If you have just started using Deskera People (Malaysia), you would want to make sure that the Monthly Tax Deduction (or Potongan Cukai Bulanan) for your employees is accurate.

Follow the below simple steps:

- Under Employees Module, select Employee List. A screen will appear

- Then, under Employee Profile>> go to the Compliance Details Tab

- From the compliance Details Tab you will be able to calculate your MTD/PCB

So, before you starting the computation of the employee's MTD, you must identify the employee's status and some other information as below:

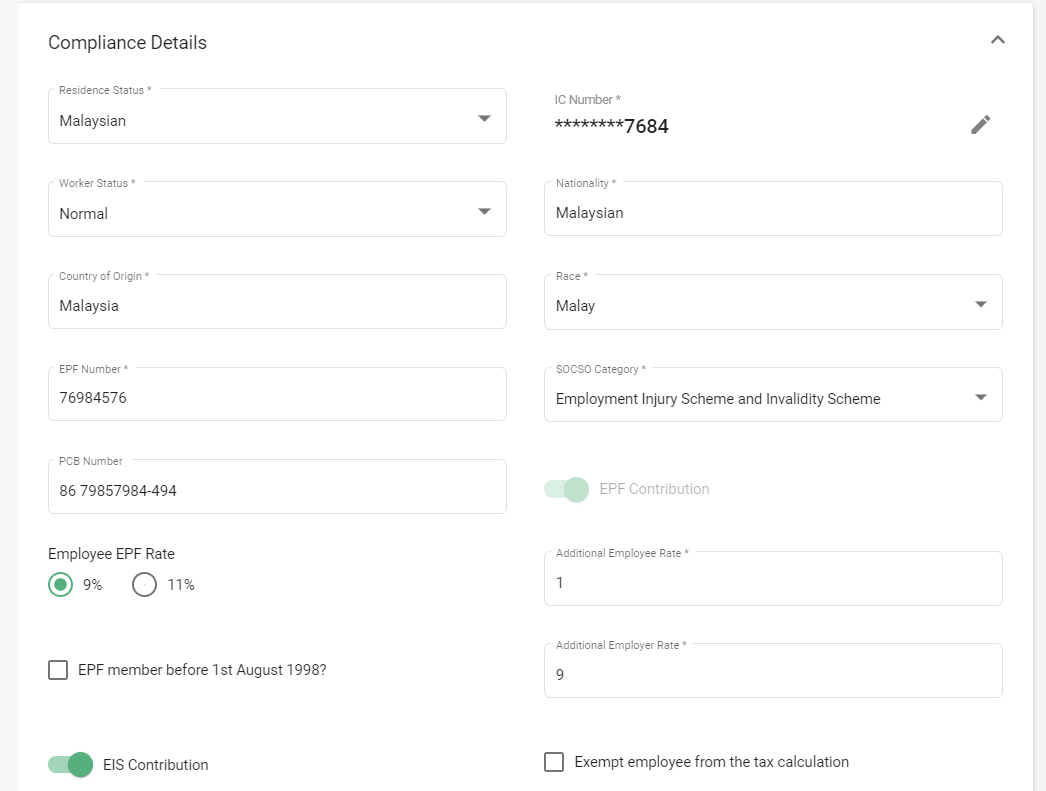

4. Under Compliance Details Section,

- Resident Status: Select the employee resident status if, Malaysian, Permanent Resident, Foreigner.

- IC/Passport Number - If employee is Malaysian/Permanent Resident mention the IC no and if Foreigner mention Passport No.

- Worker Status : Select Worker Status if , Normal, Returning Expert Program , Iskandar Knowledge Worker

- Nationality - Select from the drop down menu

- Country of Origin - Select from the drop down menu

- Race - Select from the drop down menu

- EPF Number - Add Employees EPF number

- PCB Number - Add Employees PCB number

- Employee EPF Rate : Select EPF Rate 9% or 11 %

- EPF Member before 1st August 1988? - Mark a tick on the check box if applicable or not applicable.

- Tick on the check box if you want to exempt the employee from Tax Calculation.

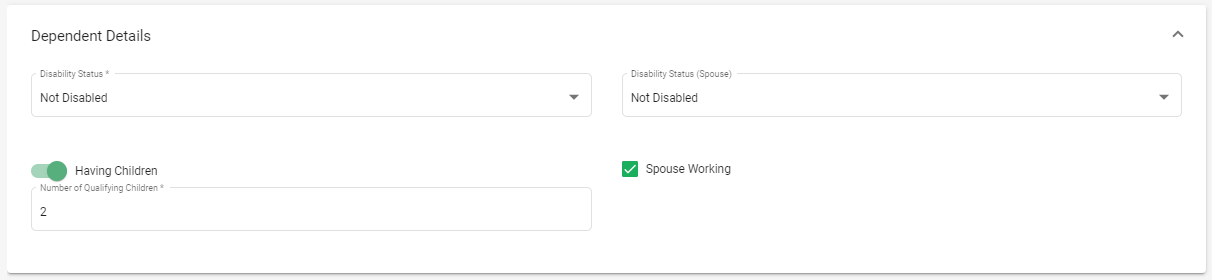

5. Under Dependent Details,

- Disability Status - Select employee disability status (Disabled/Not Disabled)

- Disability Status (Spouse) - Select employee spouse disability status (Disabled/Not Disabled)

- Spouse Working - Mark a tick on check box if spouse working yes or no

- Having Children - toggle the having children button yes or no and mention the Number of Eligible children if Having Children button is enabled.

Children Eligibility and claim amount:

1. Under the age of 18 years - Deduction RM2000 each

2. 18 Years & above and studying(included Certificate/Marticulation) - Deduction RM2000 each

3. Above 18 years and studying full time in diploma level onwards (Malaysia) or Degree level onwards (outside Malaysia) - Deduction RM8000 each

4. Disabled child - Deduction RM6000 each

5. Disabled child studying in diploma or higher level (in Malaysia)/degree or its equivalent (outside Malaysia) - Deduction RM14000 each

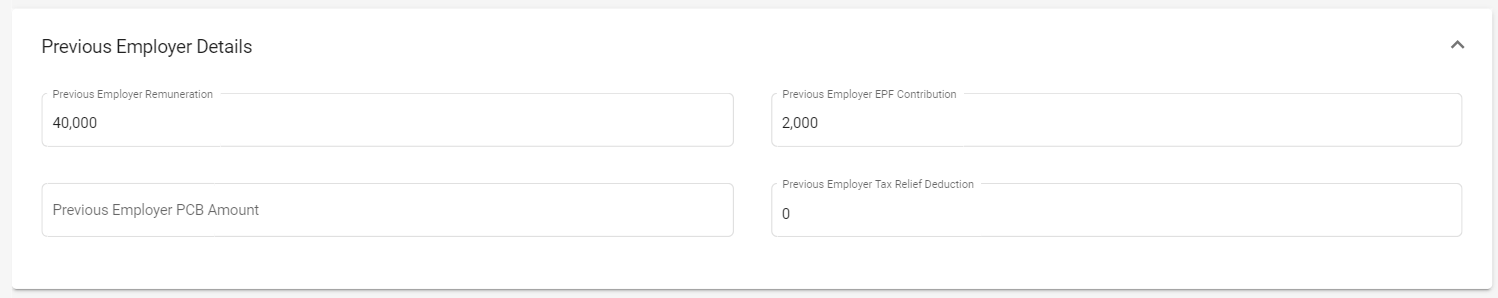

6. Under Previous Employer Details,

This details need to be filled if the employee has worked in two different organizations during the same financial year.

- Previous Employer Remuneration

- Previous Employer EPF calculation

- Previous Employer PCB amount

- Previous Employer Tax Relief Deduction

7. Do ensure that all these fields are completed correctly in the fields provided for accurate PCB/MTD calculations.

8 Once all these above mentioned details are saved, Deskera People will auto calculate the PCB/MTD according to the the official formula, which you can verify from LHDN Official Calculator (MTD Calculation).

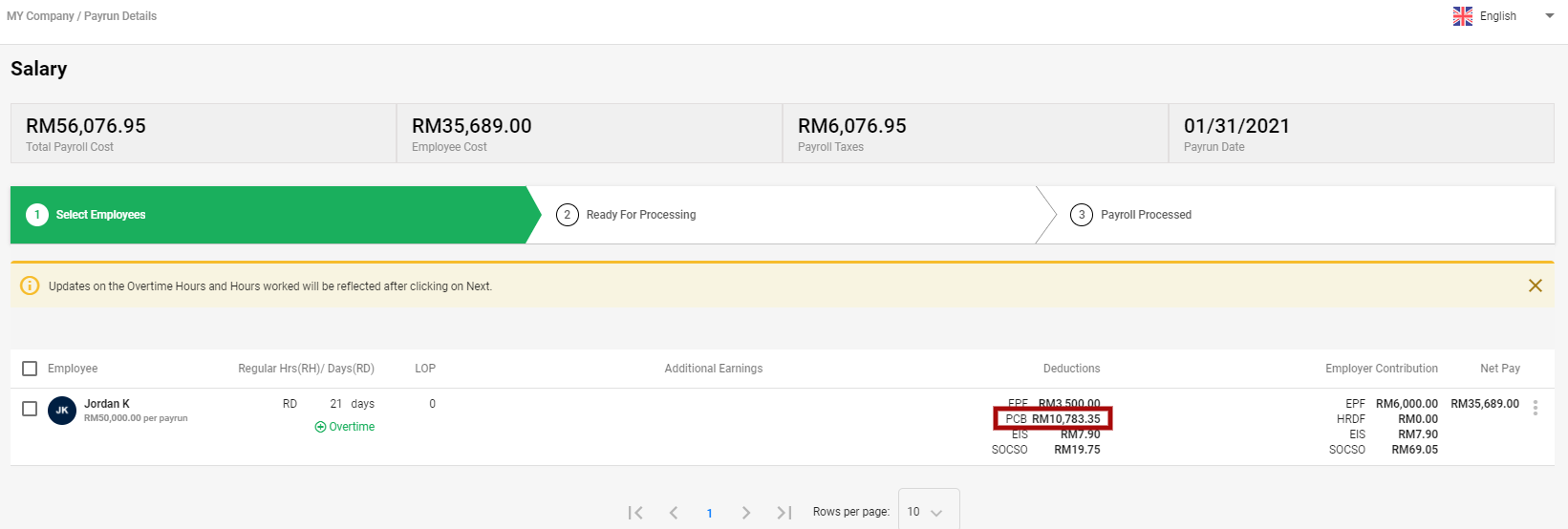

How to further verify accurate MTD calculation on Deskera People?

1. After processing payroll, in Payrun Module>> Select the payrun>>Process Payrun, you can see the PCB amount calculation for the employees under Deductions Column.

You can auto-verify with LHDN and a .pdf report that will be generated from LHDN Official Calculator (MTD Calculation).