Understanding the HSN Code

HSN stands for the Harmonized System of Nomenclature. It is used for the classification of goods in a systematic way.

HSN is a 6 digit code developed by the World Customs Organization (WCO) which is accepted worldwide. The purpose of the implementation of the HSN Code/SAC in GST is to make GST more systematic in India and make it globally accepted.

The structure of the HSN code consists of 21 sections, 99 chapters with 1244 headings and 5224 subheadings.

Each section is divided into chapters, each chapter is divided into headings and each heading is divided into subheadings.

The section and chapter stand for the broad categories of goods, whereas the headings and subheadings describe the products’ details.

The criteria for HSN Codes to be declared

Number of Digits of HSN to be declared

- Less than Rs 1.5 crore - 0

- More than Rs 1.5 crore but less than Rs 5 crore - 2

- More than Rs 5 crore - 4

Under the GST Act, in the case of export and import, it’s mandatory to fill in 8 digits of the HSN code.

Every tax invoice issued by the taxpayer will have to indicate the declaration of the HSN code.

What is SAC code?

SAC stands for Service Accounting Code. It is used for the classification of services in a systematic way.

This code is provided for recognition, measurement, and taxation of services. All these services start with a number 99, which makes it easy to differentiate between HSN and SAC.

In India, an 8 digit HSN/SAC code is used instead of a 6 digit code. The first two digits stand for the chapter in which the goods or services are listed in the Code List.

The next two digits are the chapters and the next two digits are for products. The last two digits are further classification of the product.HSN/SAC codes exist for each commodity in more than 200 countries, and the code remains the same for almost all goods.

In some countries, HSN numbers can vary a little because they are entirely based on the nature of the items classified.

HSN/SAC codes are codes that are internationally recognizable. With the help of these codes and a common structure, the government can analyze the purchase and sales of the commodities and can decide on macroeconomic policies for the country.

HSN/SAC codes help to classify the products and mapped them to the right tax codes plus the Cess amount based on the India GST regime.

How does the HSN/SAC apply to Deskera users?

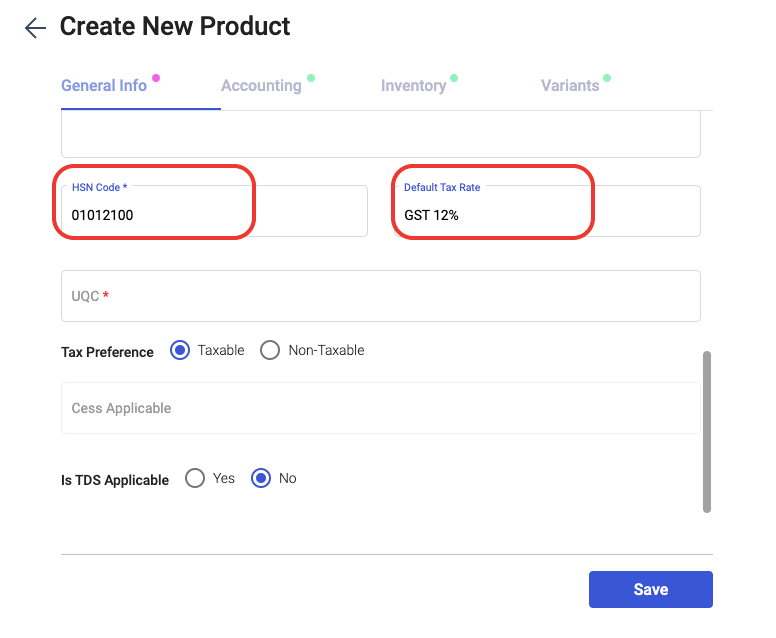

When Deskera users are creating a product, they are required to fill in the HSN/SAC of the particular products.

- Go to the Products on the sidebar menu and click on the 'Item' tab.

- Click on the Add Product at the top right corner of the page and fill in the information of the products.

3. Tag your product as goods if they are tracked-product.

4. For tracked products, you are required to fill in the HSN code.

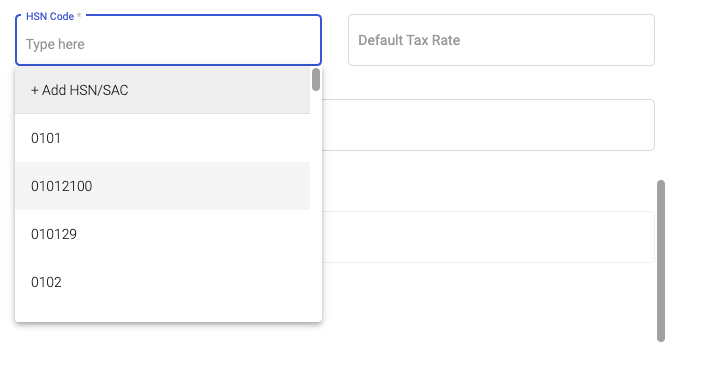

5. Alternatively, if you are providing services to your clients, you can tag the type of product as a service.

6. Users are required to fill in the SAC code instead of HSN for products labeled as service.

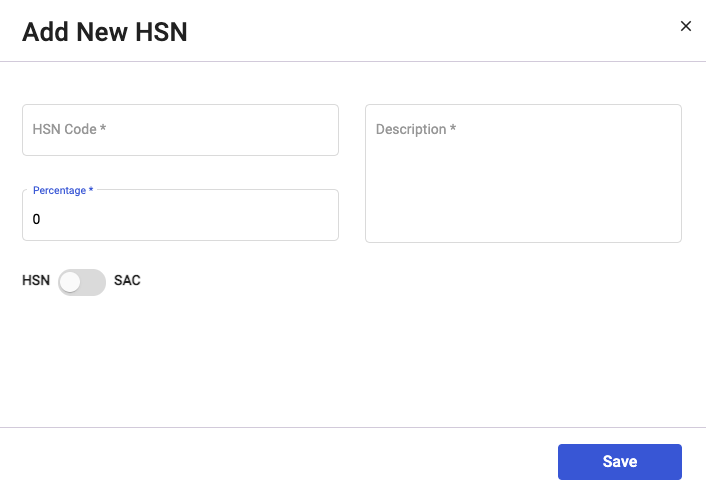

7. If you're unable to find your HSN/SAC in the system, you can always click on the Add HSN/SAC button.

8. Enter the HSN/SAC code here, the percentage and code description.

9. Once done, click on the Save button.

If you are unsure of the HSN/SAC code of the particular products, click here to find out more.