The Employment Insurance System Act 2017 was introduced and came into force on 1 January 2018.

Coverage

All employers in the private sector are required to pay monthly contributions on behalf of each employee. (Government employees, domestic workers and the self-employed are exempt)

An employee is defined as a person who is employed for wages under a contract of service or apprenticeship with an employer. The contract of service or apprenticeship may be expressed or implied and may be oral or in writing.

All employees aged 18 to 60 are required to contribute. However, employees aged 57 and above who have no prior contributions before the age of 57 are exempt.

Contribution rates are capped at an assumed monthly salary of RM4000.00.

Contribution Rates

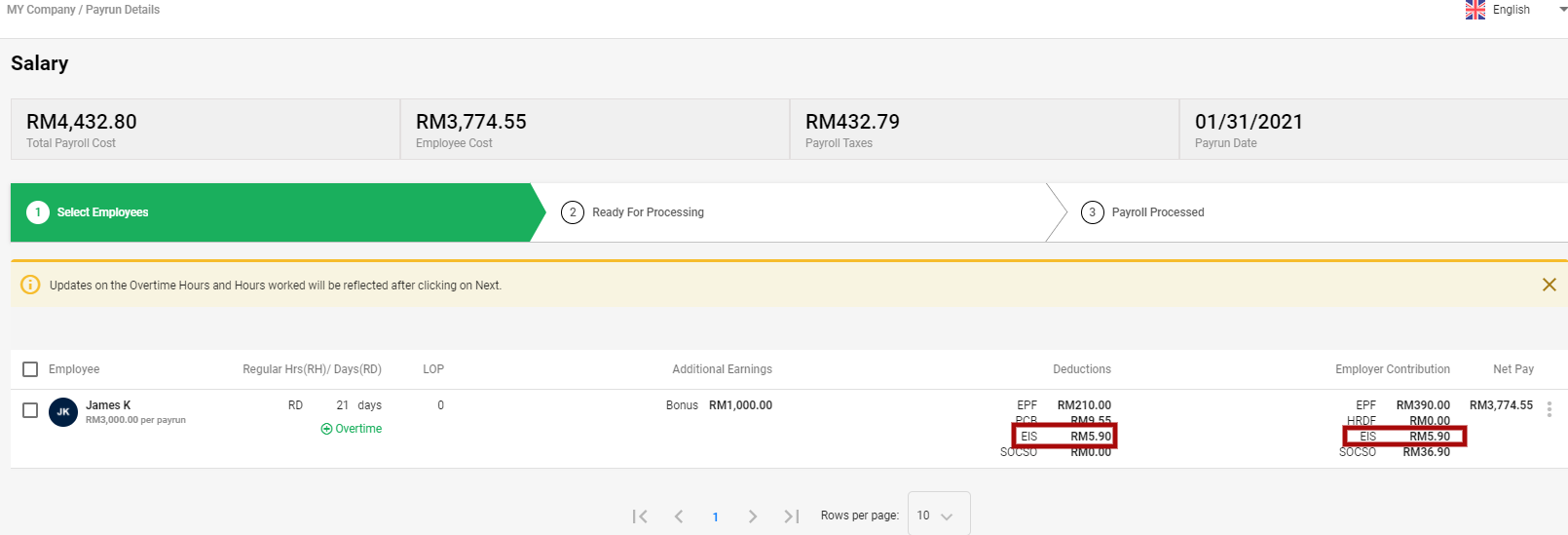

Contributions to the Employment Insurance System (EIS) are set at 0.4% of the employee’s assumed monthly salary. 0.2% will be paid by the employer while 0.2% will be deducted from the employee’s monthly salary.

Contribution rates are set out in the Second Schedule and subject to the rules in Section 18 of the Employment Insurance System Act 2017.

Employers in the private sector are required to pay monthly contributions on behalf of each employee. (Government employees, domestic workers and the self-employed are exempt).

For better clarity, do refer to the EIS Contribution Rate table.

Eligibility To Claim Benefits

The Employment Insurance System (EIS) is a financial scheme aimed at helping employees who lost their jobs until they find new employment are eligible with the following exceptions:

- An Insured Person who has opt for Voluntary resignation

- Expiry of the Insured Person’s fixed-term contract

- Unconditional termination of a contract of service based on an agreement between the Insured Person and his/her employer

- Completion of a project specified in a contract of service

- Retirement of the Insured Person

- Dismissal due to misconduct by the Insured Person

Contribution / Payment deadline

15th of the following month

Penalty for Late payment / contribution

Interest on late payment of contributions will be imposed at a rate of 6% per annum for each day of contributions not paid within the stipulated period.

How is EIS contribution applicable on Deskera People?

With Deskera People, with the below mentioned simple steps you can simply calculate the EIS contribution for employees,

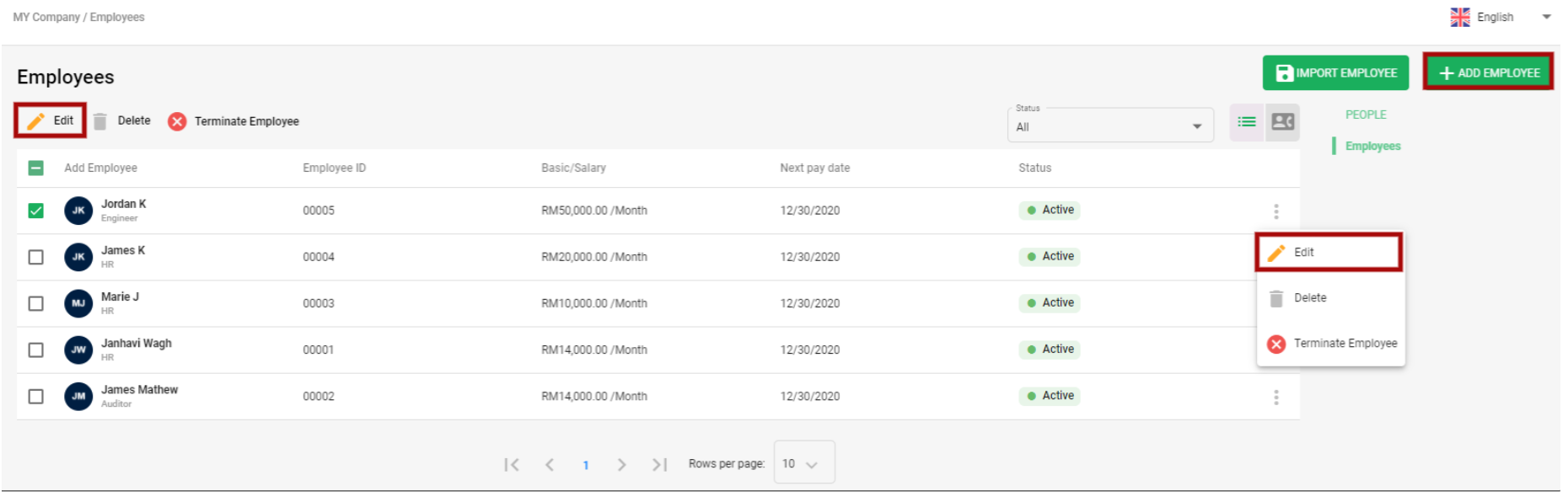

- Under Employees Module>>Select Employee List, a screen will appear

- To Select the enable EIS for employees, select the Employee and edit the profile or you can enable it while creating a new employee profile by clicking on +Add Employee.

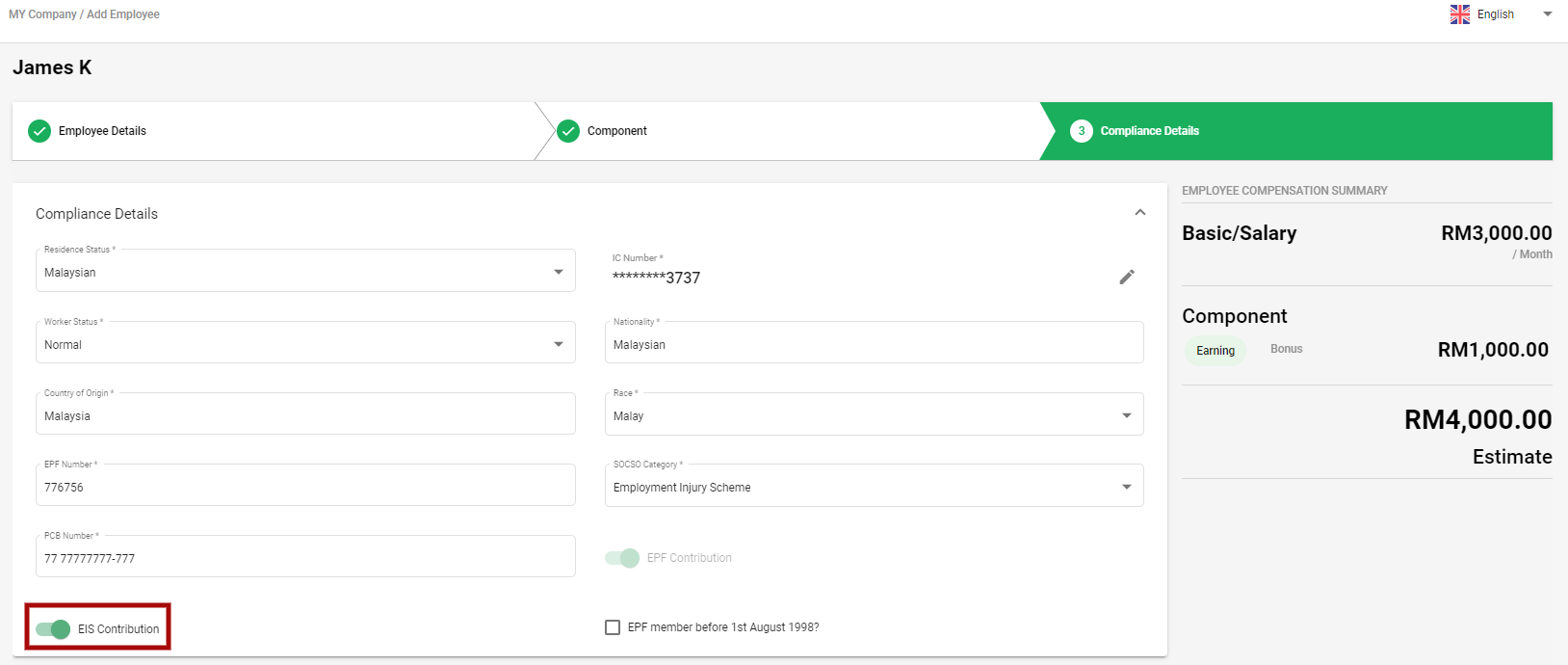

3. It will take you to the Employee Profile, under the Compliance Details Tab you can see a EIS Contribution toggle button where you can enable and disable the EIS applicability for the employee ,

4. With the inbuild EIS contribution rates implemented in the Deskera People, after the EIS button is enabled the employee and employer EIS calculation is auto calculated.

Congratulations! you have successfully learned what is EIS? How it is applicable in Deskera People?