What Is Form 941?

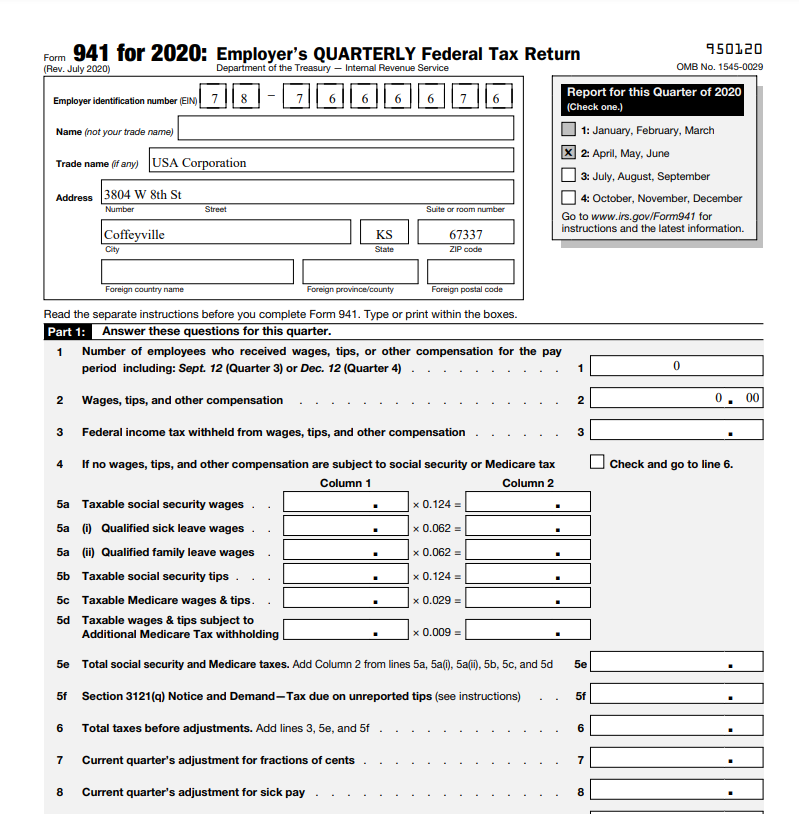

Form 941 is a Internal Revenue Service (IRS) tax form for employers in the U.S. It is filed quarterly. Employers use this form to report income taxes, social security tax or Medicare tax deducted from employee paychecks. Form 941 is also used to pay an employer’s part of Medicare tax or social security, according to the IRS

Who must file Form 941

Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters. The only exceptions to this filing requirement are for seasonal employers who don’t pay employee wages during one or more quarters, employers of household employees and employers of agricultural employees.

When Must Form 941 Be Filed?

After you file your first Form 941, you are required to file a return for each quarter, even if you don’t have any payroll taxes to report. So, you need to file Form 941 every three months.

The due dates for Form 941 are as follows:

- April 30

- July 31

- October 31

- January 31

Each due date covers the three prior months. For example, when you file on January 31 you’ll be reporting amounts withheld on payroll from October 1 to December 31 of the previous year.

What are the Penalties for late filing of Form 941?

Failure to timely file a Form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. The penalty caps out at 25%. A separate penalty applies for making tax payments late or paying less than you owe. The IRS will charge you 2 to 15% of your underpayment, depending on how many days you are late paying the correct amount.

How to Download Form 941 Using Deskera People?

Using Deskera People you can Download federal form 941 for employer with the , following steps

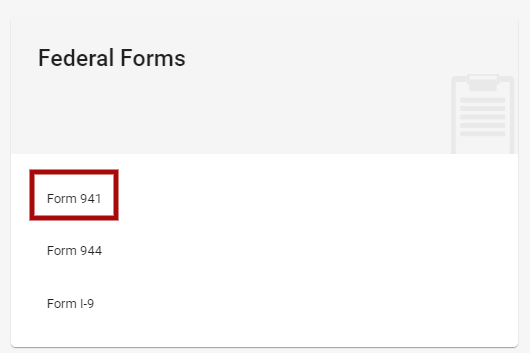

- 1. Go to the Report Tab>> under Federal Forms Section>> click on form 941

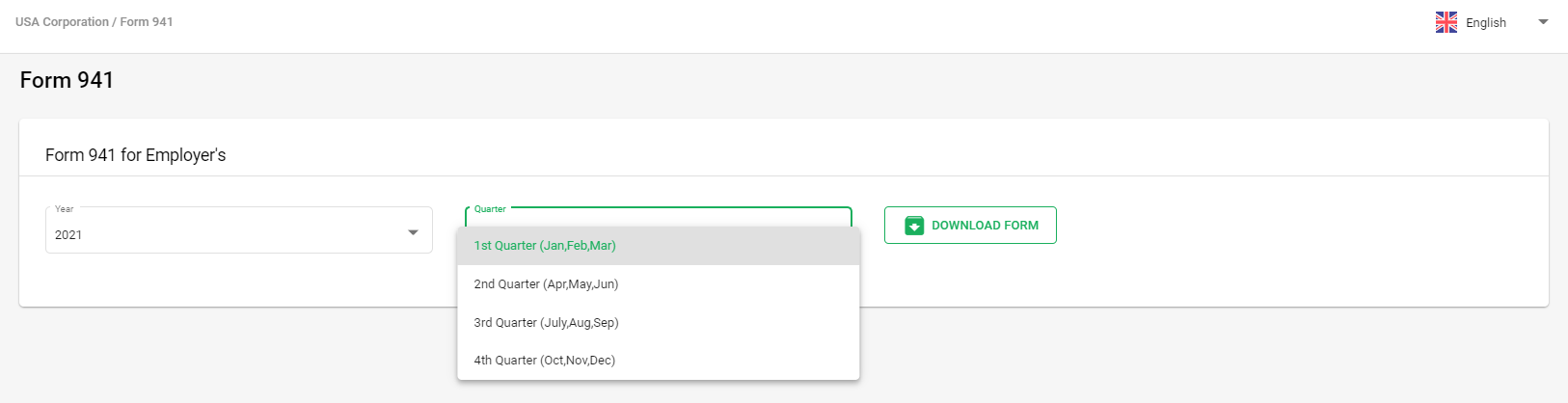

2. A below screen will appear,

- Year - Select the year from drop down list

- Quarter - Select the quarter you need to file the form 941 from drop down list

After the above details are selected, click on Download form button and a below form 941 will be downloaded for further submission to IRS