What Is PAYG Withholding?

Most Australian workers pay income tax, calculated as a percentage of the income that they earn. The ATO only confirms the total amount of tax owed by a worker after the worker files their tax return at the end of the financial year.

The purpose of PAYG withholding is to avoid workers having to pay a big tax bill in one lump sum when the ATO confirms the amount payable, which could lead to issues if people have not saved the amount that they owe.

Therefore, PAYG withholding allows an employer to deduct money from the worker’s pay and send it to the ATO on the worker’s behalf throughout the year. This should occur every time the employer pays an employee and the employer should notify them of the amount withheld in tax on their pay sheet.

When a worker completes their tax return at the end of the financial year, the ATO confirms the income tax owed by the worker.

A company is obliged to register for PAYG if it has:

- employees;

- directors;

- workers without ABNs; and

- contractors if the business voluntarily agrees to withhold money.

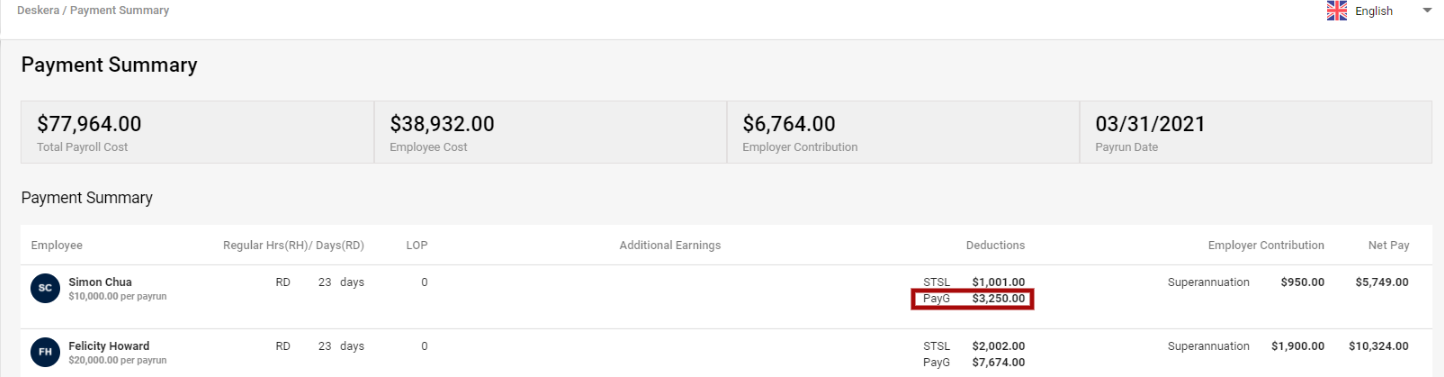

How is PayG applicable in Dekera People?

In Deskera People The Pay as you go(PayG) withholding is the income tax being withheld every pay run for each employee.

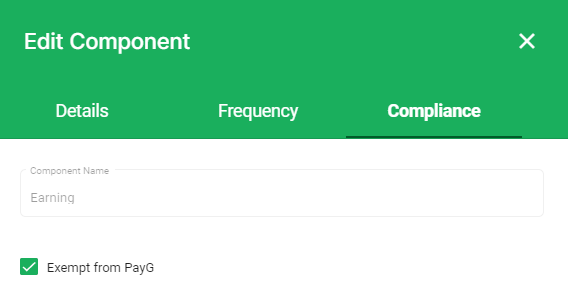

- The withholding amount is based on the basic salary and earning components which are not exempt from income tax.(Not exempt from PayG)

In Deskera people, you can exempt the PayG from earning components if required where the PayG calculation will not happen for that component.

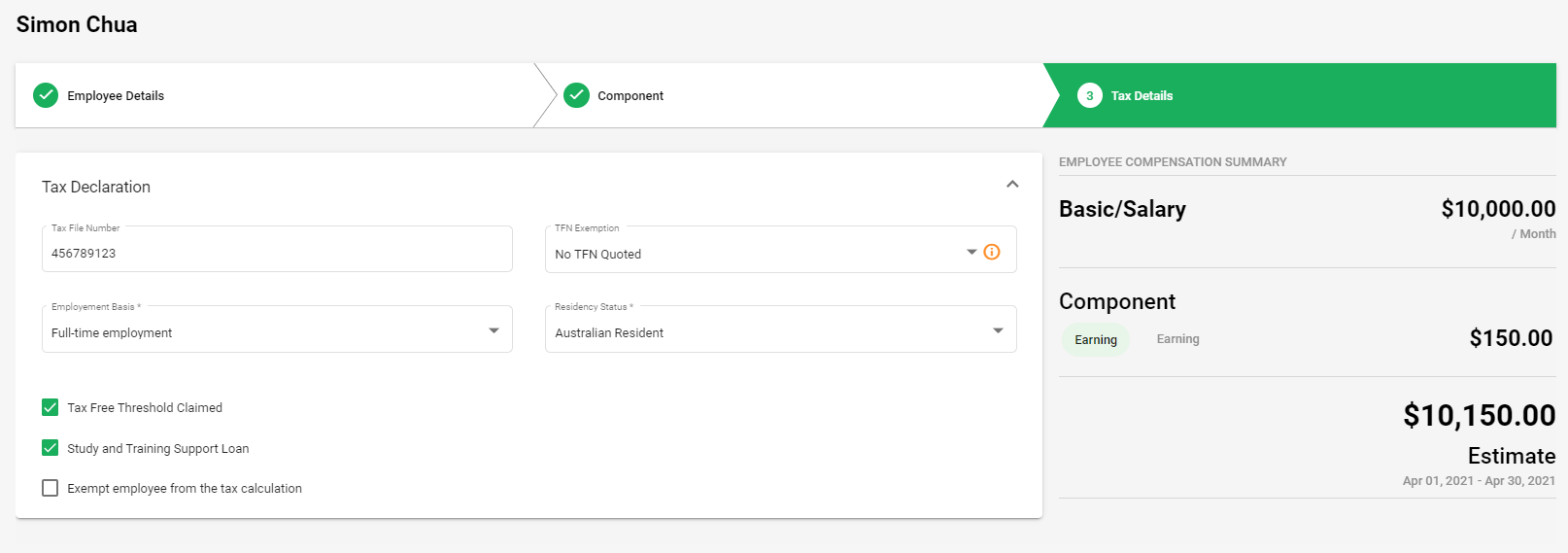

2. The PayG amount withheld are based on the following parameters in the employee profile page in Deskera People:

- Where Tax tax-free threshold is not claimed

- Where the employee claimed the tax-free threshold

- Where the employee is a foreign resident.

- Where a tax file number (TFN) was not provided by employee

Based on the above details PayG Withholding amount will be auto calculated while processing the payrun.