What Is Employees State Insurance (ESI)?

Under the Employees State Insurance Act, 1948, ESI is governed and is a self-financed social security scheme designed to protect employees. Employees of an eligible organization are protected against financial distress arising out of sickness, disablement, and death due to employment injury.

Key Features and Benefits of ESI

The Employee State Insurance Corporation offers many attractive features and benefits. Some of these are listed below:

- Medical Benefits

- Disability Benefit

- Maternity Benefit

- Sickness Benefit:

- Unemployment Allowance

- Dependent's Benefit

What Are the ESI Contribution Rates?

There are specified rates for ESI contribution paid to the ESI corporation for both employee and employer. From time to time, these rates are revised.

Currently, the ESI contribution to the employer is 3.25% of the wages, and for employees is 0.75% of the wages payable in each wage period(Monthly).

Percentage of Gross Pay | Example Gross Salary | Contributions | |

| Employee Deduction | 0.75% | Rs 15,000 | 15,000 * 0.75% = 112.50 |

| Employer Contribution | 3.25% | Rs 15,000 | 15,000 * 3.25% = 487.50 |

| Total Contributions for this employee | 112.50 + 487.50 = Rs 600.00 |

Employees who earn up to Rs 176 on an average daily basis are exempted from the contribution payment. However, the employer will continue to contribute their share for such employees.

Due Dates for The ESI Payment and Return Filing

Every month, the employer shall pay their contributions and the employee's contribution to the ESIC. The due date for ESI filing contribution is the 15th of the following month.

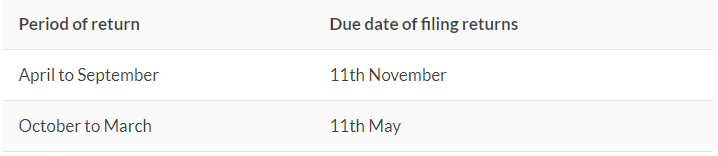

The employer also needs to file an ESI return on a half-yearly basis. Below mentioned are the due dates,

Penalty for Non-payment or Late Payment of ESI Contributions

There will be a simple interest of 12% per annum for each day applied to every employer who fails to make an ESI payment contribution under the ESI Act for each delay on the payment. It may also lead to imprisonment for two years and a fine of up to Rs 5,000.

How is ESI contribution calculated in Deskera People?

With Deskera People, with the below mentioned simple steps you can easily calculate the ESI contribution for both employee and employer.

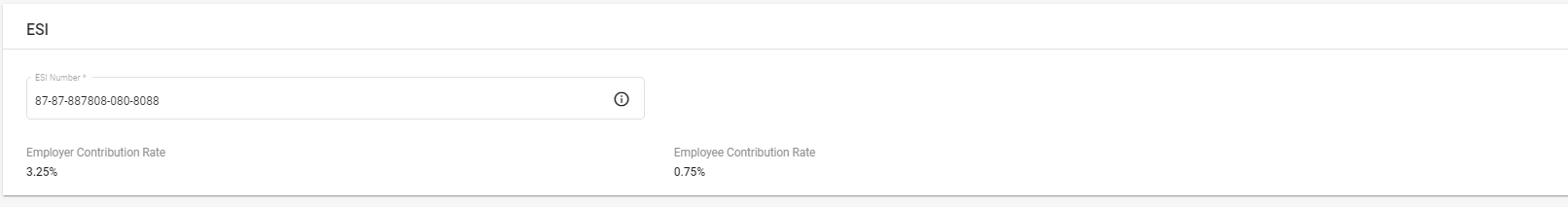

- Under Settings>>click on Tax Details, a screen will appear

- Under the ESI section, you can see the Employer Contribution Rate set at 3.25% and and Employee Contribution Rate set at 0.75%. Also mention your employer ESI number.

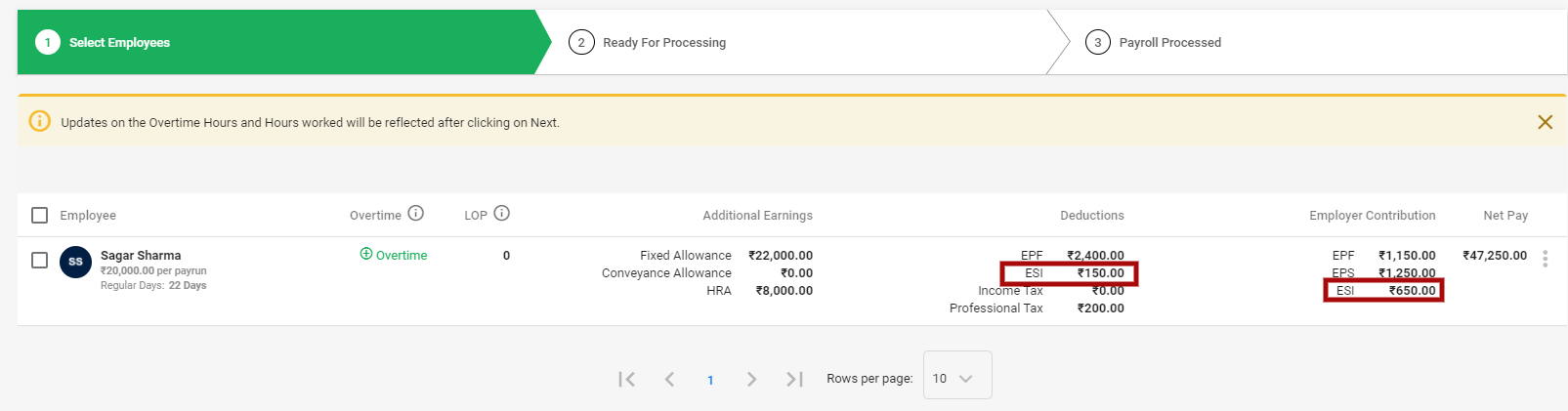

4. As per the ESI rates for employer and employee, implemented in the Deskera People, the ESI calculation is auto calculated once you run the payrun,

Congratulations! you have successfully learned what is ESI? How it is calculated in Deskera People.