What is GST Form 5?

GST Form 5 is a document containing the taxpayer's income tax details required to file to the tax authorities.

Business owners have to file GST returns, including sales, purchases, GST on sales, and GST paid on purchases.

It's compulsory to file a GST Return form under GST regulations.

It will lead to a fine of $5000 or imprisonment of six months if business owners fail to do so.

Steps to complete GST Form 5

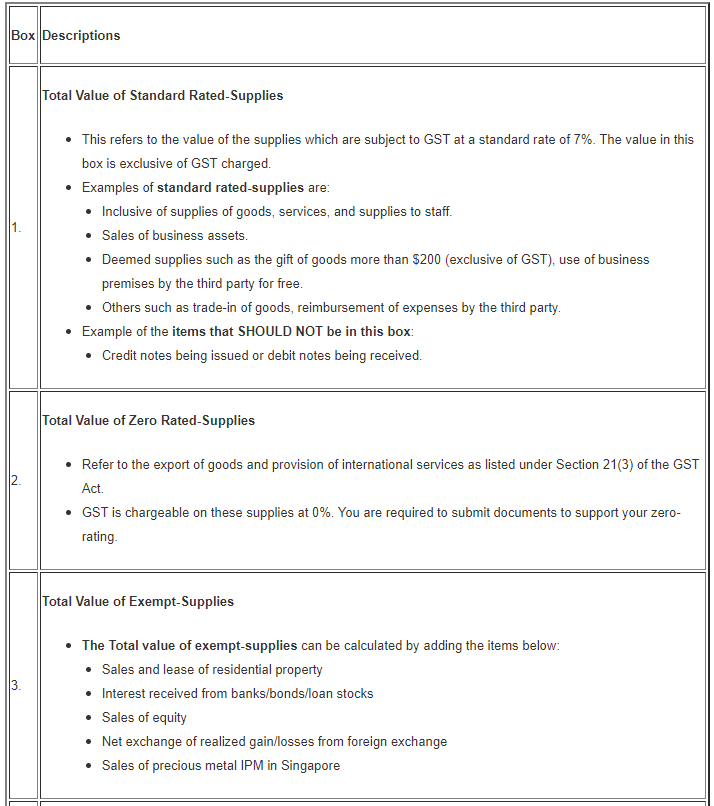

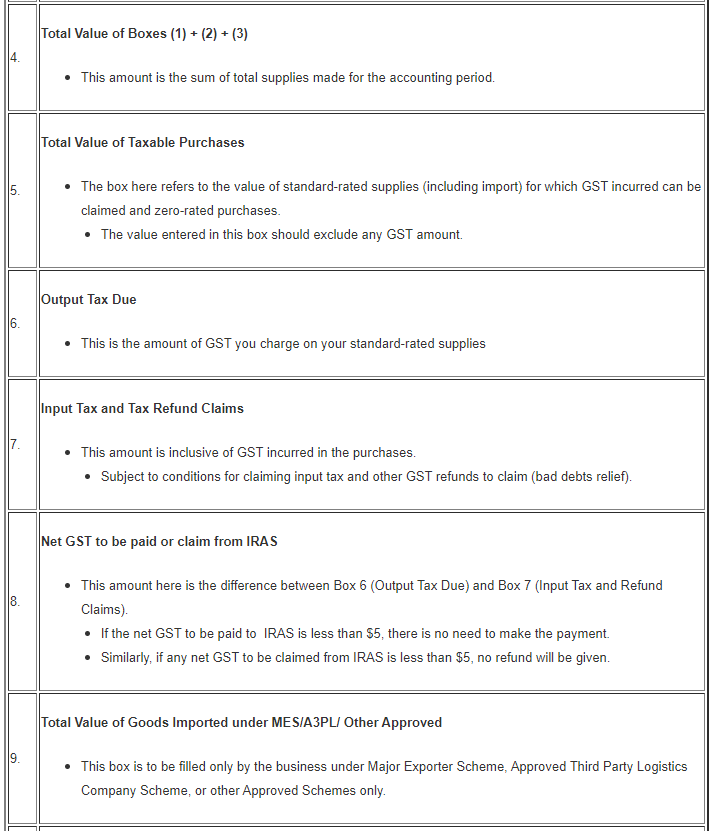

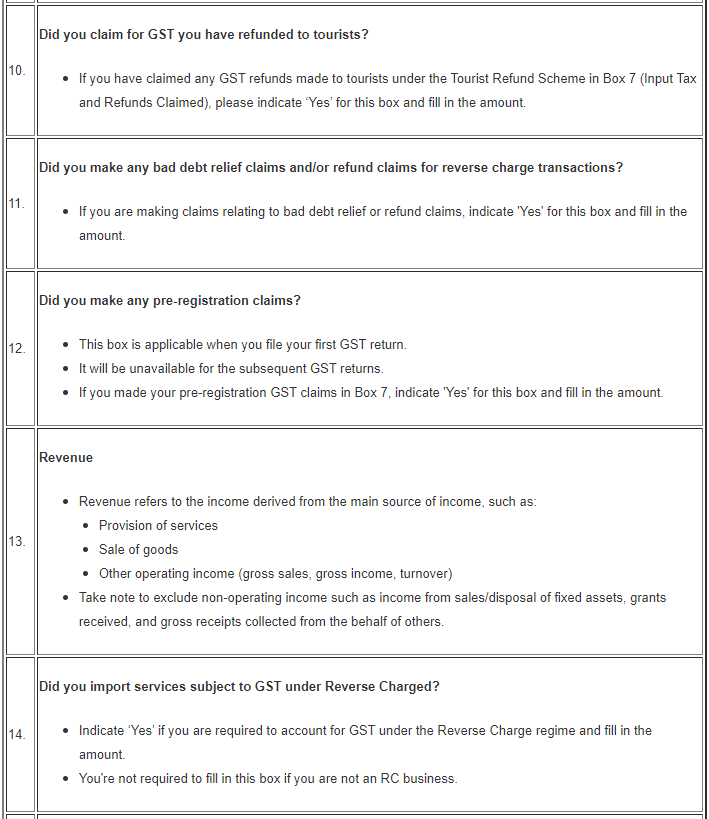

The GST Form 5 has 15 boxes that need to be filled.

You can log in to myTax Portal to access your GST Return portal.

All figures reported have to be stated in Singapore currency for the GST Return.

If you have transactions in foreign currency, please refer to Foreign Currency Transactions on how you should report them in Singapore currency.

Note: You are required to e-File a nil return even though you do not have any transactions during the respective accounting period.

What is GST Form 7?

If you have made errors in your previous GST F5, F7, and F8, you can file GST F7 to amend the errors.

Here are the requirements to file GST Form 7:

A) Administrative Concession for Correcting Errors

You may adjust the errors made in your next GST F5 due to administrative concession if you meet both of these criteria.

- The Net GST amount in error (i.e., output tax error - input tax error) for all the affected prescribed accounting periods is not more than $1,500

- The total non-GST amounts in error for (each of) the affected accounting period(s) is not more than 5% of the total value of supplies declared in the submitted GST return (i.e., Box 4).

- The 5% rule applies to the total value of the taxable purchases (i.e., Box 5) in the circumstance where there was no supply made during the accounting period.

Do note that the administrative concession doesn't apply to the following items:

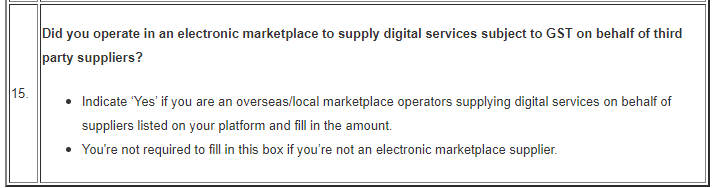

- Errors that affect Boxes 9 to 12, 14, and 15 of your past GST F5

- Errors made in your last return, GST F8

You can use the GST F7 calculator to determine whether you are qualified for the administrative concession.

B) File claim for overpaid or wrongly paid GST

You can file for GST F7 to claim a refund if you have paid the wrong GST amount earlier.

If you are unsure of the GST Treatment, you can clarify the GST Treatment with IRAS before filing GST F7.

Here is the following information that you need to provide them:

- Explanation of the error or issue involved

- Total GST to be refunded for all accounting period impacted

You should claim a GST refund within the range of five years from the end of the relevant accounting periods.

What is GST Form 8?

You will need to file GST Form 8 when you cancel your GST Registration within 30 days when you stopped making taxable supplies and do not intend to make taxable supplies in the future.

You are required to:

- Submit the GST F8 and account for GST within one month from the end of the prescribed accounting period stated on the return; and

- Settle all outstanding GST returns and payments, if any.

How do I generate GST Form 5, Form 7 and Form 8 in Deskera Books?

- Login to your Deskera account.

- Click on the Switch To button at the bottom left screen >> Select Deskera Books.

- The system will direct you to Deskera Books' main dashboard.

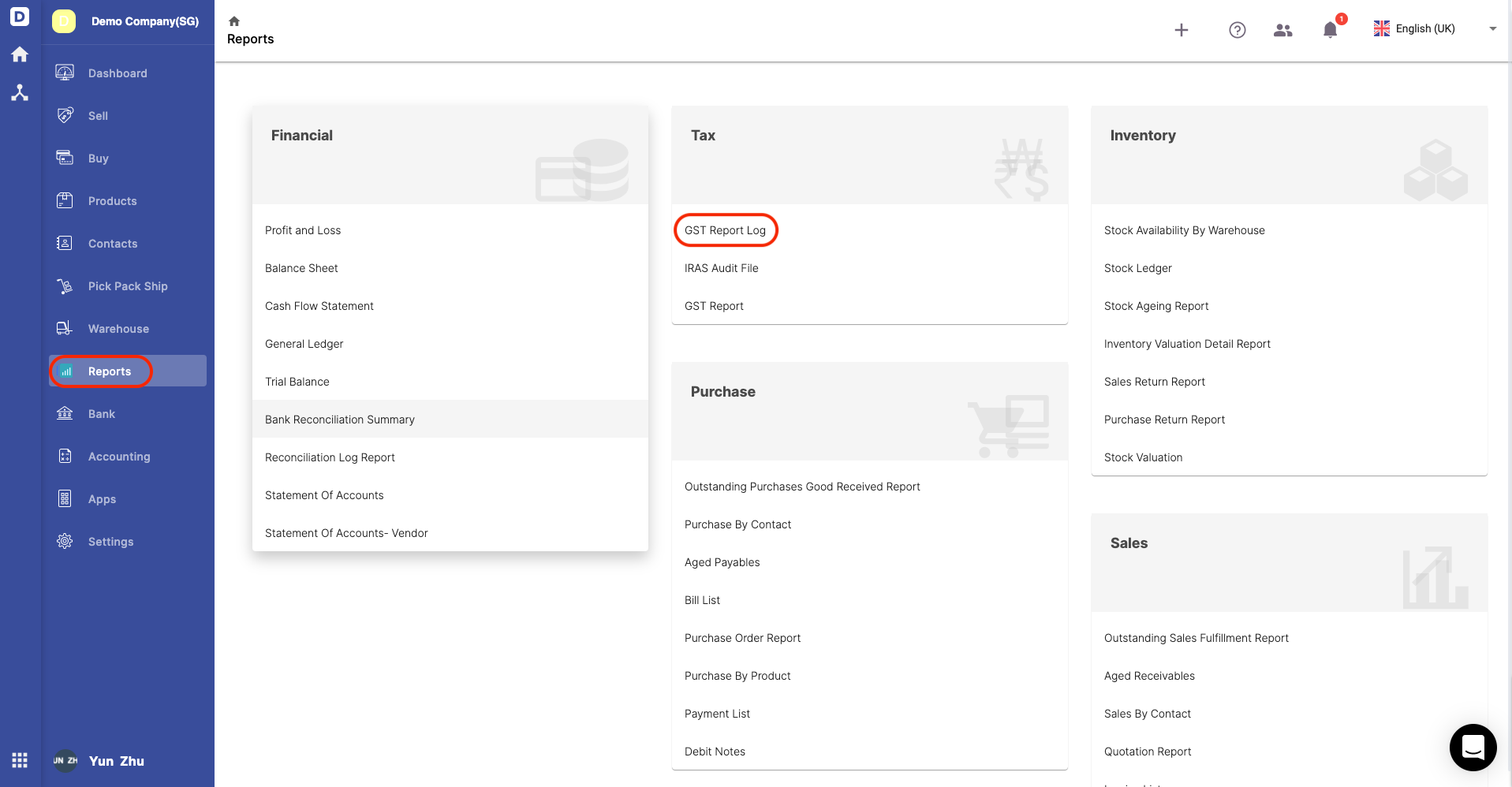

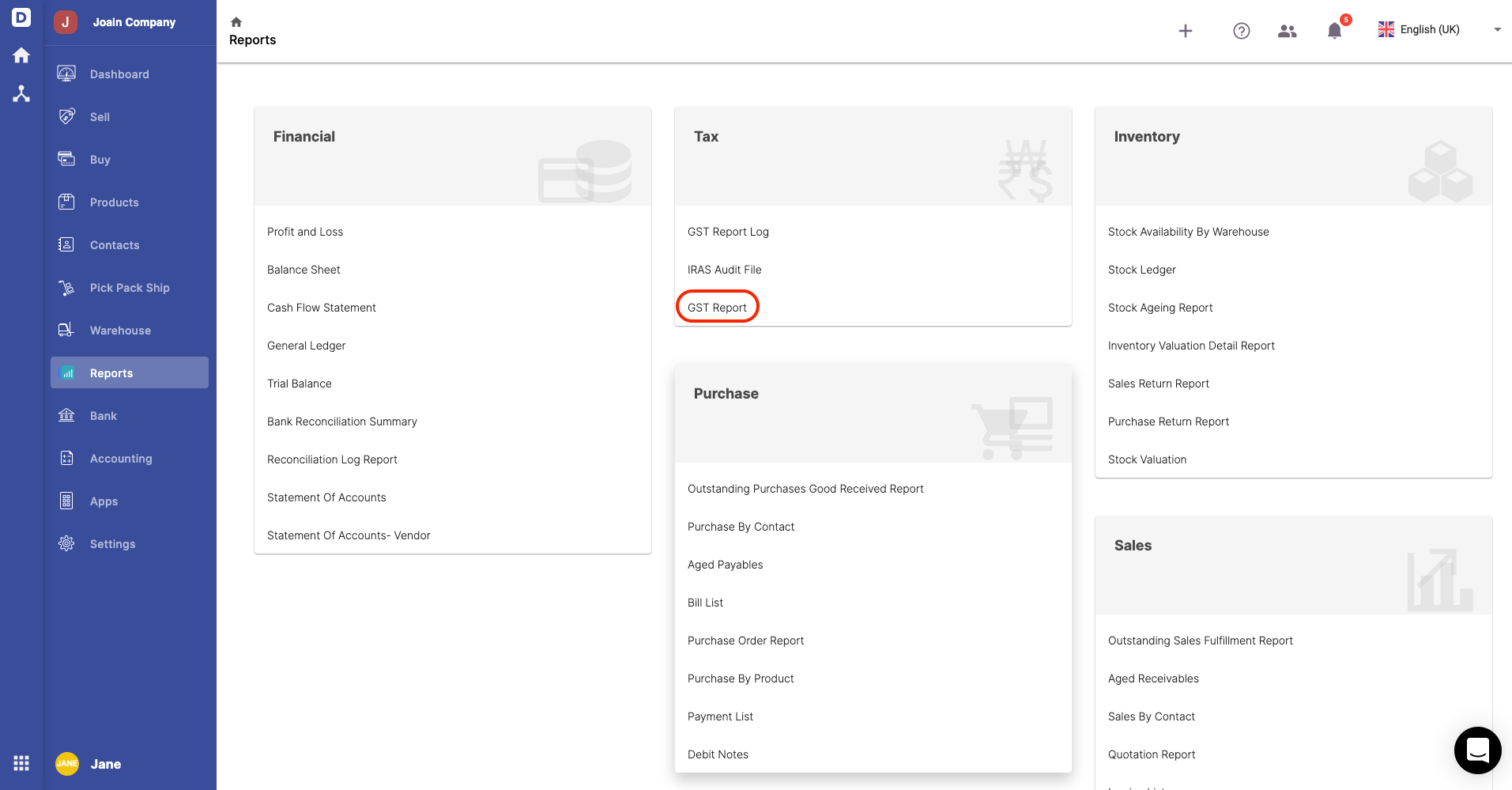

- Click on Reports via the sidebar menu.

5. Click on GST Report Log button.

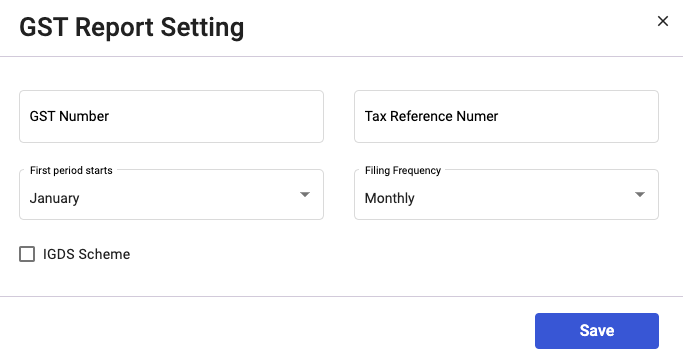

6. A pop-up will appear.Indicate the GST number, tax reference number, first period start date, and filing frequency.

7. Enable the checkbox if you are under Import GST Deferment Scheme (IGDS).

8. Click on the Save button.

9. Once you have set up the GST Report setting, you can create the GST report next.

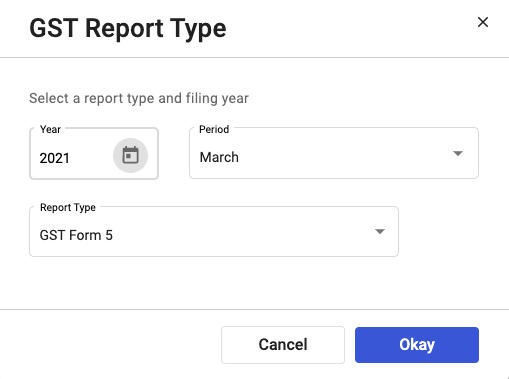

10. A pop-up will appear. You need to fill in the following fields:

- Year- The filing year

- Period - The filing month

- Report Type- Choose from GST Form 5, Form 7, and Form 8

11. Click on the Okay button.

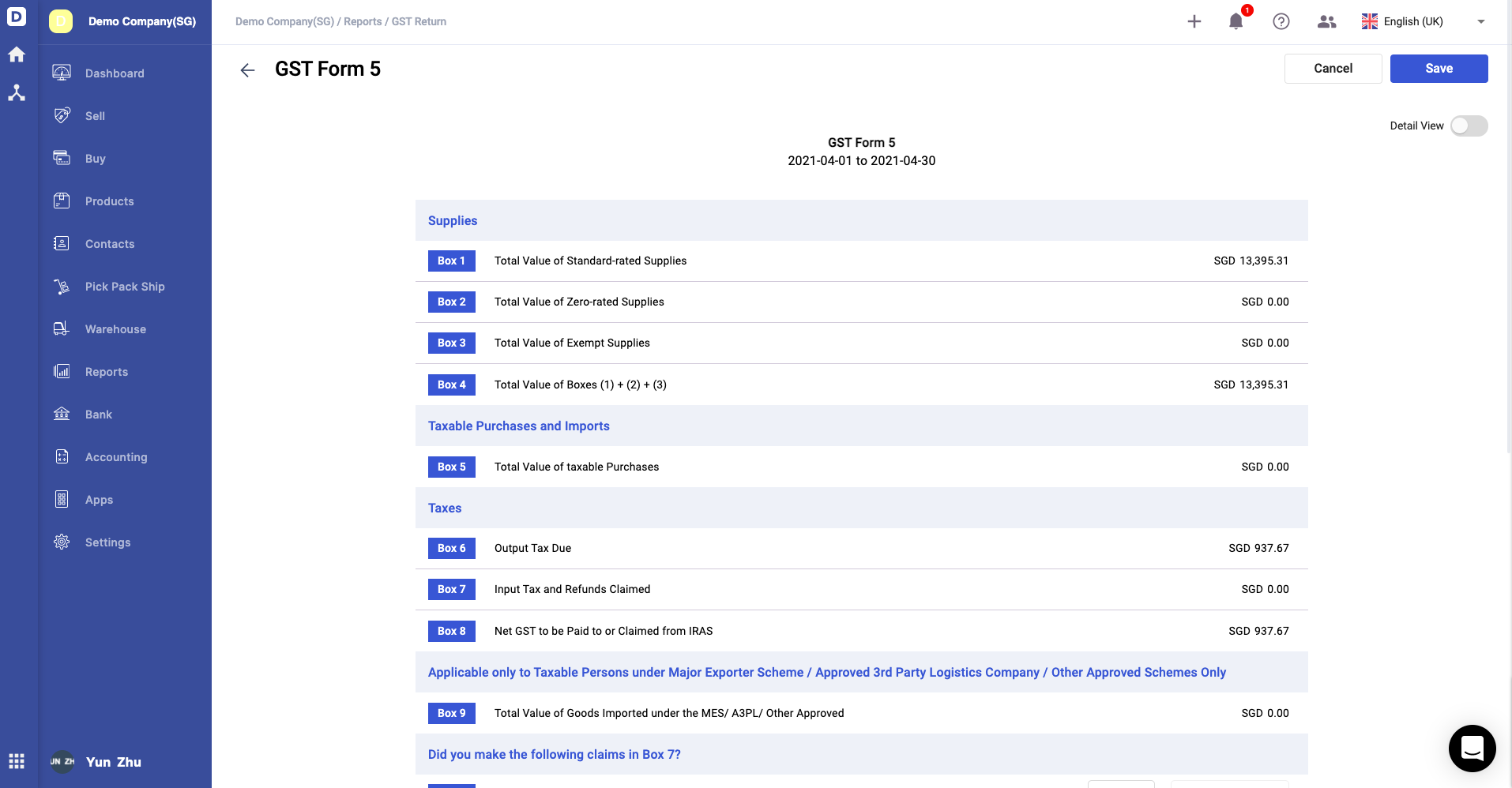

12. The respective report will be populated with the amount in each box as per the image above.

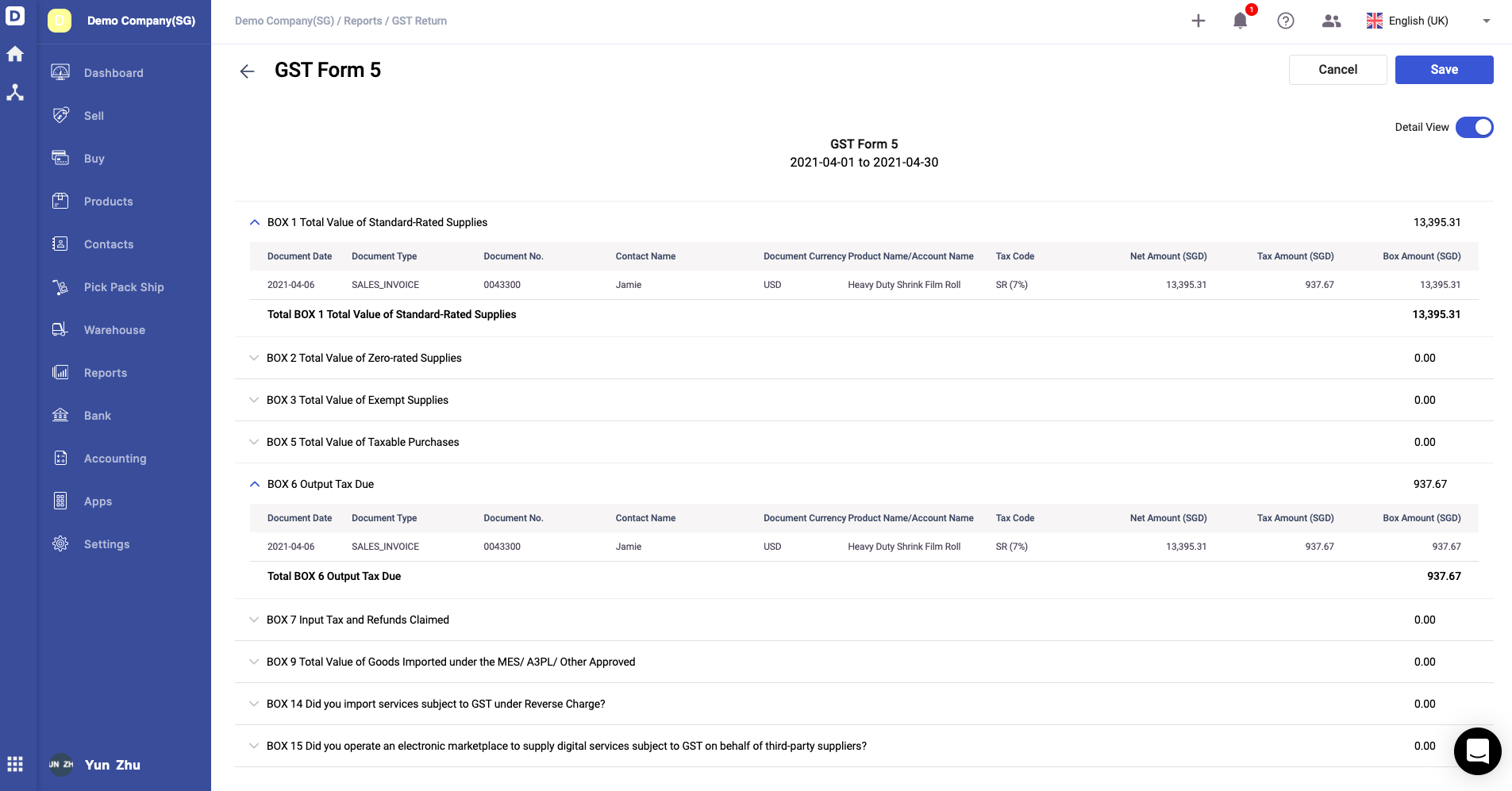

13. You can expand the view the enabling the detail view toggle. After expanding the view, you can view the respective transactions tagged under each box.

14. After verifying all the information, click on the Save button.

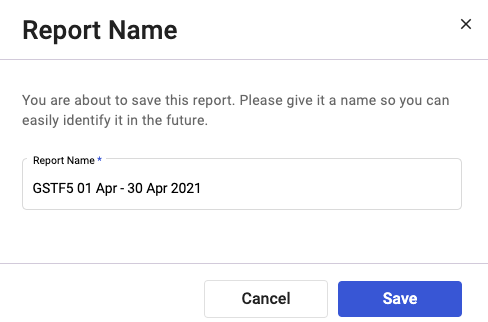

15. Enter the report name and click save.

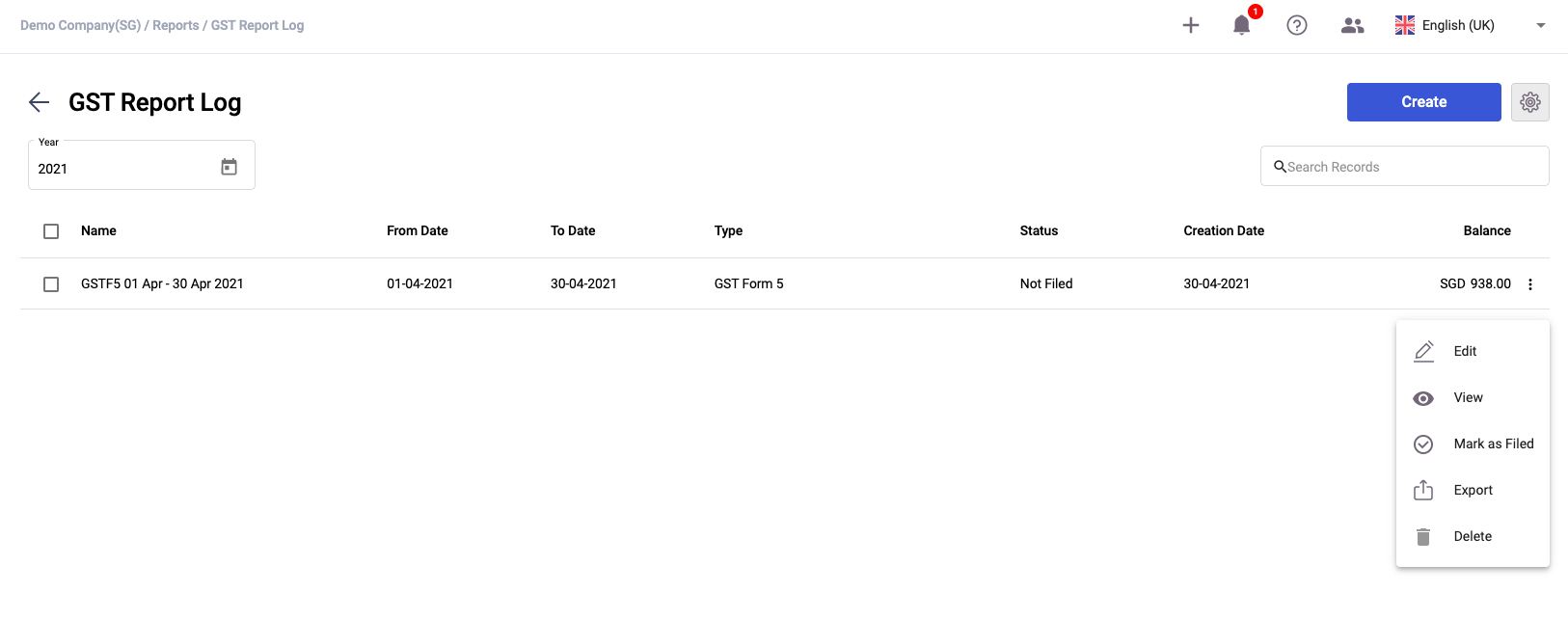

16. You can view the report under the GST Report Log window.

17. Click on the three dots of the report to:

- Edit - Edit the details for the report, if you haven't file it

- View - To have an overview of the entire report

- Mark as Filed - Once you have filed the report, you can manually mark it here

- Export - Download the report in .xlxs format

- Delete - To remove the report from the system. Once you mark the report as filed, you cannot delete this report anymore

What is GST Report in Deskera Books?

- Go to Reports in Deskera Books.

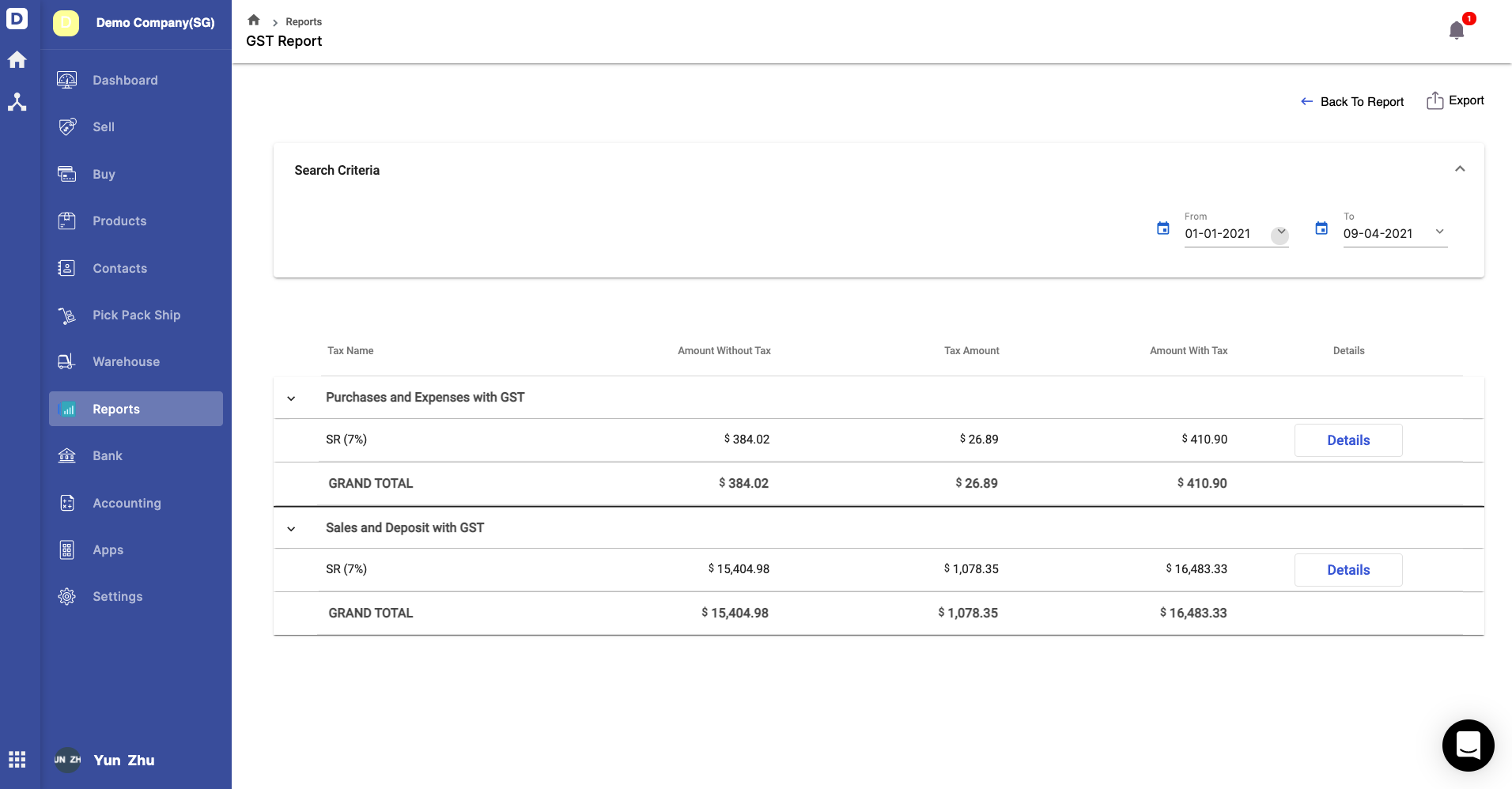

- Click on GST Report - This report is for tracking and reference purposes only.

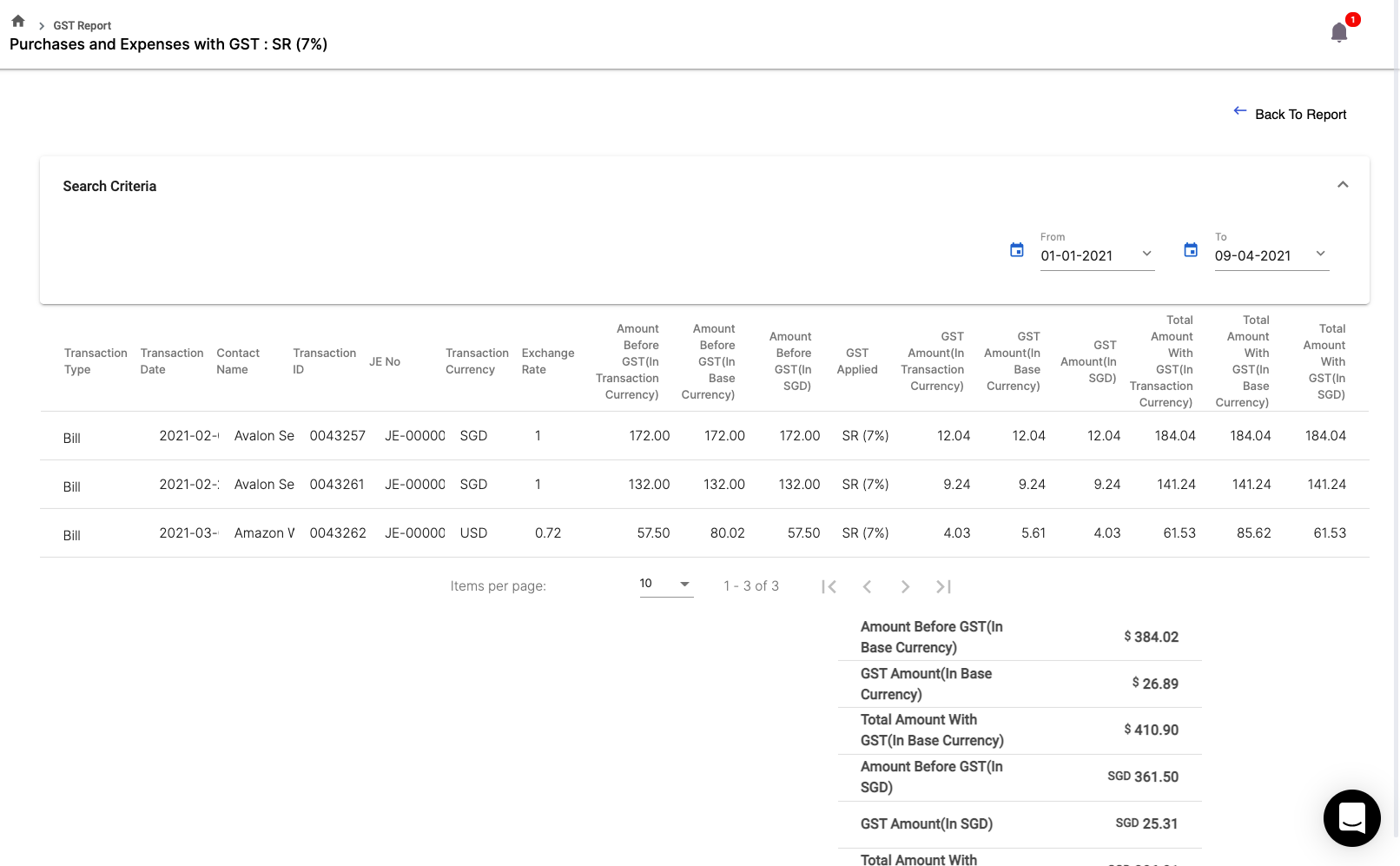

3. On the GST Report window, you can view the amount and tax amount for Purchase and expenses with GST account and Sales and Deposit with GST account.

4. Click on the Details button to view all the transactions created in the system for each account.