TCS means Tax Collected at Source. It is a process where the tax is collected by the e-commerce operator when a supplier sells goods and services through its portal, and the payment received by the e-commerce operator.

To setup TCS in your organization, follow the steps below:

- Login to your Deskera account.

- Click on settings via the sidebar menu.

- Select TCS setup.

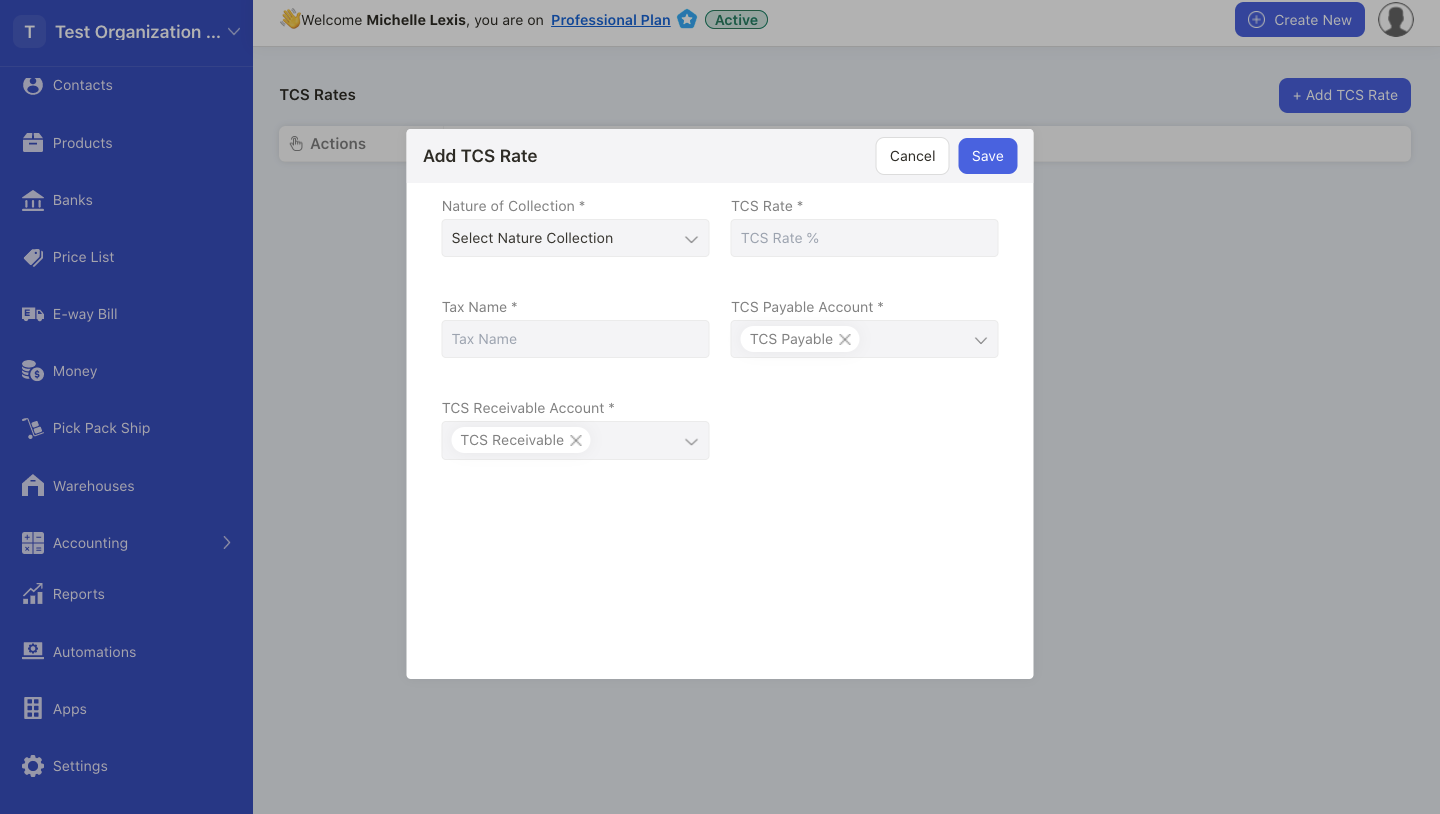

- On this page, click on the "Add TCS rate" button.

- Fill in the fields in the pop-up menu:

- Nature of collection: Choose or create a new nature of collection here

- TCS Rate: Enter the TCS rate

- Tax Name: Enter the tax name

- TCS Payable Account: Choose the relevant account for TCS payable

- TCS Receivable Account: Choose the applicable account for TCS Receivable

6. Once you are done, click on the Save button.

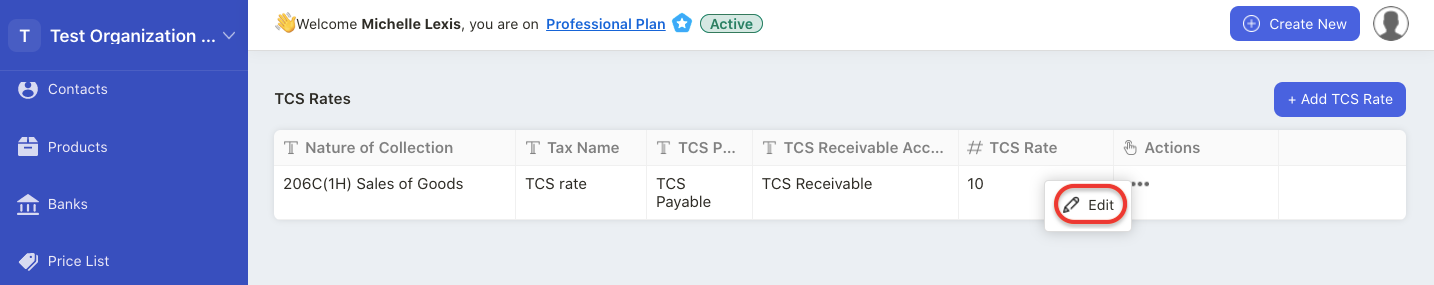

7. You can edit the TCS rate after creating it. However, you cannot delete the TCS rate after you have saved it.

How to apply TCS in a bill document?

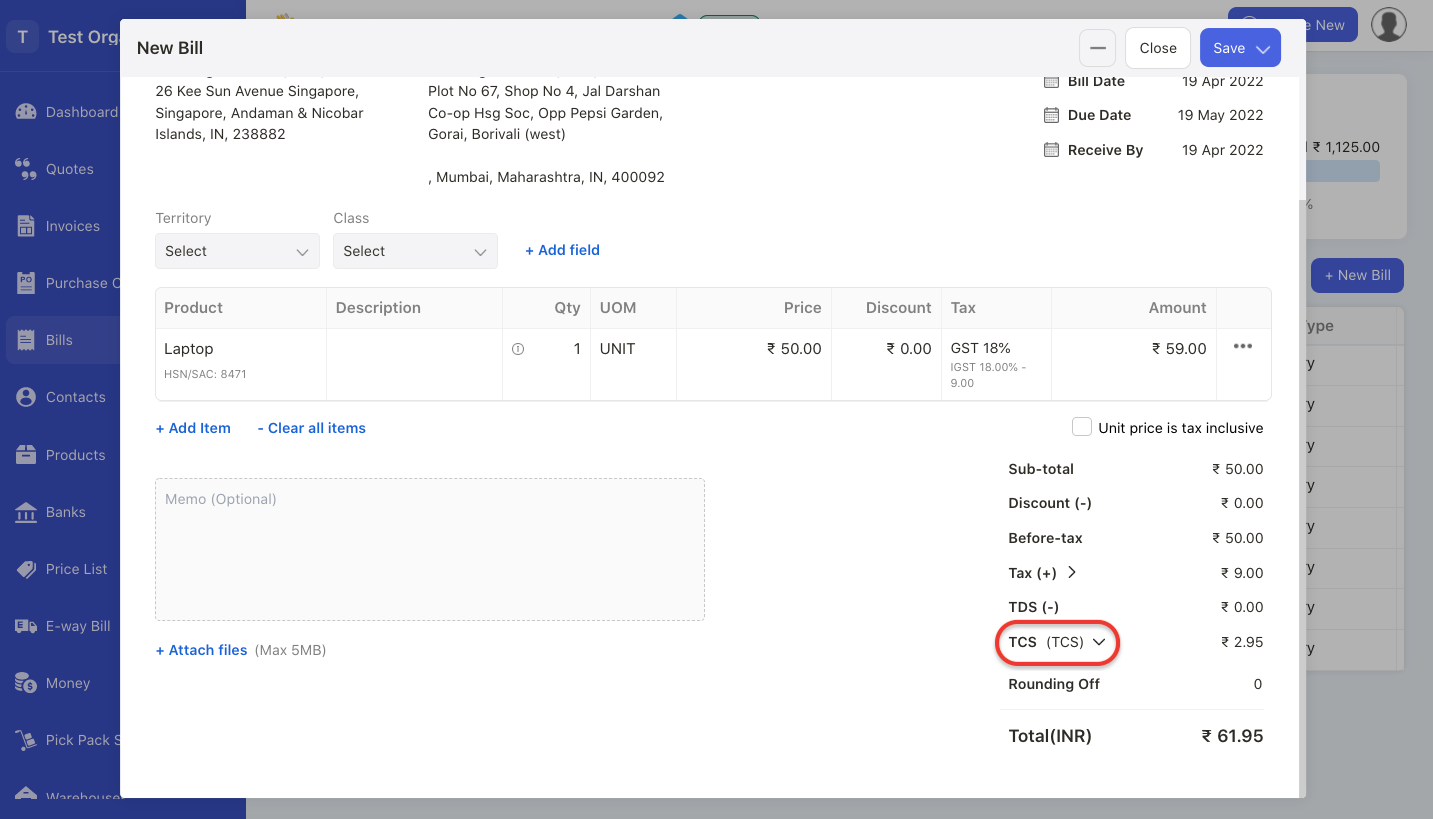

- Go to the Bills Module.

- Next, create a bill document.

3. Once you have added the contact and product, scroll to the bottom of the document. Click on the drop-down arrow on the TCS section. You can choose from the existing TCS rates, or you can create a new TCS rate here as well.

4. The bill document will be adjusted based on the TCS applied.

How to apply TCS in an invoice document?

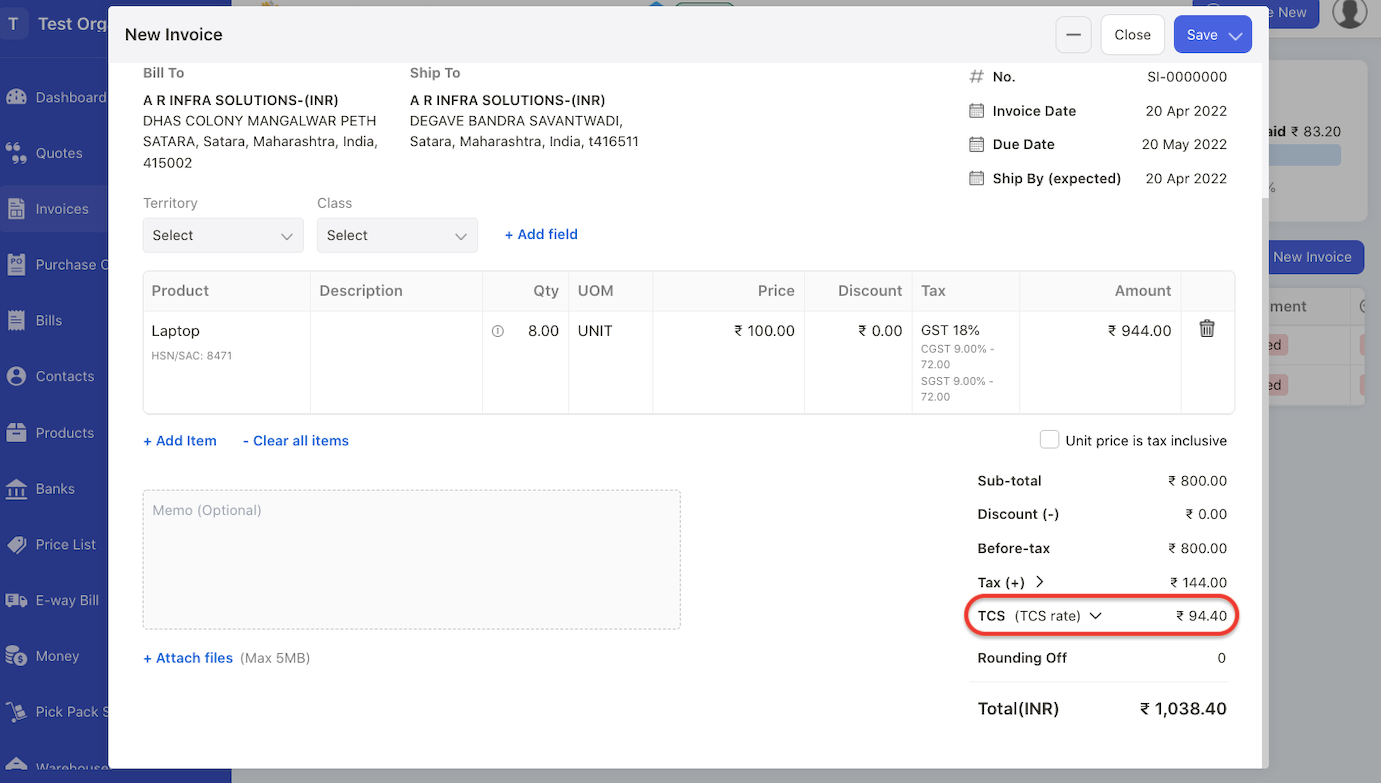

- Go to the Invoices Module.

- Next, create an invoice document.

3. Once you have added the contact and product, scroll to the bottom of the document. Click on the drop-down arrow of the TCS section. You can choose from the current TCS rates or create a new rate here.

4. Click on the Save button.