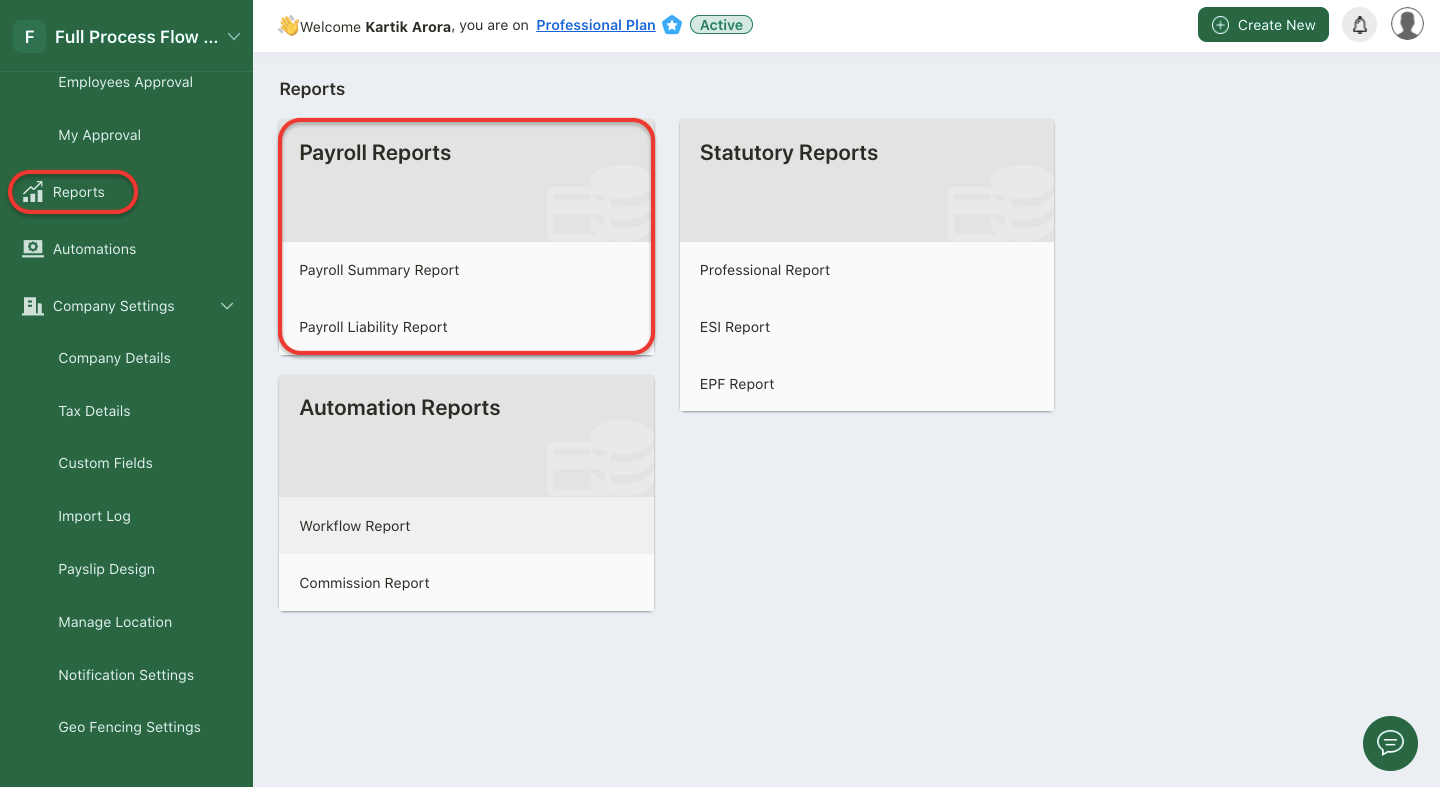

In Deskera People + there are two types of payroll reports available:

- Payroll Summary Report

- Payroll Liability Report

Let us read more about these reports in further details.

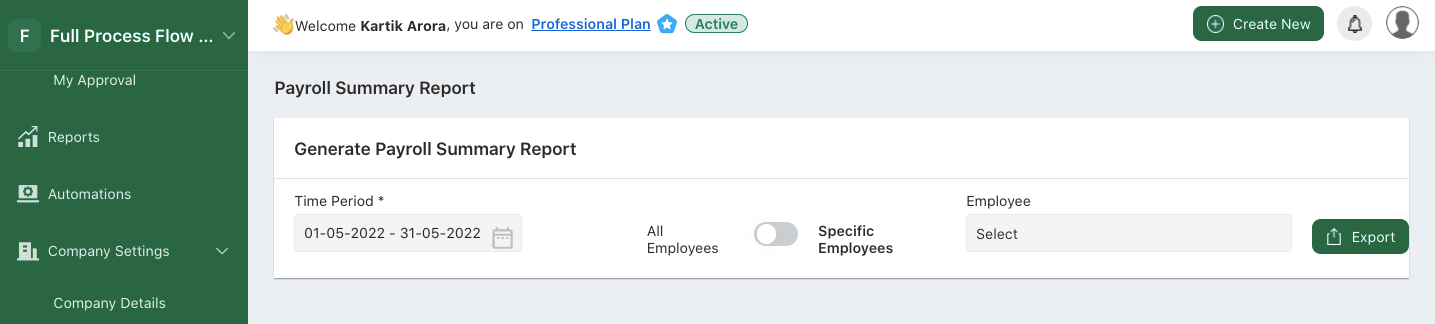

Payroll Summary Report

The Payroll Summary Report is a report for reviewing all payroll information for paid employees based on a date range.

With Deskera People +, you can now generate the payroll summary report easily and get a summary of employee payroll activity with date range, or see pay components for a specific period or individual employees.

Follow the below steps to get the payroll summary report:

- After you have logged into the People + system, under the Payroll Module click on Report>>A screen will appear>>click on Payroll Summary Report. A below screen will appear.

- Time Period - Select the date range to generate the report.

- For Employees, select all employees, specific employees to generate the report accordingly

2. After the required details are selected, you can generate this report in an excel format by clicking on the Export button.

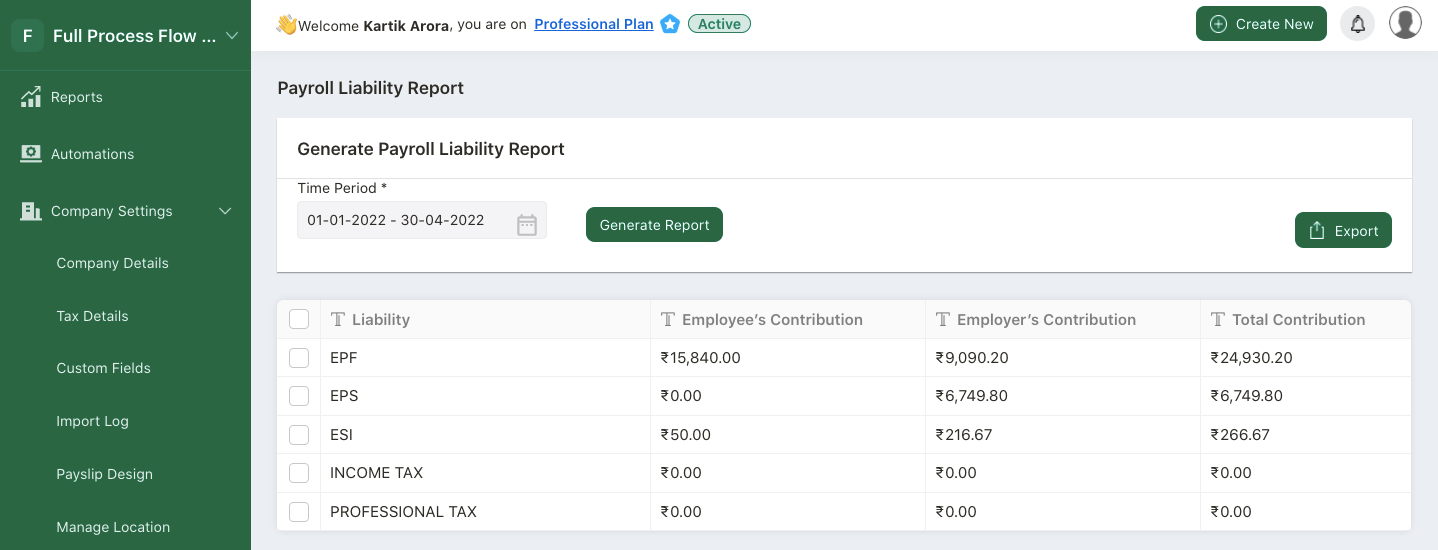

Payroll Liability Report

Payroll liability reports show which payroll liability amounts have been withheld from employee payments, and which amounts have been paid, for any given period. Payroll Liabilities reports—lists amounts that have been withheld for all or selected liability types.

With Deskera People +, you can now generate the payroll liability report easily and get a summary of total contributions amount that have been withheld from Employees and Employers.

Follow the below steps to get the payroll summary report:

- After you have logged into the People Plus account, click on Reports via the sidebar menu.

- A screen will appear.

- Click on Payroll Liability Report.

- On the report, you can view the following field such as;

- Time Period - Select the date range for which you need to generate the Payroll Liability Report

5. Once you select the date range, you can view the payroll liability report for respective tax liabilities based on your country. For instance, a user in India should be able to view EPF, EPS, ESI, income tax and professional tax segregated based on employer and employee's contribution.

6. If you wish to download the report, click on the Export button to download the file in xls format.