The definition of PPh 21 is a tax on income in the form of salaries, wages, honoraria, allowances and other payments in whatever name and in any form in connection with work or position, services and activities carried out by individuals who are domestic tax subjects or referred to as taxpayers.

To understand the details of calculating PPh Article 21, you can learn the basic components and concepts of how to calculate PPh 21 as below,

Gross Income (Gross Income) PPh Article 21

Gross income or gross income is a type of income that is subject to withholding Income Tax Article 21.

Income-adding elements included in gross income are:

- Routine Income The

method of calculating PPh 21 will not be separated from the routine income of individual taxpayers, namely wages or salaries that are received regularly within a certain period, such as: - Basic Salary

Basic salary is the basic salary set to perform a particular department or job at a certain rank and time. - Allowances

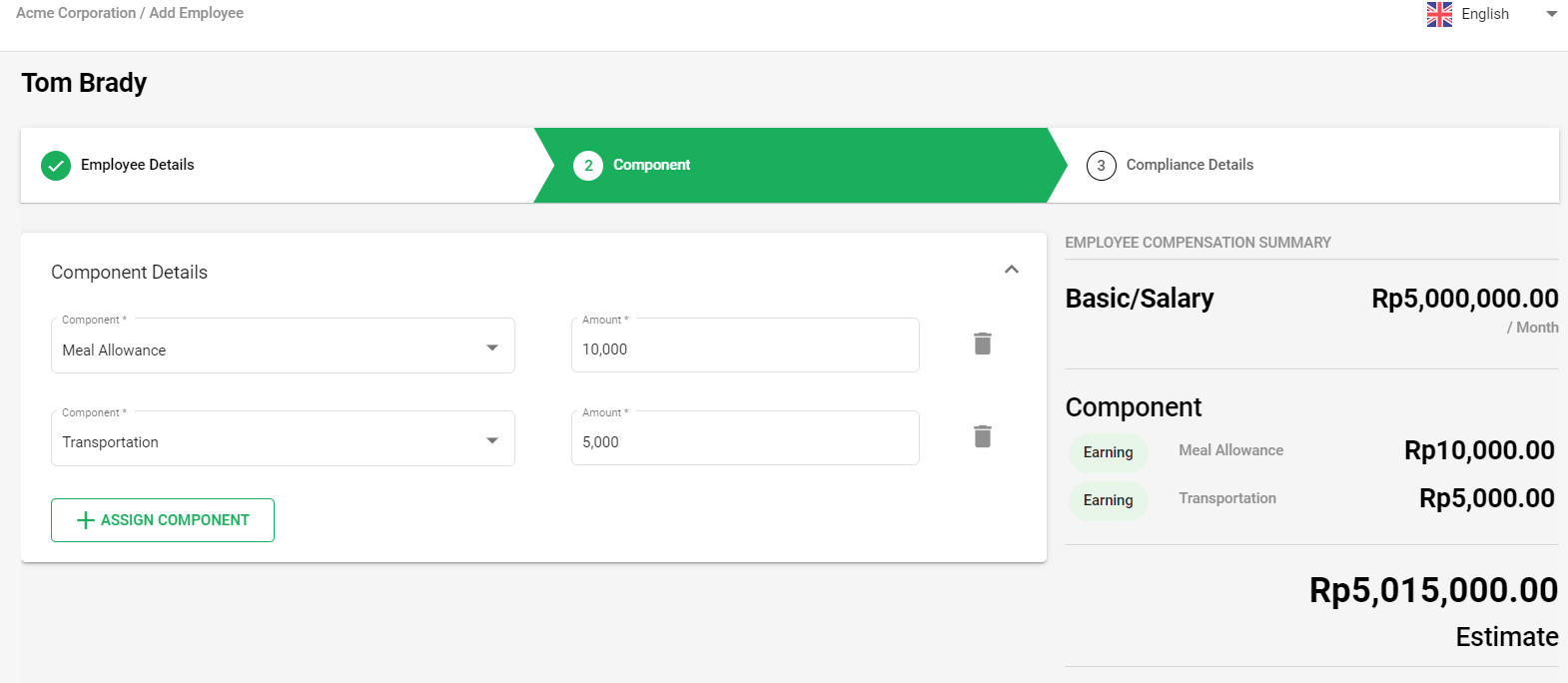

Allowances are additional income beyond the basic salary related to the performance of tasks and as an incentive. For example, a job allowance, transportation allowance, meal allowance, etc.

Non-Routine Income

Irregular income is wages or salaries that are received irregularly by an employee or other income earner, such as:

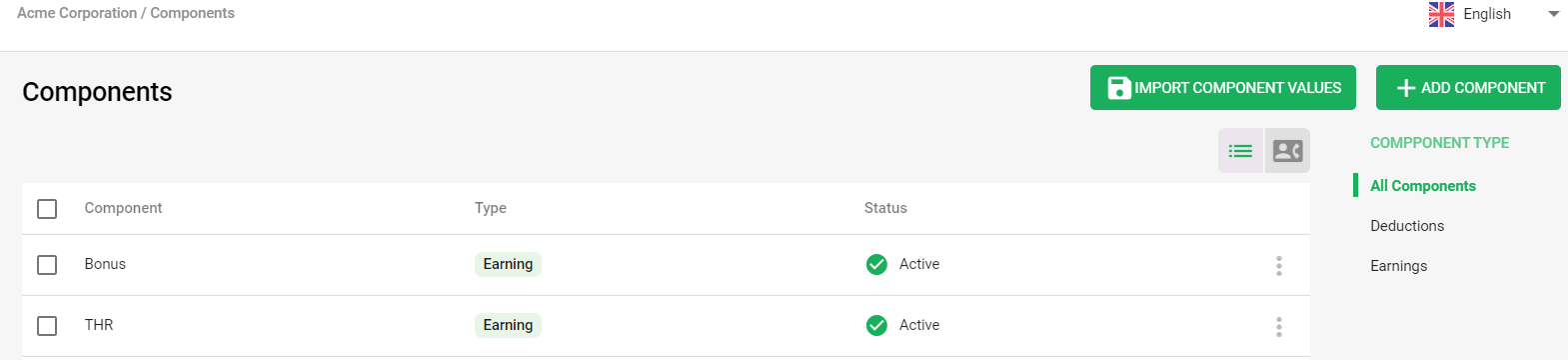

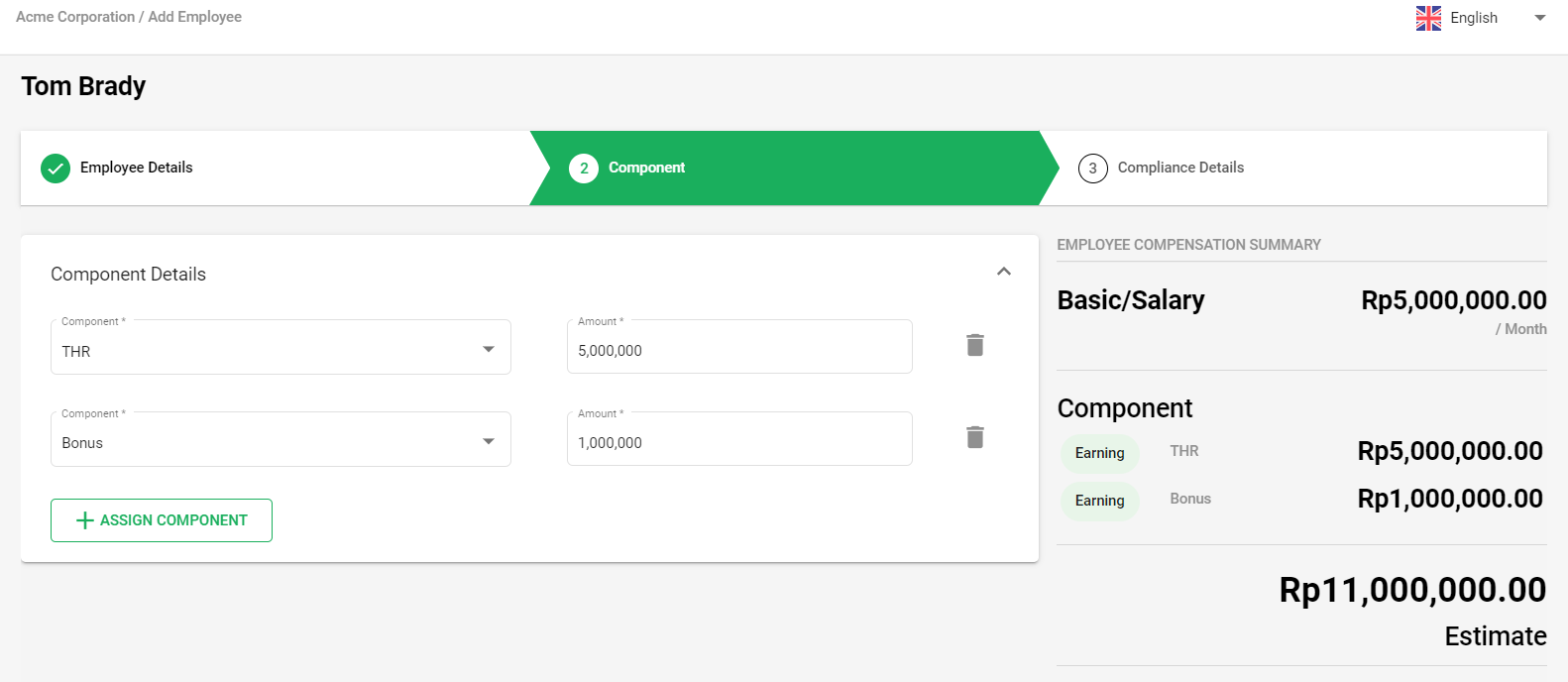

- Bonus

Bonus is additional income beyond pay to officers or additional dividends to shareholders. - Religious Holiday (THR)

THR is a non-wage income that must be paid by the employer to the employee / laborer who has a working month of 1 month with propositional calculations and is paid by the religious holiday. - Overtime Wages Overtime

wages are additional wages paid by the company because workers extend their working hours from the normal predetermined working hours

In Deskera People, go to Component and add the irregular Income components,

Then go to Employee List>>Edit/Add Employee>>Components>>Assign Component,

BPJS contributions or employee insurance premiums paid by the company

BPJS is a social security program administered by the Social Security Administering Body (BPJS).

Every Indonesian and foreign citizen who has lived in Indonesia for more than 6 months is required to become a member of the BPJS.

BPJS contributions are paid by employers and workers with a percentage of contributions from salary or wages (it is not stated in the regulation that whether this salary is the base salary, gross salary, net salary, etc.) which has been determined in a Government Regulation.

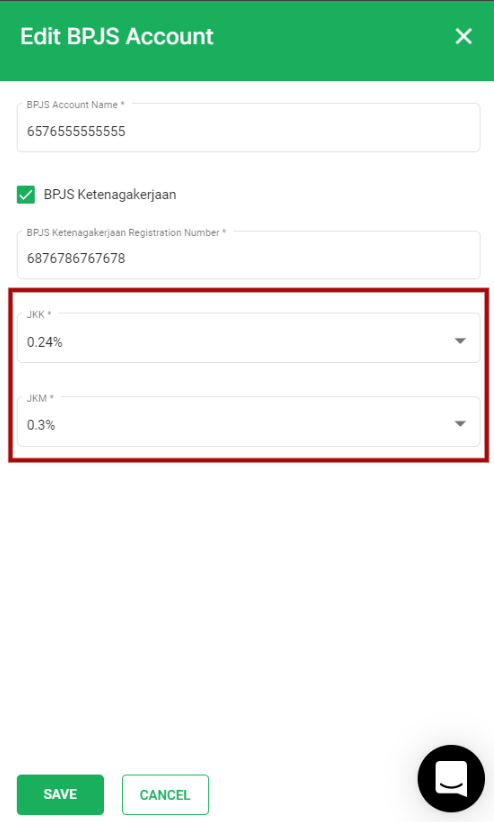

- Work Accident Benefits (JKK)

- Work Accident Security is compensation and rehabilitation for workers who have an accident when they start going to work until they return home or suffer from work-related illnesses.

- The JKK fee is fully paid by the company. The amount of fees based on the type of business and risk:

- Group I: premiums of 0.24% x monthly wages.

- Group II: the premium is 0.54% x monthly work wages.

- Group III: premium of 0.89% x monthly wages.

- Group IV: premium of 1.27% x monthly work wages.

- Group V: premium of 1.74% x monthly wages.

2. Death Insurance (JK)

Death Security is intended for the heirs of the BPJS Ketenagakerjaan program participants who died not due to a work accident.

Employers are required to bear the death benefit program contribution of 0.3% of their salary or wages.

In Deskera People, go to company Settings>>Company Details>> Add BPJS Account>>Select JKM and JKK contribution Rates

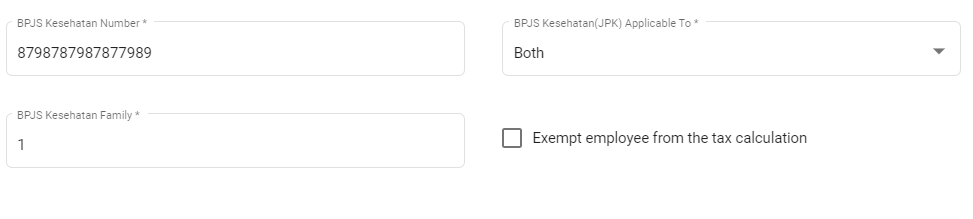

Health insurance (JKes / BPJS Kesehatan) is valid since July 2015

Health Insurance is a BPJS Health program that taxpayers participate in.

Since 1 July 2015, the health insurance contribution rate is 5% of monthly salary, namely 4% paid by employers and 1% by employees.

The salary or wages that are used as the basis for calculating the health insurance contributions consist of the salary or basic wage and fixed allowances.

The highest limit of monthly salary or wages used as the basis for calculating contributions is 2 times the PTKP with the status of being married with 1 child.

For other families, consisting of the fourth child and so on, parents and in-laws, the contribution is 1% per person of salary / wages.

PPh 21 allowance (paid by the company, if any)

For employers who provide PPh 21 allowances to their employees, in this case the PPh 21 allowance is full or partial, the amount of this PPh 21 allowance is an additional component of gross income.

Meanwhile, the method of calculating salaries for employees who receive PPh 21 allowances is the gross-up method .

BPJS allowance (paid by the company, if any)

For employers who provide full BPJS (JKK, JK, JP, JKes) benefits using the net salary calculation method or gross up , this allowance is used as a component of increasing gross income.

Subtraction from Gross Income

Subtraction from gross income is expenses that can reduce gross or gross income. This includes:

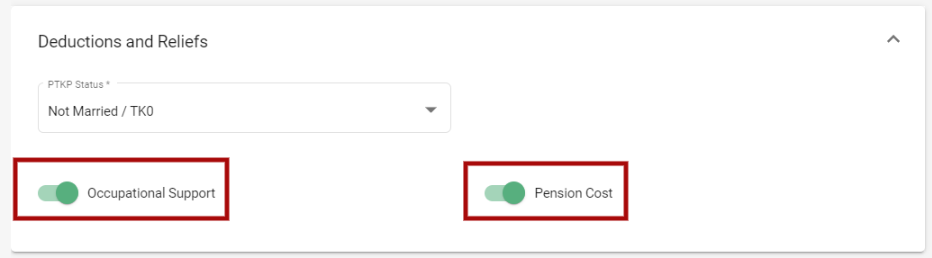

- Positioning Fee Job

fee is the cost assumed by the tax officer as an expense (cost) for a year related to work. Director General of Taxes Regulation No. PER-16 / PJ / 2016 stipulates that the cost of office is 5% of gross income a year and a maximum of IDR 500,000 a month or IDR 6 million a year. From ordinary staff to directors are entitled to this gross income deduction. - Pension Costs Pension

costs are deductions from gross income in calculating the Income Tax Article 21 payable and must be deducted from the monthly income received by pension recipients. The amount of pension costs stipulated by the Director General of Taxes Regulation No. PER-16 / PJ / 2016 is 5% of gross income and a maximum of IDR 200,000 per month or IDR 2,400,000 per year.

- BPJS Contribution Paid by Employees

In the event that BPJS contributions are paid by employees, the component is included as a deduction from gross income. BPJS contributions which are included as a deduction from gross income are,

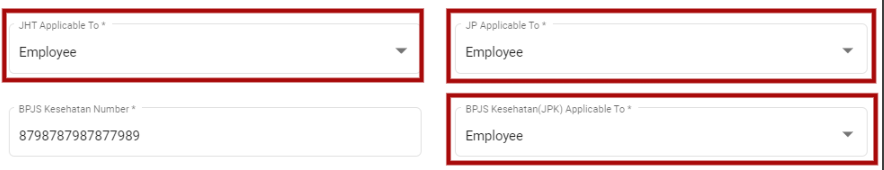

- Old Age Security (JHT)

This program is intended as a substitute for loss of worker's income due to death, disability or old age and is administered using the old age savings system. The company has contributed 3.7% for the old age insurance program, while 2% for the worker. The JHT premium provided by the employer is not included as an income-enhancing component. The tax will be imposed when the employee receives the JHT. Meanwhile, the JHT premium paid by employees is a deduction from gross income. - Pension Security (JP)

Pension security is social security that aims to provide a decent degree of life for participants and / or their heirs by providing income after participants enter retirement age, have total disability or die. The pension security (JP) has been in effect since July 2015. The JP program contributions are 3%, consisting of 2% employer contributions and 1% employee contributions. - Health Insurance (JKes)

Since 1 July 2015, the rate for health insurance contributions paid by employees is 1%.

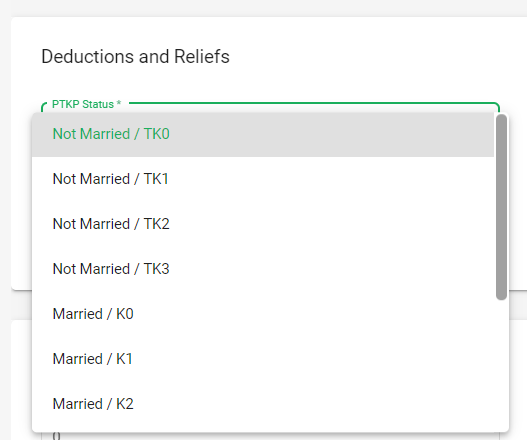

PTKP (Non-Taxable Income)

Non-Taxable Income (PTKP) which is an important component of how to calculate PPh 21 2018 is the total gross income value for taxpayers who are not taxed. In accordance with the Director General of Taxes Regulation No. PER-16 / PJ / 2016 and PMK No. 101 / PMK.010 / 2016, here are the latest PTKP rates you need to know:

- IDR 54,000,000 per year or IDR 4,500,000 per month for individual taxpayers

- IDR 4,500,000 per year or IDR 375,000 per month additional for married taxpayers

- IDR 54,000,000 per year or IDR 375,000 per month for a wife whose income is combined with the husband's income

- Rp 4,500,000 per year or an additional Rp 375,000 per month for each member of the blood family and the immediate family in a straight line of descent as well as the fully dependent adopted child, at most 3 people for each family.

Yearly PPH 21 is calculated as per below Tax Rates(Progressive)

a. 0 - 50.000.000 = * 5%

b. 50.000.001 - 250.000.000 = * 15%

c. 250.000.001 - 500.000.000 = * 25%

d. > 500.000.001 = * 30%

Monthly PPH21 is calculated = Yearly Tax/12

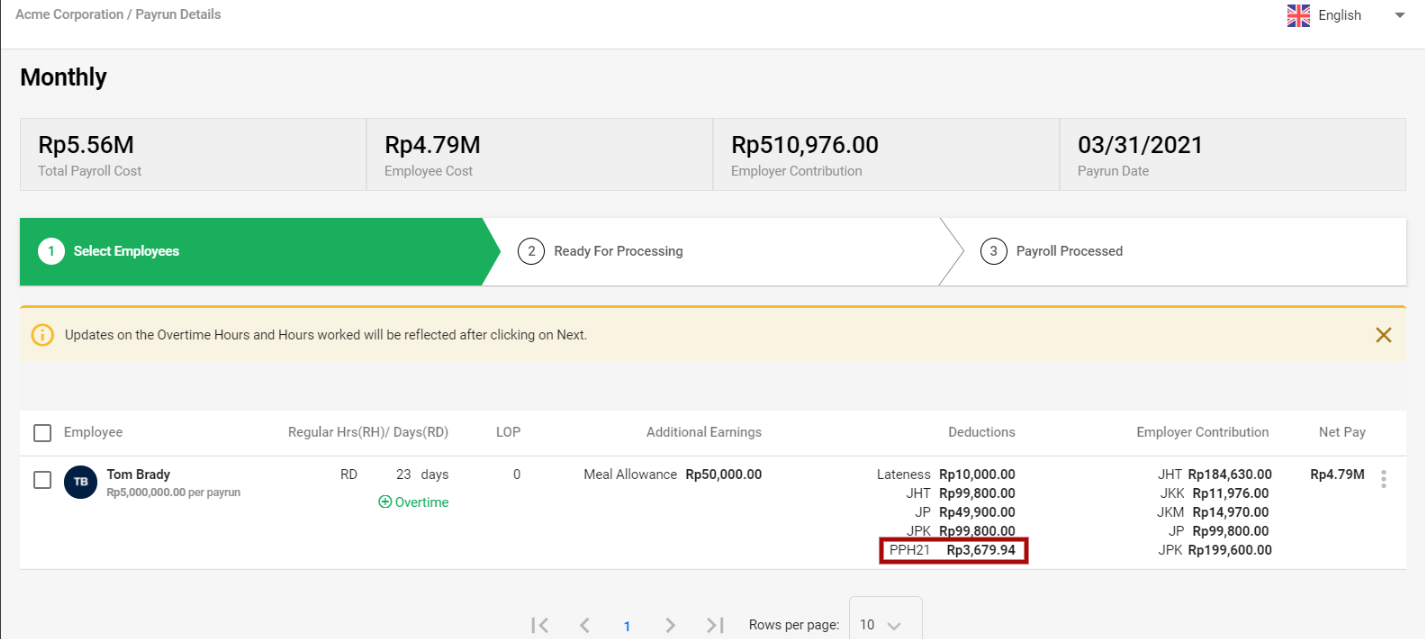

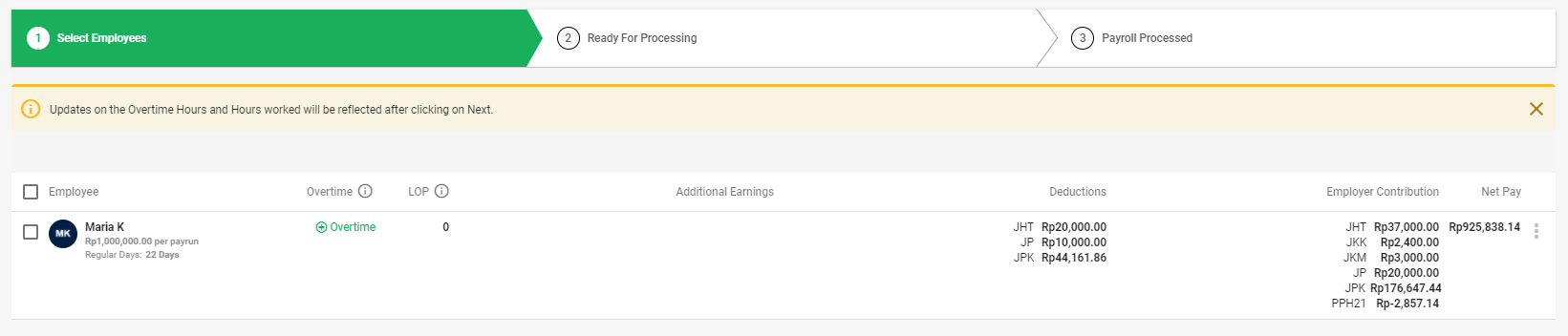

How to further verify accurate PPH21 calculation on Deskera People?

1. After processing payroll, in Payrun Module>> Select the payrun>>Process Payrun, you can see the PPH21 amount calculation for the employees under Deductions Column.

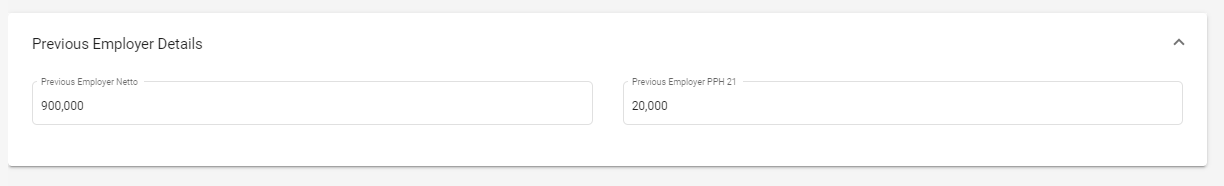

PPH21 Calculation for employees previously employed in current year

With Deskera People, you can now calculate the PPH21 for the employees who were previously employed in same year with the simple few steps,

- Go to employees>>employees list>> +add employees>>Compliance Details Tab>>Previous Employer Details section

- Previous Employer Netto - Enter the previous employer net income

- Previous Employer PPH21 - Enter previous employer PPH21

While payroll processing the PPH21 will be calculated taking into consideration the previous employer Net income and PPH21 amounts.

You can also calculate PPH21 for resign employees and PPH21 calculation for year end finalizations.