GSTR-1 is a report about the monthly return of outward supplies that shows all the sales transactions of a business.

Who should file for the GSTR-1 Report?

Any normal and registered taxpayer in India is required to file the GSTR-1 Report by every 11th of the following month without fail. It’s mandatory to file a GSTR-1 Report even though there is zero business transaction during the given tax period. You can file the amount as NIL.

Who are not required to file for the GSTR-1 Report?

- Taxpayers who registered for the Composition Scheme

- Non-resident taxable person

- Input Service Distributor

- Tax-Deductible at Source (TDS)

- Tax Collector at Source (TCS)

- Taxpayer Covered under Online Information and Database Access or Retrieval (OIDAR)

Pre-requisites of filing Form GSTR-1

- The receiver taxpayer has to be a registered Normal Dealers and active GSTIN

- The supplier should have valid login credentials such as the User ID and password.

- The supplier should have a valid and non-expired/unrevoked digital signature certificate.

- A valid Aadhar card is required

Where can Deskera Users retrieve the GSTR-1 Report

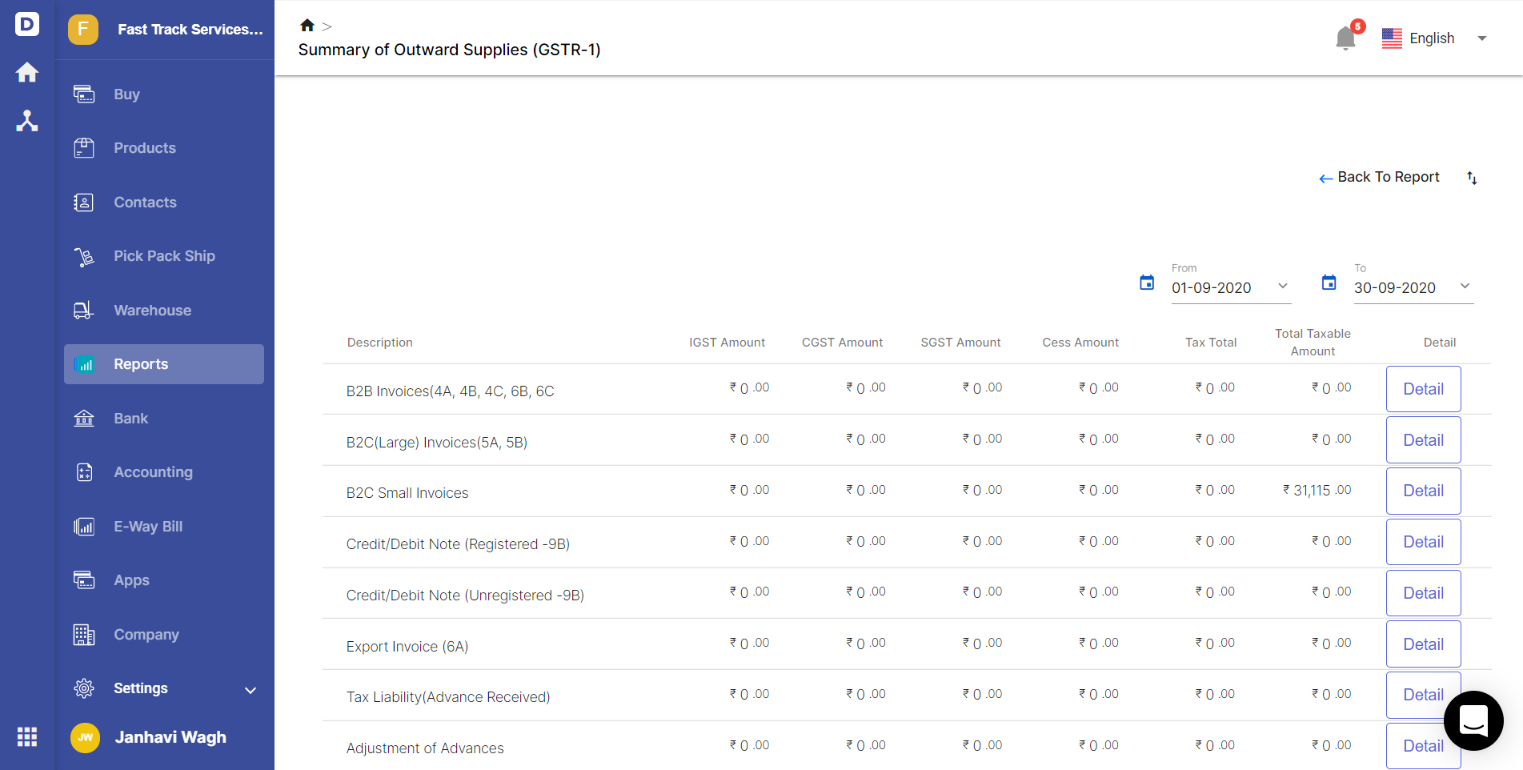

Using Deskera Books, users can now retrieve the GSTR-1 Report summary that is mapped according to the transactions on the Sell tab.

To view the details in the report, users have to click on the Report tab on the sidebar menu. Next, they will have to select the GSTR-1 Report under the Tax category.

The GSTR-1 Report will reflect the details of the following fields with the tax amount being segregated in IGST, SGST, CGST and cess and the amount is auto-populated based on the transactions in Buy and Sell Module.

- B2B Invoices

- B2C Invoices (Small)

- B2C Invoices (Large)

- Credit and Debit Notes (Registered-9B)

- Credit and Debit Notes (Unregistered-9B)

- Export Invoice (6A)

- Tax Liability (Advance Payment)

- Adjustment of Advances

- Nil Rated Invoices - 8A, 8B, 8C, 8D

- HSN Invoices

Export

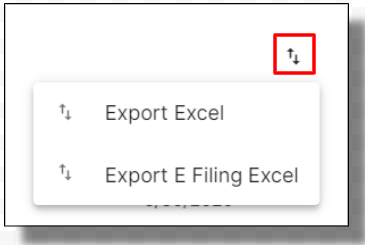

Deskera users can file their GST return via India's GST Portal using the report generated from our system.

You can export the data in either Excel or E Filing excel

You can also generate the report based on the date range you prefer by using the date filter at the top right of the screen.