No matter how hard you work to provide the best service for your clients, there will always be times they won’t meet the payment due date.

And as a small business owner, it’s your job to chase after these past due invoices in order to keep your cash flow healthy.

We know that asking for money twice can be uncomfortable, but thankfully there are ways to make the process painless and encourage your customers to pay back quickly.

That’s exactly what we will be covering in this guide.

Read on to learn:

- What Is a Past Due Invoice?

- How to Deal with Past Due Invoices

- 3 Easy Ways to Prevent Late Payments

- Automate Invoicing with Accounting Software

- Past Due Invoice FAQ

What Is a Past Due Invoice?

Every invoice has specific payment terms, that dictate how much time the buyer has to pay back the seller for products or services they’ve purchased. When payment is late as of these terms, the invoice is recognized as a past due invoice.

In simpler terms, a past due invoice is just a label placed on a regular sales invoice when the buyer doesn’t pay back on time.

Pro-tip

If you use an invoice management system, late invoices will automatically mark as Past Due, and you’ll get a notification of the overdue payment right away. This way, you’ll save yourself the time and headache of manually chasing after stacks of invoice papers, and avoid missing any late payments altogether.

The Difference Between an Outstanding and Past Due Invoice

You may hear the words “outstanding invoice” and “past due invoice” used interchangeably, but in fact, these terms have somewhat different meanings.

An outstanding invoice means that the buyer has yet to pay, but his payment due date hasn’t come yet.

A past due invoice, on the other hand, means the buyer hasn’t paid and at the same time, has passed his payment term.

So basically, an outstanding invoice turns into a past due one, when the payment due date passes.

Want to learn more about the different types of invoices for your small business? Head over to our guide on invoice types.

How to Deal with Past Due Invoices [Step-by-Step]

The most common approach to dealing with a past due invoice is sending a reminder to the client through a professional email. In cases when these polite notices don’t work, and it’s obvious the buyer isn’t going to pay you back, it could be time to take legal action.

Let’s check out in detail when exactly these methods are an appropriate solution, along with everything else you need to know about handling late payments.

1. Make Sure You’ve Issued the Invoice Properly

Before taking any action to try and recover the payment, double-check the invoice to make sure you’ve sent it to the right recipient, and that it contains the correct details.

Watch out for any inconsistencies in the postal or email address (depending on the method you used to send the invoice), as well as the payment due date, in case you’ve written down the wrong credit term.

If an issue of this sort arises, send a short apology note or give the buyer a call explaining the problem. Then, fix the issue by resending the invoice in the correct form.

2. Send the First Past Due Invoice Email

You’re probably wondering: how long should I wait before sending a past due invoice email?

Well, generally, it’s best to send a reminder right after you’ve confirmed that there are no issues with the billing process. This is particularly necessary when you’re dealing with a client who has a track record of paying late.

If you’re dealing with a new customer or one that regularly pays back on time, consider giving them some space by waiting around 2-3 days.

Now, let’s move on to the actual contents of the email.

For this email, make sure to keep it friendly. It’s important you don’t hurt the relationship over rude language, because most probably all the customer needs is a short and nice reminder.

The main elements of this email include:

- A clear subject line stating the invoice number, with a short description of what the email will be about.

- A friendly opening.

- Email body detailing the issue, invoice details, a polite request for payment, and any late payment fees (depending on the terms).

- An attached copy of the original invoice.

Here are two examples of how a past due invoice email should look like:

Example 1

Subject: Payment Reminder for Invoice Number XXXXX

Hi [Client Name],

I hope everything is well!

I’m writing to let you know that we’ve yet to receive your payment on [invoice number], for [invoice total amount], which was due on [due date]. A late payment fee of [fee amount], was added to the previous invoice, changing the new invoice total to [new amount].

If you have any questions, please let me know.

Best regards,

[Your Name].

Example 2

Subject: Past Due Reminder for Invoice Number YYYYY

Hello [Client Name],

Hope everything is going great on your end.

I’m following up on the invoice submitted on [billing date], for [total amount], which is now past due for [number of days]. You can find a copy of the original invoice attached.

Could you let us know when we can expect payment?

Please get back to us at your earliest convenience.

Kind regards,

[Your Name].

If you don’t get a response back within 24 hours, give the client a call to talk face-to-face about the reasons why payment isn’t being made. Maybe their email isn’t working (or they haven’t checked it), and the issue can be resolved through the phone.

If they pick up, remember to keep your language friendly, just like you did with the email.

Focus on touching these three main questions:

- Did you get hold of my last email about the past due invoice?

- Do you have any concerns or issues about the invoice?

- When do you think you will be able to make the payment?

Depending on their response, you could then work on setting up a payment schedule to receive the money in partial payments, or even accept the return of products, if they can’t pay you back at all.

Tip

Always make records of your communication with the customer (both by email and phone). Write down who you’ve talked to, when, and what was discussed. This will be useful in the future if you decide to make matters legal.

3. Send a Second Past Due Email Reminder

If the client doesn’t respond to your phone call and the invoice is more than two weeks overdue, you can try sending a second reminder email.

This time around, be more straightforward and express the urgency behind the matter of receiving the payment.

Include all of the elements from the previous email, along with any new late fees.

Here’s a sample of a two weeks overdue email:

Hi [Client Name],

I wanted to follow-up on my previous email sent on [date of the first email] regarding the outstanding invoice [invoice number], that was due on [invoice due date].

As outlined on the payment terms we agreed upon in our contract, I am now entitled to charge you a late payment fee of [amount].

The total amount of payables as of today is [total amount of the invoice with the late fee].

Please pay in full immediately, to avoid any further action.

Sincerely,

[Your name].

If after all these emails, the client decides not to pay up, you can look into mediation as an alternative approach to taking legal action. After all, no one wants to waste time and money on lawyers.

4. Mediation

A good settlement approach to consider if past due notices don’t work is mediation.

Mediation is a structured, interactive process that gives room to you as a business owner, and the client to discuss the problem, led by a trained specialist of the field. You can discuss any miscommunication issues, and address any other concerns that might have led to the situation.

This approach is way cheaper than going through any legal proceedings.

5. Take Legal Actions for Debt Recovery

Taking legal steps, like going to a small claims court, depends widely on the overall amount of the overdue invoice. Bringing charges against a client can be a very costly and prolonged procedure, so it may not always be worth the effort.

So, before rushing into legal action, confirm the decision with a lawyer to make sure it’s beneficial, as well as to get a general idea of the overall process.

With that being said, there are three main legal options you can choose from, for debt recovery.

1. Arbitration

Arbitration is a resolution method that avoids the court, by using an arbitrator to settle the issue. An arbitrator is an outside third party, who reviews the evidence, listens to both parties, and makes a decision.

This method is convenient if you want a quick decision that’s less costly than taking the case to court.

2. Small Claims Court

Small claim courts deal with hearing civil cases related to private conflicts that don’t involve large amounts of money. In fact, depending on where the business is located, there are cash limits to every US state, on how much can be settled in a small claim court.

For example, California and New York process claims up to $10,000, while Vermont and Virginia have a limit of $5,000. You can check the exact limit for your state on the chart of small claims court dollar limits for any state.

Usually, you won’t need any legal representation to go to a small claims court, but it’s best to still seek some advice from a lawyer before proceeding.

3. Superior Court

And lastly, if the invoice amount exceeds that of the small claims court limit, you can sue the client in a superior court.

This isn’t a very common approach, though, since most disputes are usually settled outside of court.

3 Easy Ways to Prevent Late Payments

As we’ve seen so far, handling late payments can be an overwhelming process. That’s why in this case, prevention is the best remedy.

Let’s check out some of the main strategies you can use to reduce past due invoices, that encourage clients to pay right on time.

1. Send a Payment Reminder in Advance

Do you have neglectful clients that never seem to pay you back in time? Well, in these situations, consider sending them an advance payment reminder to let them know earlier when an invoice is due.

Do this around a week, or a few days before the actual due date, by sending a short and friendly email.

Here’s an email example you can take into consideration:

Hey [Client Name],

How’s everything going? I hope you’re doing well.

Just wanted to verify that everything’s on track regarding invoice [invoice number], due on [due date]. Also, wanted to make sure you avoid the late payment fee of [fee charge], which sets in on [date].

I’ve included the attachment of the invoice if you want to give it a review. Let me know if any questions or issues arise.

Best regards,

[Your Name].

2. Establish Late Payments Fees

Late payment fees are used to encourage early payment and are always discussed prior to making the invoice.

The most common approach in small business accounting regarding late payment fees is 1,5% per month as of the due date. Still, you’re free to choose whatever fees benefit both you and the client best.

Keep in mind to not discuss any fees before doing thorough research on how much you’re legally allowed to charge, depending on your state.

3. Allow Different Payment Methods

When setting the payment terms, offer clients a variety of payment methods such as cash, check, credit card, ACH transfers, e-wallets, and so on. This prevents any cash transfer delays they might encounter.

Automate Invoicing with Accounting Software

Tired of manually chasing after past due invoices?

Use intuitive accounting software like Deskera to automate your entire invoicing process, and never miss a payment again!

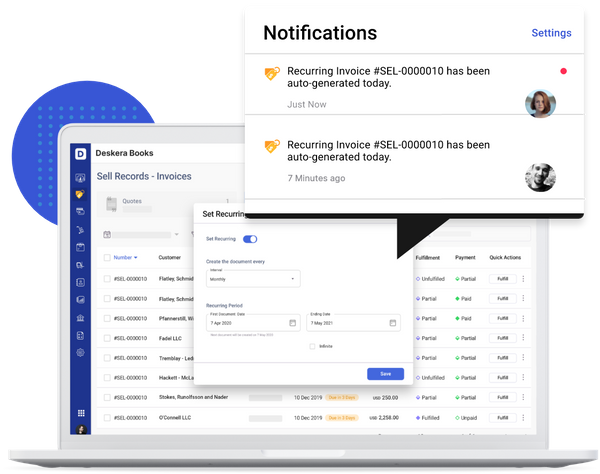

Deskera saves you the trouble of spotting late payments by sending automated reminders and notifications right when an invoice passes its due date.

The software also lets you set up recurring invoices and request advance deposits, so that you’re always on top of your invoices, due payments, bills, and expenses.

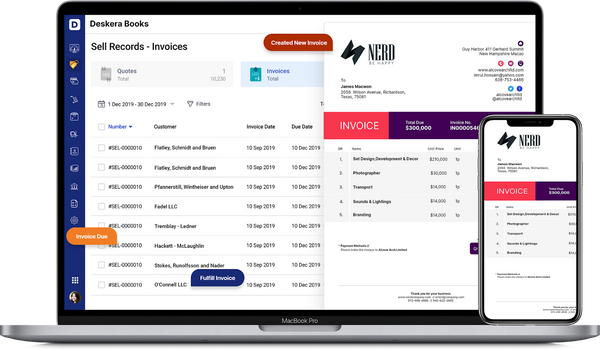

If you want to review your invoices and manage outstanding payments, you can head over to the Deskera Sell dashboard.

There, you can get access to all of the invoice details in one place, as well as create a new invoice from scratch, in just a few clicks!

The best part? You can access the software anywhere, anytime, from your mobile, tablet, or desktop by simply downloading the Deskera mobile app.

Not sure Deskera is the right choice for your business?

Well, luckily you can try the software out yourself, with our completely free trial.

Past Due Invoice FAQ

Is an Overdue Invoice the Same as a Past Due Invoice?

Generally, an overdue invoice and a past due invoice mean the same thing.

However, there is a slight distinction between the two.

A past due invoice refers to more recent invoices that are late for around a week or two, while overdue invoices relate to payments that haven’t been received for a longer period of time, such as 30 to 60 days.

Are Payment Terms and the Invoice Due Date the Same Thing?

No, payment terms and the invoice due date are two separate elements of an invoice.

The invoice due date specifies the exact date when an invoice is due.

While payment terms provide several details about the invoice such as:

- how much time the customer has to pay back (terms such as net-30, net-15, etc),

- any late fees, or early payment discounts, and

- what payment methods are available.

If you want to learn more about the elements of an invoice and how to create one from scratch, check out our guide on how to make an invoice.

Should I Always Take Legal Action for a Past Due Invoice?

Not necessarily, no.

Most of the time, you can get a solution through other means such as a reminder email, payment agenda, mediation, and so on, that don’t require legal action.

If the invoice is high in value, and the client refuses to pay you back, then yes - it’s appropriate for the case to be dealt with by a higher court.

Key Takeaways

And we’re done! We hope you found our guide to past due invoices useful, and that it helped you learn how to properly manage late invoice payments.

To recap, let’s quickly go through the main points we’ve covered:

- A past due invoice is a label placed on unpaid invoices that have passed their due date.

- The steps you should take to handle a past due invoice involve:

- Double-checking the invoice details for any inconsistencies

- Sending the first past due invoice reminder as an email, around 2 to 3 days after the due date. Keep the language friendly and attach a copy of the original invoice.

- If in the next 24 hours you don’t receive a response, give the client a call to find out why payment is late.

- After two weeks of no response, issue a second reminder email, with a more urgent and straightforward language.

- Consider mediation as a settlement approach.

- Take legal action, either through arbitration, the small claims court, or the superior court. Consult your lawyer for any of these three resolution methods.

- As precautionary measures to prevent late payments you can:

- Send a payment reminder in advance

- Establish late payment fees

- Allow different payment methods

- Use accounting software to automate invoicing, and never miss a payment.

Related Articles

![Difference Between an Invoice vs a Receipt [with Examples]](/blog/content/images/2021/01/invoice-vs-receipt.jpg)