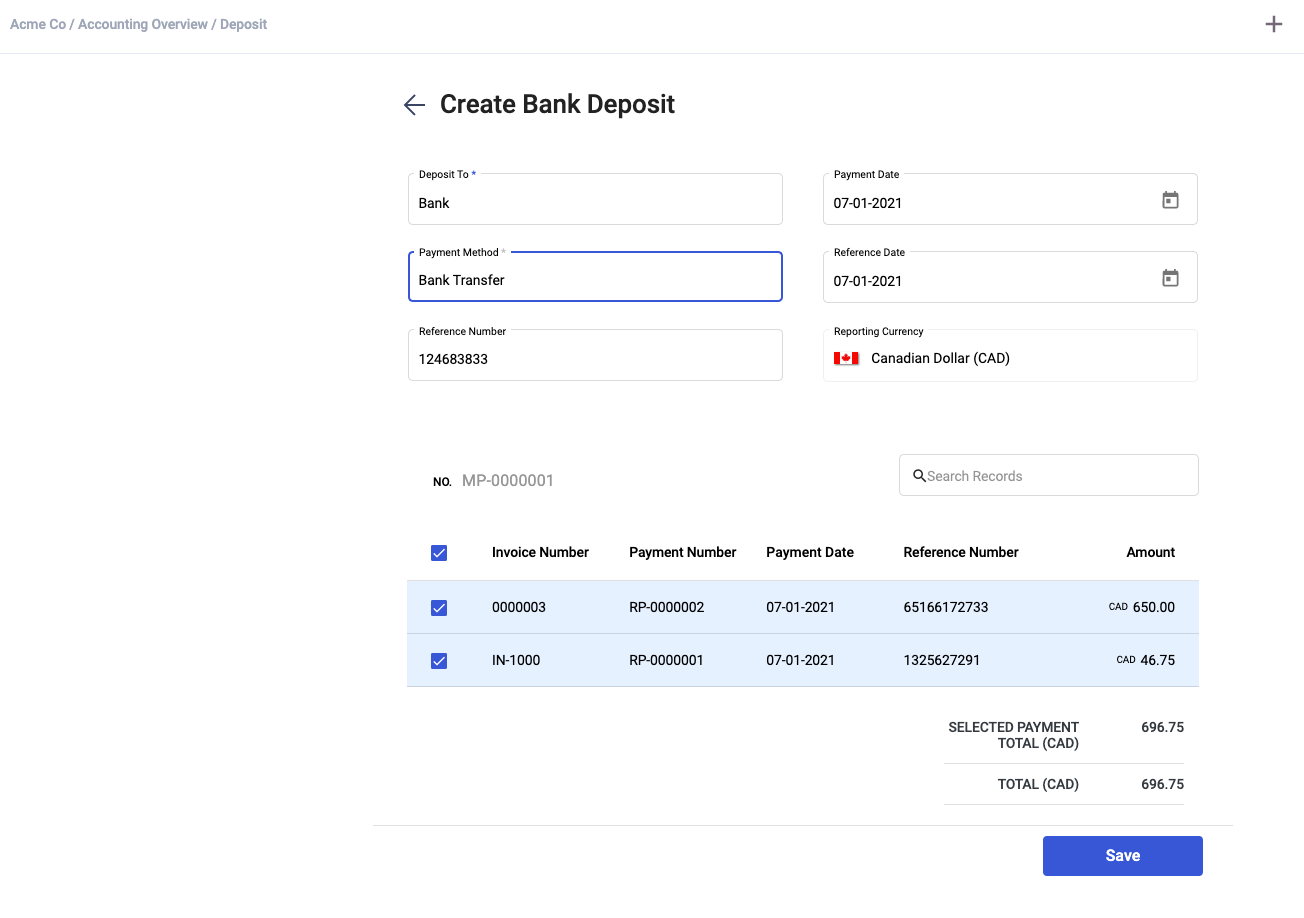

11. On this page, click on the Create button >> Select Bank Deposit

12. After that, all the invoice records marked as Undeposited Funds in the Sell Record will reflect here.

13. Fill in the respective fields here:

- Deposit To - Choose the bank to deposit the fund

- Payment Date - The date the fund is deposited to your bank

- Payment Method - The mode of payment

- Reference Date - Select the reference date

- Reference Number - Enter the reference number for the deposit made

- Reporting Currency - The base currency

14. Verify all the information on this page. Tick the checkbox of the invoices that you're going to deposit to the same bank account.

15. Click Save.

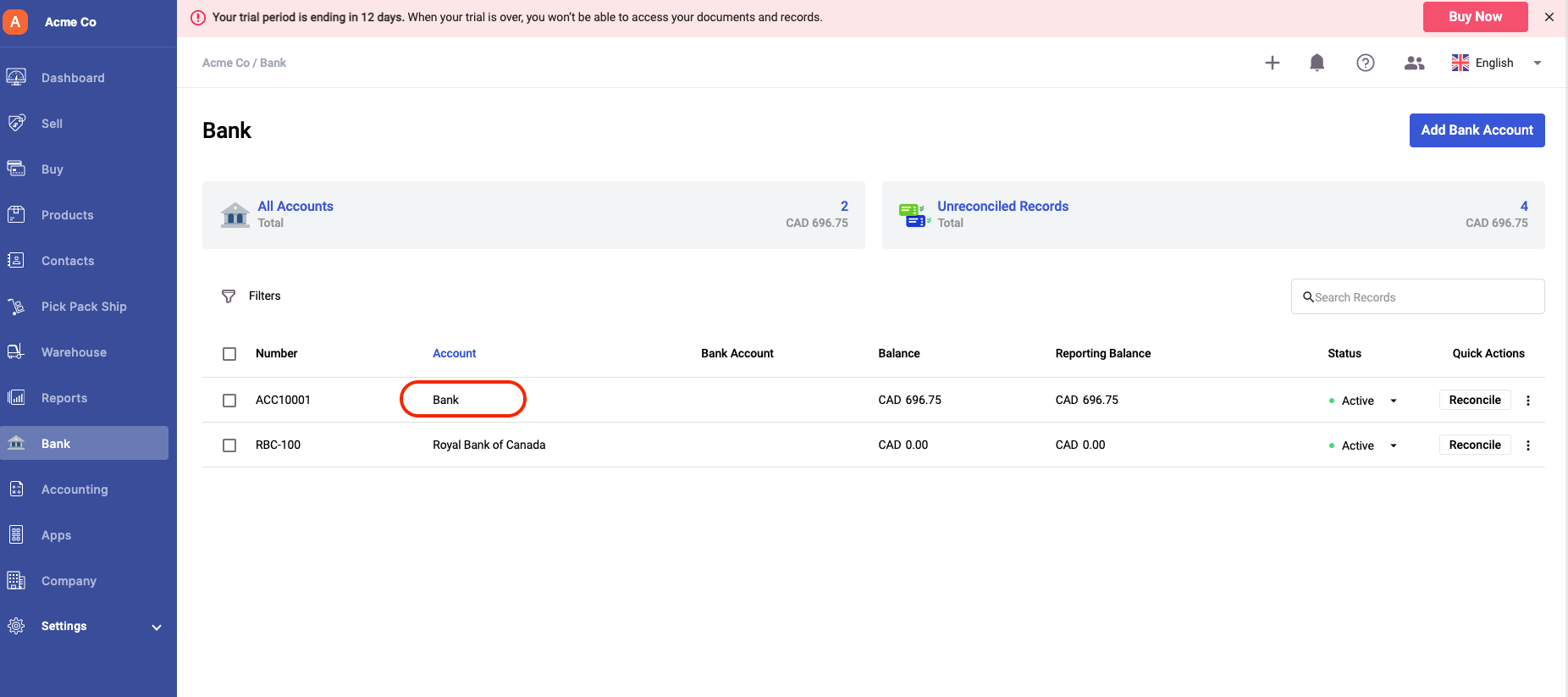

16. Go to Bank on the sidebar menu to view this record in the bank.

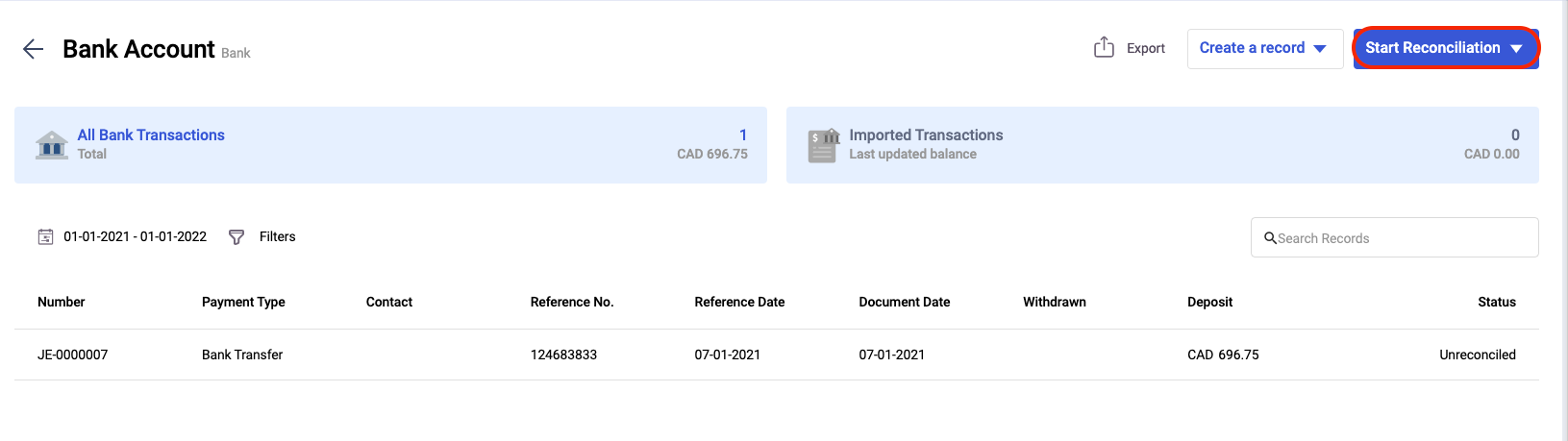

17. Click on the Bank that you have deposited the fund to.

18. Next, click on the Start Bank Reconciliation button.

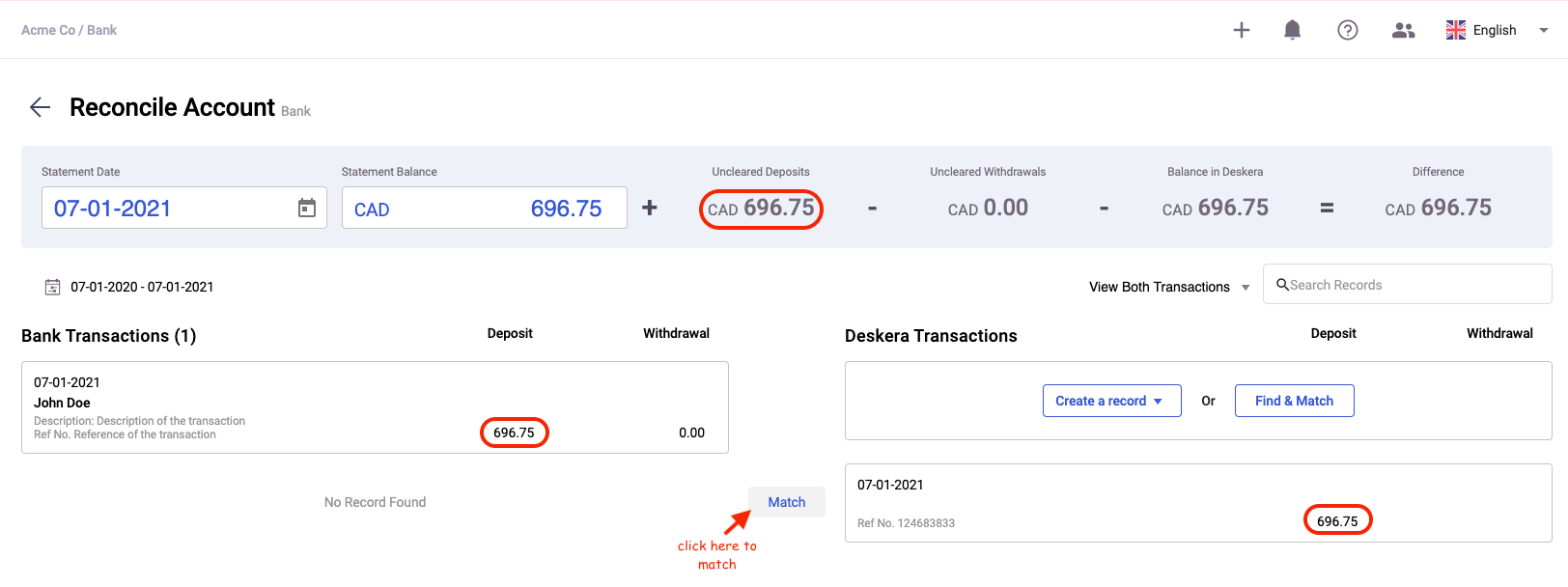

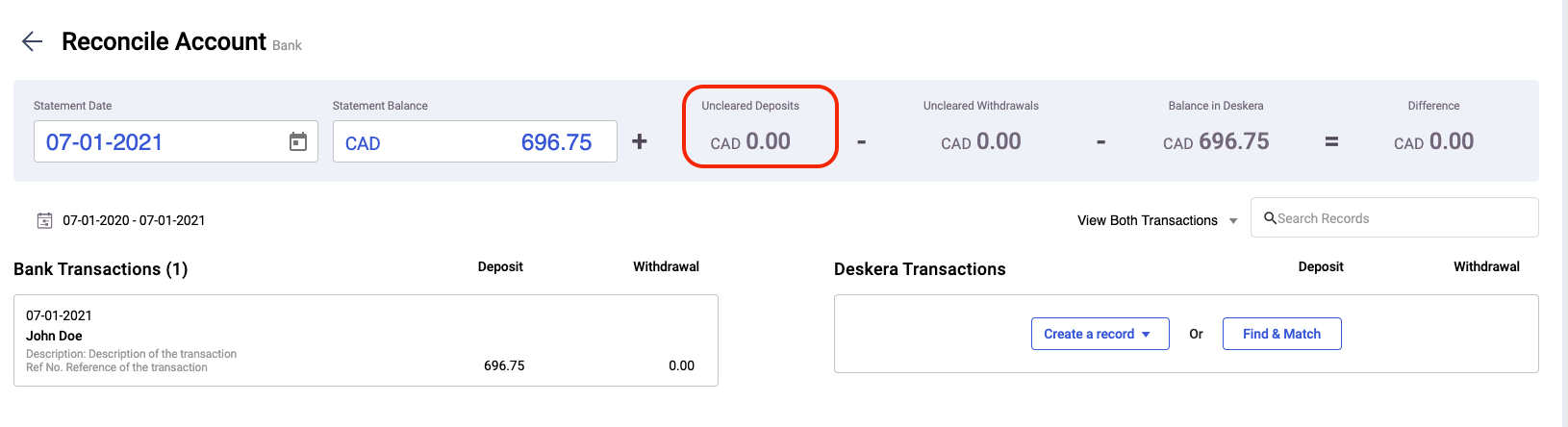

19. On this page, you can view the uncleared deposits, the Bank Transactions, and Deskera transactions in the amount of $696.75. The amount here is a summation of the lump-sum payments for two invoices. Please refer back to point 12.

20. Next, click on the Match button.

21. After the bank reconciliation, the undeposited deposit in this screen will reflect as 0. Also, the record in Deskera Transaction will disappear.

After reading this article, we hope you have a clearer picture of how the undeposited funds work in Deskera Books.