The term "labor welfare" refers to all the services offered to workers to enhance their living standards, provide social security, and improve working circumstances. A law known as the Labor Welfare Fund Act was passed by several state legislatures and focuses solely on the welfare of workers.

All the guidelines mentioned in the Act aim at improving the lives of the workers. We shall be learning about the various ways in which the Act benefits the workers as well as the employers.

Here, we fill you in on every detail.

- What is the Labor Welfare Fund Act?

- How does the Labor Welfare Fund Act Benefit the Workers?

- How does the Labor Welfare Fund Act Benefit Employers?

- What is Kerala Labor Welfare Fund Act?

- The Kerala Labor Welfare Fund (Amendment) Act, 1986 (Act 1 Of 1987)

- The Kerala Labor Welfare Fund (Amendment) Act, 1994

- How can Deskera Help You?

- Key Takeaways

What is the Labor Welfare Fund Act?

Employers, employees, and in some states, the government also contributes to the Labor Welfare Fund. The welfare funds' primary goal is to give workers and their dependents access to basic necessities such as housing, healthcare, education, and recreational services.

For several states and Union Territories, separate Labor Welfare Fund Acts and Labor Welfare Fund Rules have been drafted.

How does Labor Welfare Fund Act Benefit the Workers?

The Labor Board manages the Labor Assistance Fund or the LWF, which offers a multitude of welfare programs for employees. The programs offer assistance in the following three major categories:

Raising living standards

This includes providing nutritious food, educational opportunities, and scholarships to the children of the employees. It also includes medical care for employees of the public and commercial sectors and their families and housing at discounted prices.

Providing improved working conditions

The Act also assists with providing workers and employees with amenities including transportation to work, reading rooms, libraries, and programs for vocational training. Besides these, it also takes care of their recreational activities by offering outings and tours, recreational space at the office, and so on.

Social Security

Coordinating and accessing medical care, providing supplementary jobs for women, and the people seeking employment are all included under Social security. The relevant State Labor Welfare Board determines the fund's size, contribution rate, and frequency. The payment may be made on a monthly basis, every six months, or once a year, and sent in the necessary form to the appropriate Labor Welfare Fund Board by the deadline established by the Act.

The states of Andhra Pradesh, Chandigarh, Chhattisgarh, Delhi, Goa, Gujarat, Haryana, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Tamil Nadu, Telangana, and West Bengal are currently the only ones where this Act is in effect.

How does Labor Welfare Fund Act Benefit the Employers?

We have had a look at the various ways in which the Act’s implementations are beneficial to the workers. However, the prescriptions in the Act ensure that it proves advantageous for employers, too.

The following points detail the various advantages the employers receive:

- The employers can have improved industrial relations.

- There is a visible enhancement in productivity and efficiency.

- The various factors aid in providing better mental and moral health for all.

- The prescriptions in the Act prioritize an improvement in the prospects for Employers.

- Finally, it also helps accomplish social benefits for the employers.

What is Kerala Labor Welfare Fund Act?

An act to establish a fund for promoting labor welfare and other related matters in the State of Kerala is known as the Kerala Labor Welfare Fund Rules.

Preamble

All instances where it is necessary to provide provisions for the establishment of a fund in the State of Kerala to advance labor welfare and address a number of related issues will be enacted in the Twenty-Sixth Year of the Republic of India, in the following manner:

1. Short Title, Extent, and Commencement

1) The Kerala Labor Welfare Fund Act, 1975, may be referred to as this Act.

2) It encompasses the entirety of Kerala State.

3) It shall take effect on the date specified by the Government in its notification.

The following sections shall take us through the various components of the Kera;a Labor Welfare Fund Act in depth.

The Act applies to the entire state of Kerala.

2. Important Definitions

Board refers to Kerala Labor Welfare Fund Board that has been established under section 4.

Commissioner refers to the officer or the Labor Welfare Fund Commissioner assigned under section 22.

Contribution is the amount payable to the Board as prescribed under the provisions of section 15.

An employee is any person hired to perform any kind of skilled, unskilled, manual, clerical, technical, or supervisory work in an establishment. The duration prescribed is the aggregate period of at least thirty days during the following twelve months. However, it does not include the people from the following category:

- An individual working as a manager

- An individual exercising the duties of an officer or functions as a manager

- an individual hired as an apprentice or on a part-time basis

An employee also implies any other individual working for any establishment who the government may designate as an employee for the purposes of this Act by publication in the Gazette.

An employer refers to a person who hires one or more employees in a business, either directly or indirectly through another person, on his or her own behalf, or on behalf of someone else. The definition of an employer also includes people in the following categories:

- Any individual designated as the manager of a factory pursuant to clause (f) of sub-section (1) of section 7 of the Factories Act of 1948 (Central Act 63 of 1948)

- Any individual answerable to the owner over the management of the staff or the payment of wages in any establishment

An establishment refers to any location that is regarded to be a factory under subsection (2) of section 85 of the Factories Act, 1948 (Central Act 63 of 1948), or a factory as described in clause (m) of section 2 of that Act;

- a vehicle transportation company as described in section 2 of the Motor Transport Workers Act, 1961 (Central Act 27 of 1961), clause (g);

- [(iii) any land used for tea, rubber, coffee, cardamom, palm oil, or cocoa farming on which at least 10 or more people are currently engaged or have been employed at any one time in the last 12 months;

- any business as defined by clauses (4) [or (15)] of section 2 of the Kerala shops and commercial Establishments Act, 1960 (34 of 1960), that employs, or on any working day within the previous twelve months employed two or more people;

- A commercial establishment must continue to operate as prescribed in the Act irrespective of the reduction in the number of persons to less than five.

- The commercial establishment will cease to be an establishment for the purposes of this Act with effect from the first of the month following the expiration of the said period of six months when the number of people employed there has been less than five for a continuous period of not less than six months. However, the employer shall inform the relevant authority within one month from the date of such cessation.

- An establishment that carries out any business related to the ancillary and employs more than twenty people on any working day during the preceding twelve months, but does not include an establishment of the central or state government. However, it includes a society registered under the Societies Registration Act, 1860 (Central Act 21 of 1860) or the Travancore-Cochin Literary, Scientific and Charitable Societies Registration Act, 1955 (XII of 1955).

- any other establishment that the Government may designate as an establishment for the purposes of this Act by publication in the Gazette;

"Fund" refers to the Labor Welfare Fund created in accordance with Section 3.

"Inspector" refers to an Inspector appointed in accordance with Section 24.

"prescribed" refers to something that is governed by regulations issued in accordance with this Act;

"State" refers to the State of Kerala.

"unpaid accumulation" refers to all amounts, excluding gratuity, due to an employee but unpaid within three years of the date on which they became due, whether before or after the passage of this Act. Gratuity accrued to an employee after the passage of this Act but unpaid within three years of the date of such accrual does not include the amount of contribution.

The term "wages" refers to the definition of wages found in clause (vi) of section 2 of the Payment of Wages Act, 1936. (Central Act 4 of 1936).

3. Labor Welfare Fund

1. The Government shall establish a fund known as the Labor Welfare Fund, and, notwithstanding anything contained in any other law currently in effect or in any contract or other instrument, all unpaid accumulations shall be paid to the Board at intervals as may be prescribed and credited to the Fund, and the Board shall maintain a separate account for such purpose until claims thereto have been resolved in accordance with section 13 of the Act.

2. The other credits to the Fund will be as follows:

a. accumulated outstanding amounts paid to the Board under section 13's subsection (2);

b. Irrespective of anything stated in any contract between the employer and employee, all fines, including the sum realized under [8]["Standing Order 17 of the Model Standing Orders issued under the Kerala Industrial Employment (Standing Orders) Rules, 1958"] from the employees by the employers;

c. deductions made in accordance with the central act 4 of 1936's Payment of Wages Act's proviso to subsection (2) of section 9;

d. Employer and Employee Contributions;

e. Interest Paid as a Penalty Under Section 14;

f. Voluntary Donations;

g. Amounts raised by the Board from other sources to Supplement Board Resources;

h. any money transferred under the provisions of Section 17's Subsection 6;

i. any money borrowed under Section 18;

j. any unclaimed money credited to the government in line with the provisions of Sections 4 of the Payment of Wages Act of 1936 and 11 of the Minimum Wages Act of 1948;

k. any grants or financial assistance provided by the federal, state, or municipal governments;

3. The amounts mentioned in subsection (2) must be paid to or collected by the agencies mentioned, at the times and in the ways specified, and the accounts of the Fund must be kept and audited in the ways provided.

4. Establishment of the Board

1. A board known as the "Kerala Labor Welfare Fund Board" shall be created with effect from the date that the Government may designate in this regard by an announcement in the Gazette.

2. The Board shall be a corporation with perpetual succession and a common seal, and it may be sued and sued under the aforementioned name.

5. Constitution of Board

1. The Board will be made up of the individuals listed below who have been appointed by the government:

a. It is possible to provide the following number of representatives for employers and employees:

Providing that the Board shall have equal representation for both employers and employees; and

b. the maximum permitted number of officials and non-officials.

2. The Chairman of the Board will be chosen by the Government from among its members.

3. The Board may include no more than twenty-five members, including the Chairman.

6. Appointment of Chairman and other members

The Chairman and the other Board members must be appointed, and this must be announced in the Gazette.

7. Term of Office of Members

The Board members who are not official members have three years from the date of their appointment to serve on the Board, and they are eligible for reappointment.

With the exception that a member may remain in such position until the appointment of his replacement.

8. Disqualification and removal

A person will not be allowed to be a member of the board in the following cases:

a. If they are an officer or a servant on the board

b. If they are undischarged insolvent

c. if they are not mentally sound

d. If they have been convicted of an offense or for a moral misdemeanor

e. If they have any arrears due to the Board

The government may also remove an officer in the following cases:

a. any of the disqualifications listed in subsection (1), or

b. misses more than three board meetings in a row without the board's permission.

9. Resignation of office by a member and filling up casual vacancies

Any member other than an official member has the right to resign from his position by giving written notice to the government. If his resignation is accepted, he will be assumed to have left his position.

(2) The Government may open up a casual vacancy in a member's office at the earliest to fill the vacancy and the new member will occupy the office for the remaining term of the member he replaces.

10. Power to appointment committees

1. In order to assist the Board in making decisions, and carrying out any of the matters, particularly in the performance of its duties Section 17's subsection (3), the Board may consist of one or more committees.

2. Each committee established pursuant to subsection (1) must include at least one board member.

11. Acts of Board or committee not to be invalidated by informality, vacancy, and so on

No action or course of action taken by the Board or any committee pursuant to this Act shall be invalidated solely because of the following reasons:

a. any vacancy or flaw in the Board's or committee's constitution; or

b. any flaw or irregularity in a person's appointment to serve as its member; or

c. any flaw or irregularity in such an act or proceeding that has no bearing on the case's merits.

12. Functions of the Board

The Board's responsibilities include managing the Fund and any other duties that may be delegated to it by or in accordance with this Act.

13. Unpaid Accumulations and claims

1. All accumulated outstanding debts are regarded as abandoned property;

2. Any unpaid accumulation paid to the Board in conformance with Section 3's provisions shall relieve an employer of his obligation to pay an employee in respect of such accumulation upon such payment. However, this is accepted only to the extent of the amount paid to the Board, and the obligation to pay the employee to the extent aforesaid shall, subject to the following provisions of this Section, be deemed to have been transferred to the Board.

3. Soon after the payment of an unpaid accumulation has been completed, the Board shall inform or notify the following by the means of the notice:

a. shown on the notice board of the business where the accrued unpaid debt was earned; and

b. Invite claims from employees, their heirs, legal representatives, or assigns for any payment owed to them by publishing the notice in the Gazette and in any other manner that may be prescribed.

4. For a period of three years following the date on which the unpaid accumulation was paid to the Board, the notice referred to in sub-section (3) shall be provided in the manner aforesaid in June and December of each year.

5. If there is any doubt as to whether the notice referred to in subsection (3) was issued in accordance with those subsections and subsection (4), the Board's certification that it was given in accordance with those subsections must be conclusive.

6. If a claim is received within four years of the date of the notice's initial publication, whether in response to the notices or otherwise, the Board shall transfer the claim to the authority designated under section 15 of the 1936 Payment of Wages Act (Central Act 4 of 1936) with jurisdiction over the region in which the establishment is located, and that authority shall proceed to consider and decide the claim.

7. The authority referred to in subsection (6) shall have the authority granted by the Payment of Wages Act, 1936 (Central Act 4 of 1936) and shall follow the procedure (insofar as it is applicable) in hearing any claim referred to in subsection (6).

8. If the aforementioned authority determines that any such claim is legitimate and that the employee has a right to compensation, it shall decide that the unpaid accumulation in relation to which the claim is made shall no longer be considered abandoned property and shall order the Board to pay the employee the full amount of the dues claimed, or the portion of the dues determined by the authority to be property due. The Board shall make payment in accordance with the authority's decision.

The Board is not required to pay any amount in excess of what was paid to the Board as unpaid accumulations in relation to the claim under subsection (1) of section 3.

9. If a claim for payment is denied, the employee or his heirs, legal representatives, or assigns, as the case may be, may prefer an appeal to the District Court within sixty days of the date of receipt of the authority's order.

10. The authority's judgment, which is appealable to the District Court, and the District Court's decision on the appeal are final and binding in terms of the right to receive payment, the Board's obligation to pay, and the amount.

11. The unpaid accumulations in respect of a claim will accrue to and vest in the State as bona vacantia and will then be deemed to have been transferred to and form part of the Fund if no claim is received within the time frame specified in the sub-section (6), a claim has been rejected by the authority, or a claim has been rejected on appeal by the District Court.

14. Interest on the employer's and employees' contributions, unpaid accumulations, or fines after notice of demand

1. The employee must contribute to the fund as the prescribed amount under Section 15. If an employee fails to do so, the commissioner may serve a notice to them to pay the amount in the stipulated time. The employee must remember to pay the amount in the period that should not exceed thirty days from the notice served.

2. If the employee fails to pay the amount specified in the notice, without a reasonable cause, they shall be penalized with an additional amount of simple interest of nine percent per annum from the specified date.

With the caveat that the Government may, under certain situations, remit all or a portion of the penalty with respect to any period.

15. Contribution to the Fund by employees and employers

1. Every employee must pay four rupees each half-year into the Fund, and every employer must pay [eight rupees] per half-year for each such employee.

2. Before the 15th of July and the 15th of January of each year, every employer must pay both the employer and employee contributions to the Fund.

3. The employee's contribution may be recovered from the employee by the employer by deduction from his wages or in any other manner that may be prescribed, regardless of any other law currently in effect. This deduction shall be deemed to be authorized by or under the Payment of Wages Act, 1936 (Central Act 4 of 1936).

16. Grant and advances by Government

For the purposes of this Act, the Government may from time to time issue grants or advance loans to the Board under the terms and conditions it deems appropriate in each individual case.

17. Vesting and application of Fund

1. The Board, acting as trustees, will receive, hold, and use the Fund in accordance with the terms of this Act.

2. The funds in the Fund must be used by the Board to cover the costs of implementing any actions that the Government may occasionally specify to advance the welfare of employees and their dependents.

3. Without limiting the generality of the requirements of such sections (1) and (2), the Board may use funds in the Fund to cover the costs associated with the following activities:

- Community centers and social education centers including libraries and reading rooms

- Sports and games

- Vocational education

- Community essentials

- Recreational activities and other forms of entertainment

- Houses for recovering TB patients

- vacation properties near health spas;

- Housewives of employees working part-time;

- Kindergartens and preschools

- Higher education

- Providing wholesome food to the kids of workers;

- job opportunities for employees with disabilities;

- Covering the expense of administering this Act, including the salaries and benefits of the staff hired to carry out its purposes; and

- Similar other items in the government's perspective that would raise living standards and enhance working conditions in society:

All these are applicable based on the following conditions:

With the exception that the Fund may not be used to finance any actions that the employer is compelled to do to comply with any current laws:

Furthermore, notwithstanding the provisions of the Payment of Wages Act, 1936 (Central Act 4 of 1936), or any other legislation or agreement currently in effect, the Board may use unpaid accumulations and fines in accordance with this Act.

4. The Board may, with the consent of the Government, give money from the Fund to any local government or other organization in support of any endeavor for the welfare of the workforce.

5. The Government must be consulted if there is any doubt about whether a specific expenditure is or is not debitable to the Fund. Also, the decision would be final.

6. If the said Fund is properly transferred to the Board, the Board may accept the transfer of any Labor Welfare Fund of any establishment and may continue any activity funded by said Fund.

18. Power to Board to borrow

The Board may occasionally borrow any amount necessary for the purposes of this Act with the prior approval of the Government, subject to the provisions of this Act and to such conditions as may be imposed in this regard.

19. Deposit of Fund and placing of accounts and audit report before State Legislature

1. With the prior approval of the Government, all funds and receipts belonging to the Fund must be deposited in the State Bank of India, which was established by the State Bank of India Act, 1955 (Central Act 23 of 1955). They can deposit the funds in any subsidiary bank as defined in clause (k) of section 2 of the State Bank of India (Subsidiary Banks) Act, 1959 (Central Act 38 of 1959). Alternatively, they can do so in any corresponding new bank as defined in the Banking Companies (Acquisition and Transfer of U.S. Securities Undertakings) Act, 1970 (Central

Act 5 of 1970), or in any District Co-operative Bank or in the Treasury Savings Bank. This account shall be managed by the Board officers who may be authorized by the Board and in accordance with any applicable regulations.

2. The Board must submit its annual accounts to the Government, with the auditor's certification, together with the audit report. The Government may provide the Board with directions regarding those accounts that they see fit. The Board must abide by such instructions.

3. The Government is required to have the Board's financial statements and the audit report on them that was provided to them in accordance with subsection (2) laid before the State's Legislative Assembly each year.

20. Investment of Fund

The Board shall (deposit the same in Government Treasuries or in nationalized banks or in scheduled banks or in district cooperative banks or) invest the same in any of the securities specified in clauses (a) to (d) and (f) of section 20 of the Indian Trusts Act, 1882 (Central Act 2 of 1882). This is true if the Fund or any portion thereof cannot be applied at an early date for carrying out any of the activities referred to in this Act.

21. Power of Government to give directions to Board

When it comes to using the Fund or carrying out the goals of this Act, the Government may provide the Board any instructions they deem necessary or advantageous, and the Board shall be required to abide by such instructions.

22. Appointment and powers of Commissioner

1. The Labor Welfare Fund Commissioner is the Chief Executive Officer of the Board and may be appointed by the Government by publication in the Gazette.

2. The Commissioner's terms of appointment and employment, as well as his or her pay scale, shall be as may be prescribed.

3. The Commissioner is responsible for ensuring that the provisions of this Act and the rules made under it are properly implemented. He has the authority to issue any orders that are not in conflict with those provisions or the rules, including any orders that implement the Board's decisions made per this Act or the rules made under it.

23. Finance Officer

1. A finance officer must be appointed to the Board by the government and published in the Gazette.

2. The Finance Officer must exercise all relevant authority and carry out all necessary tasks.

3. The Finance Officer's terms of employment and compensation are subject to any regulations that may be issued.

24. Inspectors

1. By publishing a notice in the Gazette, the Government may appoint any individuals they deem appropriate as Inspectors for this Act. The individuals must meet the necessary qualifications. The Government may also specify the geographic areas in which Inspectors must operate as well as the types of establishments that fall under their purview.

2. Within the local limits for which he is appointed, an Inspector shall have the authority to do any of the following things, subject to any rules enacted in this regard:

- to conduct the required investigation and assessment to determine whether the requirements of this Act have been and are being followed;

- demand the production of any prescribed register and any other records in the employer's control pertaining to amounts owed to the Fund;

- to enter any place at any moment that is appropriate with any helpers he deems necessary;

- to use any further powers that may be prescribed.

25. Appointment of Board’s Staff

1. In order to fulfill its obligations under this Act, the Board must appoint the requisite number of officers and other workers.

2. The officers and servants referred to in subsection (1) shall be subject to the terms of appointment and service and pay scales that may be imposed by rules made by the Board.

26. Power of Government and authorized officers to call for records

The Board's records may be requested, inspected, and the Board's operations may be under the control of the Government or any person designated by the Government in this regard.

27. Mode of recovery of sums payable to Board

Without limiting any other method of recovery, any amount payable under this Act to the Board or the Fund shall be recovered on behalf of the Board as an unpaid arrear of public revenue owed on land.

28. Penalty for obstructing Inspector or for failure to produce documents

Any person who willfully hinders an Inspector from exercising his or her authority or performing their duties under this Act or refuses to produce any registers, records, or other documents for inspection upon the Inspector's request or to supply him or her with true copies of any such document upon request shall, upon conviction, be punished.

- For the first offense, a period of imprisonment that may last up to three months, a fine that may be up to 500 rupees or both; and

- for a second or subsequent offense, with a period of imprisonment that may last up to six months, with a fine that may last up to $1,000, or with both:

- In any scenario when the offender is solely given a fine, the amount of the fine must not be less than fifty rupees in the absence of special and adequate grounds to the contrary, which must be indicated in the court's verdict.

28A Penalties for other offenses

1. Anyone who violates or fails to comply with any of the provisions of this Act or any rules or regulations made thereunder may be punished with imprisonment for a term that may not exceed six months, a fine that may not exceed 500 rupees, or both if there is no penalty specified in section 28 for such violation or failure to comply.

2. In addition to finding a person guilty under subsection (1) of failing to pay any amount owed to the Fund or the Board, the court must additionally order that the unpaid amount be recovered from the guilty party and paid to the Fund or the Board, as applicable.

29. Cognizance of offenses

1. No offense punishable under this Act [unless on a complaint submitted by an Inspector with the prior written consent of the Commissioner] shall be recognized by any court.

2. No offense punished by this Act shall be tried in a court lower than that of a Magistrate of the first class.

30. Offenses by companies

1. Every person who, at the time the offense was committed, was in control of and accountable to the company for the conduct of the company's business, as well as the company, shall be held to be guilty of the offense and shall be subject to being pursued and punished in accordance with the following:

Given that he can demonstrate that the offense was committed without his knowledge or that he took all reasonable precautions to prevent its occurrence, nothing in this paragraph will subject him to any punishment specified in this Act.

2. When a company violates this Act and it is established that the violation was carried out with the knowledge or consent of, or as a result of any neglect on the part of, any director, manager, secretary, or other officers of the company, despite anything in subsection (1), such director, manager, secretary, or other officers shall also be deemed to have violated this Act and shall be subject to legal action and punishment.

Explanation: To better understand this section, we shall consider the following:

- A ‘company’ refers to a legal entity, which includes a firm or other type of association of people.

- A partner in a firm is referred to as a "director" in relation to the firm.

31. Limitation of Prosecution

No court shall take cognizance of an offense punishable by or pursuant to this Act unless a complaint is lodged within one year of the day on which the Inspector becomes aware of the offense.

Provided, however, that no court shall realize an offense punishable by or under this Act beyond the passage of three years from the day on which the offense is alleged to have been committed.

32. Power to supervise welfare activities of establishment

The Board shall have the following authority with respect to any funds set aside in any establishment, especially for the purpose of enhancing the welfare of the employees in such business:

i. to demand the production of any document held by the establishment's employer in relation to money so as to confirm whether the money is being used for such purpose;

ii. to request from the employer any information it may think necessary; and

iii. to provide any employer the instructions it sees suitable in order to use the fund to advance the welfare of the employees.

33. Penalty for non-compliance with the direction of the Board

Any individual who willfully refuses to provide the Board with any information requested, any document it has requested, or any instruction it has issued under Section 32 will be punished upon conviction. The punishment can be as follows:

- For the first offense, a period of imprisonment that may last up to three months, a fine that may be up to 500 rupees or both; and

- For a second or consecutive offense, a period of imprisonment that may last up to six months, a fine that may be up to $1,000, or both:

If the offender receives a fine-only sentence, the fine amount must not be less than fifty rupees in the absence of unique and sufficient grounds to the contrary, which must be noted in the court's verdict.

34. Annual Report

The Board shall prepare and submit to the Government, as soon as possible after the end of each year, in a prescribed form, a report giving an account of its activities during the previous year and of the activities, which are likely to be undertaken by the Board in the following year. The Government shall present this report before the Legislative Assembly of the State as soon as possible after it receives it.

35. Supersession of Board

1. The Board may be replaced by the Government for a period of not more than six months if the Government determines that the Board is incapable of performing, has repeatedly defaulted in the performance of the responsibilities imposed on it by, or has exceeded or misused its powers.

As long as the Government gives the Board notice before issuing a notification under this subsection, the Board must provide justification for why it should not be superseded within the timeframe specified in the notice. The Government will then take those justifications and any objections into consideration.

2. Upon publication of a notice replacing the Board pursuant to subsection (1),

- All Board members must vacate from their positions as of the date of supersession;

- During the period of supersession, any authority or person that the Government may instruct shall exercise and perform all the rights and duties which may, by or under the provisions of this Act, be exercised or performed by or on behalf of the Board and the Chairman;

- During the time of supersession, all money and other property vested in the Board shall vest in the authority or individual referred to in subsection (b); and

- The authority or person referred to in subsection (b) shall be responsible for all liabilities that are legally enforceable against the Board to the extent of the funds and assets vested in such authority or person.

3. When the supersession time described in the notification made under subsection (1) expires, the Government may:

- extend the supersession term for an additional period of up to six months as they deem necessary; or

- reassemble the Board in accordance with the instructions in section 5's

36. Delegation of Powers

1. Except for the authority to adopt rules under Section 40, the Government may, by publication in the Gazette, grant any authority or officer the right to exercise any function conferred upon them by or under this Act. In a similar manner, the government may revoke this grant.

2. The Board may, by general or special order in writing, transfer to the Commissioner or another officer of the Board those of its powers and duties under this Act that it deems necessary, with the exception of the authority to make regulations under section 42. It may also revoke such a transfer in a similar manner.

3. Restrictions and conditions that may be listed in the order, as well as control and revision by the Government or by any officer that may be authorized by the Government in this regard or, as the case may be, by the Board or any officer that may be authorized by the Board in this regard, shall apply to the exercise of any power granted under subsections (1) or (2).

4. Additionally, any officer with the authority to act under subsection shall be subject to control and review by the Government or the Board, as applicable (3).

37. Public servants must serve as board members, commissioners, and inspectors

As defined under section 21 of the Indian Penal Code (Central) Act 45 of 1860, the members of the Board, the Commissioner, the Finance Officer, Inspectors, and all other officers and servants of the Board are all considered to be public servants for purposes of this Act.

38. Protection of action taken in good faith

1. No person will be subject to any suit, prosecution, or other legal action for anything done or intended to be done in good faith in accordance with this Act or any rule or order established under it.

2. The Government or the Board are not subject to any suit or other legal action for any harm done or likely to be done as a result of anything done or intended to be done in good faith in accordance with this Act or any rule or order made under it.

39. Exemption

Any establishment or class of establishments may be exempted by the Government by notification in the Gazette from all or some of the requirements of this Act, subject to the criteria that may be outlined in the notification.

40. Power to make rules

1. The Government may enact rules to carry out the provisions of this Act by publishing notices in the Gazette.

2. Specifically, and without limiting the scope of the aforementioned power, such rules may provide for the following:

- the intervals or time frame in which any of the amounts mentioned in section 3 must be paid to the Board or into the Fund, the method of payment, and the organization responsible for and method of collection of any such amount;

- Ways in which the Fund's finances will be kept up-to-date and subject to audits;

- any allowances that may be paid to the Board members;

- Ways in which the employee's contribution may be withdrawn from his pay;

- how notification of unpaid accumulations will be given;

- Process of making grants from the Fund;

- the process for covering the costs incurred in running the Fund;

- the way the Board will conduct its business;

- the circumstances and restrictions under which the Board's powers may be exercised or its responsibilities performed, as well as the delegation of the Board's duties to the Commissioner or another officer of the Board;

- the portion of the Fund's yearly income that the Board is not permitted to spend on personnel and other administrative costs;

- the registers and records that must be kept in accordance with this Act;

- the report of the activities funded by the Fund, as well as a summary of the Fund's receipts and expenditures and a statement of accounts, being published;

- Any other relevant issue that is prescribed.

41. Rules and notifications to be laid before the Legislative Assembly

Every rule made and every notification issued under this Act must be laid before the Legislative Assembly while it is in session for a total of fourteen days. The session may be divided into one session or two successive sessions. If, before the end of the session in which it is laid, or the session immediately after, the Legislative Assembly makes any modifications to the rule or notification or decides that it should no longer be in effect, the rule or notification must be re-filed with the Legislative Assembly. However, whatever was previously done in accordance with that regulation or notification shall remain effective despite any such modification or annulment.

42. Power to make regulations

1. To give effect to the provisions of this Act, the Board may, by publication in the Gazette, make regulations that are not in conflict with this Act and the rules made under it.

2. Specifically, and without limiting the scope of the aforementioned authority, such regulations may provide for the following:

- the quorum requirements and the procedure for conducting business at Board meetings;

- the conditions under which and how transitory associations of people may be formed;

- the responsibilities, functions, and terms and conditions of employment for committee members;

- how the Board's accounts are to be maintained, both in terms of form and in content;

- Anything else that must or may be governed by regulations.

3. No regulation, or its suspension or change, shall take effect without government approval.

4. Any regulation enacted under this section may be revoked by the Government by publication in the Gazette, at which point it will no longer be in force.

43. Amendment of section 8, Central Act 4 of 1936

In order for the Payment of Wages Act of 1936 (Central Act 4 of 1936) to apply to the State of Kerala, the following proviso must be included in subsection (8), before the Explanation:

- “Provided that in the case of any establishment to which the Kerala Labor Welfare Fund Act, 1975, applies all such relations shall be paid into the fund constituted under that Act.”

The Kerala Labor Welfare Fund (Amendment) Act, 1986 (Act 1 Of 1987)

This is an Act to bring about amendments to the Kerala Labor Welfare Fund Act, 1975. The Act has been implemented in the thirty-seventh year of the Republic of India and is as follows:

We shall be looking at the amendment Act briefly in this section.

This Act will be called the Kerala Labor Welfare Fund (Amendment) Act of 1986. Section 5 will be assumed to come into effect on January 1, 1983, and the remaining of the Act will be considered to come into effect on February 25, 1985.

Apart from this, there are various amendments in the Act pertaining to the different sections, that have been mildly modified. The amendments include changing the words in some of the sections and substituting them with the words or amount relevant to today’s date.

The Kerala Labor Welfare Fund (Amendment) Act, 1994

This Act further amends and brings out modifications to the Kerala Labor Welfare Fund Act, 1975. It has been enforced in the Forty-fifth year of the Republic of India with the following details:

1. Short title and commencement

This Act will be called Kerala Labor Welfare Fund (Amendment) Act, 1994.

2. Amendment of section 2

In section 2 of the Kerala Labor Welfare Fund Act, 1975 (11 of 1977), which is referred to as the principal Act here:

i. the words "draws wages exceeding two thousand and five hundred rupees per month or" shall be omitted in item (B) of sub-clause (i) of clause (d).

ii. The word “five” will be substituted by the word “two” in sub-clause (iv) of clause (f).

3. Amendment of section 15

The words "one rupee" and "two rupees" the words "four rupees" and "eight rupees" shall, respectively, be substituted in section 15 of the principal Act, in sub-section (1).

4. Amendment of section 20

This pertains to section 20 of the principal Act, after the words "the Board shall" and before the words "invest the same", the words "deposit the same in Government Treasuries or in nationalized banks or in scheduled banks or in-district cooperative bank or " shall be inserted.

How can Deskera Help You?

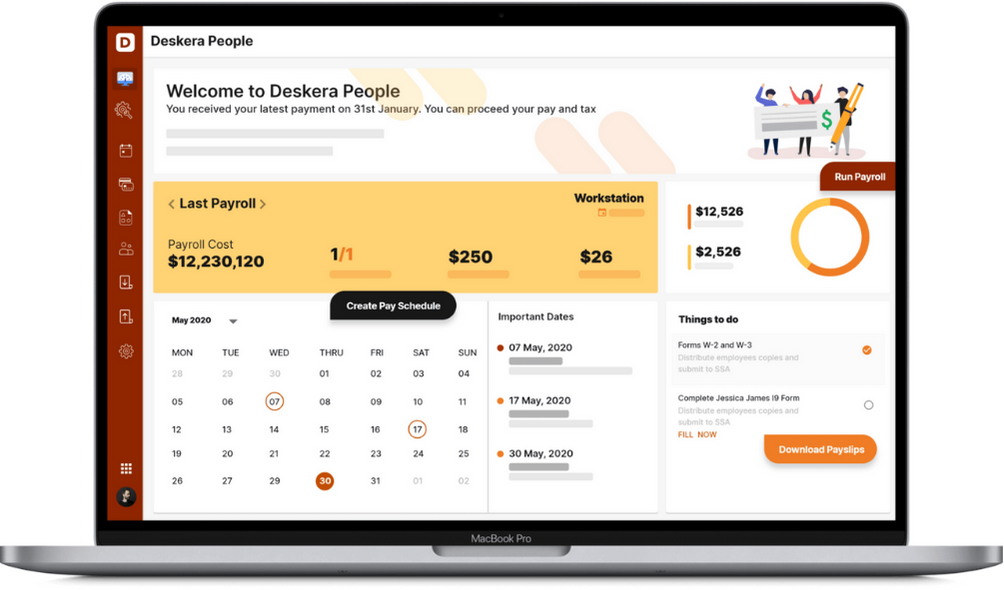

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, and creating new leave types, it makes your work simple.

Key Takeaways

- The Kerala Labor Welfare Fund Act is an act to establish a fund for promoting the welfare of labor in the state of Kerala and for certain other matters connected.

- Employers, employees, and in some states, the government also contributes to the Labor Welfare Fund. The welfare funds' primary goal is to give workers and their dependents access to basic necessities such as housing, healthcare, education, and recreational services.

- All the guidelines mentioned in the Act aim at improving the lives of the workers.

- Employers, employees, and in some states, the government also contributes to the Labor Welfare Fund.

- The welfare funds' primary goal is to give workers and their dependents access to basic necessities such as housing, healthcare, education, and recreational services.

- The Act benefits the workers by raising their living standards, improving working conditions, and offering social security.

- The Act also benefits the employers by boosting industrial relations, increasing productivity and efficiency, providing social benefits, and offering better mental and moral health for all.

- The principal act has been amended twice with certain modifications to become suitable in today's times.

Related Articles