Inventory valuation is the monetary amount associated with the goods in the inventory at the end of an accounting period.

The valuation is based on the costs incurred to acquire the inventory and get it ready for sale.

With Deskera Books, you can generate an Inventory Valuation Report that gives an understanding of the total cost of the inventory and potential profits from the sale.

This report is generated based on the Products and Services mapped in the products module.

What are the different types of Inventory Valuation Methods?

There are three methods for inventory valuation: FIFO (First In, First Out), LIFO (Last In, First Out), and WAC (Weighted Average Cost).

In FIFO, you assume that the first items purchased are the first to leave the warehouse. In other words, whenever you make a sale, under FIFO, the items will be subtracted from the first list of products which entered your store or warehouse.

In LIFO, you make the opposite assumption: that the last items that enter your store are the first ones to leave.

The WAC method uses the item’s average cost throughout the year. The average cost per unit is calculated by dividing the total cost by the total number of units purchased during the year.

Where can I access the inventory valuation report?

Following are the steps for generating the Inventory Valuation Report using Deskera Books.

- Go to the ‘Reports’ on the sidebar menu. Click on the Inventory Valuation Detail Report under the Inventory Section.

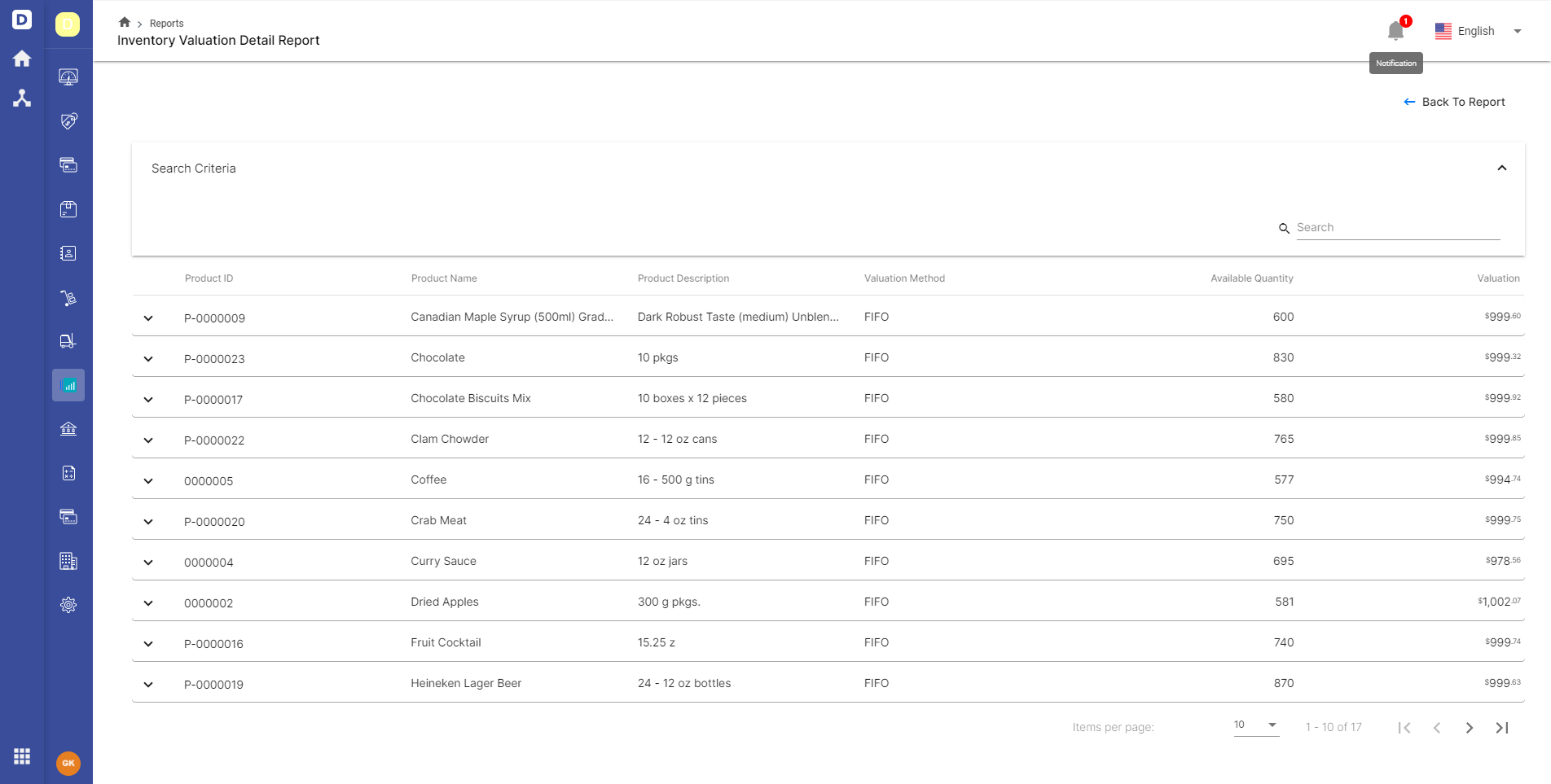

2. A Screen will with all the automated Inventory details as per products ans services mapped in the product module, along with the below details,

- Product ID

- Product Name

- Product Description

- Valuation Method

- Available Quantity

- Valuation

The report can be produced as a summary by items and the report also include cost tier information for all FIFO.

With this inventory valuation details report, it helps in identifying the unsold items is just one step in inventory valuation.