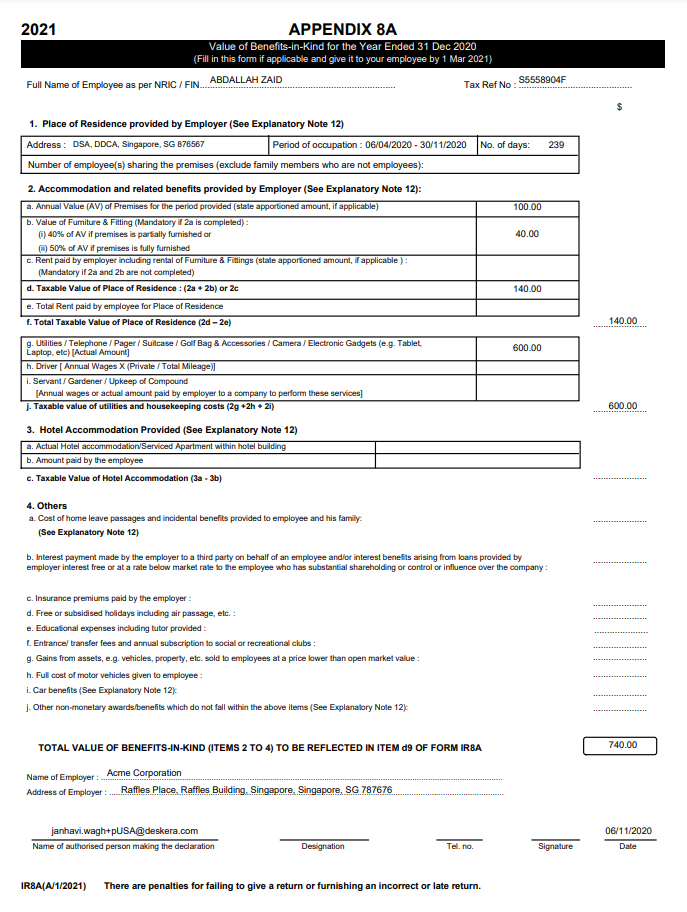

All employers in Singapore are legally needed under S68( 2) of the Income Tax Act to prepare Form IR8A, along with Appendix 8A, Appendix 8B where applicable for all Singapore-based employees. This must be done by 1 March annually and employers will be accountable for submitting these forms to the Inland Revenue Authority of Singapore (IRAS).

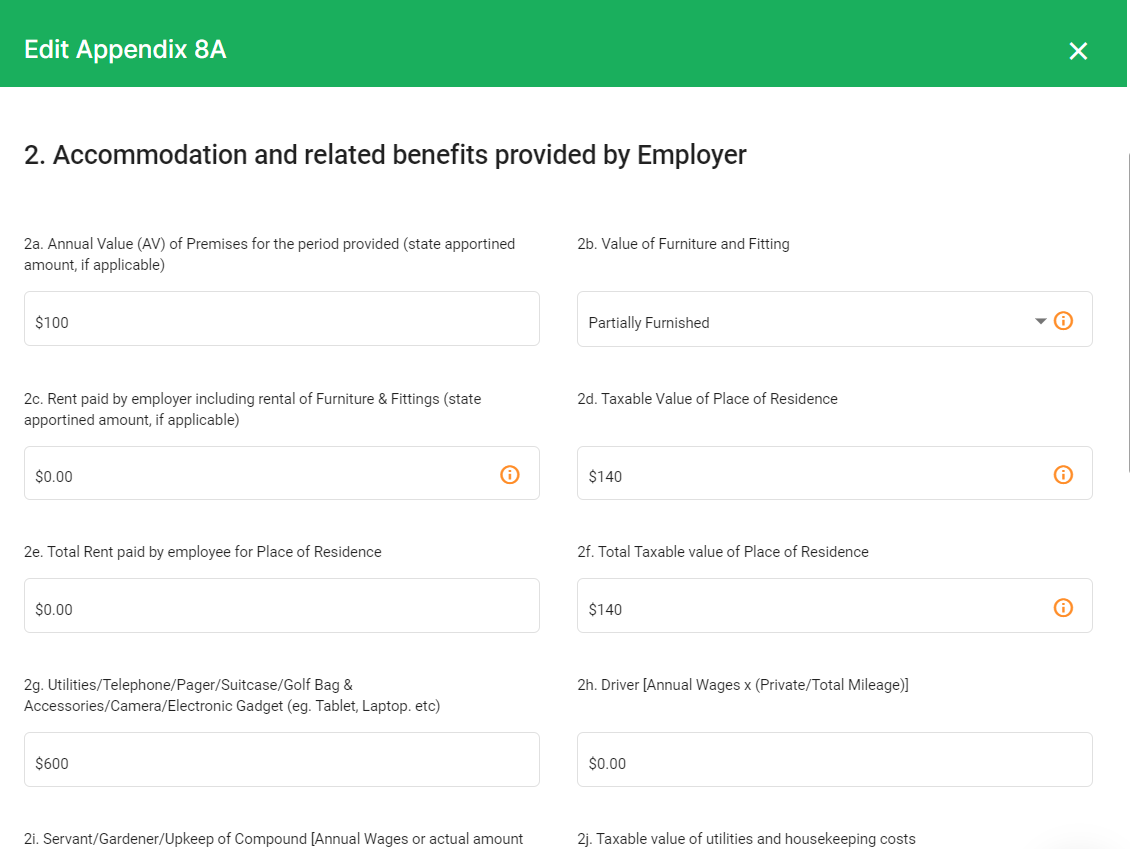

About Appendix 8A

If you are an employee in Singapore who receives benefits in kind, must complete this form.

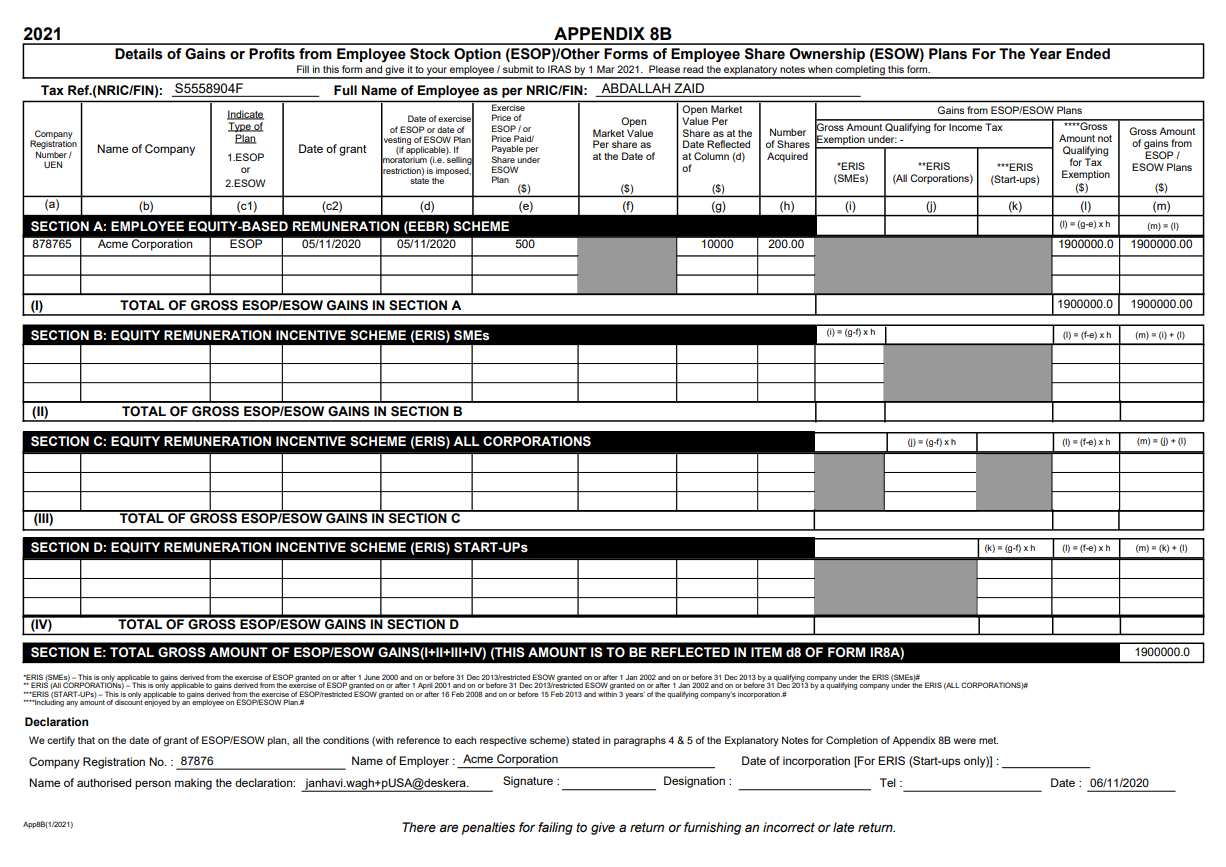

About Appendix 8B

If you are an employee in Singapore who has derived gains or profits from Employee Stock Options (ESOP) Plans, you will be required to complete this form. This is applicable if you have other forms of Employee Share Ownership (ESOW) Plans as well.

Downloading Appendix 8A and Appendix 8A Forms using Deskera People

Follow the below steps for downloading these forms,

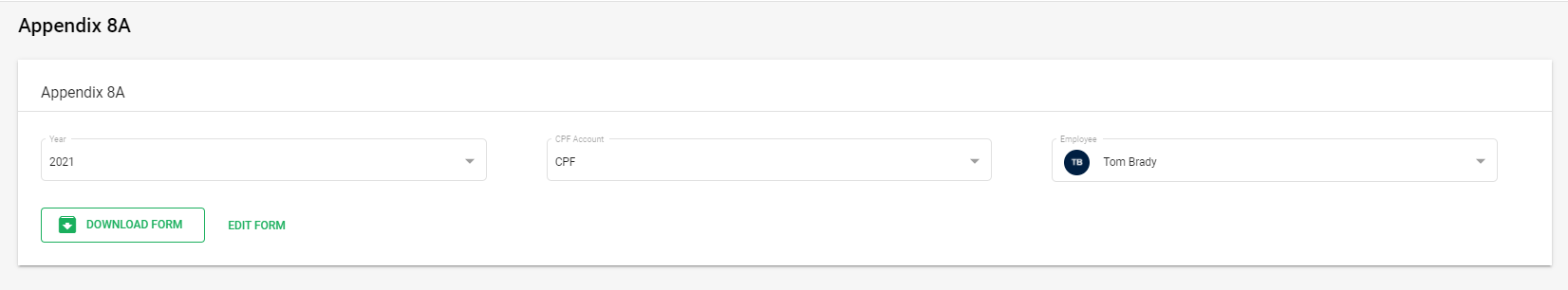

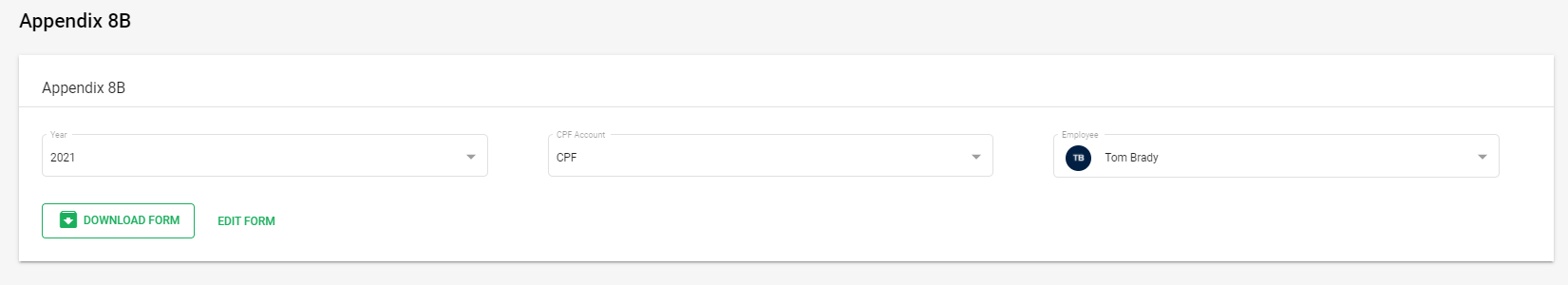

- Go to the Report Tab under the sidebar menu>> A window will appear>>Under IRAS>>click on Appendix 8A and Appendix 8A Forms >>below screen will appear.

2. You can Select the CPF Account and Employee Name from the drop down list which will be set along with the current accounting year Appendix 8A and Appendix 8B forms.

3. To download the Appendix 8A and Appendix 8B forms, click on the Download Form button and the form will be downloaded in PDF format for the selected employee. The details will be auto populate in the form as mentioned in the system.

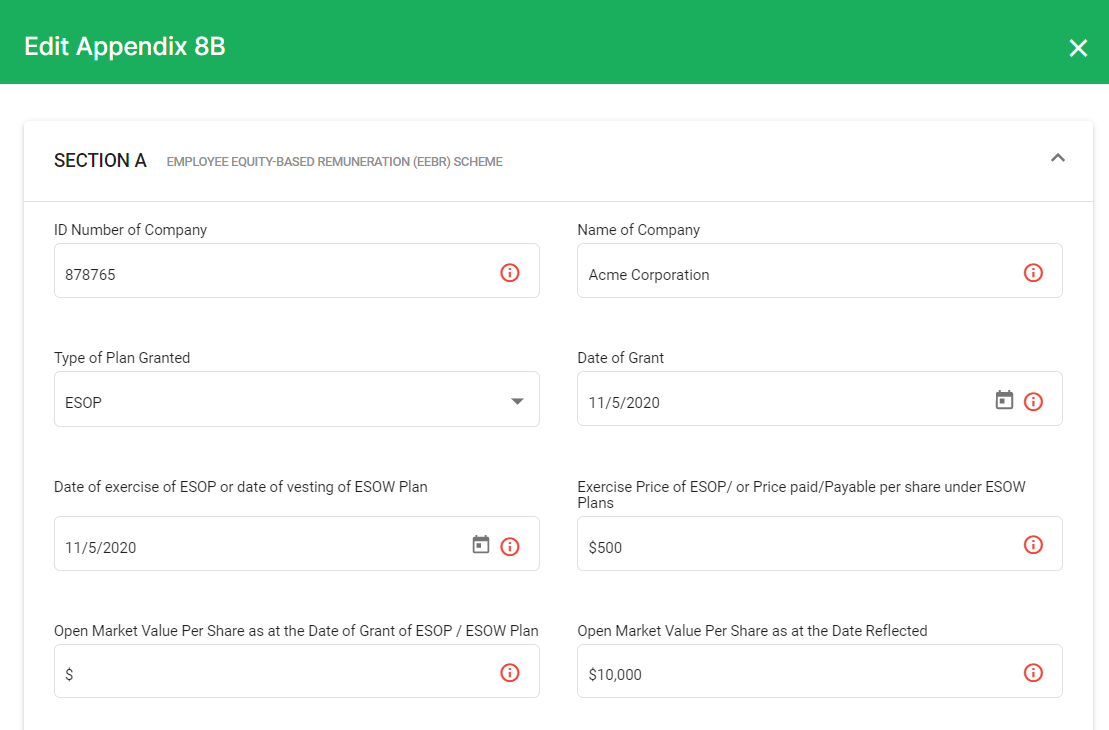

Edit Appendix 8A and Appendix 8B Forms

For instance, if you wish to make any changes in these forms just click on the Edit Form button, which will open a editable forms, where you can make the changes in the required sections of the forms.

Once the required information in the form is edited, click on the save button, where the updated details will then get reflected after you download these forms.

After the form is downloaded, filled in correctly, further you can submit the forms to the IRAS.

Congratulation! you have successfully learned how to download form Appendix 8A and Appendix 8B Forms using Deskera People.