BAS, also known as Business Activity Statements, is an activity statement submitted to the Australian Taxation Office (ATO) by all taxpayers in Australia.

It's a form submitted by registered business entities to lodge and pay their tax liabilities at a single time.

Some of the tax obligations include:

- Goods and Service Tax (GST)

- Pay as you go (PAYG) income tax installment

- Luxury car tax (LCT)

- Wine equalization tax (WET)

- Fringe benefits tax (FBT) installment

- Pay as you go (PAYG) tax withheld

Do I need to lodge Business Activity Statement?

Any businesses' expected gross income (excluding GST of 10%) is equivalent to or more than $75,000, will need to register for the Goods and Services Tax (GST).

Only those businesses registered for GST will need to lodge the Business Activity Statement.

When are the Business Activity Statement filing period?

Your company's annual turnover will determine the Business Activity Statement filing's frequency.

Here's the filing period based on the annual turnover:

- Quarterly - more than $20 million annual turnover

- Monthly - less than $20 million turnover

- Annually - less than $75,000 annual turnover or $150,000 for non-profits bodies

How to I configure Business Activity Statement setting in Deskera Books?

To generate the BAS, follow the steps mentioned below:

- Login to your Deskera account

- Click on the Switch To button at the bottom left of the screen and choose Deskera Books.

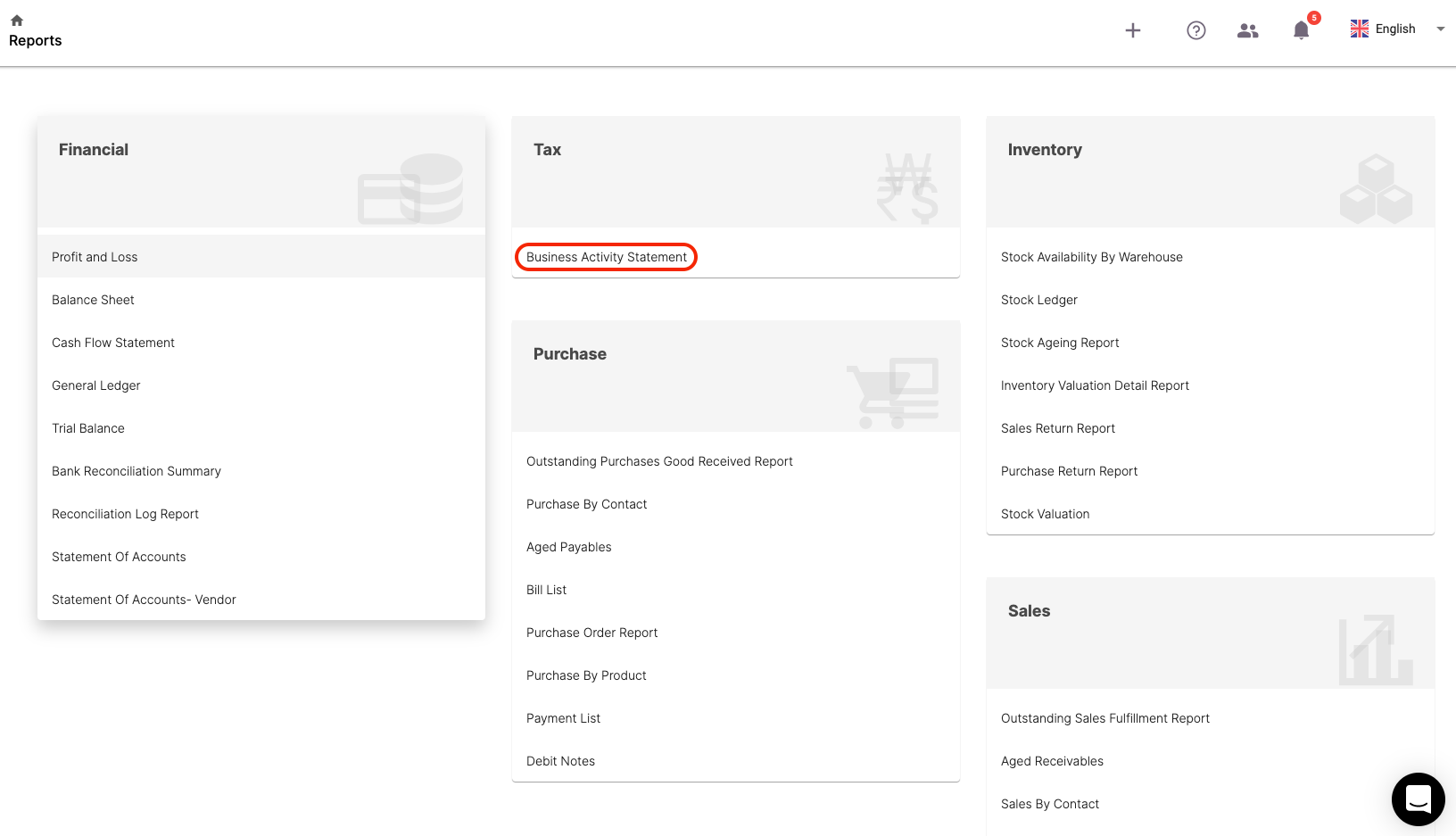

- On Deskera Books' main dashboard, click on the Report via the sidebar menu >> Select Business Activity Statement

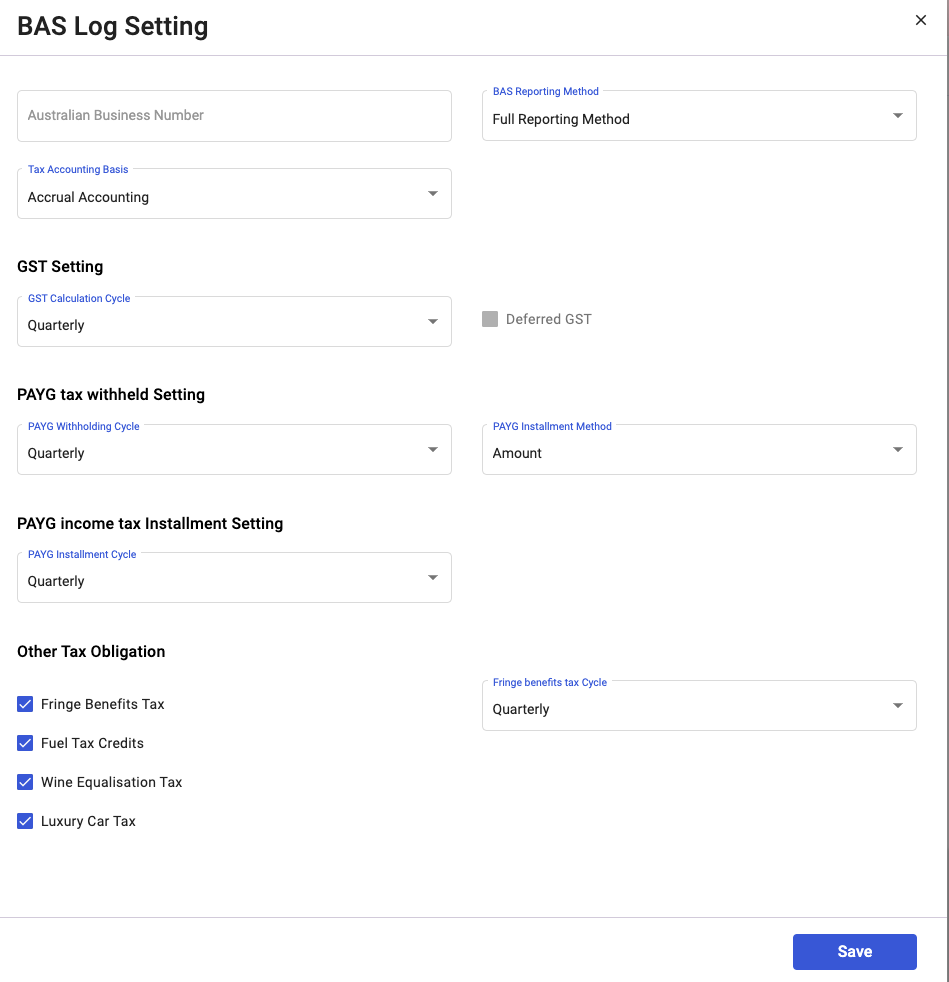

4. Configure the setting in the Business Activity Statement Log screen.

5. This action will open the slider on the right hand side of the page. Fill in the fields in the slider:

- Your Australian Business Number

- BAS Reporting Method: Choose either Simpler Method or Full Method

- Tax Accounting Basis: This field is set to the default Accrual Accounting

- GST Calculation Cycle: Indicate whether monthly, annually or quarterly. If you choose a monthly basis, you can enable the checkbox to defer GST

- PAYG tax withheld setting: Indicate whether monthly, annually or none. Select amount or rate

- PAYG income tax installment setting: Indicate whether monthly, annually, quarterly, or none

- Enable the checkbox if you have other tax obligations and choose the filing period accordingly

6. Click Save.

How can I generate Business Activity Statement in Deskera Books?

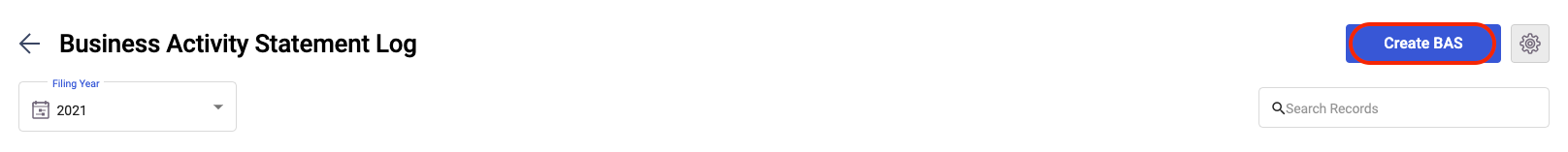

After you have configured the BAS setting, you can generate the BAS form next.

On a similar screen, click on Create BAS.

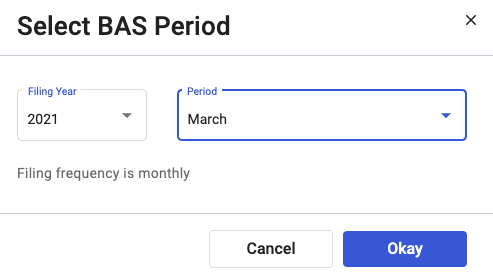

Next, indicate the filing year and the filing frequency.

Hit the Okay button.

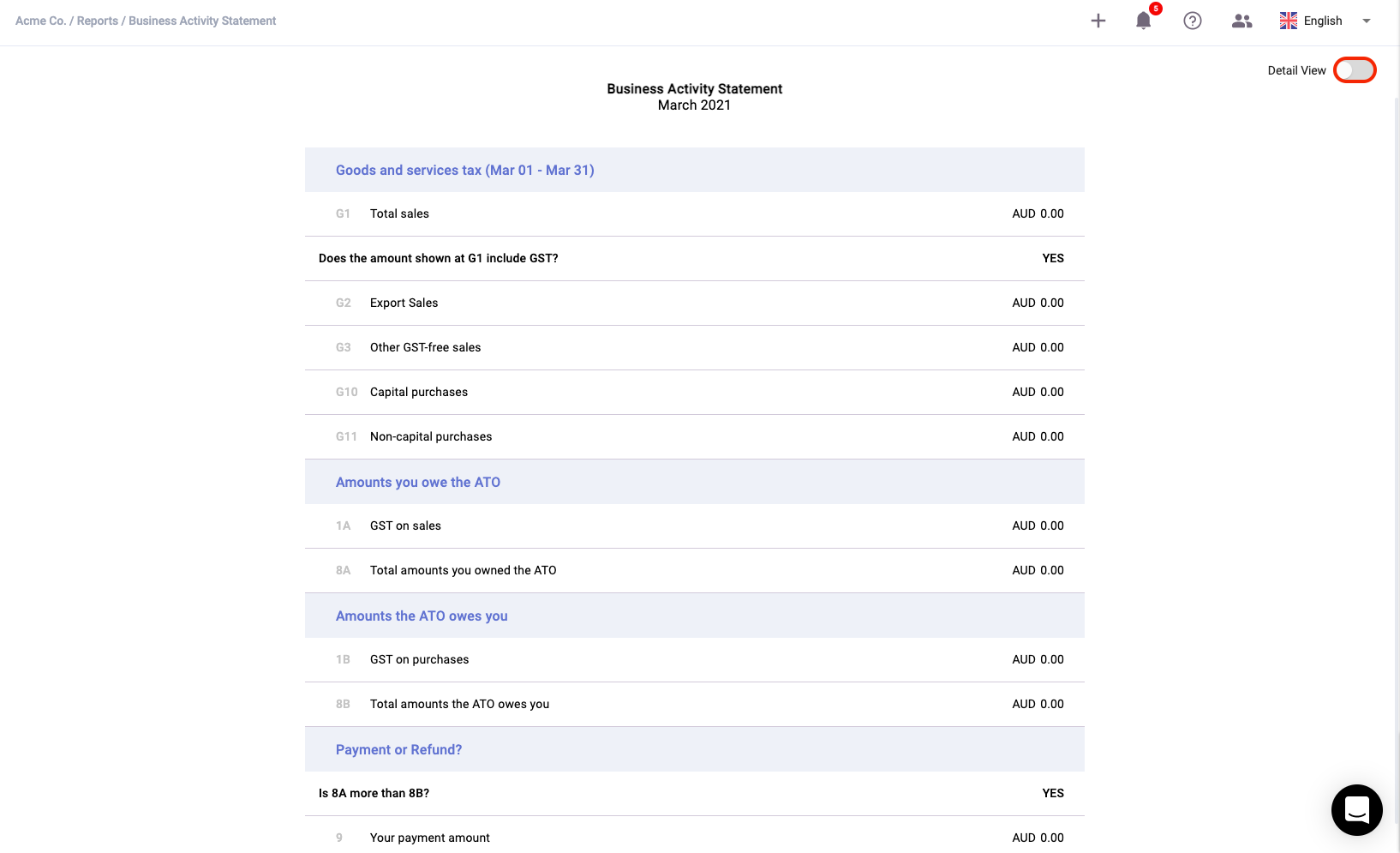

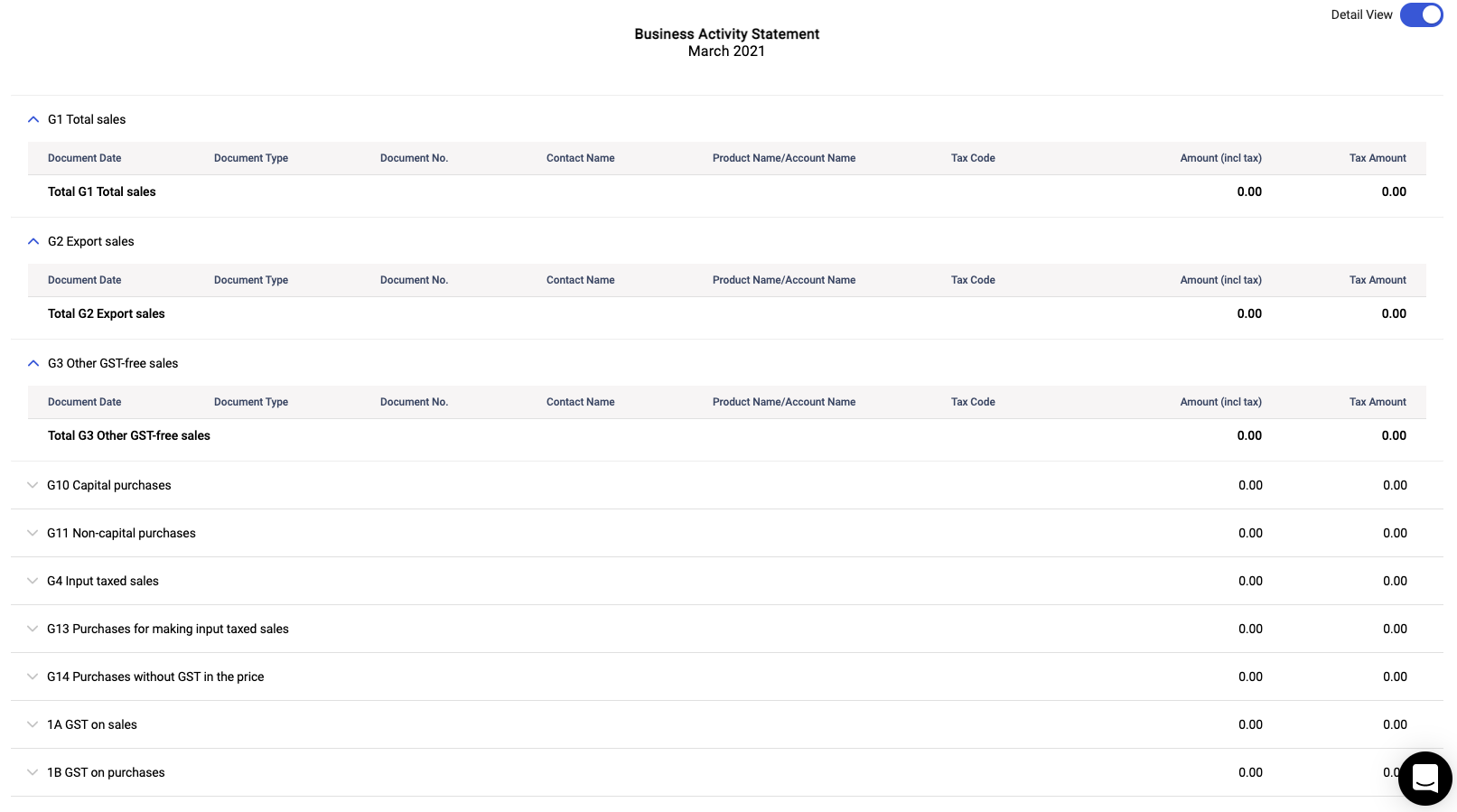

The BAS will be generated as per the image above. You can expand the record by enabling the detail view toggle.

You can view all the documents in Deskera Books tagged to each section in BAS.

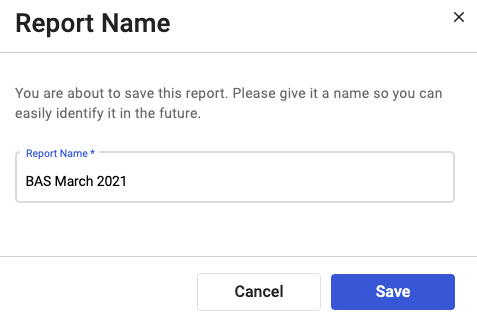

Click on the Save button.

Enter the Report Name and click save again.

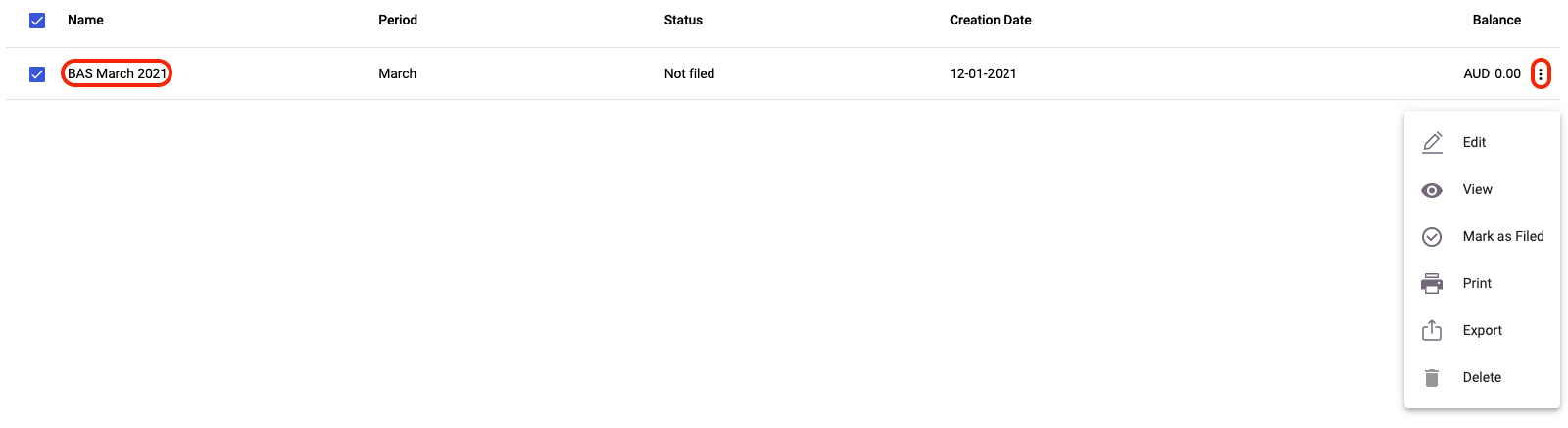

The Business Activity Statement created will reflect in the BAS Statement Log. Click on the three dots to:

- Edit - Edit the Business Activity Statement

- View - View the Business Activity Statement

- Mark as paid: Once you have cleared your tax liabilities, you can mark it as paid

- Print - Print the Business Activity Statement

- Export - Download the Business Activity Statement to your electronic device

- Delete - Remove the Business Activity Statement record from your account

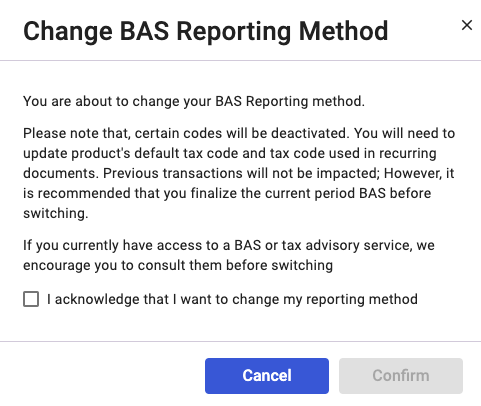

Can I change the Business Activity Statement reporting method?

You can change the BAS reporting from a simpler method to a full method, and vice versa.

Whenever you change the reporting method, you will be prompted with the message below.

A few things you need to note down before changing the reporting method

- Please note that certain codes will be deactivated.

- You will also need to update the product's default tax code used in recurring documents.

- Any latest updates will not update the previous transactions

- You should finalize the current period BAS before switching to a new method

Acknowledge the information stated and hit the confirm button.

Congratulations! You have learned how to customize the BAS setting in Deskera Books and generate the BAS form.