As a GST-registered business in New Zealand, you must file GST101A and GST103B Report.

Once you have registered for GST, you will need to:

- charge GST to your customers

- file the GST Returns

- remit GST payment owes to Inland Revenue

- keep track of your GST records

What are the filing period for GST101A and GST103B?

Your annual turnover rate will determine your filing frequency.

- Monthly: turnover above NZD 24 million in any 12 months

- Two-monthly: turnover between NZD 500,000 and NZD 24 million in any 12 months

- Six-monthly: turnover below NZD 500,000 in any 12 months

Note: The filing frequency is also known as your taxable period. GST returns have to be submitted to Inland Revenue by the 28th of the month following the end of the reporting period.

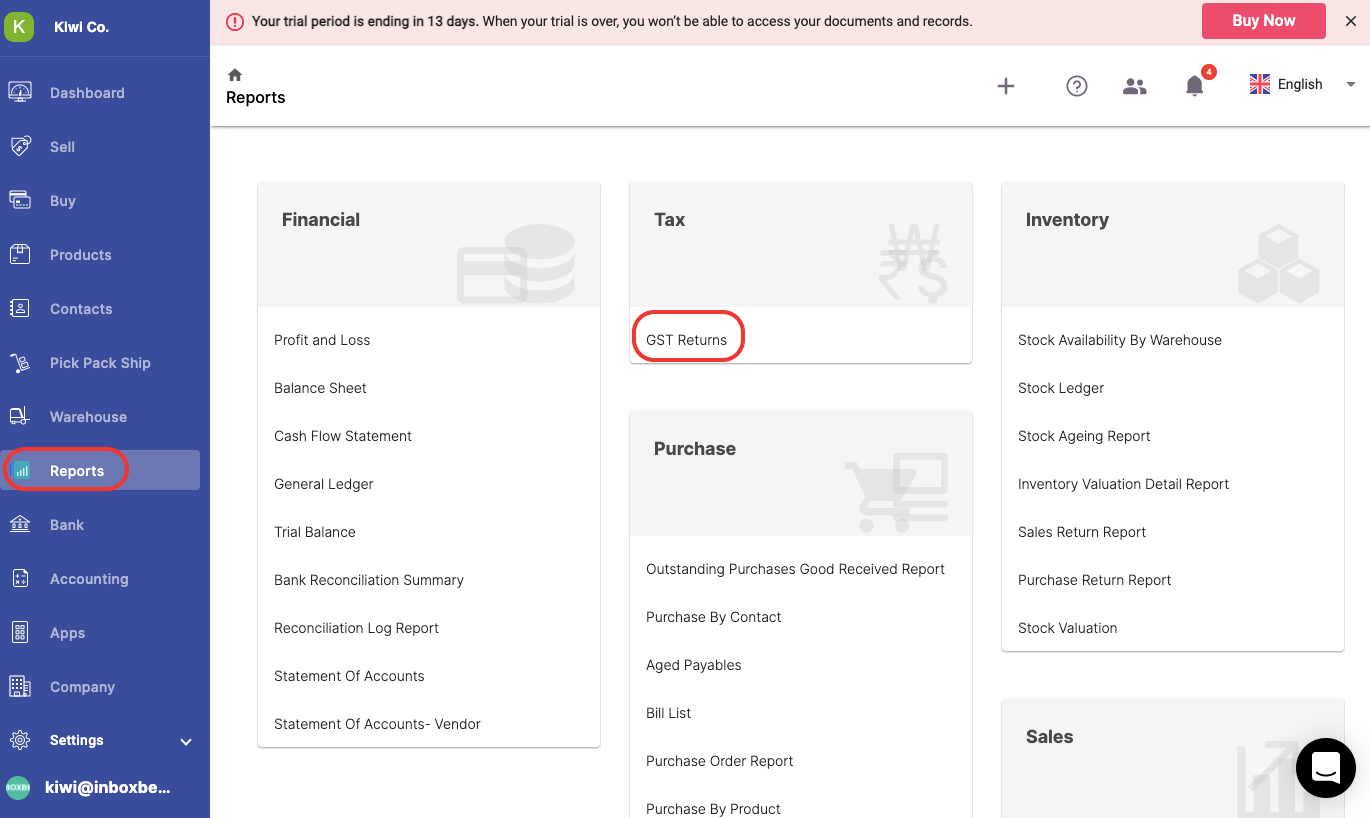

How can I view the GST Return Report?

To view the GST Return Report for New Zealand, follow the steps below:

- Login to your Deskera account

- Click on the Switch To button at the bottom left. Select Deskera Books.

- On Deskera Books' main dashboard, click on the Reports button via the sidebar menu.

4. Click on the GST Returns >> Click on the setting icon at the top right page.

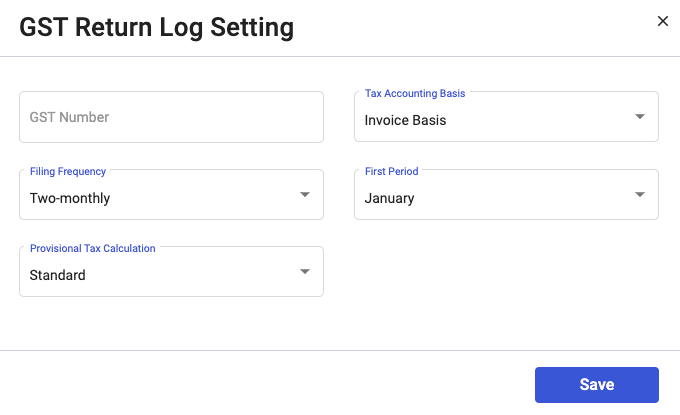

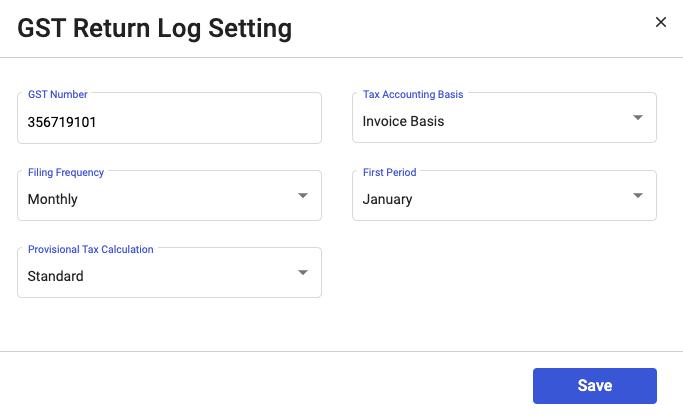

5. A pop-up screen will appear. Fill in the fields GST Return Log Setting:

- GST Number - Your business registered GST number

- Tax Accounting Basis - Choose from the default option; Invoice Basis

- Filing Frequency - Choose your filing frequency; Monthly, Two-monthly, or Six-monthly

- First Period - Choose the first period of filing the report; January, February, March, April, May, June, July, August, September, October, November, or December

- Provisional Tax Calculation - Choose from the options available for the computation; Standard, Estimate, or Ratio

6. Click on the Save button.

How can I generate the GST101A and GST103B Report?

To generate the GST101A and GST103B Report, follow the steps here:

- On the GST Log main screen, click on the Create button.

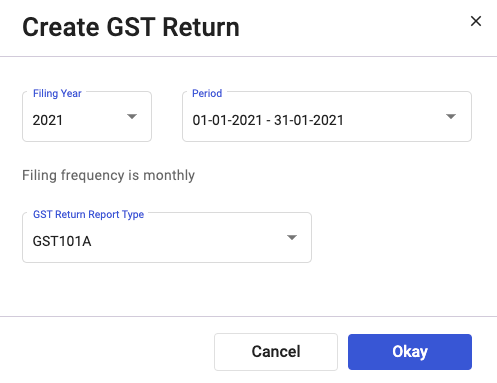

- A pop-up screen will appear. You can view the following fields below:

- Filing Year - Change the filing year by clicking on the drop-down arrow

- Period - The reporting period will be populated based on filing frequency saved in the setting screen

- GST Return Report Type - Choose the report type; GST101A or GST103B

3. Click on the Okay button.

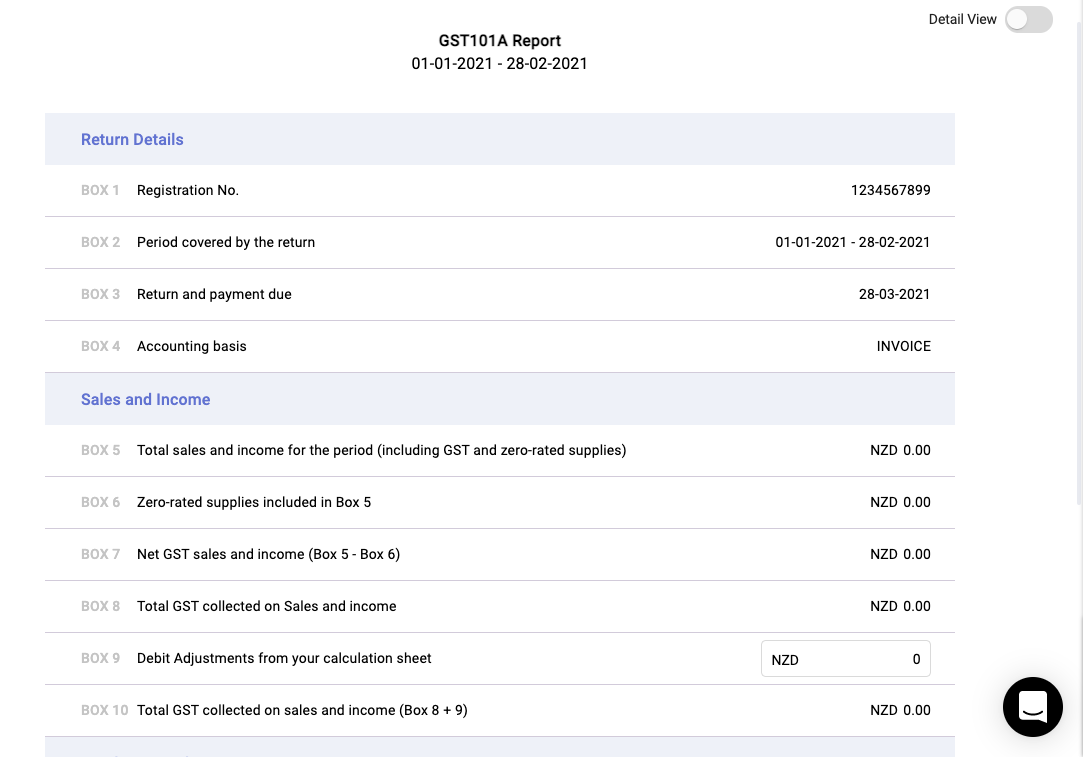

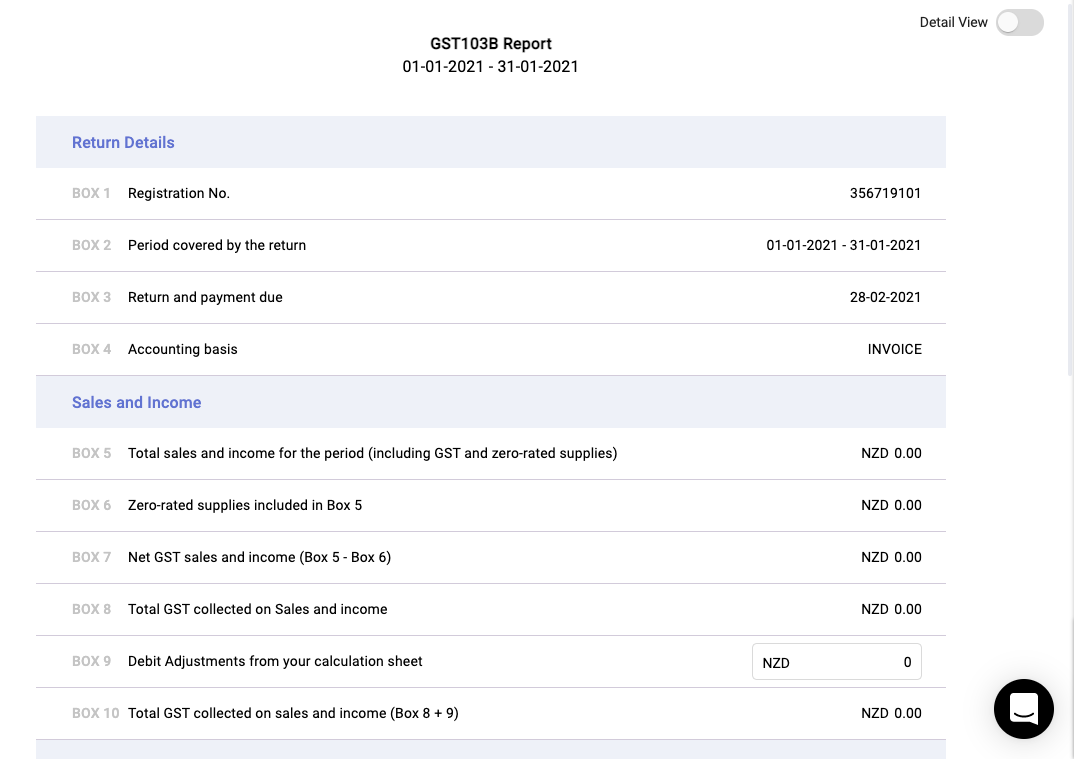

4. This will populate the GST101A Report as per the filing period saved. If you choose GST103B Report as your report type, this report will be created.

a) GST101A Report

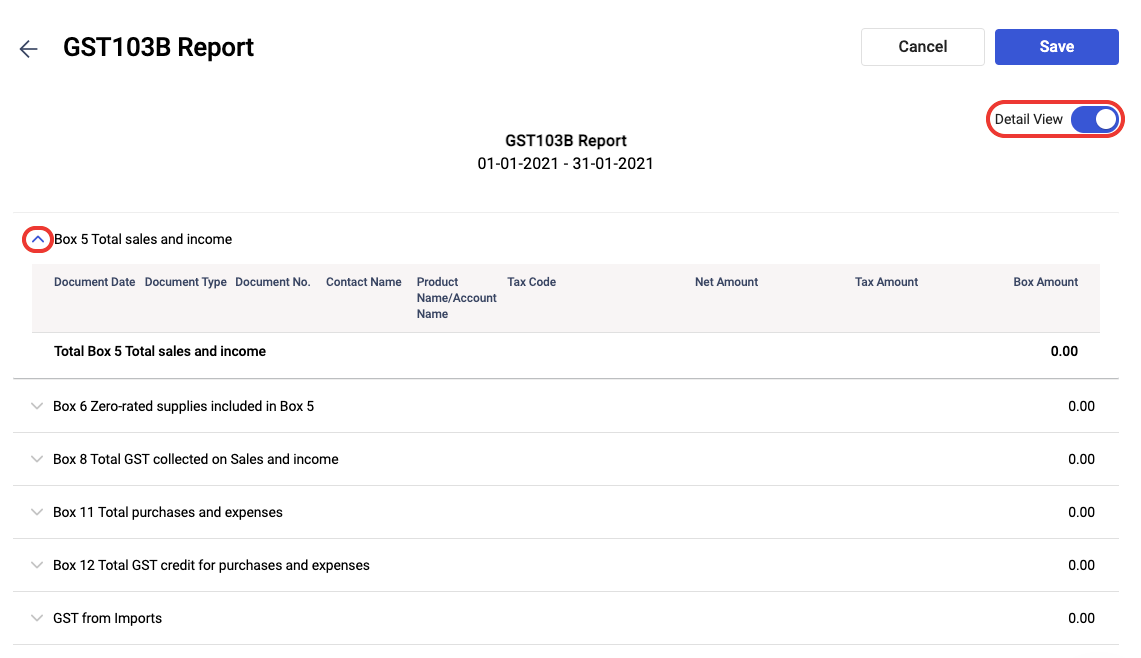

b) GST103B Report

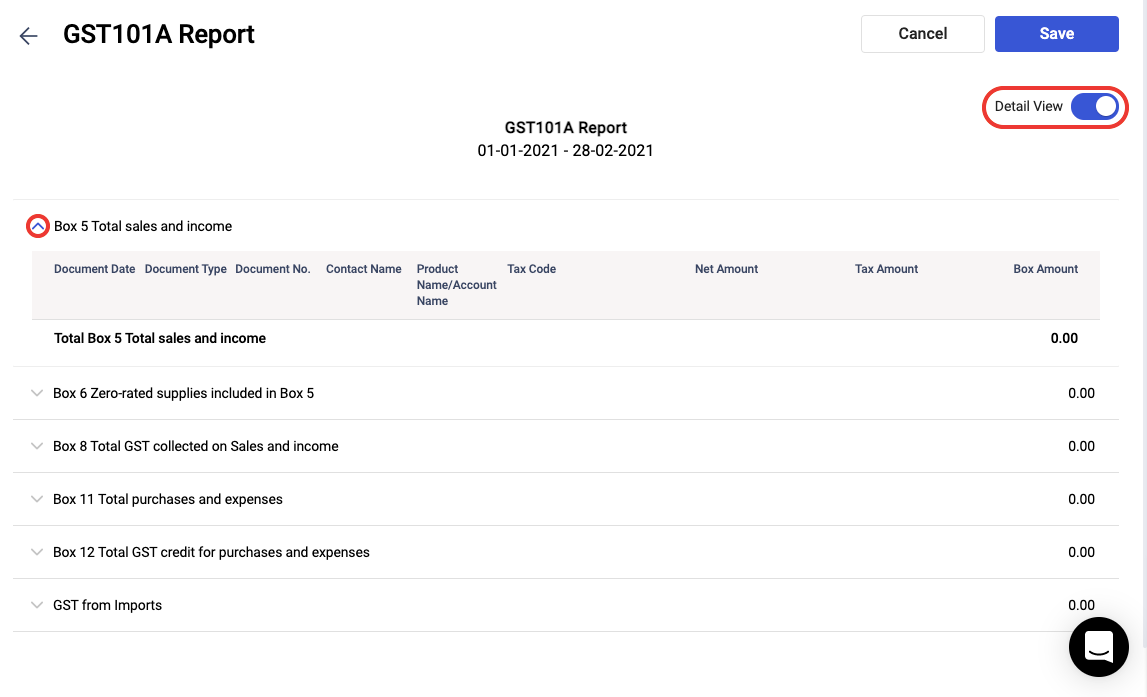

5. Enable the toggle to expand the record view for Box 5, Box 6, Box 8, Box 11, Box 12, and GST from Imports.

6. Click on the Save button after verifying all the information.

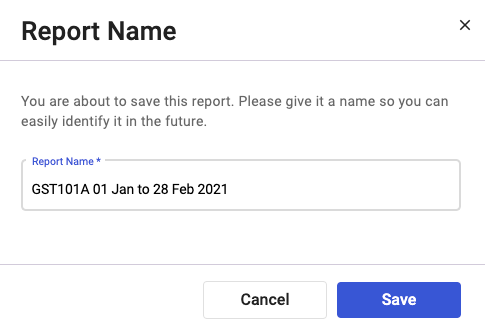

7. Next, edit the report name instead of using the default name populated >> Click Save.

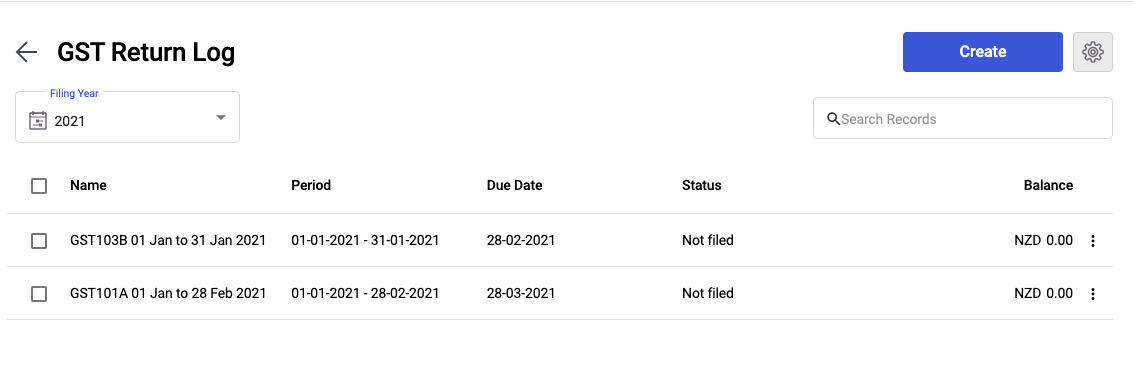

8. After generating the GST101A and GST103B Report, you can view these reports on the GST Return Log page.

How can I edit the GST101A and GST103B Report?

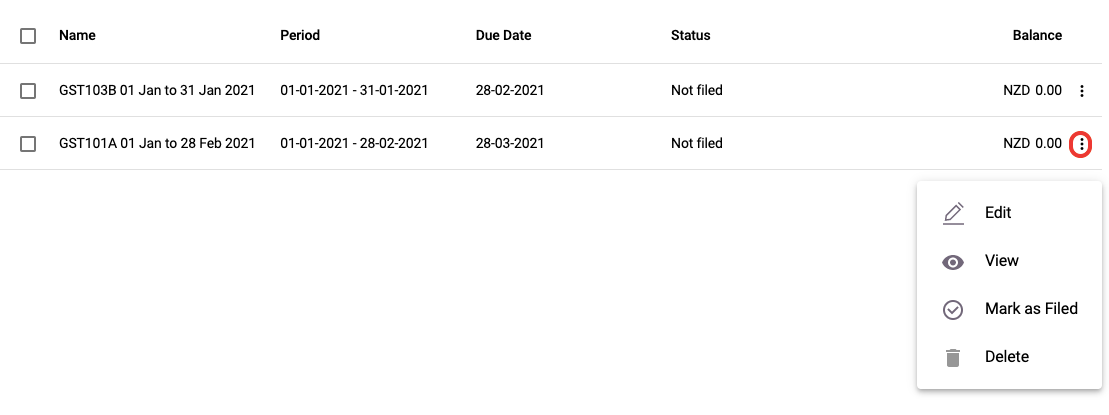

To edit the GST101A and GST103B, click on the three dots of the reports created:

To edit the GST101A and GST103B, click on the three dots of the report created:

- Edit - Click on the edit button to edit the figure in Box 9 and Box 12

- View - View the report to verify the information before filing the report

- Mark as Filed - Once you have filed the report, mark it as filed. You cannot edit the report that you have filed. You can always change the status of the file report to not filed, and vice versa

- Delete - You can only delete the report you have not filed

Congratulations! You have successfully generate the GST101A and GST103B Reports.