Methods to Calculate PPH 21?

In general, there are 3 methods that can be used to calculate PPh 21, namely the Net, Gross, and Gross Up methods. Before calculating, it is better to look at the PPh 21 tariff layer imposed on taxpayers.

- Taxpayers with an annual income of up to IDR 50,000,000 are subject to a tax rate of 5%,

- Taxpayers with an annual income above IDR 50,000,000 to IDR 250,000,000 are subject to a rate of 15%,

- Taxpayers with annual income above IDR 250,000,000 to IDR 500,000,000 are subject to a tax rate of 25%.

- Taxpayers with an annual income above IDR 500,000,000 are subject to a tax.

Lets take a look at these methods more in details,

Net Method

This method is a tax withholding method where the company bears the taxes of its employees. The net method is the deduction of income tax and social security contributions such as BPJS Ketenagakerjaan and Health which has been carried out by the company directly at the salary to be received.

This results in employees no longer needing to calculate the amount of taxes and contributions that must be paid, and no need to pay taxes and contributions independently. The salary received is the net salary which has been deducted from several mandatory deductions.

Most companies pay employees by salary or nett , with tax borne by the employer. This means that employees receive the nominal income exactly as promised at the beginning.

Example of calculating PPh 21 for an employee who is unmarried and without dependents (PTKP TK / 0) who is promised a net salary of IDR 8,000,000 a month.

|

Salary |

IDR 8,000,000 |

|

|

Less: Office fee: 5% x IDR 8,000,000 |

IDR 400,000- |

|

|

Net income |

IDR 7,600,000 |

|

|

Annual net

income |

IDR 91,200,000 |

|

|

Less: Non-Taxable Income (PTKP) TK

/ 0 |

IDR 54,000,000 |

|

|

Taxable income |

IDR 37,200,000 |

|

|

Income Tax 21 payable

annually: 5% x IDR 37,200,000 |

IDR 1,860,000 |

|

|

PPh 21 payable a month |

IDR 155,000 |

|

Salary |

IDR 8,000,000 |

||

|

Tax subsidies |

IDR 155,000 |

Income Tax 21 |

IDR 155,000 |

|

Total income |

IDR 8,000,000 |

Net salary |

IDR 8,000,000 |

Therefore, the PPh 21 tax in the example above is Rp. 155,000 which is borne by the company and is not added to the employee's salary because it is not included in the gross income subject to tax.

Although the tax subsidy results in company expenses, the Rp. 155,000 tax cannot reduce the company's gross income in the calculation of corporate income tax.

Gross Method

This is a tax withholding method where employees bear their own income tax amount.This method means that the employee's salary is the full amount of salary that has not been subject to any mandatory deductions, the same as no allowance for any mandatory deductions is provided. This salary when compared to the net method will feel great.

The salary slip provided will also include deductions for income taxpayers and BPJS Employment and Health contributions. It also includes other variable chunks.

How do you calculate it?

For example, how much tax is borne by the company with the salary offered of Rp. 11,000,000 per month for an employee who is unmarried and without dependents (PTKP TK / 0)?

- Compute Net Income: Gross Income - Cost of Position =

salary- Rp. 11,000,000

Position allowance - 5% x Salary: IDR 550,000

Monthly Net Income- (Rp. 11,000,000 - IDR 550,000)= Rp. 10,450,000

Annual Net Income Rp. 125,400,000 (Rp. 10,450,000 * 12)

- Calculate Taxable Income (PKP) : Net Income for One Year - Non-Taxable Income (PTKP) TK / 0 IDR 125,400,000 - IDR 54,000,000 = IDR 71,400,000

- Calculate PPh 21 Payable : in a Progressive Tax Year (because IDR 71,400,000 is more than IDR 50,000,000) (5% x 50,000,000 = IDR 2,500,000) + (15% x 21,400,000 = IDR 3,210,000) = IDR 5,710 .000.

- Calculate monthly income tax payable: IDR 5,710,000: 12 = IDR 475,833

Gross Up Method:

Calculating PPh 21 using the Gross Up method is a tax deduction where the company provides tax allowances that are equal to the amount of tax withheld from employees. The Gross Up Method is more complicated. The tax allowance is calculated based on the amount of taxable income (PKP) by following the formula for the Taxable Income Layer (PKP)

This is a method in which the company provides allowances for employee income, according to the amount of tax or BPJS Employment and Health contributions that are borne by employees.

So in simple terms, taxes and fees are borne by the company, by including tax allowances on the income provided.

There are 2 steps in calculating PPh 21 gross up , namely:

1. Calculating Tax Allowances

To calculate PPh 21 allowances, a gross up PPh 21 formula is needed , so that the nominal value of the allowance is exactly the same as the tax to be deducted later. The formula is as follows:

|

Taxable

Income (PKP) Layers |

Income

Tax Allowances 21 |

|

IDR

0 - IDR 47,500,000 |

(PKP a year - 0) x 5/95 + 0 |

|

IDR

47,500,000 - IDR 217,500,000 |

(PKP a year - IDR 47,500,000) x 15/85 + IDR

2,500,000 |

|

IDR 217,500,000 - IDR 405,000,000 |

(PKP

a year - IDR 217,500,000) x 25/75 + IDR 32,500,000 |

|

More than IDR 405,000,000 |

(PKP

a year - IDR 405,000,000) x 30/70 + IDR 95,000,000 |

To make it clearer, here is an example of calculating the tax allowance for an employee's salary of IDR 8,000,000. Determine the amount of the Taxable Income in advance.

|

Yearly salary (12 x IDR

8,000,000) |

IDR 96,000,000 |

|

Less: One |

( IDR 4,800,000 ) |

|

Net income a year

|

IDR 91,200,000 |

|

Non-taxable

income TK / 0 (unmarried without dependents) |

( IDR 54,000,000 ) |

|

Taxable Income (PKP) |

IDR 37,200,000 |

Since PKP is between Rp. 0 to Rp. 47,500,000, the formula applies:

Income tax allowance 21 a year:

= (PKP a year - 0) x 5/95 + 0

= 37,200,000 x 5/95

= IDR 1,957,895

Income tax allowance 21 a month is IDR 1,957,895: 12 months = IDR 163,158

2. Calculating Gross Up Income Tax withholding 21

After obtaining the nominal tax allowance, the next step is to enter this figure into the employee's gross income for the calculation of PPh 21 . Correct calculation will result in withholding PPh 21 which is the exact same amount as the tax allowance, as shown in bold below:

|

Income tax allowance salary 21 |

IDR

8,000,000 |

|

|

Gross

income |

IDR

8.163.158 |

|

|

Less: |

( IDR

400,000 ) |

|

|

Net

Income |

IDR

7,763,158 |

|

|

Year net income |

IDR

93,157,896 |

|

|

Less: |

( IDR

54,000,000 ) |

|

|

Taxable income |

IDR

39,157,896 |

|

|

PPh 21 rates: 5% x IDR 39,157,896 |

IDR

1,957,895 |

|

|

Income Tax 21 payable a year |

IDR

1,957,895 |

|

|

PPh 21 payable a month |

Rp.

163,158 |

With the formula above, if the company wants employees to get a take home pay (net salary) of IDR 8,000,000, then the company needs to pay a gross income of IDR 8,163,158.

|

Salary |

IDR

8,000,000 |

||

|

Tax allowances |

Rp.

163,158 |

Income

Tax 21 |

Rp.

163,158 |

|

Total

income |

IDR 8.163.158 |

Total pieces |

Rp.

163,158 |

|

Take home pay |

IDR

8,000,000 |

How is Net, Gross and Gross Up methods applicable in Deskera People?

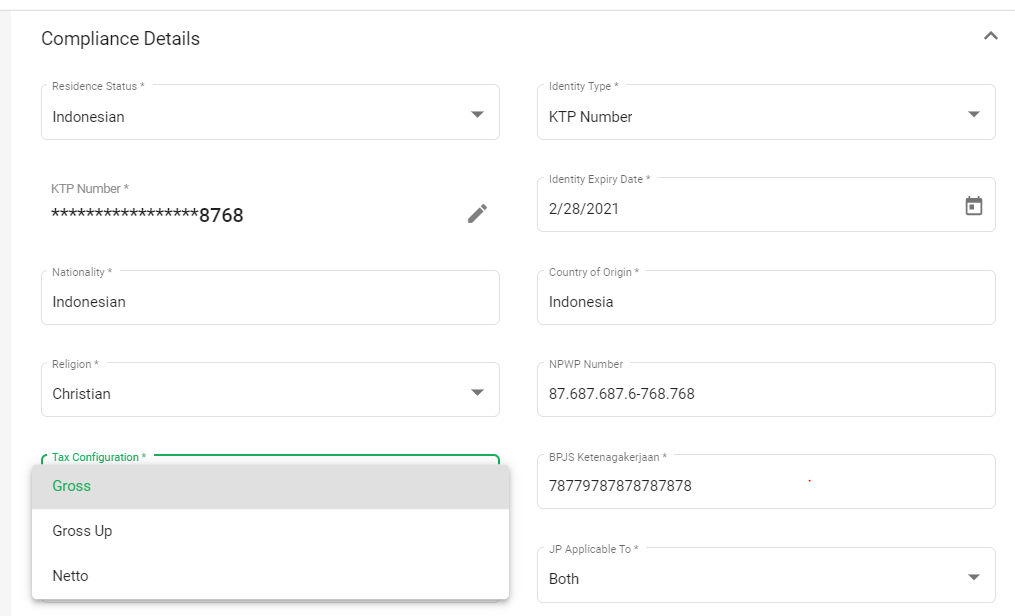

With Deskera People, you have an option to select the type of tax calculation according to company regulations.

Go to Employee List>>Add/Edit Employees>>Compliance Details>>Tax Configuration>>Select the option from drop down list,

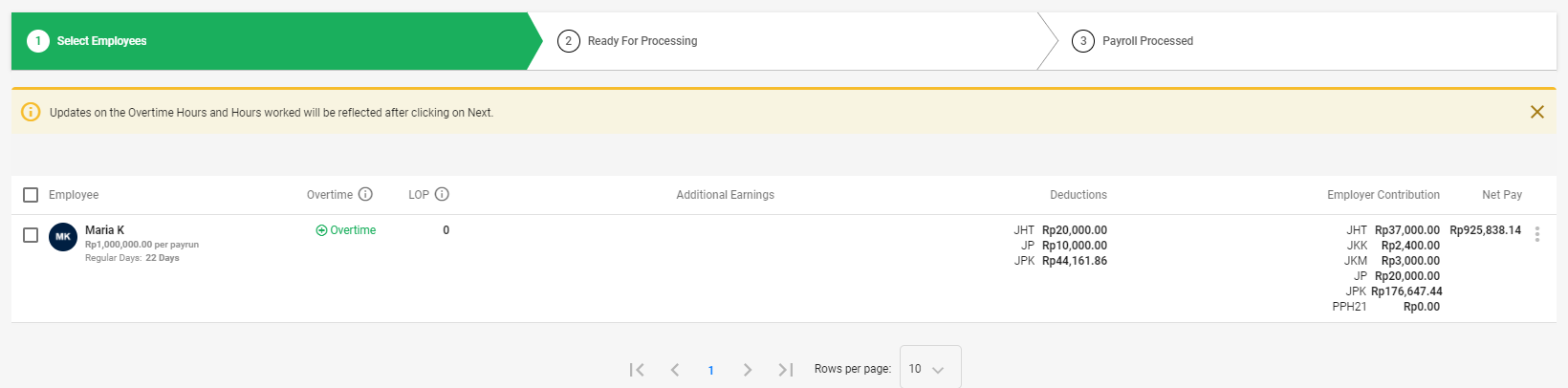

Gross method calculation in Deskera People during payroll processing

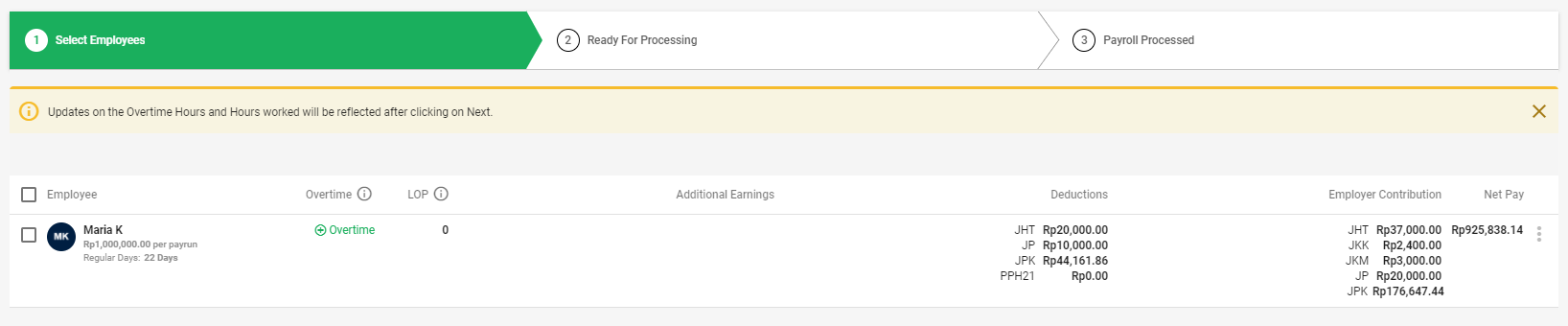

Gross up method calculation in Deskera People during payroll process

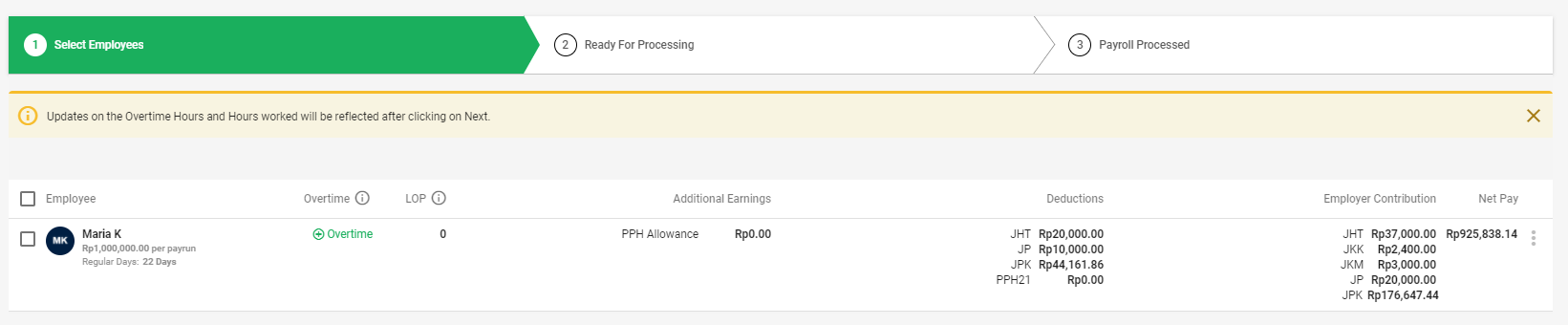

Netto method calculation in Deskera People during payroll process