According to the Sales Tax Act 2018, Section 35, the Minister has the authority to exempt sales tax. The sales tax exemption can be categorised into two groups such as exemption by order of the minister and specific exemption.

Based on Malaysia's Sales Tax Exemption Guidelines, there are three types of exemption allowed in the Purchase section such as persons exempted from the payment of Tax under Schedule A, Schedule B and Schedule C.

Schedule A

Based on Orders of Schedule A, the lists or class of persons exempted from the payment of sales tax are Ruler State (The Yang Di-Pertuan Agong), Ruler of States, Federal or State of Department, Local Authority, Duty Free Shops, Inland Clearance, Public Higher Education Institution etc.

Schedule B

The Schedule B provides sales tax exemption to manufacturers of specific non-taxable goods - tax are exempted from the acquisition of raw materials, components, packing materials and manufacturing aids used directly in manufacturing activities.

Schedule C

The person exempted from tax under Schedule C is the registered manufacturer of taxable goods- exemption of tax for the acquisition of raw materials, components, packing materials and manufacturing aids used directly in manufacturing of taxable goods.

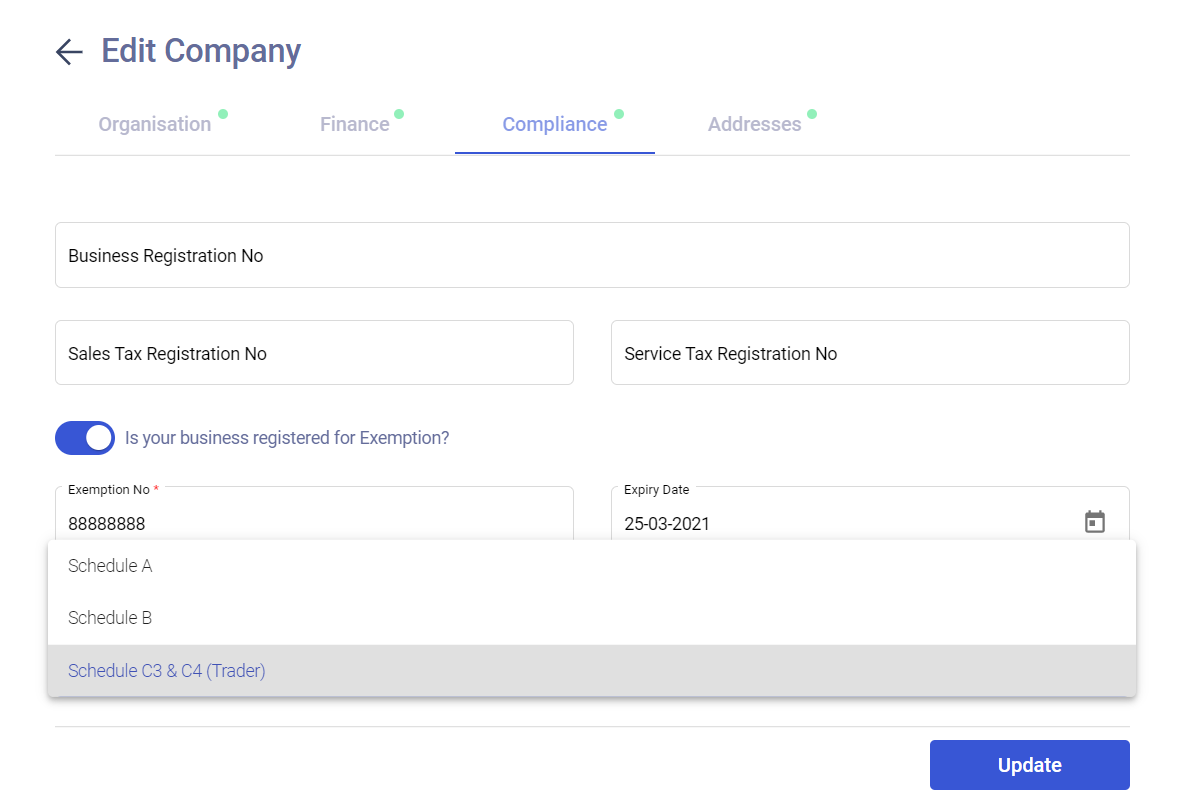

When you’re creating a new organization in the Deskera Book, you’re required to indicate if your business is registered for exemption. If yes, you’ll have to provide the exemption number, expiry date and indicate the exemption criteria that applies to you. Indicating the right exemption criteria enables our system to generate an accurate Report in compliance.