HSN stands for the Harmonized System of Nomenclature. It is used for the classification of tracked goods in a systematic way.

On the other hand, SAC stands for Service Accounting Code (SAC), which is use to classify services-related goods.

It's mandatory to indicate your products HSN and SAC codes in order to stay compliant with the GST Rules in India.

Follow the steps below to indicate your product's HSN and SAC in Books+:

- Login to your Books+ account.

- Click on the Product Module on the sidebar menu.

- Next, click on the Add New Product button.

- During product creation, fill in the fields in general info, accounting, inventory and variant tab as per this guide.

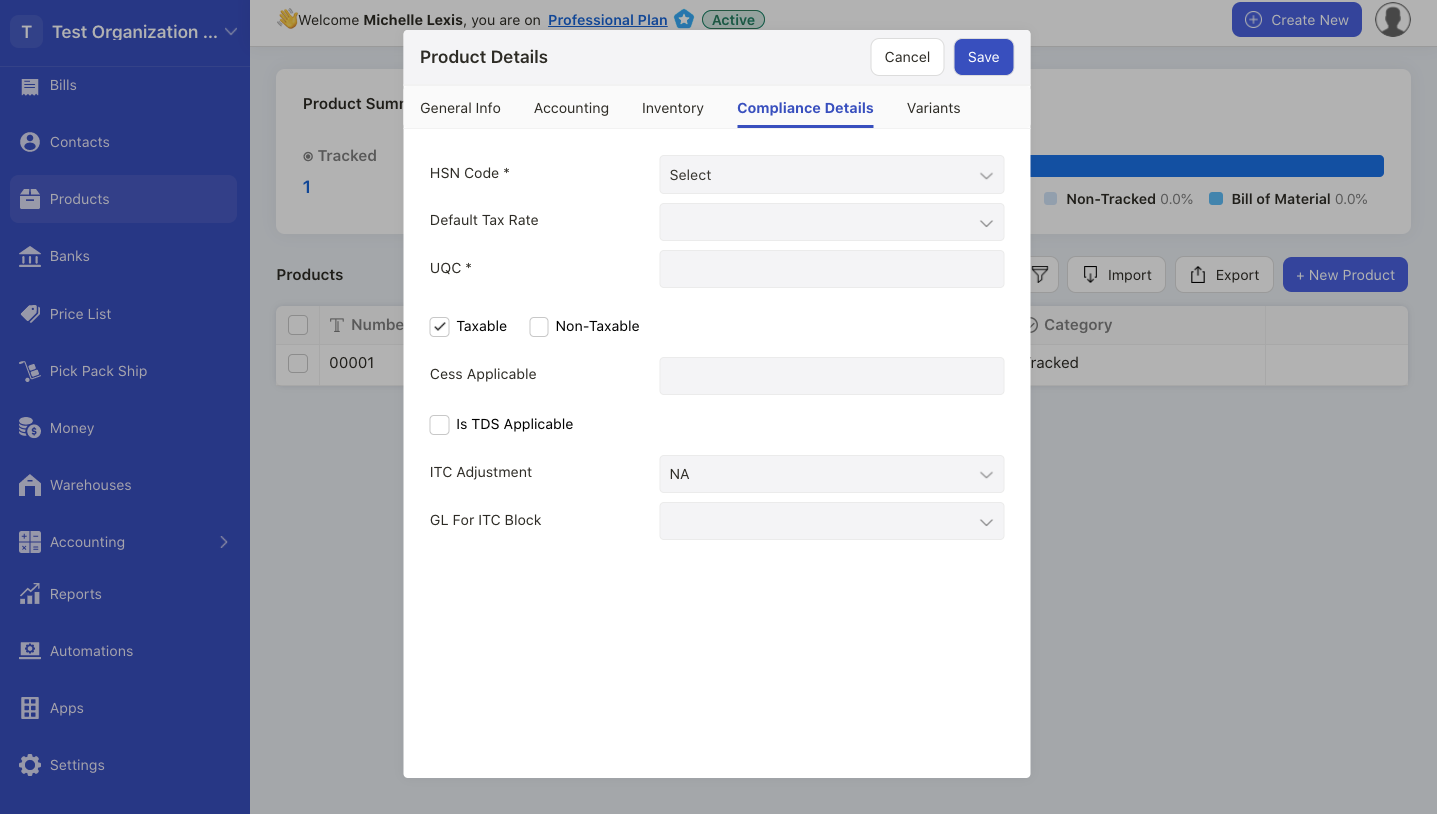

5. To indicate the product HSN and SAC, click on the compliance details tab. On this page, fill in the fields below;

- HSN code; enter the HSN/SAC code here. If you cannot find your HSN/SAC code, click on the Add new HSN/SAC code button.

- default tax rate; choose the product's default tax rate. This is auto-populated based on your tax setting

- UQC; enter the product's Unit Quantity Code (UQC). UQC is a product measurement quantity under the India GST system. Examples of UQC are bag, mtr, pcs, rol, sqm, ton, and etc.

- Taxable or non-taxable; tick the checkbox whether the product is taxable or non-taxable

- cess application; enter the cess amount if required

- TDS applicable; tick the checkbox if TDS is applicable for this product.

- Nature of income; select the nature of income type from the drop-down menu

- ITC adjustment; choose whether ITC reversal or ITC is blocked. Choose N/A if ITC is non-applicable

- GL for ITC blocked; if ITC is blocked, choose the correct account for this posting in journal entry

6. Click on the Save button to save this product in the system.