Establishing a startup can be overwhelming work. And as a founder, you probably don’t have time to worry about sending invoices or balancing the books. However, it’s still crucial to have some general knowledge of the fundamentals of accounting.

Establishing a startup can be overwhelming work. And as a founder, you probably don’t have time to worry about sending invoices or balancing the books.

However, it’s still crucial to have some general knowledge of the fundamentals of accounting.

After all, no matter how great an idea is, it won’t launch without proper financing. The hard truth is that almost 30% of newborn businesses fail due to burning up all their money before breaking even.

Don’t worry, though! To ensure your startup is profitable, all you need is a solid understanding of the accounting basics. Which is why we created this guide.

Even if you decide to hire an accountant to do the job, it’s still valuable to know the principles upon which accounting works. It’ll help you run your business more efficiently.

In this guide, we’re going to cover everything you need to know in order to do accounting for your startup:

- What Is Accounting for Startups?

- Accounting Essentials You Should Know

- How to Streamline Accounting For Your Startup

- 10+ Essential Startup Accounting Tips

- Accounting for Startups FAQ

What Is Accounting for Startups?

Accounting for startups involves tracking the inflows and outflows of cash and summarizing this data into financial statements that can, later on, be used to analyze the business’ performance.

Now, don’t confuse bookkeeping with accounting.

Bookkeeping is the actual process of recording all of your business transactions. It doesn’t involve a lot of analytical work, in contrast to accounting, which focuses more on the in-depth financial evaluation of the business.

As a startup founder, some of the most common financial activities you’ll have to deal with are:

- Daily bookkeeping. This involves tasks like processing payments, making journal entries, creating financial reports, and so on.

- Creating & sending invoices to clients.

- Checking payables and receivables to make sure clients are transferring payments on time.

- Making sure cash flow is able to meet upcoming expenses.

- Calculating tax liabilities and filing for tax returns.

There’s a lot of documentation that goes into each one of the tasks above. Tracking and documenting the above could be done manually (on spreadsheets and physical folders) or through automated accounting software.

We don’t recommend the manual method, though. The accounting process is long and complex, so writing everything down by hand (or typing it) isn’t convenient unless you’re running a very small business. It can be time-consuming, tiring, and leaves plenty of room for accounting errors.

That’s why business owners usually invest in accounting software and automate most of the accounting cycle steps.

Before jumping into the nits and grits of how you can automate accounting for your startup, let’s go over some of the most common accounting terms and concepts you need to know as a startup owner.

Accounting Essentials You Should Know

The Accounting Equation

Whether it is the largest international corporation or your local barbershop, all businesses base their financial position on the same principle. This principle is known as the accounting equation.

The accounting equation shows the relationship between three main entities of your startup:

Assets, Liabilities, and Equity.

Assets are the resources, equipment, cash your startup owns.

Liabilities are the wages, debts, taxes your startup owes.

The owner’s equity is what’s left after you subtract liabilities from assets

So, the accounting equation looks like this:

Assets = Liabilities + Owners Equity

When a business keeps correct recordings of their transactions, the accounting equation always balances. Meaning, the left side always equals the right.

Double-entry bookkeeping

Now, how does the accounting equation always balance? Through an accounting method called double-entry bookkeeping.

In double-entry bookkeeping, every transaction affects two accounts, meaning two entries are made. One account is debited, and the other credited. This mechanism keeps the equation balanced.

What are debits and credits, specifically? They are words that describe whether cash is going in, or out of an account. Debits record money flowing in, while credits the opposite.

Here’s a table that compiles everything you need to understand about the relationship between debits and credits for each account:

Chart of Accounts

The chart of accounts is a listing of all the different types of accounts. This is an organizational tool needed so you can create clear and correct financial statements.

Now, each business has its own specific chart of accounts, based on their financial activity. However, we divide these accounts into 5 main types:

- Assets are the resources, equipment, cash your startup owns.

- Liabilities are the wages, debts, taxes your startup owes.

- The owner’s equity is what’s left after we differentiate assets and liabilities (as previously mentioned in the accounting equation section)

- Revenue is what the startup makes from sales or other activities.

- Expenses are the costs of operating the business.

In the table below, you’ll find the majority of accounts used by businesses (with their respective types), that might come in handy when doing accounting for your startup. Highlighted in blue, are the 8 most necessary accounts every business needs.

Ethics In Accounting

Just like a doctor treats a patient’s illness based on certain rules, an accountant follows standards when creating financial statements as well.

These standards are called GAAP (Generally Accepted Accounting Principles) and contain sets of rules on how to report economic events.

For instance, the principle of non-compensation states that all features of a business’ performance have to be reported, whether they’re good or bad.

This, along with the other collection of rules in GAAP are all mandatory to follow because they ensure accurate and ethical financial reporting.

The Four Core Accounting Reports for a Startup

Recording entries and dividing them into accounts is only the starting point of the accounting process.

This data needs to get organized into something more useful for the investors, creditors, and analysts interested in the startup’s performance. That’s why we make financial statements.

Also, financial statements are required by law (from GAAP specifically), for transparency and convenience reasons.

Here are the four main reports you’ll need to put together for your startup.

Balance Sheet

The balance sheet represents assets, liabilities, and equity at a particular date. This financial statement is unique in that it reports information for a specific day, not for an extended period of time (a month, a year).

The balance sheet is based upon the accounting equation, which we explained above:

Assets = Liabilities + Owner’s Equity.

For that reason, the statement is divided into two sections (left and right) as shown below:

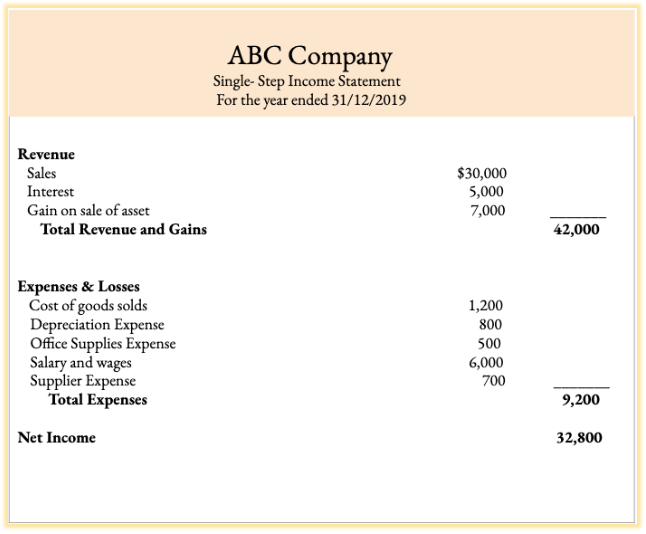

Income Statement

The income statement (also known as the profit and loss statement) reveals how financially successful your startup has been for a period of time.

This report differentiates revenues and expenses in order to see how much net income has been generated. That in turn, allows you to analyze how well your startup performed during that time period.

Here’s what an income statement looks like:

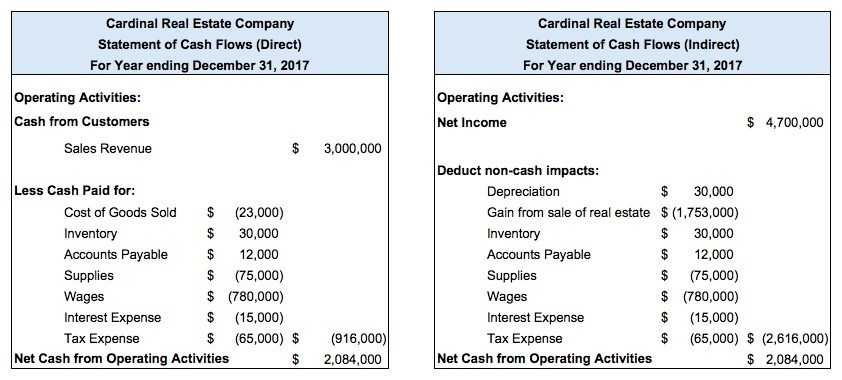

Cash Flow

The cash flow statement records money entering and leaving the business. It’s a complementary document to the income statement and balance sheet.

The three main components of the cash flow statement are:

- Operating activities such as sale receipts, income tax payments, interest payments, salary payments, and more.

- Financing activities such as loans from banks, payment of dividends, sale of treasury stock, and so on.

- Investing activities such as the purchase of buildings, land, bonds, etc.

Here’s what a cash flow statement typically looks like:

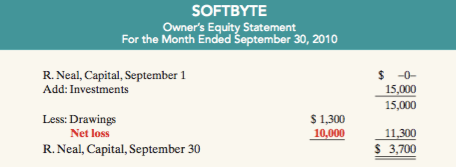

Statement of Owner’s Equity

The owner’s equity statement (also known as the statement of retained earnings) is a sum of the owner’s investments and withdrawals, as well as the business’s income and expenses.

So, essentially, this statement shows you how much your capital has changed, due to these four factors.

For small startups, it’s not a necessary step, however. The owner’s equity is usually used by huge corporations to make decisions on dividend disbursements, company evaluations, and so on.

Here’s what a statement of owner’s equity looks like:

How to Streamline Accounting For Your Startup

Choose Your Business Entity

One of the first steps in establishing a startup is figuring out what business structure you’re going to use. This decision will determine how much taxes you’ll pay, your financial liabilities, and more.

If you’ve already decided on a business entity, great!

In case you haven’t, there are 5 main types you can choose from. Here’s a table of their pros and cons to help you decide what’s right for your startup:

Open a Business Bank Account

Once you have selected the type of business entity your startup will be, you need to open a business bank account. This ensures that your startups’ money won’t get mixed up with your personal finances.

You’ll look more professional to clients, keep track of the business’s performance better, and ease the tax filing process.

Choose an Accounting System

Your capacity to organize your finances can decide whether the business succeeds or fails in the market. But let’s face it, accounting can be a wearying process, and running a startup is hard enough as it is.

That’s why it’s best to streamline your accounting with a practical and easy-to-use system.

Nowadays, there are three main accounting systems you can choose for your startup:

Manual Systems

Using a manual system means recording transactions and putting together financial statements by hand (in books, paper, or spreadsheets).

This is typically an outdated method.

Manually recording your data can be time-consuming, tiring, and it leaves a lot of room for error. Also, your documents could potentially get lost, stolen, or damaged if not kept carefully.

Automated Accounting Systems

Accounting software automates almost every part of your accounting process, saving you time and preventing any errors. You can make journal entries, pay bills, schedule invoices, create financial statements, and so much more. And everything is in one place, only a click away, for you to easily manage and review.

ERP (Enterprise Resource Planning)

This type of software is mostly used by huge corporations that need a system to bind their departments together. It’s a useful but incredibly costly tool that requires over $10,000 a month to maintain.

Now, you might be asking yourself. Is there a scenario where it’s best to go for manual systems rather than automated ones?

Well, manual systems are an okay choice when doing accounting for a small businesses with few financial transactions taking place. If your startup won’t deal with inventory and only needs a simple system for recording money flowing in and out, spreadsheets will do.

For any other business size, however, online accounting software is a way more suitable option. And one of the best accounting software for startups is Deskera.

Deskera is a cloud-based, easy to use accounting software that integrates directly with your business bank account. You can access your financial data at any time of the day, from any device, just by downloading the Deskera mobile app.

Decide on an Accounting Method

There are two main methods through which business transactions are recorded: accrual-accounting and cash-accounting.

Now, how do these two differ?

Well, the accrual method recognizes money right when you make an expense, or bill your clients. This means, transactions get recorded the moment they happen, whether or not payments have been made.

You should go for accrual-accounting, if:

- You are serious about your business growth

- Your startup deals with inventory.

- You want to analyze financial performance and find new ways to improve the business.

- You want clear and accurate record-keeping.

Also note that if your startup starts to make more than $5 million a year, you’re legally required to do accrual accounting (as stated in GAAP).

Cash-accounting, on the other hand, records money the moment it’s paid or received.

This is the method for you, if:

- Your startup is very small.

- You can’t employ an accountant.

- You don’t deal with inventory.

- Your transactions are all handled in cash, and there aren’t any sales or investments done on credit.

Keep Track of All Your Expenses

The first step in recording every expense is knowing what qualifies as an expense. Here’s a list of some of the most common business expenses:

- Wages or salaries made to employees

- Training program fees

- Equipment and supply purchases

- Insurance fee

- Interest payments

- Maintenance costs

- Software license purchases

- Rent

Now that you know what to consider as an expense, here are a few tips on how you track them correctly:

- When manually recording, store every receipt in an organized file folder or binder.

- If you’re using software, then just keep digital copies of your receipts.

- Although the IRS declares that a receipt under $75 doesn’t have to be tracked, it’s good to hold on to every receipt, without exception.

Make Journal Entries

Journal entries are the very first recordings of the financial transactions of your startup.

They’re posted into what’s known as the General Ledger, which is the business book that summarizes every transaction made.

Now, journal entries follow the double-entry bookkeeping method we previously explained.

What gets included in a journal entry? Usually, the six following elements:

- A reference number, unique for every transaction.

- Date of the journal entry, the date when the entry gets recorded

- Accounts, names of the accounts affected

- Debit, the amount that was debited

- Credit, the amount that was credited

- Journal entry explanation, which describes the characteristics of the journal entry.

Example of a Journal Entry

To understand journal entries better, let’s take an example.

Say you paid your monthly rent expense of $300 on October 13th.

In this example, the accounts affected will be the rent expense account and cash account.

Since debits increase expenses, Rent Expense will be debited for $300. And since credits decrease assets, Cash will be credited for $300.

Here’s what the journal entry would look like:

PRO TIP

Use accounting software like Deskera, to automate journal entries. Our software allows you to directly integrate your bank accounts and credit cards, so whenever an expense occurs, it is automatically recorded as a transaction.

This way, you won’t have to worry about manually creating each journal entry or posting it to the correct ledger account.

Prepare Payroll

Employees are your startups’ most valuable assets.

And as the owner, you’ll have to handle their payroll. You might be thinking, how hard can paying your workers be, right?

Well, the truth is, the process is a bit of a chore. There are tons of administrative and tax-related regulations you must learn and comply with.

Here are the steps you need to follow to set up payroll:

1. Review laws on minimum wage and overtime work. You can find this information on the Department of Labor website or your state’s website.

2. Apply for an EIN (employer identification number). This number recognizes you as a taxpayer as well as an employer. Applying is free of charge and can be one online, through fax, email, or phone. On the IRS site you can find out more details on how to apply for an EIN.

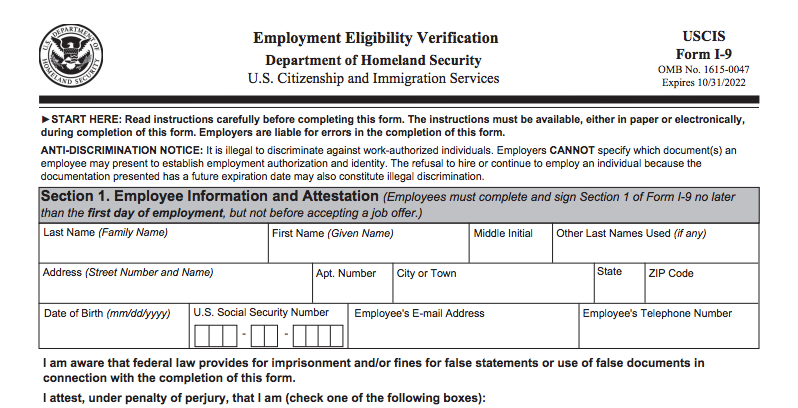

3. Collect I-9 Forms from every employee. Issued by Immigration Services, this form serves as legal proof of employees’ work status. Meaning, it proves that your employees have the legal ability to work in the US.

4. Enroll in the Electronic Federal Taxpayer Payment System (EFTPS). This is a free online system you can use to pay your payroll taxes. You have to make these employer tax payments every time you give your employees their wages.

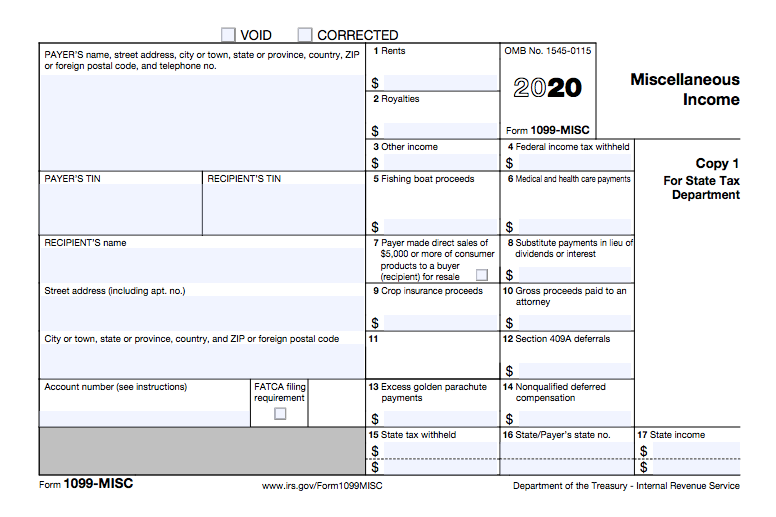

5. Keep a record of the names, addresses, and how much you are spending on each independent contractor. US businesses have to file a 1099 form at the end of each year, for every independent contractor. You can find blank 1099 forms and related instructions on the IRS website.

Employee Fringe Benefits

Employee benefits help you attract and keep your workers satisfied. They vary depending on how much the business is able to afford these bonuses.

Some of the most common employee benefits are:

- Health insurance

- Dental insurance

- Disability insurance

- Vacation

- Sick leave

- Retirement plan

- Flexible hours (working from home)

Learn the Different Types of Employment Taxes

Employment Taxes

- Federal Withholding Taxes is the amount withheld directly from the employee’s wage and paid based on earnings. IRS provides a tool employees can use to calculate their tax withholding.

- Social Security and Medicare Taxes fund Social Security and Medicare programs, which provide benefits for people who have retired and/or are disabled. You can find the exact rates of both taxes on the IRS website.

- Local Withholding Taxes is the tax you’ll have to pay based on the city where your startup is located.

Unemployment Taxes

The FUTA (Federal Unemployment Tax Act) grants compensation to employees who have lost their previous jobs by taxing you, the employer.

There are three main types of unemployment taxes:

- Federal Unemployment Tax is paid to the IRS every three months.

- State Unemployment Tax is paid to the state tax department quarterly.

- Worker’s Compensation Insurance covers any injuries that may occur at work.

Does all of the above sound a bit overwhelming?

Luckily, accounting software like Deskera can automate your tax calculation for you.

Through our inbuilt tax calculation functions and easy-to-use dashboard, you’ll be making employee payrolls with your eyes shut.

Choose a Method of Payment

As a business owner, you can either get paid offline or online.

Offline payments are done by receiving up-front cash or checks. Online payments refer to eWallets, credit cards, online bank payments, or payment gateways.

Nowadays, most businesses are switching from traditional offline payments to online ones.

Why the change?

Well, there are numerous advantages to online payments, cash and checks don’t provide. These include:

- Quick and easy to use

- Convenience in transferring large amounts of cash

- Lower fees

- Simplicity in tracking the cash

- Get payments from customers from all over the globe

If you’re looking for credit and debit card payments, you can use Paypal or Stripe as providers. They are both top of the market options that guarantee safety, ease in use, and trustworthiness.

The only downside with these systems is their high fees, which go up to around 3% for every transaction.

If you are running a Shopify store, you can use Shopify’s integrated payment provider called Shopify Payments.

Raising Money for Business Growth

Launching your own business requires a lot of money, and it’s likely that the need to borrow will eventually rise. After all, there are very few bootstrapped startups that make it to the top.

Now, there are a number of ways for a business to raise funds, some more reliable than others.

One option would be to get a loan directly from the bank. However, if you’re at the early stages of the business, chances are that won’t be easy. Banks require a lot of documentation proving the business is worth the investment, and that you’ll be able to repay.

So, your best bet as a small startup owner would be borrowing from a close circle of friends and family or investing your own money.

Whatever the source of the borrowed money is, you’re obligated to create a legal promissory note. The note ensures the second party you’ll pay back the lent money under specific conditions (decided by you and the lender).

Other funding alternatives include peer-to-peer lending, angel investors, or crowdfunding.

Build Business Credit

If you’re new to the business world, building credit might seem complicated. Truth is, it only takes some preparation and forethought. And the sooner you start, the faster the credit builds.

Here are some steps to follow to build business credit:

1. Maintain good relations with vendors and suppliers. As your allies in business, vendors and suppliers majorly affect the success of your startup. The better your relationship with them, the more likely it is you won’t have to pay upfront for goods and services.

Aim for a line of credit or payment terms like net-30 or net-60, to establish a positive business credit history.

2. Get a business credit card. Especially if you own an e-commerce business or a dropshipping store, you have to get a business credit card. You can use the credit card to pay for things like inventory or any other business expenses.

The only thing you need to keep in mind, is to make sure to repay everything on time!

3. Keep up your personal credits just as carefully. When you loan money from banks, they care about your personal credit score just as much as the businesses. Don’t forget to take care of your personal credit card repayments on time.

And, we’re done!

These are the 11 steps you have to follow to successfully streamline accounting for your startup.

Finally, here are 10 essential tips to keep in mind when doing accounting for your startup:

10+ Essential Startup Accounting Tips

- Learn the laws that apply to your business type, especially tax regulations. Not following them correctly can have severe penalties on the startup.

- Set reminders for tax deadlines, so you have enough time to fill in the tax returns.

- Separate your business and personal expenses. Open a business checking account and business card, instead of using a personal one.

- Get cloud-based accounting software like Deskera to automate the process.

- Create and stick to budgets, to know exactly where your cash goes.

- Set financial goals and regularly analyze whether you’re on the right track towards them.

- Keep and hold on to all of your receipts and invoices. Even the ones under $75! Keeping copies of transactions helps you balance your books more easily.

- Don’t pay any personal expenses with your business checking account. It will be recorded in your accounting as an owner’s withdrawal.

- Create a separate folder specifically for any legal agreements or financial statements of the startup (such as contracts, receipts, invoices).

- Get a TIN (taxpayer identification number). With one, you won’t have to use your Social Security Number when asked for verification.

Finally, below, we’ve answered some frequently asked accounting questions that business owners have.

If you have any other unanswered questions, feel free to let us know in the comment section below.

Accounting for Startups FAQ

Should I hire an accountant for my startup?

No, hiring an accountant isn’t necessary in order to do your finances. You can automate most of your accounting process using accounting software for considerably cheaper.

There are some cases you may consider consulting with one, however:

- When the startup has to deal with the government.

- When you get audited.

- When you’re ready to delegate.

- When the startup is rapidly growing.

How much does an accountant cause for a startup?

The cost of an accountant depends on many factors like the size of the business or experience of the accountant. However, based on US Labor Statistics, for an in-house US accountant, you’ll be paying an annual average of $70,000. As for the hourly charge, it varies between $150-$400+.

Even outsourcing your startups’ accounting to a contractor or firm, will cost you thousands of dollars a month.

The good news: you can use online accounting software instead, for as little as $9 per month.

What is the best accounting software for a startup?

There are many alternatives out there, but the best all-inclusive accounting software for your startup is Deskera.

Deskera is a cloud-based, affordable accounting application, you can access from any device with an internet connection. It integrates directly with your bank accounts and automatically tracks any expenses or payments made. Without you having to lift a finger!

Other features include late payment reminders, invoice creation, advanced inventory management, and so much more.

Still not convinced? Try Deskera out yourself, with our completely free trial.

Key Takeaways

And you’ve finally made it to the end!

We know it was a long guide, so here’s a recap of the main points to remember:

- Accounting for startups tracks money flowing in and out of the business. This data is then put together into financial statements used to analyze and improve performance.

- The essentials terms of accounting you need to know as a business owner are:

- The accounting equation, where assets equal liabilities plus owner’s equity.

- Double-entry bookkeeping where each transaction affects two accounts (one is debited, the other credited).

- Five main types of accounts are assets, liabilities, owner’s equity, revenues, expenses.

- Generally Accepted Accounting Principles (GAAP) are sets of rules that dictate how finances get reported.

- The four most important financial statements are the balance sheet, the income statement, the cash flow statement and the owner’s equity statement.

- And to wrap it up, the steps to follow in order to streamline accounting for your startup:

- Step 1 - Choose your business entity

- Step 2 - Open a business bank account

- Step 3 - Choose an accounting system

- Step 4 - Decide on an accounting method

- Step 5 - Keep track of all of your expenses

- Step 6 - Make journal entries

- Step 7 - Prepare payroll

- Step 8 - Learn the different types of employment taxes

- Step 9 - Choose a method of payment

- Step 10 - Raise money for business growth

- Step 11 - Build business credit

Related Articles