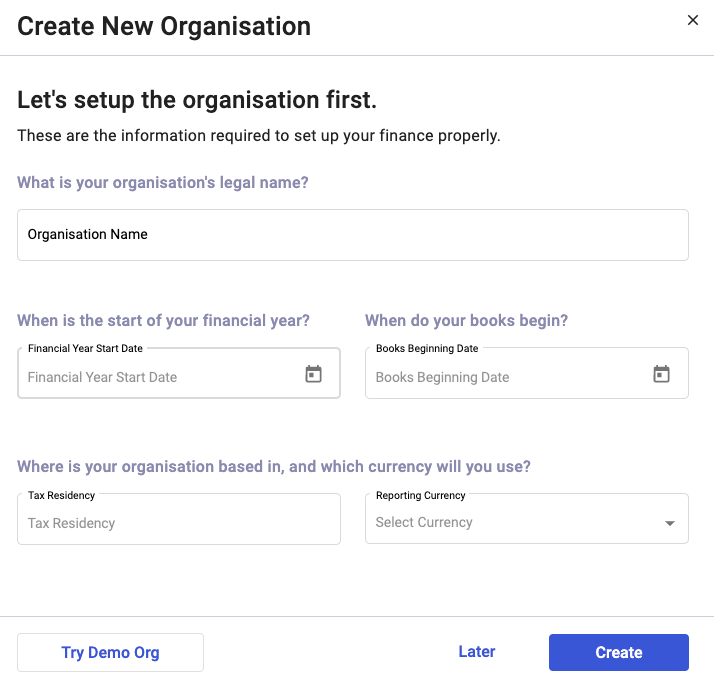

Once you have signed up for an account, the next thing that you need to do is to set-up your organization.

To start off, you will need to fill in your organization's name. The name of your organization will be reflected in the system and is visible to the users of the account.

Tax Residency indicates the country where you run your business. The country selected in the Tax residency field will determine the currency being used in the system. For example, if you select Singapore as the country, the currency will automatically be reflected as the Singapore dollar (SGD).

Financial Settings

You are required to indicate your organization's Financial Start Date and Book Beginning Date.

The Financial Start Date indicates the date where the accounting period of the organization starts for the year. According to accounting standards, the Financial Start Date is typically at the start of a month, but this might vary from business to business.

For example, if you set it as 01-01-2021, then your financial year is Jan - Dec.

Book Beginning Date is the date that you start to use Deskera and key in transactions into the system. This will also be used as the cut-off date for opening transactions.

The Book Beginning Date can be any date when you start using Deskera Books. Do note that the book beginning date cannot be earlier than the financial start date. If you opt for multi-currency, please tick the checkbox in this page.

For instance, if you have set Book Beginning Date as 01-01-2021, then you need to note few points stated below:

- You need to provide the opening balances of all accounts, contacts, and inventory based on their closing balance as of 31-12-2020

- You will not be able to create transactions before 01-01-2021. Any outstanding invoices/bills need to keyed in as opening transactions for your contacts. These opening transactions will be used to calculate the opening balance of your Account Receivable and Account Payable

Address Details

Here, you can fill in your organization's address details. The country selected in the Tax residency field will determine the timezone setting.

Compliance Details

The Compliance Details form will have different fields depending on the country chosen under the Tax residency field.

In the screenshot above, we are using Singapore as the country of tax residency.

For businesses based in Singapore, you are required to fill in your company’s GST number if applicable. Some companies in Singapore are not required to register for GST, hence they can choose to omit this field.

Companies based in Singapore must also provide their company’s Unique Entity Number (UEN), a 9 to 10 digit identification number given to all entities operating in Singapore. You may tick the checkbox if you choose to opt-in for e-invoicing and fill in the Peppol ID.

If your business is not operating within Singapore, the Compliance Section will vary depending on the compliance of the country selected.

For example, businesses with the country of tax residency listed as the United States of America are required to fill in their Tax ID No. and the states where the organization is authorized to collect the tax.