Before delivering a product and service, issuing an invoice, and getting paid, one of the most important details you have to discuss with your clients is your payment terms.

You’ve probably heard many businesses use net 30, as their go-to payment term. But what exactly is net 30, and should you use it for your small business accounting?

That’s what we will be answering in this guide, along with everything else you need to know about the net 30 payment term.

Read on to learn about:

- What Is Net 30?

- When Does a Net 30 Start?

- The Advantages of Net 30

- The Disadvantages of Net 30

- Should I Use Net 30 for my Small Business?

- Net 30 FAQ

- Automate Invoicing with Accounting Software

What Is Net 30?

Net 30 is a payment term in which the client has 30 calendar days to pay back the business, after the billing date, for the service or products they purchased. In simpler terms, a net 30 term gives the buyer 30 days to pay back, after they receive the invoice.

In essence, it’s a form of trade credit extended to clients. For that reason, you have to record the transaction as debt under accounts receivable.

If you want to learn more about the elements of an invoice, and how to create one from scratch, check out our guide on making an invoice.

Is Net 30 the Same as Due in 30 days?

No, they’re not exactly the same thing.

Net 30 means that the client can get a discount if they pay back before the deadline.

While when the payment terms state “due in 30 days”, this benefit doesn’t apply. It simply tells the buyer they have 30 days to make the invoice payment.

What Does Net 30 EOM Mean?

EOM stands for the end of the month. So, if the payment term is net 30 EOM, it means that the customer has 30 days to pay back, after the end of the month when the invoice was sent.

For example, if you invoice your client with a payment term of net 30 EOM on October 13th, the payment will be due on November 30th - 30 days after October 31st.

What does 2/10 Net 30 Mean?

As we previously mentioned, some businesses offer discounts to their clients who pay back earlier.

When the buyer offers a 2% discount for clients who send payment within 10 days, it’s written in the invoice as a ‘2/10 Net 30’ payment term.

This can be switched up to whatever type of discount you want to give out. For example, a 3% discount for customers who pay back within 10 days, would be ‘3/10 Net 30’, and so on.

When Does a Net 30 Start?

Usually, net 30 starts after you send the invoice. However, net 30 can also begin 30 days after the sale or 30 days after the delivery of the product or service.

It all depends on the type of invoice you’re issuing, what you have agreed upon initially with the client, and how generous you’re willing to be regarding the deadline.

Whatever the case may be, make sure to clearly communicate it to the buyer, and write it down on any contract you signed with them, as well as the final sales invoice.

The Advantages of Net 30

Incentive to Buy

The main advantage of the net 30 credit term is that it creates an incentive to buy.

When you give clients some breathing time to pay, you increase their willingness to buy from you, since they have the extra time to collect the cash.

Ability to Offer Discounts

Net 30 payment terms allow you to offer early payment discounts to clients. These discounts encourage clients to pay you back on time and it helps the business keep a steady cash flow. And at the same time, by offering discounts, you can attract a larger customer base.

Remain Competitive

If most of your competitors are offering net-30 credit terms, but you’re still demanding clients for up-front payment, that harms your ability to stay relevant in the marketplace. In these cases, switching to net-30 can help you remain competitive.

Builds Trust and Customer Loyalty

When you offer a net 30 payment term, you show your clients that you trust them. This helps you form good relationships with them and in the long run, creates a loyal customer base.

The Disadvantages of Net 30

Net 30 is a great option for medium to large-sized companies. They can usually afford to wait 30 days, because of the high number of customers and income coming into the business.

For smaller businesses, on the other hand, the net 30 payment term can put their finances on the hot spot, fast.

Extended credit terms can put your business in a financial situation where there might not be enough cash flow to pay back liabilities. So, if your small business’ only source of income is a handful of customers, don’t offer net 30.

Also, it’s recommended to avoid using net 30 when dealing with new clients, since you don’t know when or if they’ll be able to pay you back.

Should I Use Net 30 for my Small Business?

Again, it all depends on how much money you have on hand, the number of buyers, if it's the usual payment term for your business/industry, and most importantly, how generous you can afford to be with your consumers.

If you have heaps of cash saved up, several different customers, and can handle a few missed fees, net 30 is a great option and can help you attract new customers.

But if that’s not the case, and you’re relying on just 3-4 buyers, giving net 30 terms may open up a lot of cash flow issues, especially if they pay late.

Net 30 FAQ

Should I Give All My Clients Net 30 Payment Terms?

No, you don’t have to give all your clients the same net 30 payment term.

We’d recommend using net 30 for clients you’ve already built a relationship with, or for products and services that have a high cost/value, which might need some time to compensate.

Does Net 30 Include Weekends?

Net 30 means 30 calendar days, not business days.

So, yes, both weekends and holidays are included.

Do All Businesses Use Net 30?

No, not at all. Businesses are free to choose whatever payment term best suits their industry, products, and clients.

For instance, businesses working in retail rarely extend credit to their customers. If you buy a latte at your local coffee shop, you’ll most likely have to pay right there on the spot.

Net 30 isn’t convenient for small businesses with few clients, either. 30 days can be a long time to wait if your only source of income comes from two or three customers.

Is a Payment Term and the Due Date the Same Thing?

No, they’re not the same thing.

The due date states the exact date when an invoice is due, for example: “Due on December 31st”. While payment terms specify the time period the client has to pay back, along with any early payment discounts.

What Are Some Alternatives to Net 30?

If you want to reinforce earlier payments than 30 days, net 7 or net 15 are great options.

But if you’re looking for longer credit terms, you can try out net 60 and even net 90, which are most common for large and expensive projects.

Automate Invoicing with Accounting Software

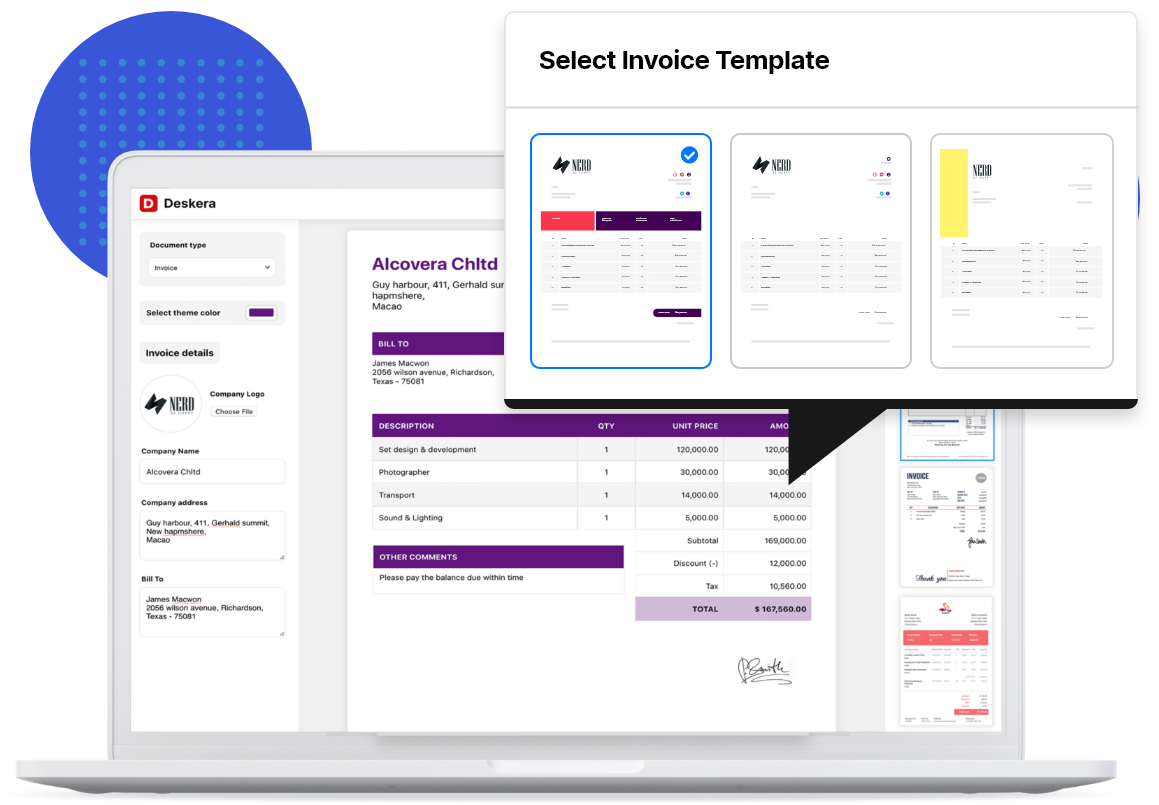

Use accounting software like Deskera to create and send out invoices with just a few clicks!

Deskera offers over 100+ free templates, which you can easily fill in and customize to your brand with the preferred color scheme, business logo, signature, font, and more.

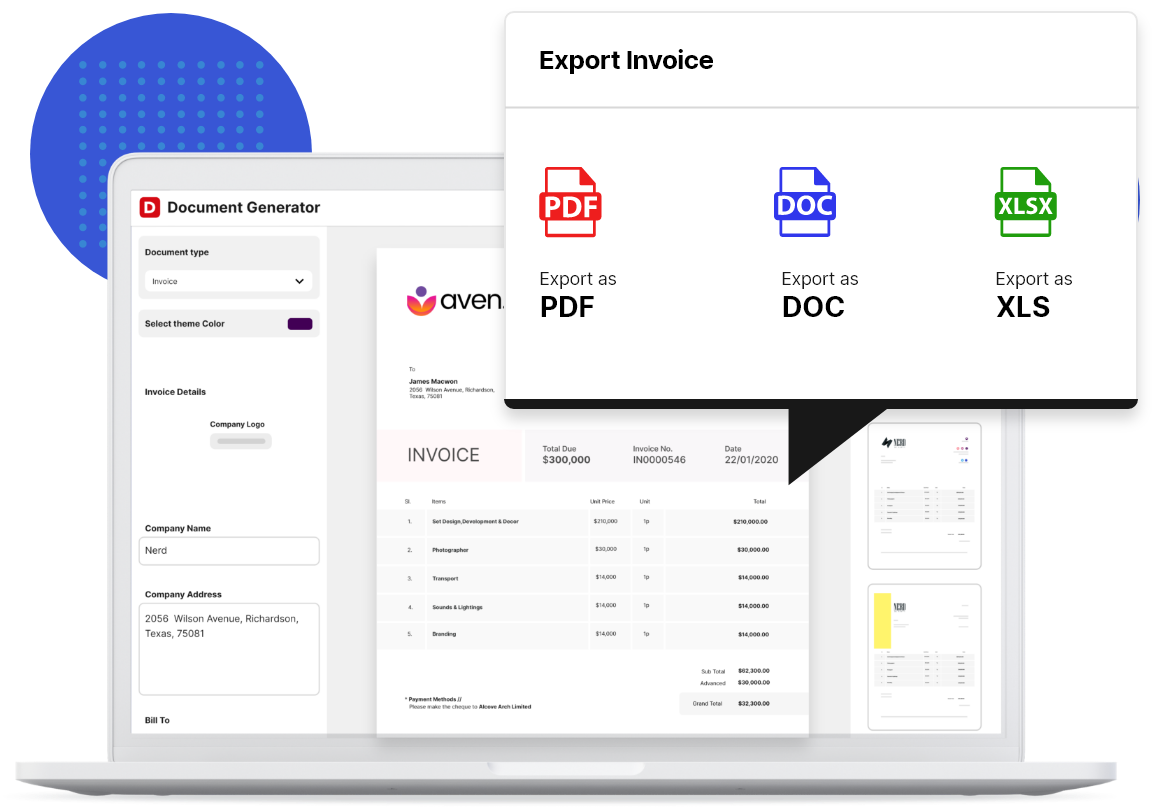

Then, just press Share and export the document in whatever format you prefer: PDF, DOC, or XLS.

And done! Your invoice has arrived and it’s ready to get paid!

But wait, that’s not even the best part!

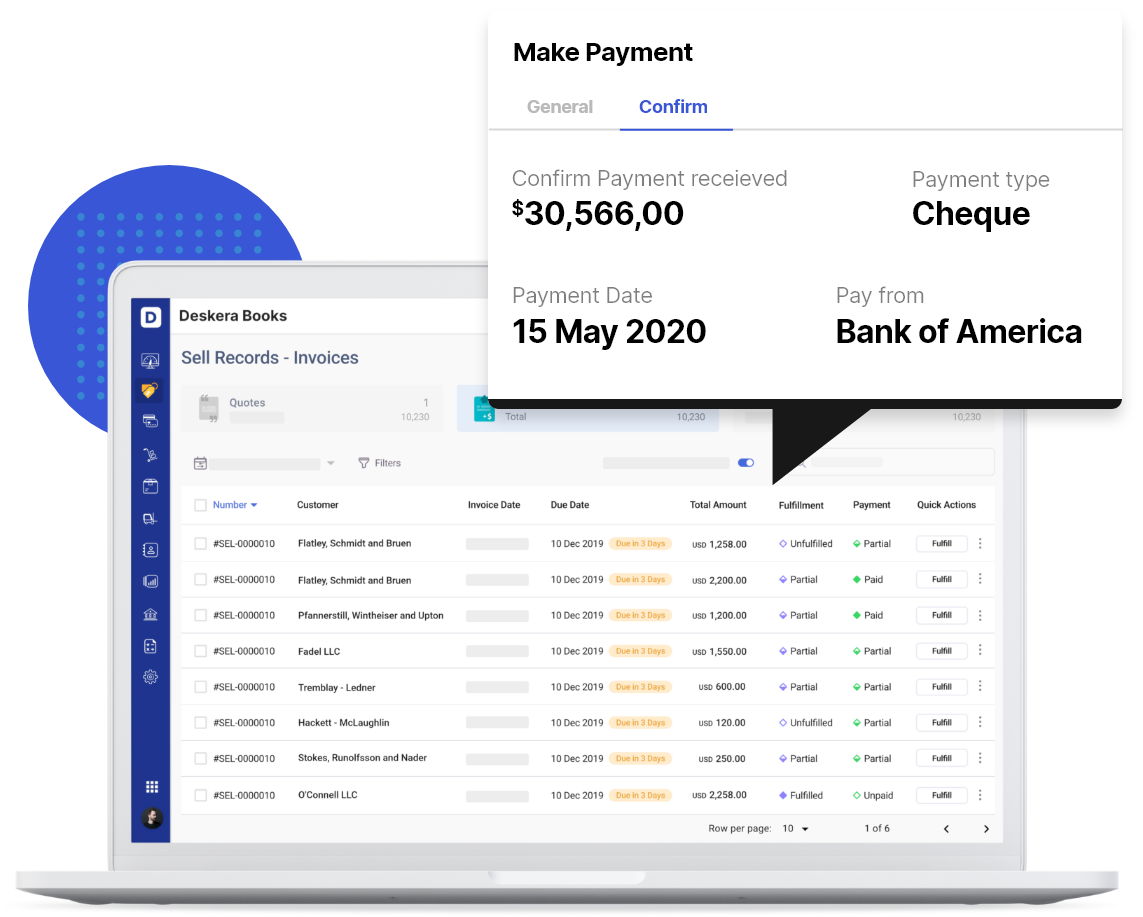

Deskera’s comprehensive Sell dashboard allows you to manage and overview your invoices, all in one place.

From there you can get a glimpse of the customer, the amount due, invoice due date, and whether payment has been received yet.

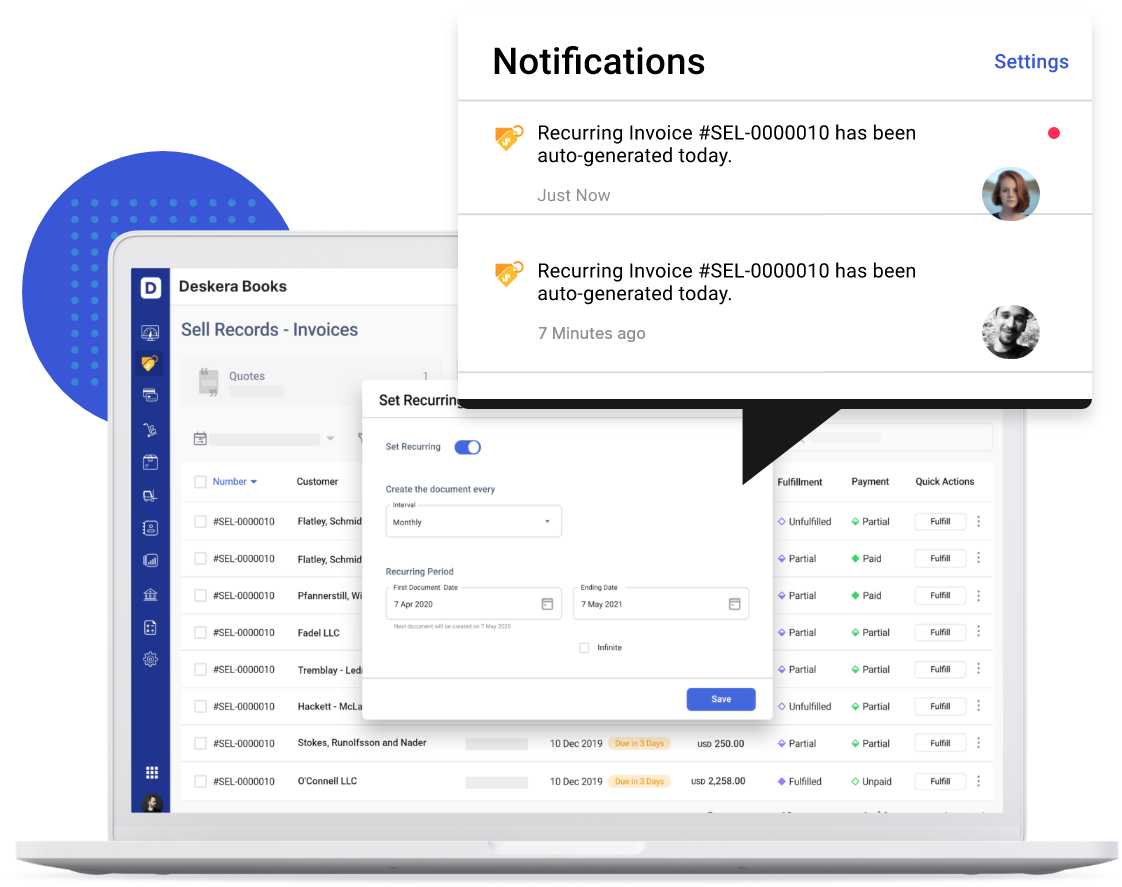

From that same dashboard, you can set up recurring payments, advance payment requests, and receive immediate automated notifications for any past due invoices.

Still not sure Deskera is the right choice for your small business accounting?

Well, luckily you can give the software a try yourself right away, with our completely free trial. No credit card details required.

Key Takeaways

And that’s a wrap! We hope our guide was helpful in deciding whether or not net 30 is the right payment term for your business.

For a quick recap, let’s check out the main points we’ve covered:

- Net 30 means the buyer has 30 calendar days to pay back for purchased goods and services. This could mean 30 days after:

- The sale

- Products were delivered

- Sales invoice was issued

- When the payment term is ‘Net 30 EOM’, it means that the customer has 30 days after the end of the month to pay back an invoice.

- A “2/10 Net 30” means that if the client pays back within 10 days, they get a 2% discount.

- Advantages of net 30 include:

- Offers an incentive to buy, and attracts new clientele

- Discounts encourage early payments

- It can help you remain competitive in the market

- Builds trust and great relationships with customers

- For small businesses with very few clients, and not many sources of income, net 30 can be a risky decision.

Related Articles

![Difference Between an Invoice vs a Receipt [with Examples]](/blog/content/images/2021/01/invoice-vs-receipt.jpg)