Goods and Services Tax (GST) is also known as indirect tax or consumption tax in India on the supply of goods and services. It is a comprehensive, multistage, and also known as destination-based tax. The GST in India is comprehensive because it has subsumed almost all the indirect taxes except a few state taxes.

The GST is imposed at every stage of the production process, but all the parties will be refunded in the different stages of production except the end consumer.

There are five different tax slabs for the collection of tax, and they are 0%, 5%, 12%, 18%, and 28%. The individual state government also taxed on items related to petroleum, alcoholic drinks, and even electricity. On top of that, a special rate of 0.25% will be charged on rough precious and semi-precious stones, and 3% will be charged on gold. Also, a cess of 22% or other rates on top of 28% GST applies on products such as aerated drinks, luxury cars, and tobacco.

In case you are unaware, the tax rate of most goods was about 26.5% before the implementation of GST. Post GST, the tax rate of most products have declined to almost around 18%.

To find out more about the four different tiers of tax-rate and how to input the right tax-rate to the right products, click here.

Who is liable to pay GST?

In the GST Regime, businesses whose turnover exceeds Rs. Forty lakhs* (Rs 10 lakhs for North East and hill states) is required to register as a normal taxable person. It's mandatory for some businesses to register for GST irrespective of the turnover and they are:

- E-commerce operators and sellers

- Input service distributors

- Interstate supplier of Goods and Services

- Agents supplying on behalf of a taxable person

- Any entity or individual under the GST Act that is required to deduct tax deducted at source (TDS)

- Any foreign entities running a business in India or individuals registered outside India are liable to pay tax in India due to their business operation in the country.

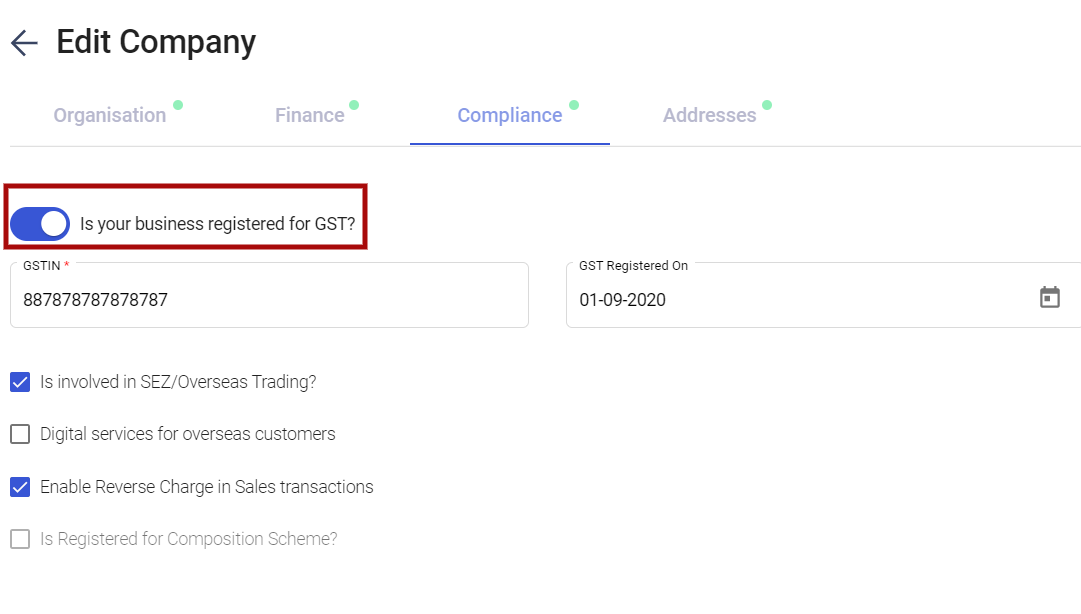

Let say you are not required to register GST when creating an account with Deskera, tick on the checkbox 'No' when prompted with the question 'Is your business registered for GST?'.

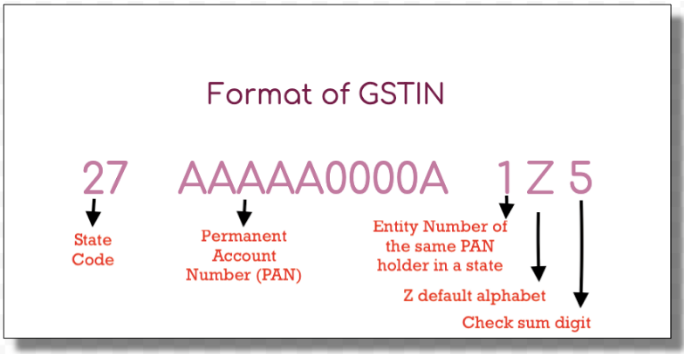

If you are a GST-registered business, you are required to fill in the GSTIN field. Goods and Services Tax Identification Number (GSTIN), is a fifteen digits number that is given in a certificate of registration to an applicant. This number is provided once the application for the grant of GST registration is approved. It is a unique identifier assigned to a business or person registered under the GST Act.

Next, tick the checkbox that is relevant to your company. You can select more than one field that is applicable to your organization. By selecting the right field enables us to compute the accurate Goods and Service Tax that you'll have to pay to the government.

In addition, when creating an account as a GST-registered business, you will have to make sure that you input the accurate information of your business address such as the address line, city, state and zip code as the tax will vary depending on the place of supply.

GSTIN Format

- As per the Indian Census 2011, the first two digits stand for the state code. Every state or Union territory has a special code. For example, 27 stands for Maharashtra, and 09 is for Uttar Pradesh.

- The following ten digits are the PAN number of the taxpayers.

- The number of registrations in a state is indicated on the 13th digit for the same PAN. It is an alphanumeric digit (first 1-9 and then A-Z).

- By default, the 14th digit will be the alphabet 'Z.'

- The last digit of the GSTIN is a check code to detect errors that can be an alphabet or a number.

What does this mean to Deskera users?

When creating an account with Deskera, users will have to fill in the respective address their business is operating and check if their businesses are required to register for GST.

If they have registered for GST, they are required to fill in the 15 digits GSTIN number, the date the GST is registered and the type of scheme applied to them.

All the information filled in the fields has to be accurate.