TDS means tax deductible at source, in which the buyer, who is liable to make payment to the seller (deductee), will deduct tax at source and transfer the balance to the deductee.

The TDS amount deducted will then be paid to the Central Government.

How to add TDS rate in Deskera Books?

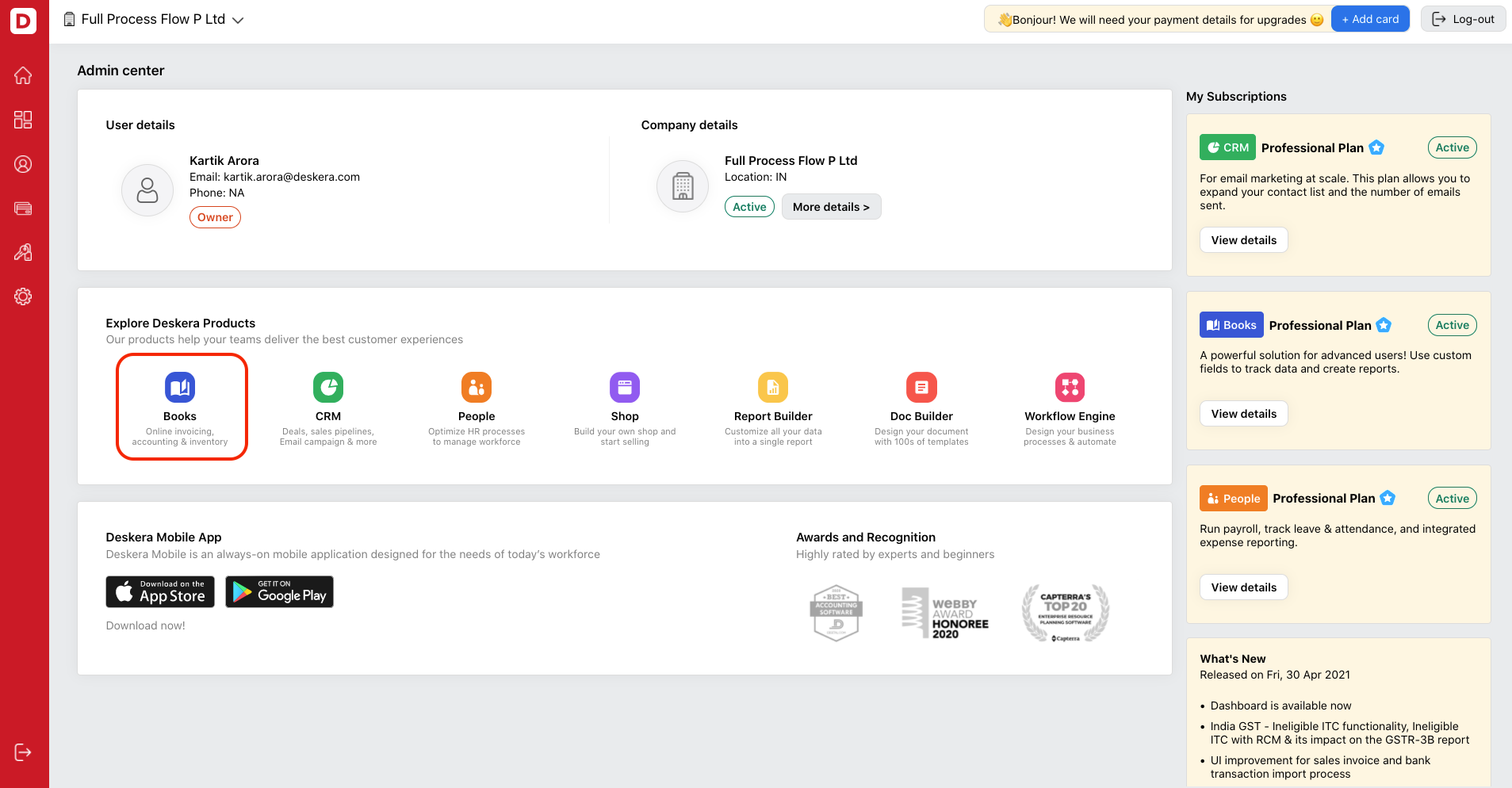

- Login to your Deskera account.

- Click on Books on Deskera Console and the system will direct you to Deskera Books' main dashboard.

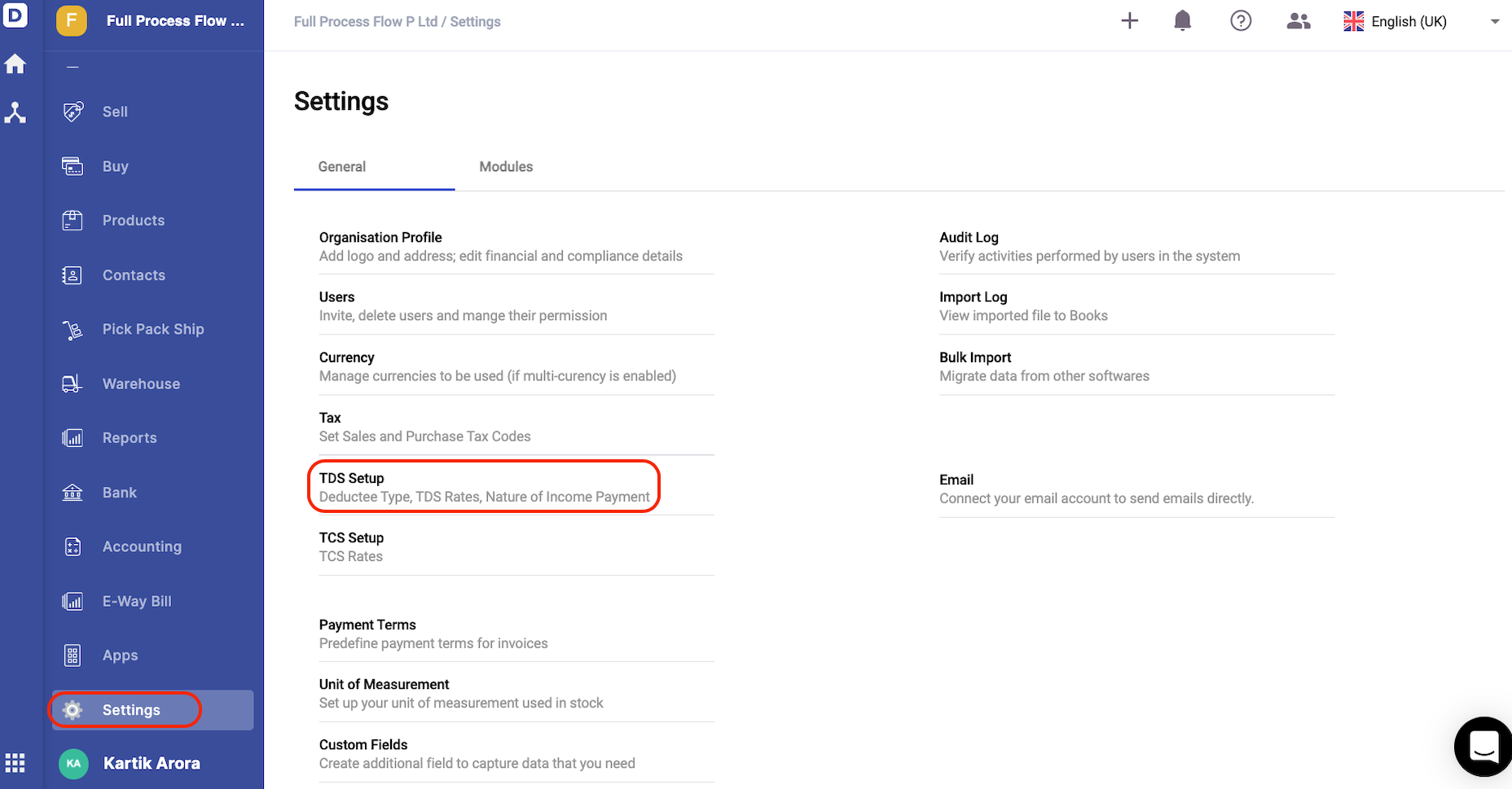

3. Click on Settings via the sidebar menu. Then, select TDS setup option and click on the Add button.

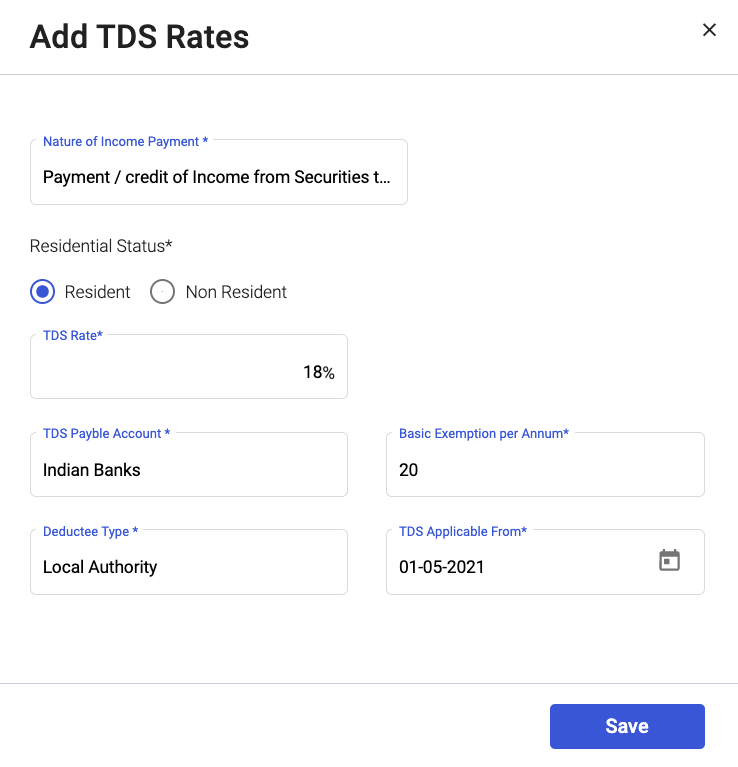

4. A pop-up will appear and you can fill in the fields below:

- Nature of income statement- Choose the nature of income statement. The drop-down options here are reflected from the nature of income statement tab.

- Residential status - Select either resident or non-resident option

- TDS rate- Indicate the TDS rate here

- TDS payable account- Choose the TDS payable account affected

- Basic exemption per annum- The amount of basic exemption per annum

- Deduction type- Choose the deduction type; the drop-down menu options are as per the deductee type screen

- TDS applicable from- Choose the date the TDS is applicable from

5. Once you are done, click on the Save button.

6. You can edit and delete the TDS rate that you have created in the system.

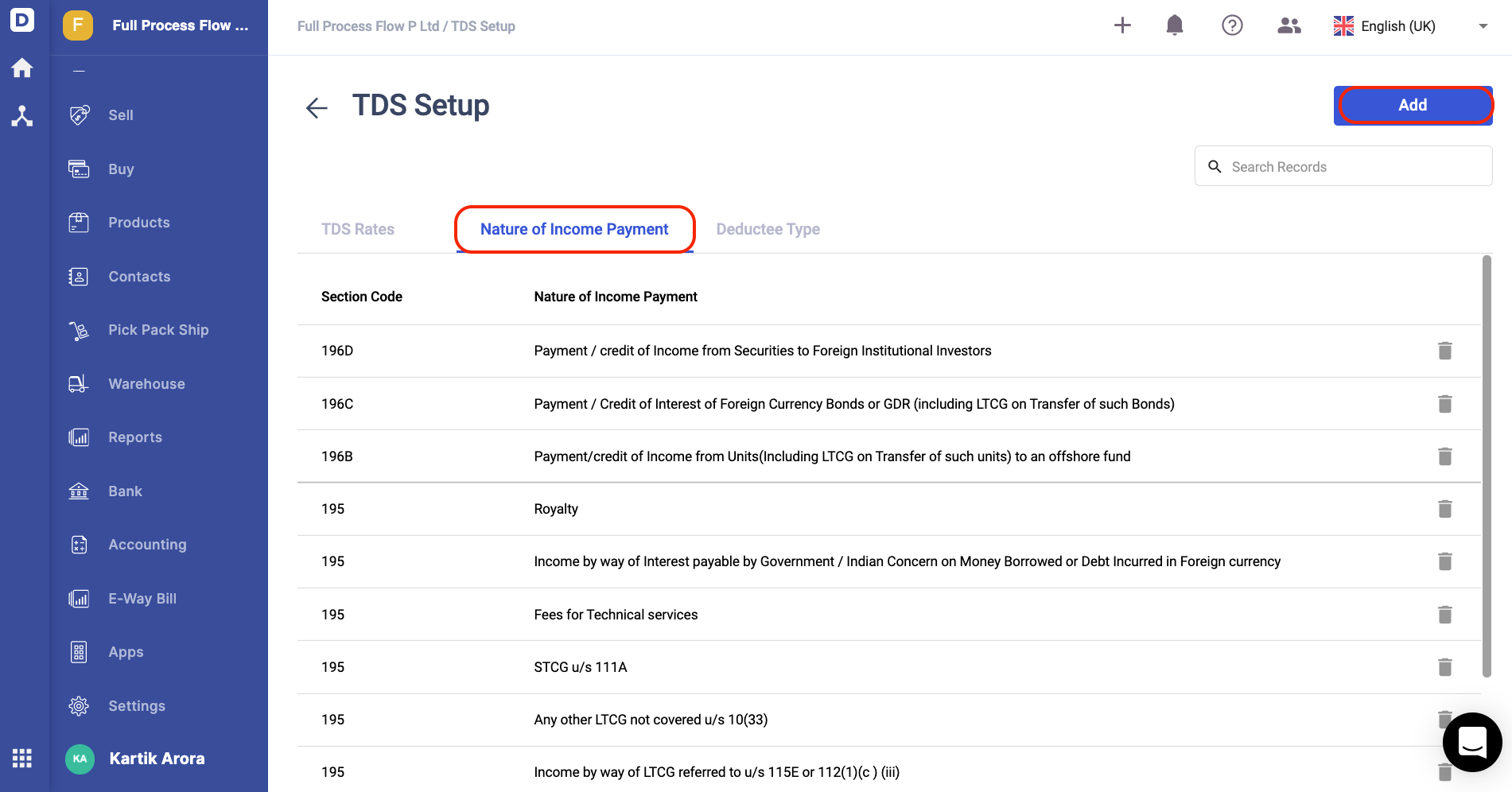

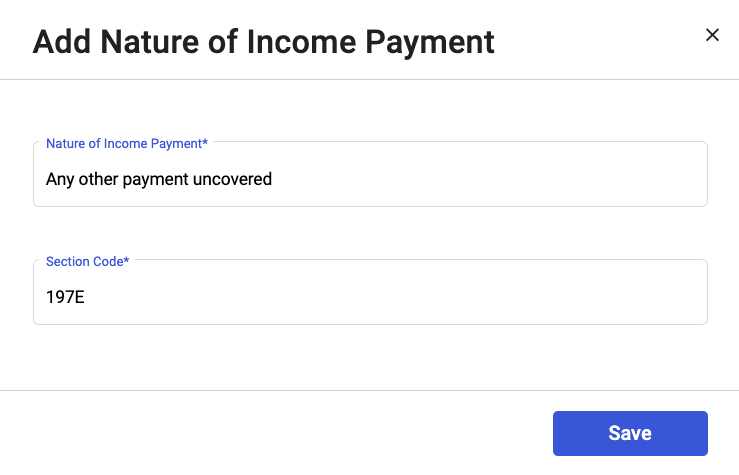

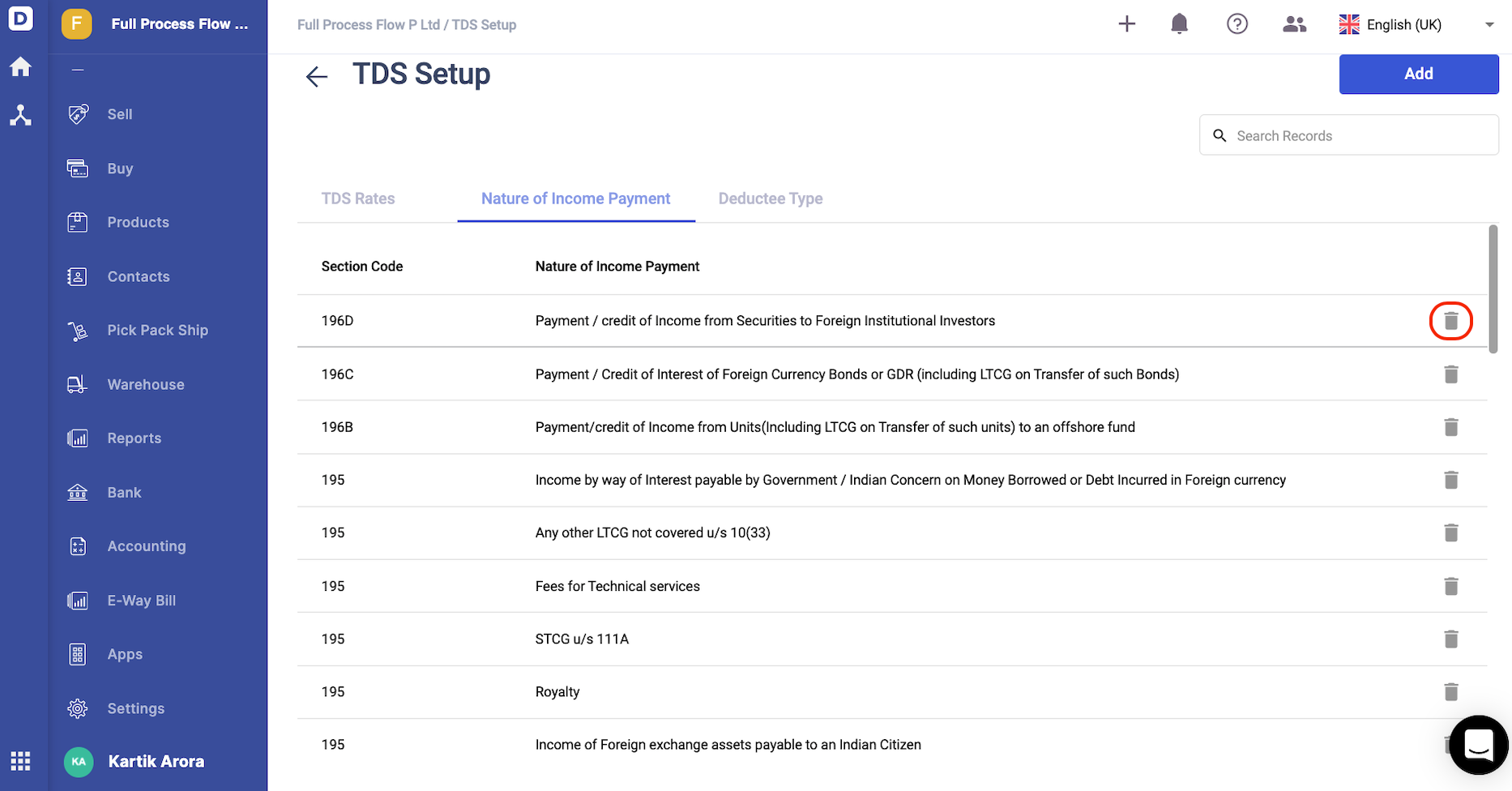

How to add a new nature of income payment?

- On the TDS screen, click on the Nature of Income Payment tab.

- Then, click on the Add button.

3. A pop-up will appear and you will need to fill in the nature of the income payment and the section code.

4. Click Save.

5. You can always delete the nature of income payment, by clicking on the bin icon.

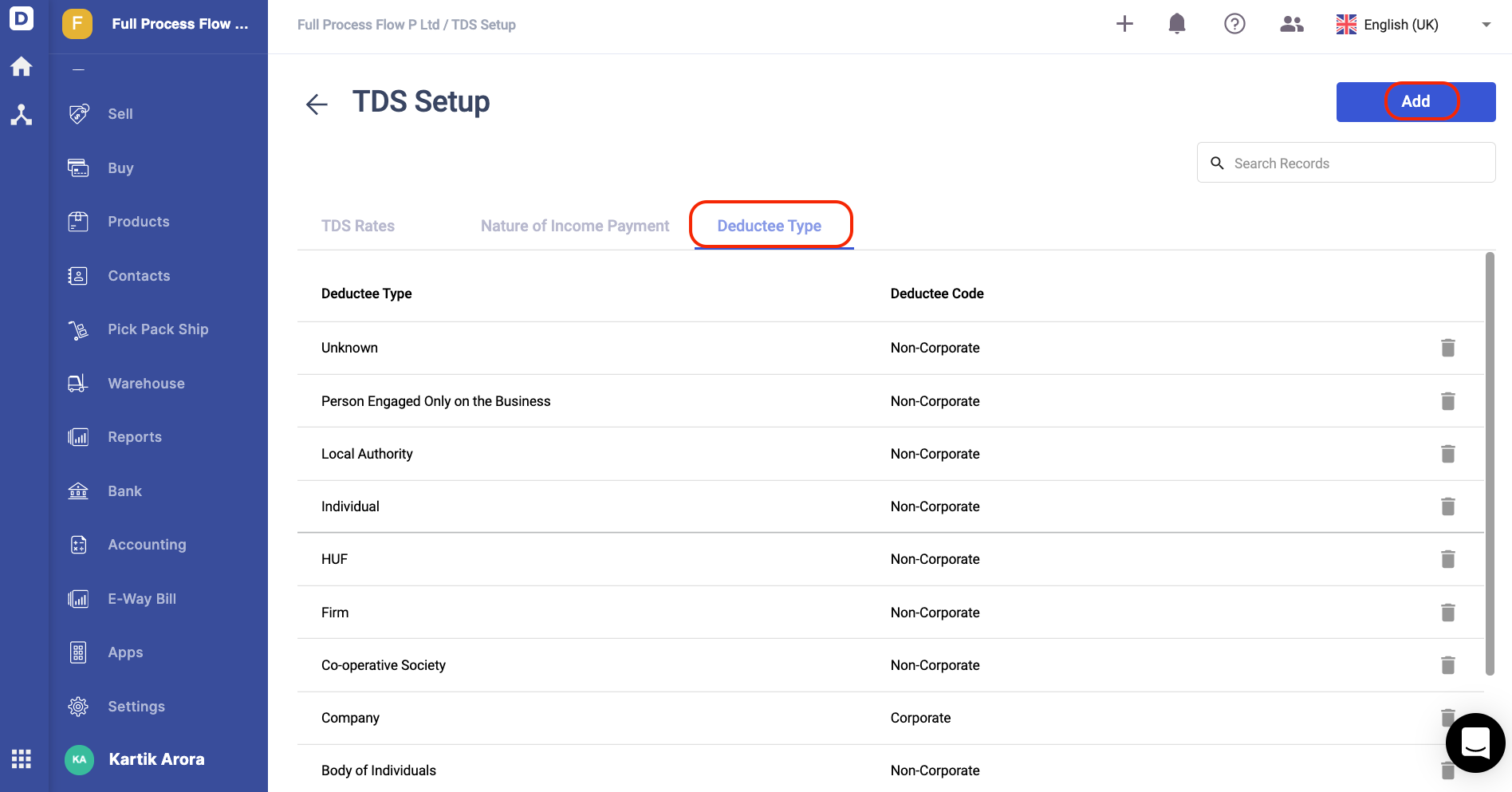

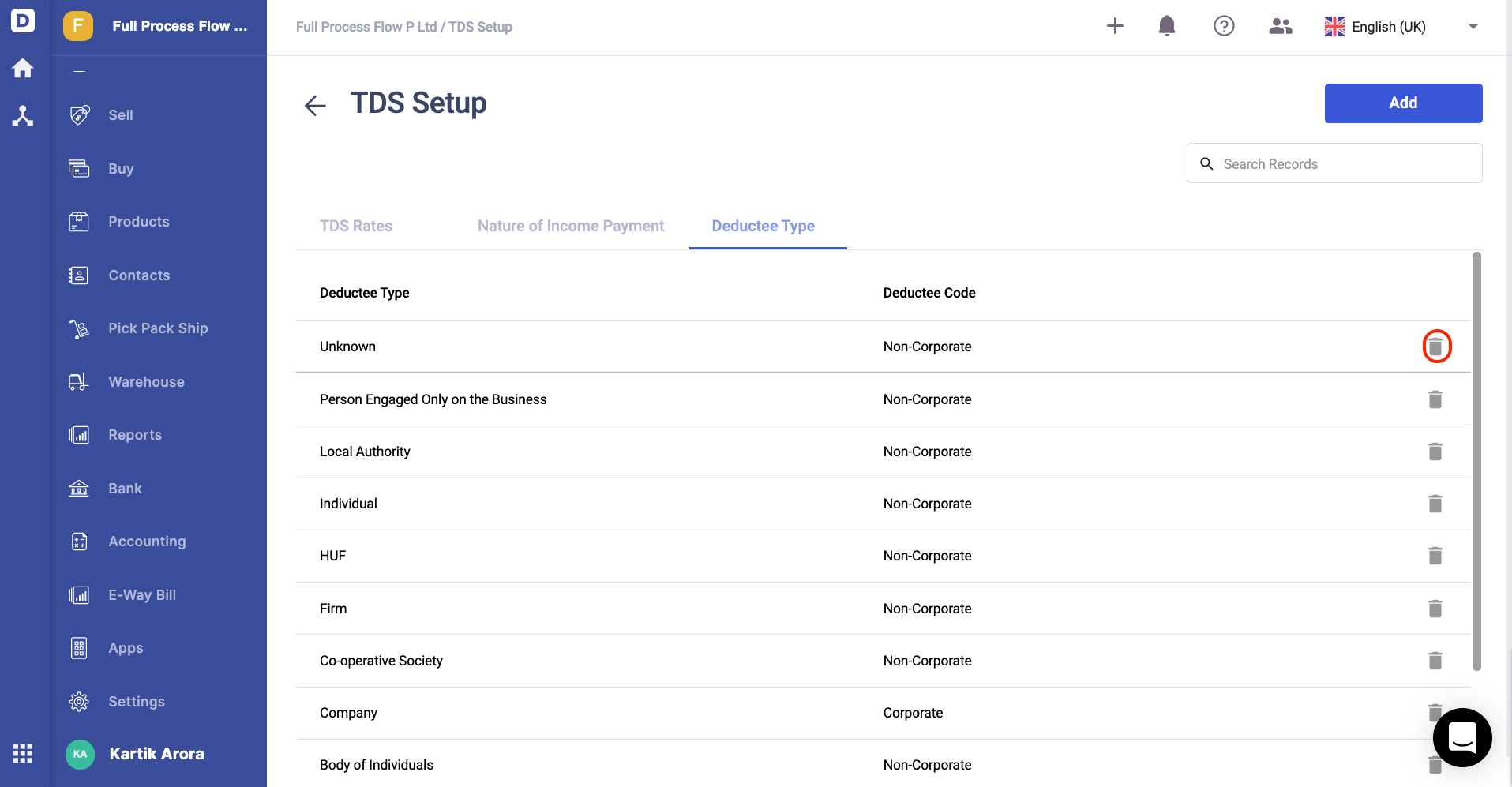

How to add a new deductee type?

- On the TDS screen, click on Deductee Type tab.

- Then, click on the Add button.

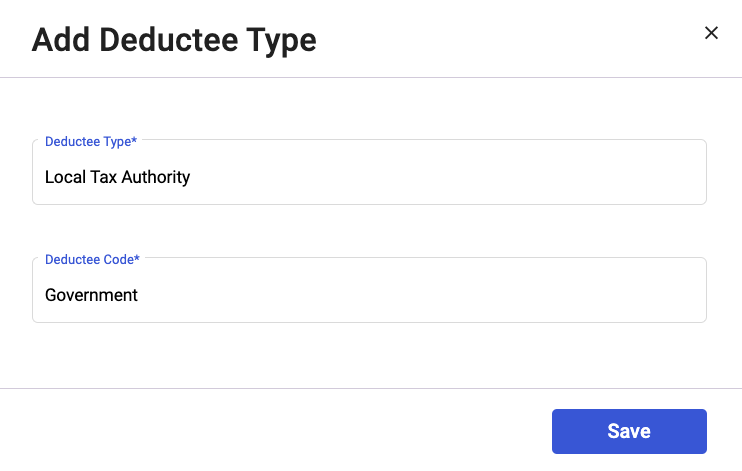

3. A pop-up will appear and you will need to enter the deductee type and the deductee code.

4. Click on the Save button.

5. Click on the bin icon to delete the deductee type.

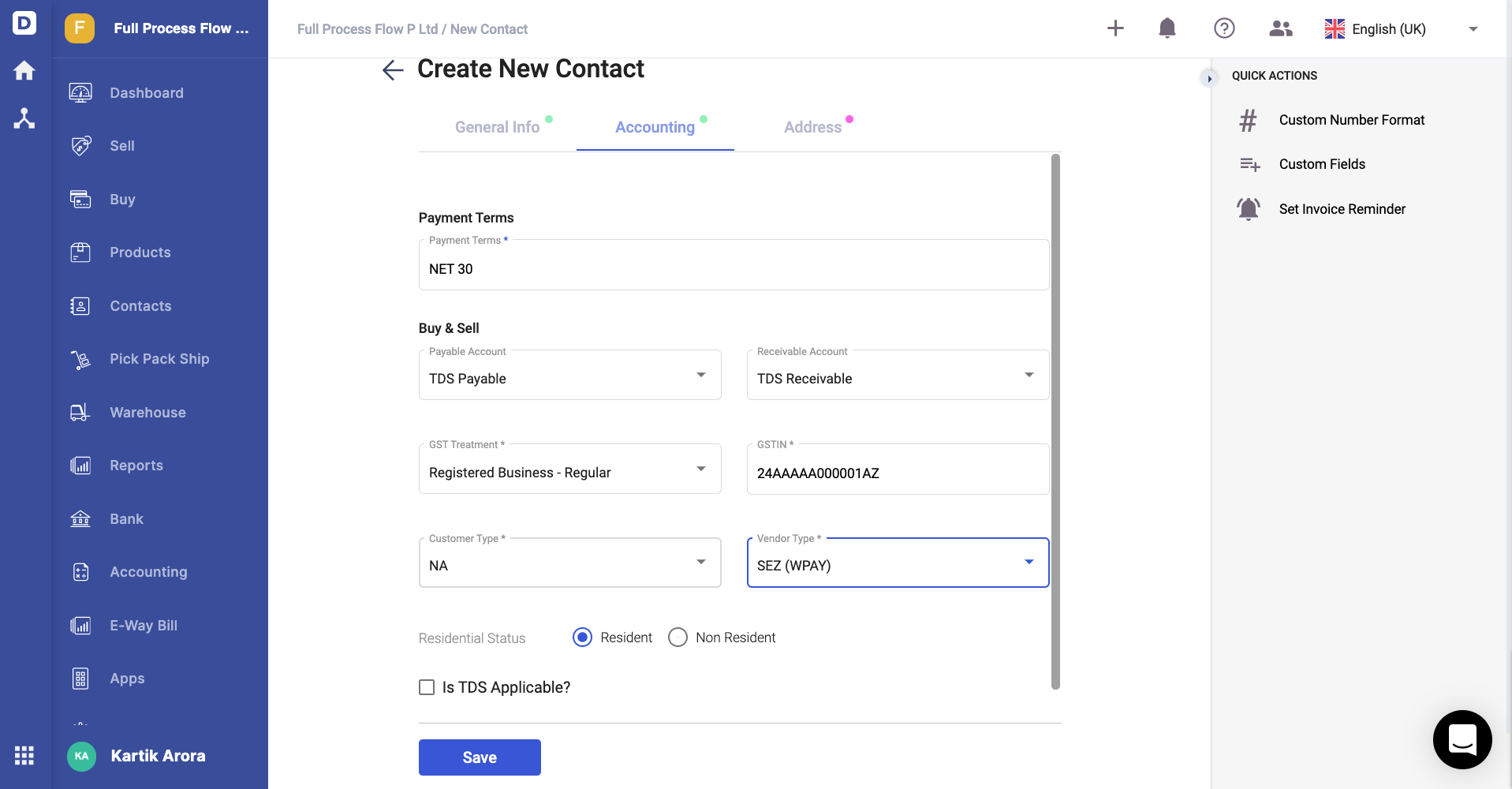

How to apply TDS for a contact?

- Go to the Contact tab.

- Create a new contact.

3. Enable the checkbox if TDS is applicable to you.

4. After enabling the TDS checkbox, you are required to fill in the:

- Vendor's PAN number

- Deductee Type

- Enable exemption limit, and input the TDS higher rate here

- Non-deduction or lower deduction applicable; enter the certificate number and TDS rate after enabling this option, From and to date and state the reason

5. Save the contact details.

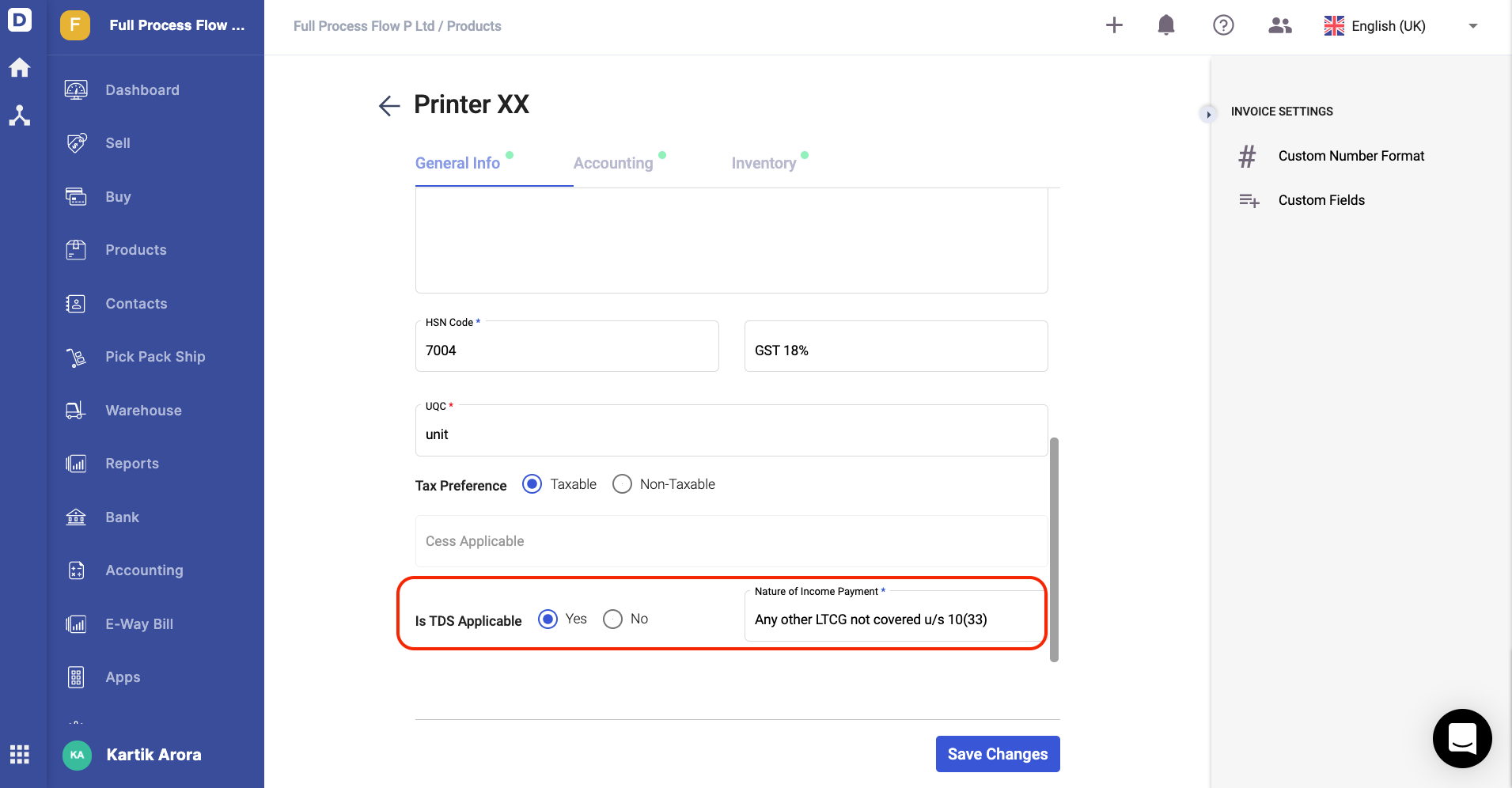

How to apply TDS against a product?

- Go to Product Module.

2. When creating the product, you will come across "Is TDS applicable" option. Choose the Yes option.

3. Once you have enabled the TDS option, choose the nature of income payment.

4. Next, fill in the fields in the product's accounting and inventory tab.

5. Then, click on the save button.

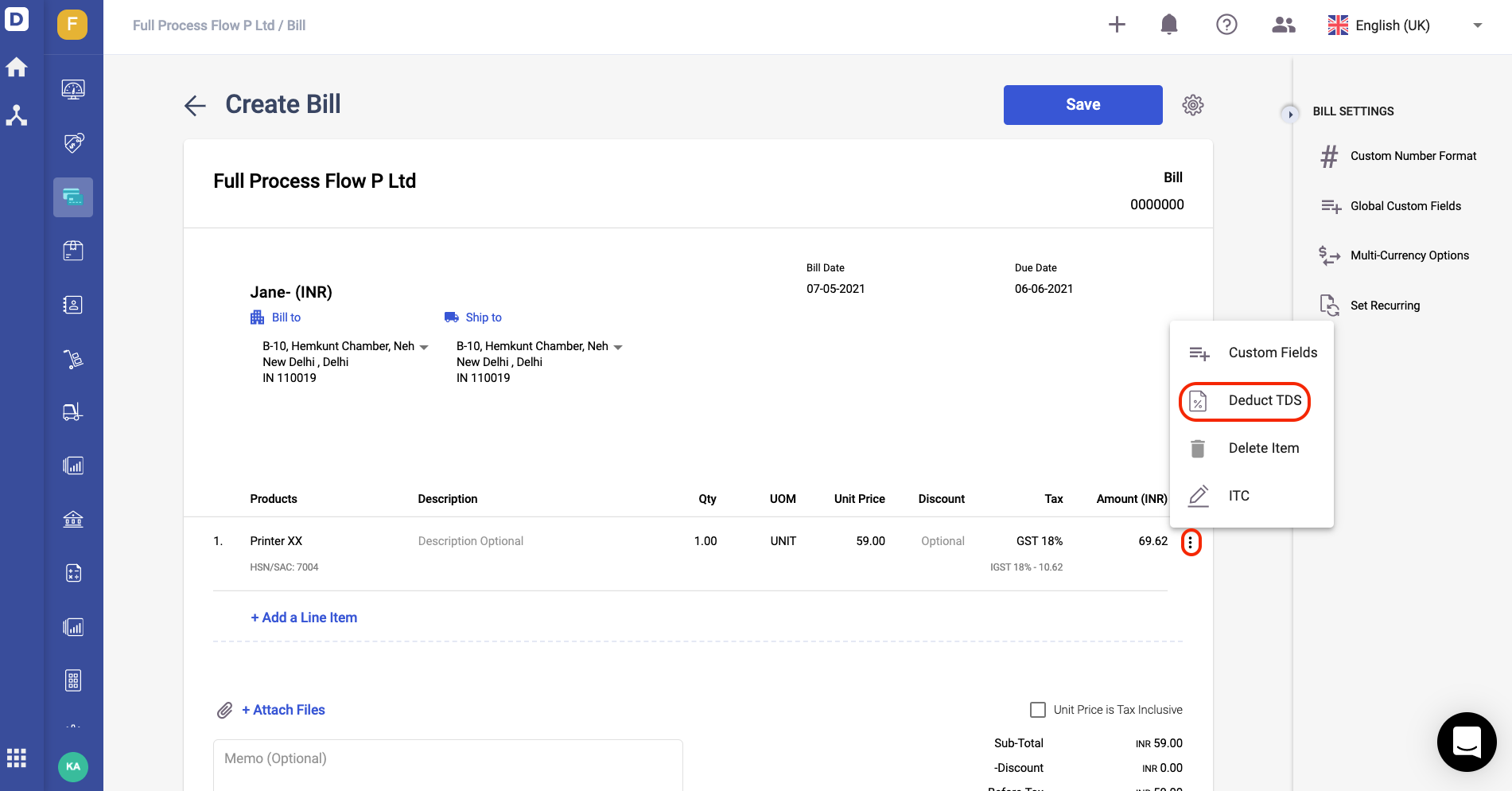

How to apply TDS for a bill document?

- Go to the Buy tab.

- Next, create a bill document.

- Select the contact and product with applied TDS as per the steps above.

4. After you have added the line item, click on the three dots and select deduct TDS button.

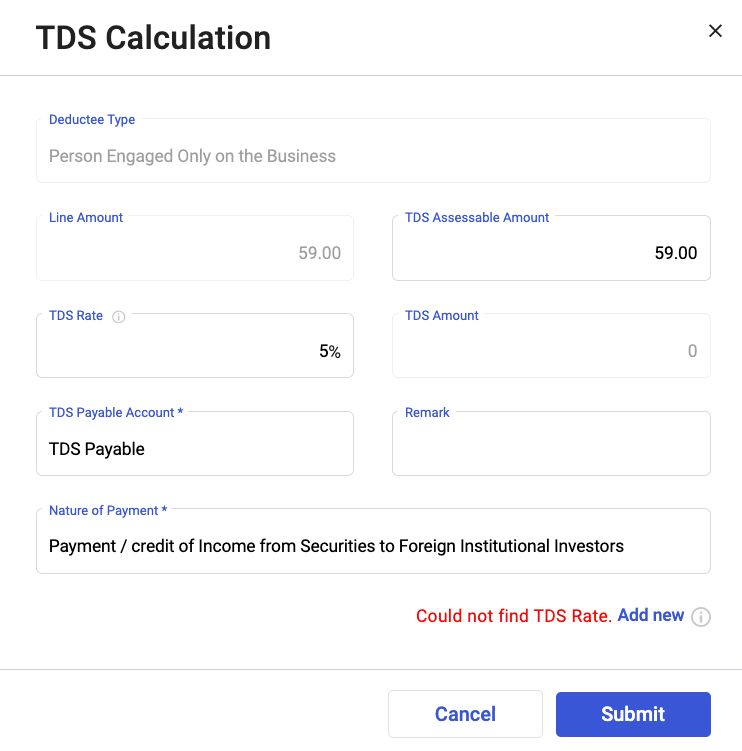

5. A pop-up will appear. Fill in the fields in the pop-up box;

- TDS assessable amount - Enter TDS amount, in which this amount can't be greater than the line amount

- TDS rate- Enter the TDS rate

- TDS amount- This field is auto-populated

- TDS account - Enter the TDS account

- Remark- Enter any notes or short description for this field

- Nature of payment- Choose the nature of payment for this TDS

6. Click on the Submit button.

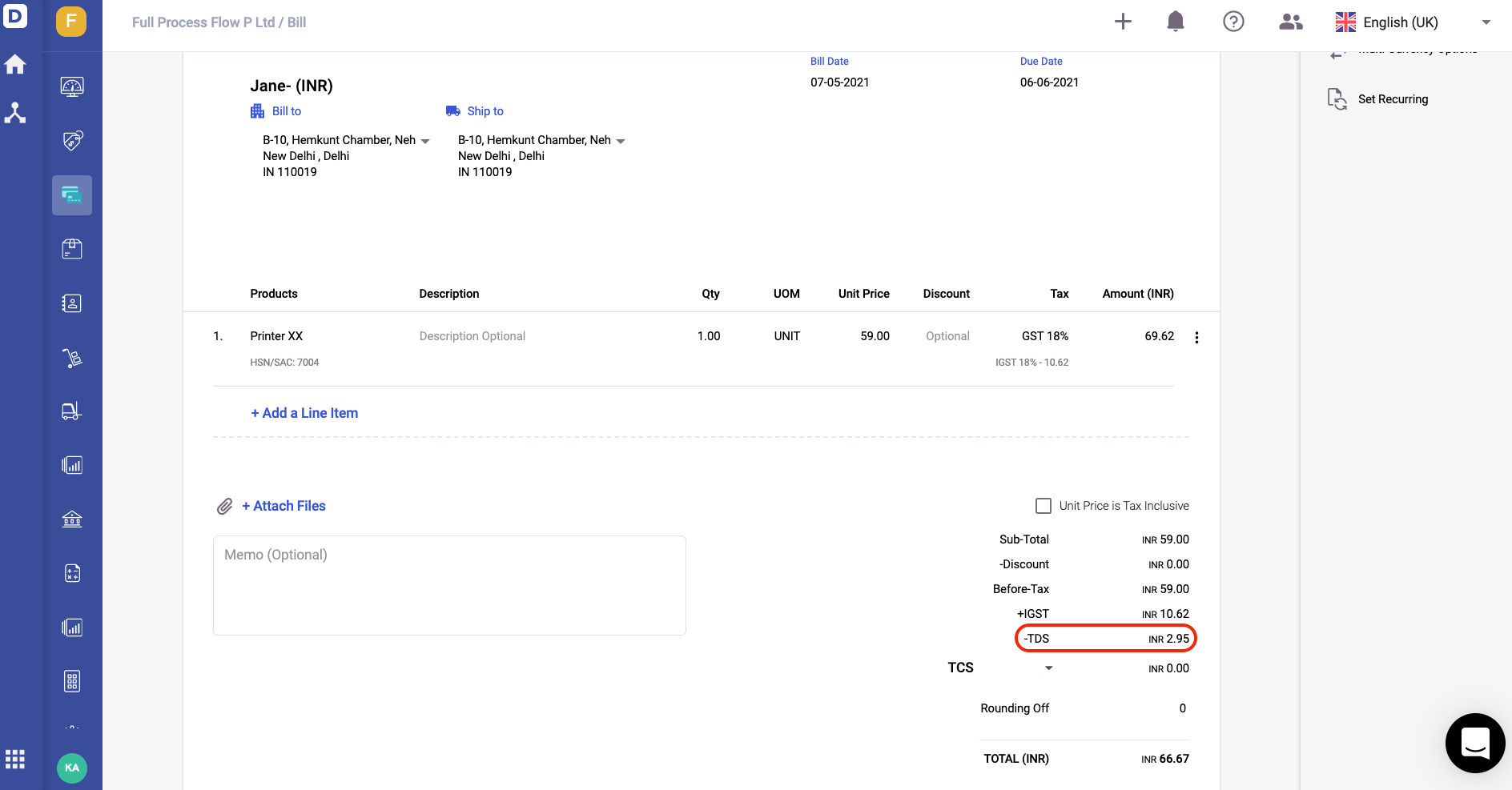

7. Once you have applied the TDS in the bill document, you can view the TDS deduction in the bill document itself.

8. Then, click on the Save Bill button.

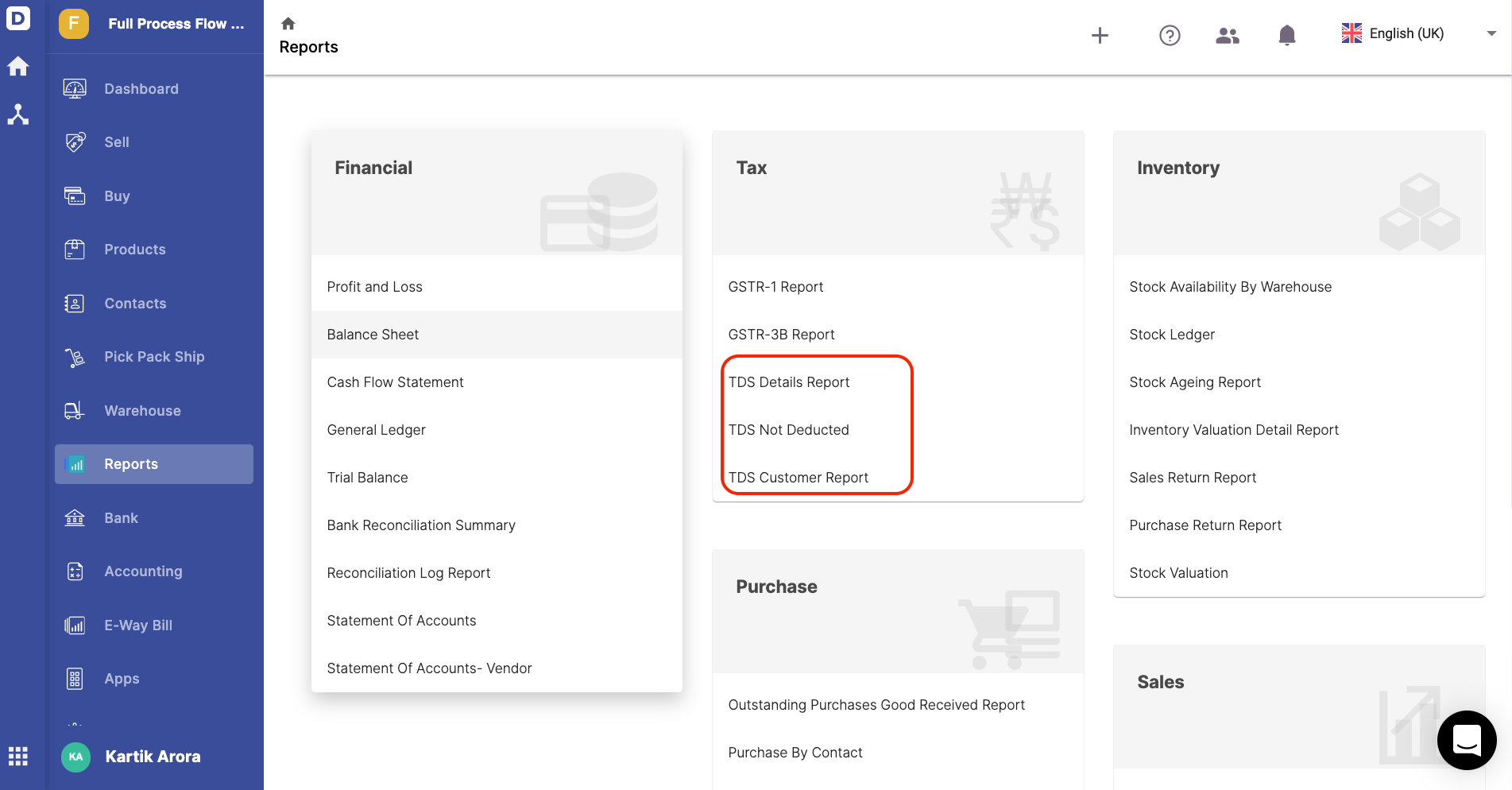

How can I generate the TDS reports?

- Go to Reports section via the sidebar menu.

2. On the report window, you should be able to view the TDS reports such as;

- TDS details report- The summary of all the contacts with TDS applied

- TDS not deducted- The summary of contacts, with TDS not deducted

- TDS customer report- The summary of customer's report with TDS

3. Click on the Export button to download a copy of these reports.

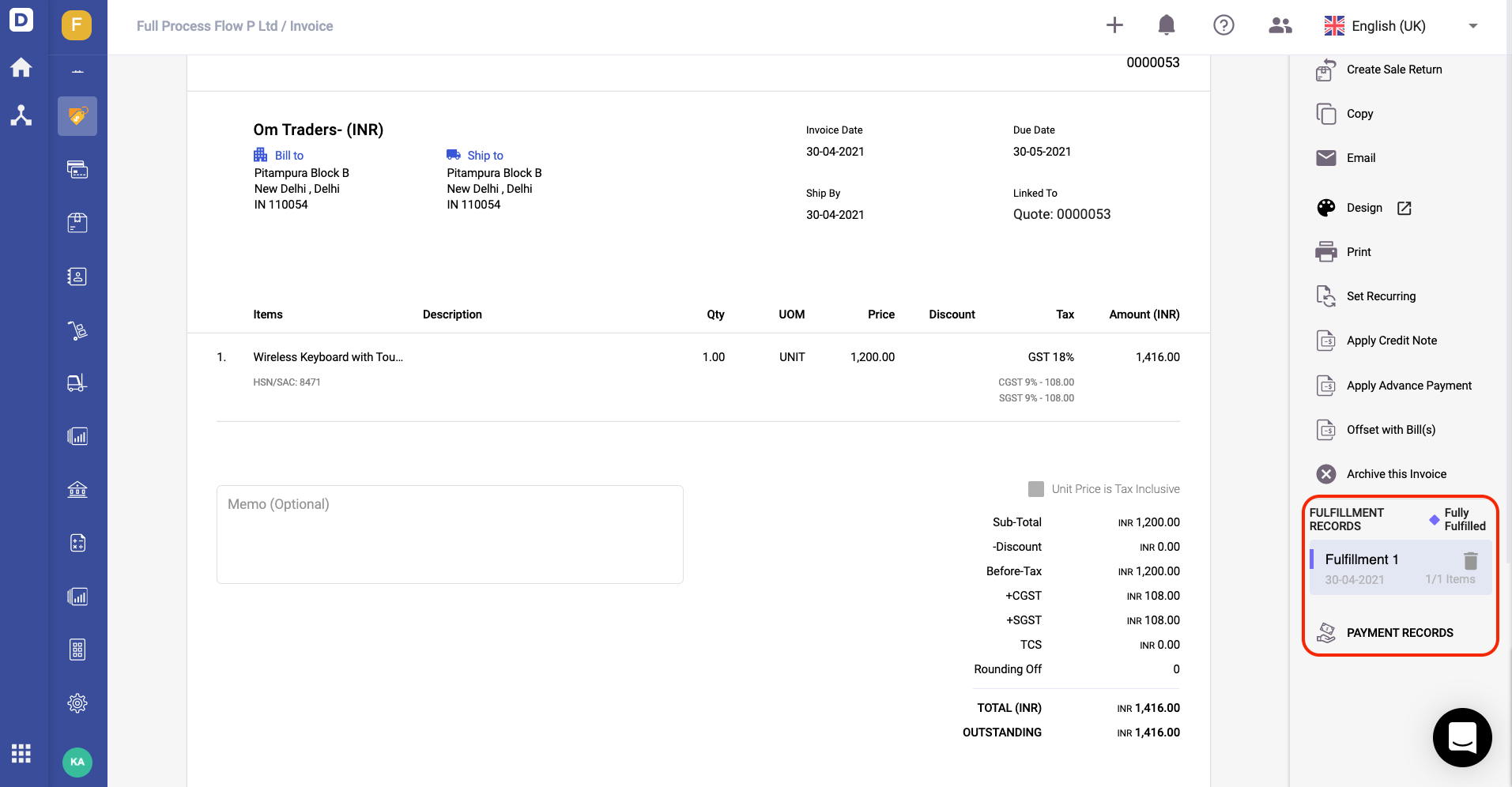

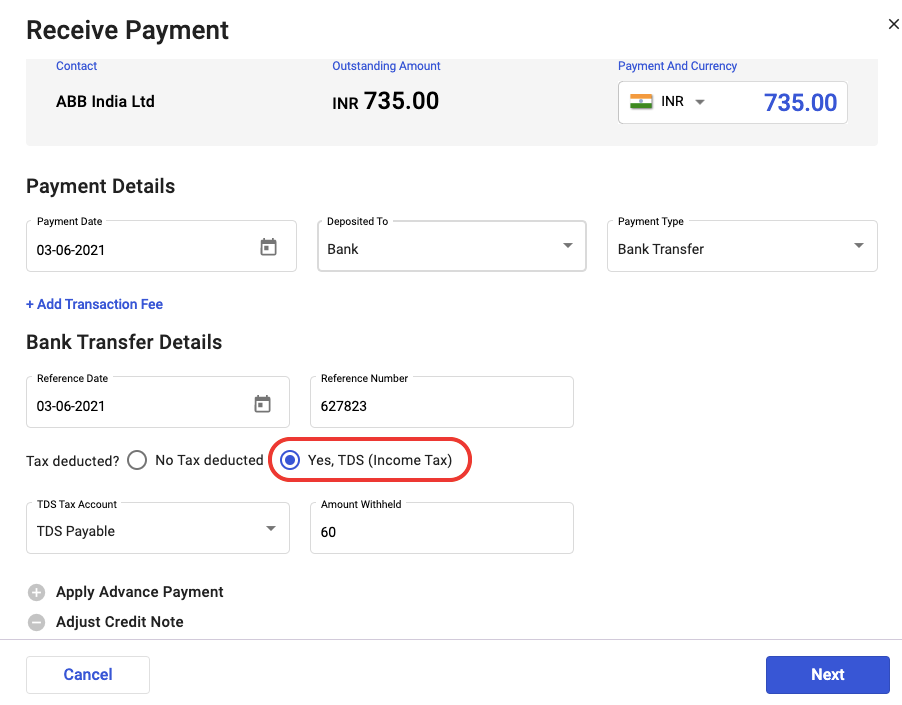

How to apply TDS in an invoice document?

- When receiving a payment for an invoice, you can view the TDS option.

- To apply the TDS for this invoice, enable the Yes TDS (income tax) option.

- Next, indicate the account impacted and the amount withheld.

- Click Next and confirm the payment.