In the previous articles you have seen how to add, view, edit and delete WHT tax using Deskera Books.

Let is now take a look at, how the WHT is applicable in different modules on Deskera Books

As a user WHT Rate is calculated while creating business transactions like invoice, advance payments, make payment and receive payments, as per product setup for nature of payment, contact setup.

1. WHT Rate applicable for Payment receive for Invoice and Bills

After creating the invoice and bill you, and once they are fulfilled you need to make the payment where you have an option to apply WHT on that purchase.

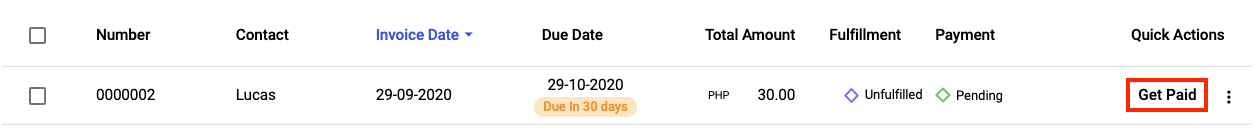

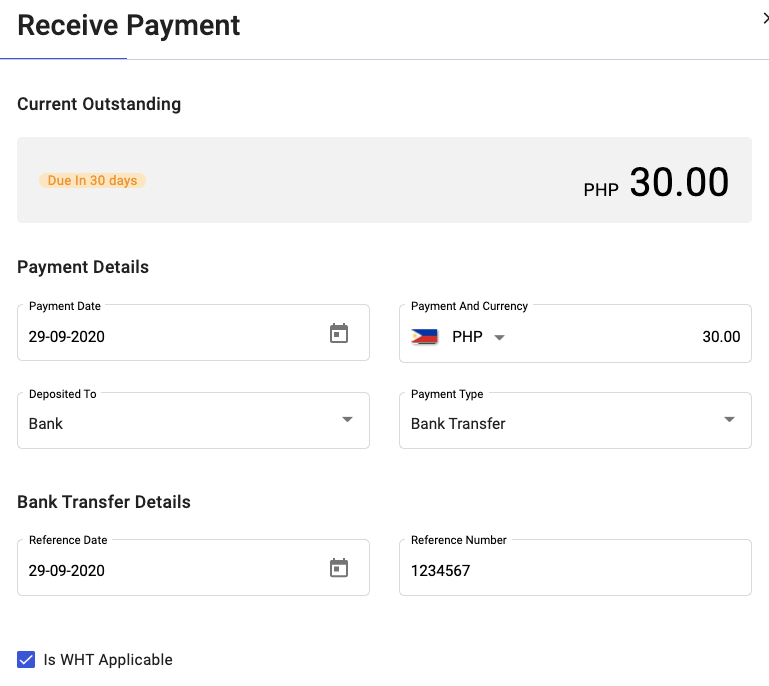

Click on the “Get Paid” option to receive the payment for the purchase made. Below window will appear with all the payment details

You will see all the payment details to be made, where you will also see an option Is WHT applicable for this purchase.

Mark as tick if you want to include WHT Rate while making the payment which will get added in the total amount.

WHT rate will be calculated as per the rate setup while creating a contact and product.

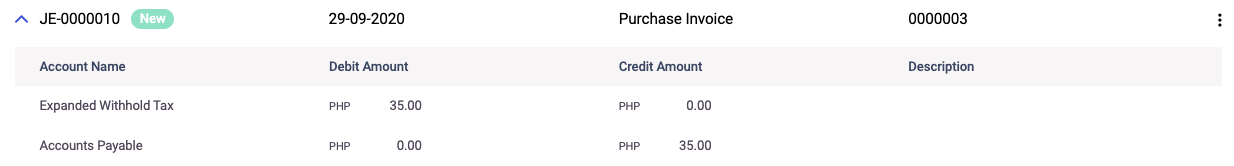

2. Journal Entry:

A separate Journal entry will be passed for each WHT rate made applicable for each payment made.

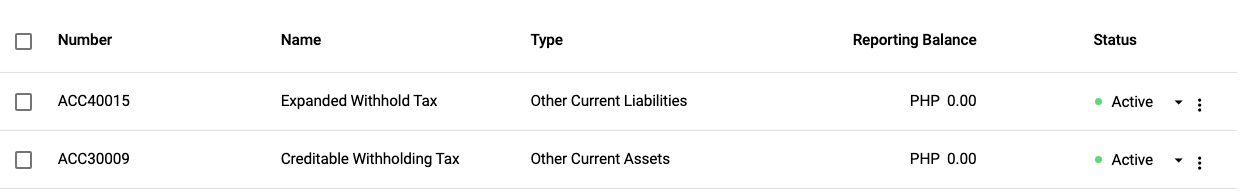

3. Charts of Accounts:

You will also be able to view a separate account maintained for WHT under COA which is the total amount being changed for payment made and received.

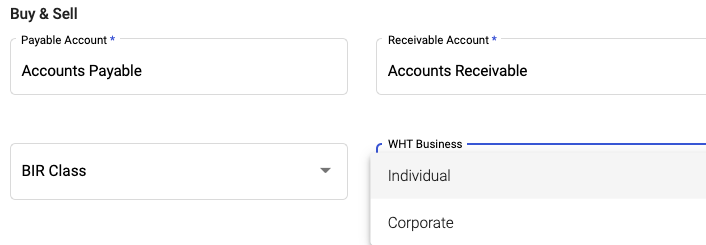

4. WHT setup under Contacts

While creating a contact under” WHT Business” field you need to select the options as Individual/Corporate, if WHT rate is applicable as per tax rates mapped with these values in the system.

This WHT business will determine the tax rate while creating the invoice/bill selected for this contact.

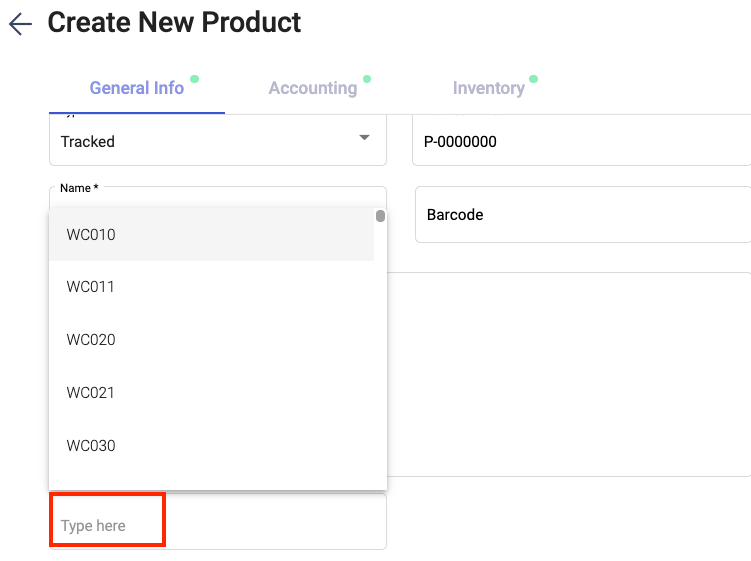

5. WHT Setup with Product:

While creating a new product under “Nature of payment” field you need to select the tax rate which will be applied to the product you are creating.

This selected WHT rate for the product will be applicable while creating an invoice/bill.

Congratulations! You have successfully learned how WHT is applicable on Deskera Books.