Reverse Change is a process under GST in which the receiver, makes the payment of GST instead of the supplier.

In normal cases, the supplier is the one who pays tax on supplies, but in the case of reverse charge, the role gets reversed.

Under the RCM Rule, the buyer pays taxes directly to the government. This usually happens in the case of import and other notified supplies.

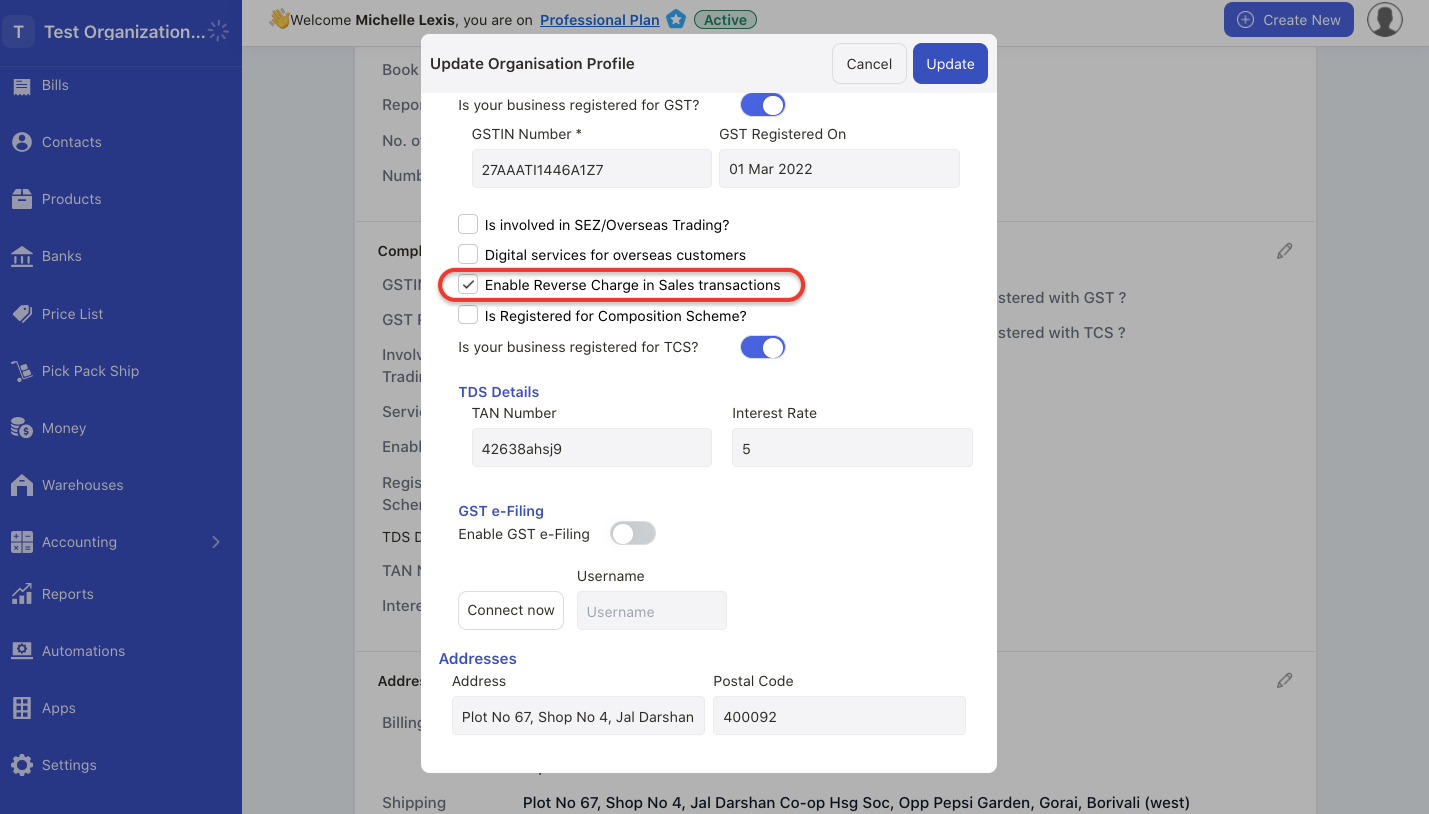

To activate RCM in the system, follow the guides below:

- Login to your Books+ account.

- Go to Setting Module

- Select organization profile

4. On this page, make sure that you have enabled the reverse charge in sales transactions checkbox.

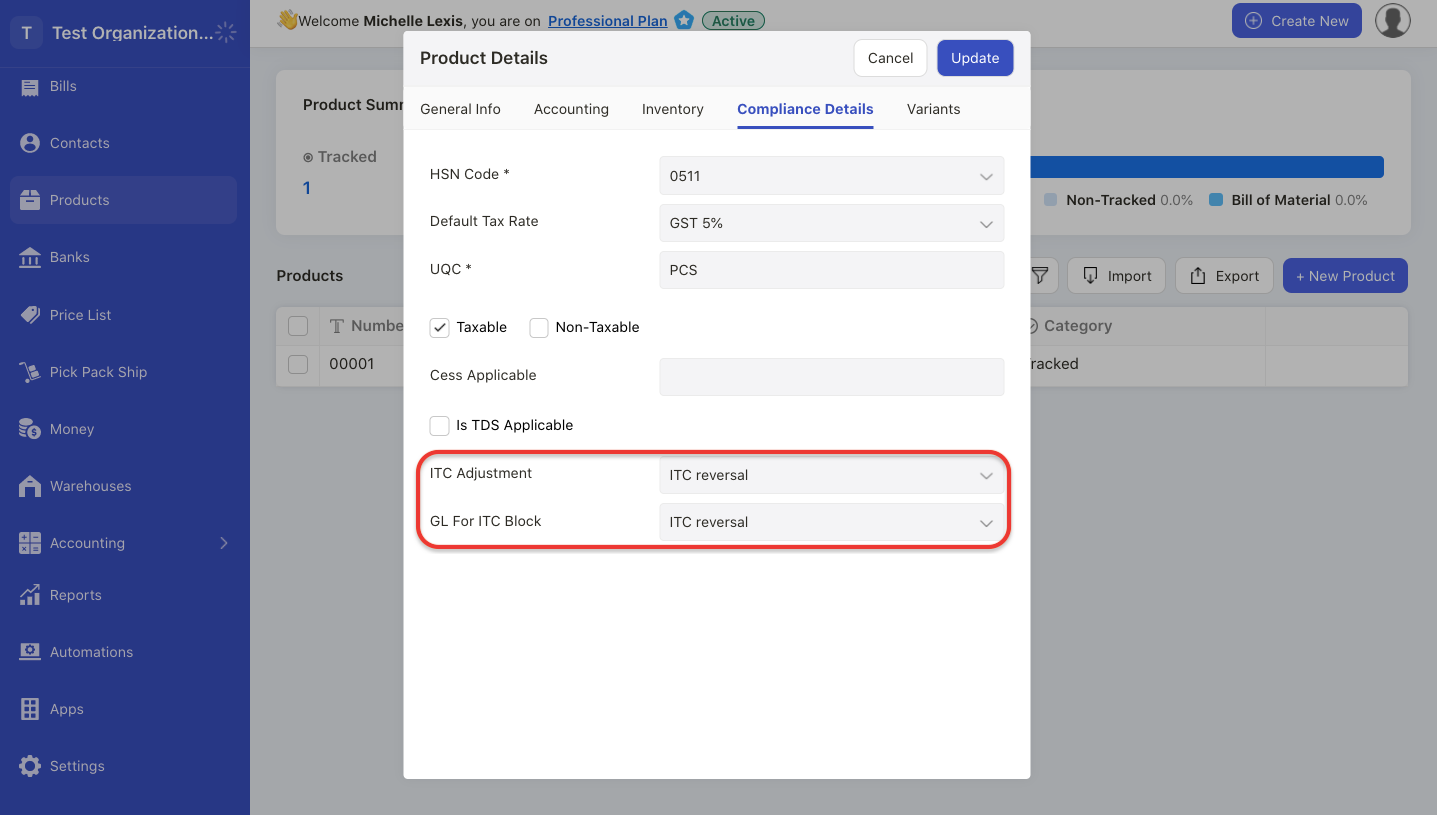

5. Next, go to the product module. During product creation, make sure that you have selected ITC reversal under ITC adjustment. Save the product.

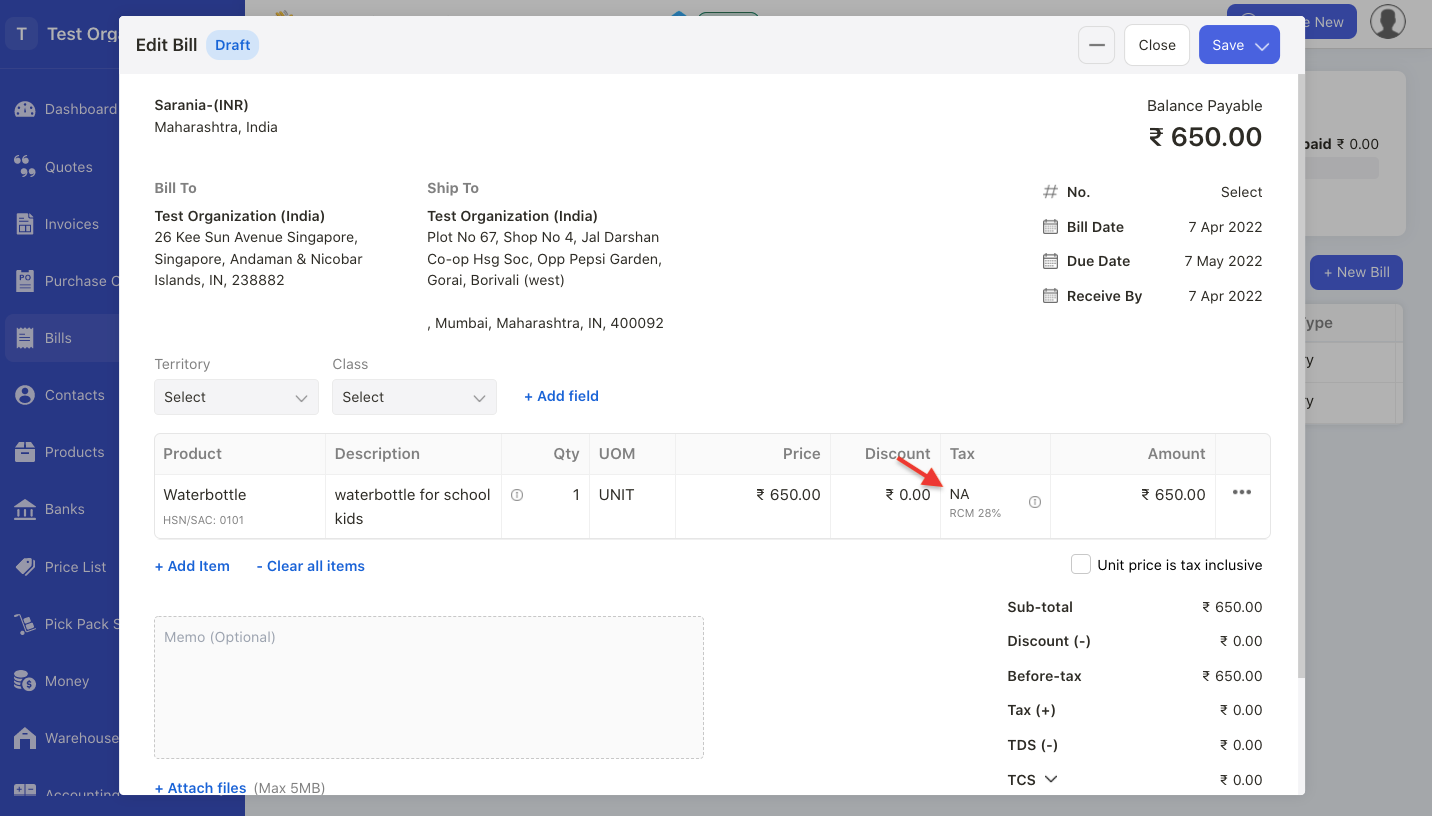

6. Go to Bill page and proceed to create a bill document. If you have selected the product with ITC reversed created earlier, under the tax column, you can view the RCM field appear here, with NA tax.

7. Under RCM, tax amount will be reflected as zero in the bill document.